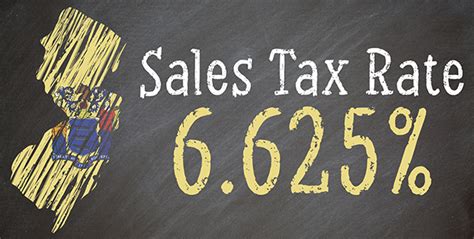

Nj State Sales Tax

The sales tax landscape in the United States is intricate, with each state imposing its own rates and regulations. New Jersey, with its vibrant economy and diverse population, has a unique sales tax structure that impacts both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of the New Jersey State Sales Tax, exploring its rates, applicability, exemptions, and the impact it has on the Garden State's economy.

Understanding the New Jersey State Sales Tax

New Jersey’s sales tax system is a fundamental component of the state’s revenue generation strategy. Officially known as the New Jersey Sales and Use Tax, it is a tax levied on the retail sale, lease, or rental of most goods, as well as certain services. The tax is an essential revenue stream for the state, contributing significantly to the funding of various public services and infrastructure projects.

Tax Rates and Geographic Variations

The New Jersey State Sales Tax operates on a progressive rate structure, which means that different jurisdictions within the state may have varying tax rates. The state’s sales tax is comprised of two components: the state sales tax and the local sales tax. The state sales tax is a flat rate applicable statewide, while the local sales tax can vary depending on the municipality or county.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.625% |

| Local Sales Tax | Ranges from 0% to 3.5% |

The combination of these rates determines the total sales tax applied to a transaction. For instance, in a municipality with a 3% local sales tax, the total sales tax would be 9.625% (6.625% state tax + 3% local tax). This progressive structure allows for localized funding of essential services while maintaining a state-wide base rate.

Applicability and Exemptions

The New Jersey State Sales Tax applies to a broad range of goods and services. However, there are certain exemptions and special provisions that are worth noting. Some of the key exemptions include:

- Food and Drugs: Most unprepared food items, over-the-counter medications, and prescription drugs are exempt from sales tax.

- Clothing: Clothing and footwear items priced under $100 are tax-exempt. However, this exemption does not apply to accessories or items that enhance the value of clothing, such as jewelry.

- Educational Materials: Textbooks, instructional materials, and certain supplies used for educational purposes are exempt from sales tax.

- Manufacturing Equipment: Sales or purchases of machinery and equipment used in manufacturing processes are exempt from sales tax.

- Certain Services: Services such as legal, medical, and accounting are generally not subject to sales tax.

Compliance and Administration

Compliance with the New Jersey State Sales Tax is a critical aspect for businesses operating within the state. Here are some key considerations:

Registration and Reporting

Businesses that make taxable sales in New Jersey are required to register with the New Jersey Division of Taxation and obtain a Sales and Use Tax Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state. The registration process involves providing detailed information about the business, including its legal status, ownership, and location.

Once registered, businesses are responsible for accurately calculating and remitting sales tax to the state on a regular basis. The frequency of these remittances depends on the business's sales volume and can range from monthly to annually. Late or inaccurate filings can result in penalties and interest charges.

Record-Keeping and Audits

Maintaining proper records is essential for sales tax compliance. Businesses are required to keep detailed records of all sales transactions, including the date, amount, and tax collected. These records must be retained for a minimum of four years, as they may be subject to audit by the state’s tax authorities.

The New Jersey Division of Taxation conducts audits to ensure compliance with sales tax regulations. These audits can cover a specific period of time or a specific aspect of a business's sales tax operations. Businesses should be prepared to provide accurate and complete records during an audit to avoid potential penalties.

Online Sales and Nexus

With the rise of e-commerce, the definition of nexus (the connection between a business and a state that triggers tax obligations) has become more complex. In New Jersey, out-of-state sellers that meet certain sales thresholds may be required to register, collect, and remit sales tax on transactions with New Jersey customers. This is known as economic nexus and is a critical consideration for online retailers.

Impact on the Economy

The New Jersey State Sales Tax plays a significant role in the state’s economic landscape. Here are some key ways in which it impacts the Garden State’s economy:

Revenue Generation

The sales tax is a substantial source of revenue for the state, contributing billions of dollars annually to the state’s coffers. This revenue is vital for funding public services such as education, healthcare, infrastructure development, and social welfare programs.

Economic Incentives

New Jersey offers various tax incentives and programs to attract businesses and stimulate economic growth. These incentives often involve sales tax exemptions or reduced rates for specific industries or geographic areas. For instance, the Grow New Jersey Assistance Program offers substantial tax credits to businesses that create jobs and invest in certain economically distressed areas of the state.

Consumer Behavior

The sales tax can influence consumer spending behavior. Higher sales tax rates may encourage consumers to seek out tax-free alternatives, such as online shopping or traveling to neighboring states with lower tax rates. Conversely, lower sales tax rates can stimulate local spending and boost the economy.

Job Creation and Business Growth

The sales tax is indirectly linked to job creation and business growth. The revenue generated from sales tax supports various public services and infrastructure projects, creating an environment conducive to business expansion and employment opportunities.

Conclusion

The New Jersey State Sales Tax is a complex yet vital component of the state’s fiscal landscape. It plays a significant role in funding essential services, stimulating economic growth, and shaping consumer behavior. For businesses and consumers alike, understanding the intricacies of this tax is crucial for compliance, strategic decision-making, and ensuring a positive impact on the Garden State’s economy.

What is the current state sales tax rate in New Jersey?

+As of the latest information, the current state sales tax rate in New Jersey is 6.625%. This is the flat rate applicable statewide, but it’s important to note that the total sales tax can vary based on the local sales tax rate, which can range from 0% to 3.5% depending on the municipality.

Are there any sales tax holidays in New Jersey?

+Yes, New Jersey does have sales tax holidays. These are designated periods when certain items, often back-to-school supplies or energy-efficient appliances, are exempt from sales tax. The dates and eligible items for these holidays vary from year to year, so it’s advisable to check the New Jersey Division of Taxation’s website for the latest information.

How does New Jersey handle sales tax for online purchases?

+New Jersey has established economic nexus rules for online retailers. Out-of-state sellers that meet certain sales thresholds to New Jersey customers are required to register, collect, and remit sales tax. This ensures that online purchases are subject to the same tax obligations as in-state purchases.