Texas Property Tax Calculator

Texas, the second most populous state in the United States, has a unique property tax system that often raises questions and concerns among homeowners and prospective buyers. Understanding the intricacies of this system is crucial for effective financial planning and budgeting. The Texas Property Tax Calculator is a powerful tool designed to provide accurate estimates of property taxes, offering valuable insights into one of the state's most significant expenses.

Understanding the Texas Property Tax System

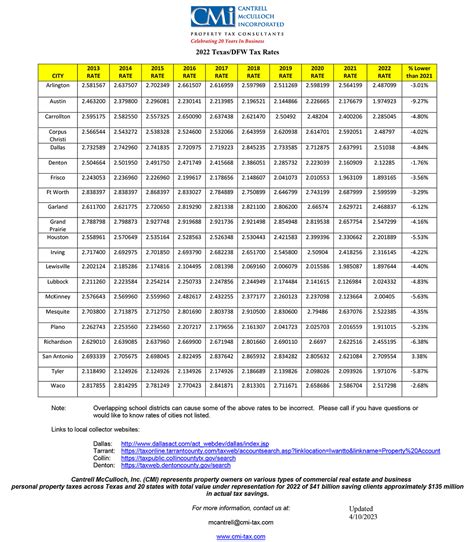

The property tax system in Texas operates differently from many other states. Unlike a statewide property tax, Texas relies on local taxing jurisdictions, including cities, counties, school districts, and special districts, to levy taxes on real estate properties. These taxes are used to fund essential public services and infrastructure.

Property taxes in Texas are calculated based on the appraised value of a property and the tax rate set by the local taxing authorities. The appraised value is determined by the local Appraisal District, which assesses properties annually. This value can vary significantly, even for similar properties, due to factors like location, improvements, and market conditions.

Tax Rate Components

The tax rate, often referred to as the tax levy, is a crucial factor in determining the final property tax bill. It is comprised of various components, each representing a different taxing entity.

- Maintenance and Operations (M&O) Rate: This rate funds the day-to-day operations of local governments and school districts. It can vary significantly between districts.

- Interest and Sinking (I&S) Rate: Used to repay bonds and debt obligations, this rate is typically lower than the M&O rate.

- Special Districts: Some properties may be subject to additional taxes levied by special districts, such as water districts or municipal utility districts.

Tax Rate Calculation

To calculate the total tax rate, the rates from all applicable taxing entities are added together. For example, if a property is located in a city with an M&O rate of 0.45% and a school district with an M&O rate of 1.40%, and it is also within a water district with an I&S rate of 0.15%, the total tax rate would be 2% (0.45% + 1.40% + 0.15%).

| Taxing Entity | Rate |

|---|---|

| City M&O | 0.45% |

| School District M&O | 1.40% |

| Water District I&S | 0.15% |

| Total Tax Rate | 2.00% |

The Role of the Texas Property Tax Calculator

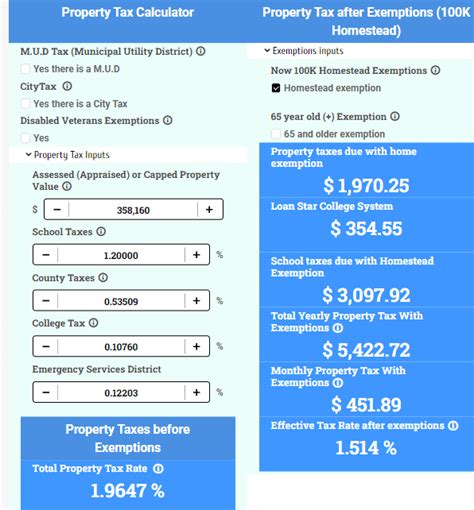

In a state with such a diverse and complex property tax landscape, the Texas Property Tax Calculator serves as an invaluable resource. It empowers homeowners and prospective buyers to make informed decisions by providing accurate estimates of their potential property tax liabilities.

This calculator takes into account the appraised value of a property, the tax rates of the specific taxing jurisdictions it falls under, and any applicable exemptions or abatements. It then calculates the estimated annual property tax bill, offering a clear financial snapshot.

Key Features of the Calculator

- Accuracy: The calculator utilizes official tax rate data from local governments, ensuring precise estimates.

- Ease of Use: Designed with a user-friendly interface, it allows users to input their property details and instantly receive an estimate.

- Comparative Analysis: Users can compare property tax estimates for different properties or locations, aiding in decision-making processes.

- Exemption and Abatement Considerations: The calculator takes into account various tax relief programs, such as the Homestead Exemption, ensuring accurate calculations for eligible properties.

Property Tax Estimates and Real-World Examples

To illustrate the effectiveness of the Texas Property Tax Calculator, let’s consider a few hypothetical scenarios and how the calculator can provide valuable insights.

Scenario 1: Single-Family Home in Austin

Imagine a single-family home in Austin, Texas, with an appraised value of $350,000. The property is located in the Austin Independent School District, which has an M&O tax rate of 1.50%, and the City of Austin has an M&O rate of 0.35%. There are no additional special districts.

Using the Texas Property Tax Calculator, we can estimate the annual property tax as follows:

- Total Tax Rate: 1.85% (1.50% + 0.35%)

- Estimated Annual Property Tax: $6,475 (1.85% of $350,000)

Scenario 2: Commercial Property in Houston

A commercial property in Houston, with an appraised value of $1.2 million, is subject to a more complex tax structure. It is located in the Houston Independent School District (HISD) with an M&O rate of 1.35%, the City of Houston with an M&O rate of 0.38%, and it falls within a municipal utility district (MUD) with an I&S rate of 0.12%.

Calculating the tax estimate:

- Total Tax Rate: 1.85% (1.35% + 0.38% + 0.12%)

- Estimated Annual Property Tax: $22,200 (1.85% of $1.2 million)

Scenario 3: Rural Property in Texas Hill Country

A rural property in the Texas Hill Country, valued at $500,000, is situated in a smaller taxing jurisdiction. The local M&O rate is 0.80%, and there are no additional special districts.

The estimated annual property tax:

- Total Tax Rate: 0.80%

- Estimated Annual Property Tax: $4,000 (0.80% of $500,000)

Future Implications and Considerations

Understanding property taxes is not only crucial for financial planning but also for evaluating the long-term affordability of a property. The Texas Property Tax Calculator provides a snapshot of current tax rates, but it's important to consider potential future changes.

Tax Rate Fluctuations

Tax rates can vary annually as local governments adjust their budgets. While the calculator provides accurate estimates based on current rates, it’s essential to stay informed about potential rate changes, especially in rapidly growing areas where infrastructure demands may lead to higher taxes.

Property Value Appreciation

In a state like Texas, where the real estate market has seen significant growth, property values can increase rapidly. This appreciation can lead to higher appraised values and, subsequently, higher property taxes. Regularly updating property assessments and staying aware of market trends is crucial for accurate tax planning.

Exemptions and Tax Relief Programs

Texas offers various tax relief programs, such as the Homestead Exemption, which reduces the taxable value of a property for homeowners who reside in the property as their primary residence. Understanding these programs and ensuring eligibility can significantly impact the overall tax liability.

Conclusion: Empowering Homeowners and Buyers

The Texas Property Tax Calculator serves as a vital tool for homeowners and prospective buyers, offering a transparent view of one of the most significant expenses associated with property ownership in Texas. By providing accurate estimates, the calculator enables individuals to make informed financial decisions, compare properties, and plan for the long-term financial health of their real estate investments.

As the state's property tax landscape continues to evolve, tools like the Texas Property Tax Calculator will remain essential for navigating the complexities of Texas' unique tax system.

How often are tax rates updated in the calculator?

+The tax rates in the calculator are updated annually to reflect the latest rates set by local taxing authorities. It is recommended to check for updates each year during the tax season to ensure accurate estimates.

Can I compare property tax estimates for multiple properties at once?

+Yes, the Texas Property Tax Calculator allows users to input multiple properties and compare their estimated tax liabilities side by side. This feature is particularly useful for investors or individuals considering properties in different locations.

Are there any limitations to the calculator’s accuracy?

+While the calculator provides highly accurate estimates, it relies on the user’s input for property details and the official tax rates. Any inaccuracies in the input data may affect the accuracy of the estimate. Additionally, it’s important to note that tax rates can change rapidly, especially in dynamic real estate markets.