What Is Jock Tax

The concept of "Jock Tax" has gained attention and sparked discussions in the sports and tax spheres. This term refers to a unique taxation system applied to athletes and sports teams, particularly those who travel and perform in different states or countries. It raises questions about fairness, practicality, and the impact on sports organizations and individuals. Let's delve into the details of the Jock Tax, its origins, how it works, and its implications for athletes and teams.

Understanding the Jock Tax

The Jock Tax, also known as athlete tax or sports franchise tax, is a specific type of income tax that targets professional athletes and sports organizations. It is a form of state or local tax imposed on the earnings of athletes or teams when they participate in events or competitions outside their primary jurisdiction.

The concept emerged in the United States, particularly in states like California and New York, which have a long history of hosting major sports events and having successful professional sports teams. These states recognized the potential revenue stream from taxing the earnings of visiting athletes and teams, especially in popular sports like baseball, basketball, and football.

How Does the Jock Tax Work?

The Jock Tax operates on a straightforward principle: athletes and sports organizations are taxed on the income they earn within a state or locality, regardless of their primary residence or tax jurisdiction. This means that when an athlete, such as a baseball player, plays a game in a different state, they may be subject to that state's income tax laws.

For instance, if a basketball team from Texas plays a series of games in California, the team's earnings from those games may be subject to California's Jock Tax. Similarly, an individual athlete who participates in a tennis tournament in a different country may face taxation in that country, even if they are a resident of a different nation.

The tax rates and regulations vary across states and countries. Some jurisdictions have specific thresholds or exemptions, while others tax a flat percentage of the athlete's earnings. The complexity arises from the need to calculate and allocate the tax accurately, considering the varying income sources of athletes and the potential double taxation issues.

| State/Country | Tax Rate | Exemptions/Thresholds |

|---|---|---|

| California | Variable (up to 13.3%) | Earnings below $1 million are taxed at a lower rate |

| New York | 8.82% | No specific exemptions |

| Texas | 0% (No state income tax) | N/A |

| Canada | Varies by province | Provincial-specific exemptions |

Implications and Challenges

The Jock Tax presents several implications and challenges for athletes, teams, and the sports industry as a whole.

Financial Impact

For athletes, especially those with high earnings, the Jock Tax can result in a substantial financial burden. The cumulative effect of taxes from multiple states or countries can significantly reduce their overall income. This is particularly relevant for athletes in team sports who travel frequently during their careers.

Compliance and Administration

Athletes and teams must navigate complex tax regulations and administrative processes to ensure compliance with the Jock Tax. This often involves working with tax professionals or specialized accounting firms to accurately calculate and report their earnings across different jurisdictions. The administrative burden can be significant, especially for smaller teams or individual athletes without dedicated support.

Equality and Fairness

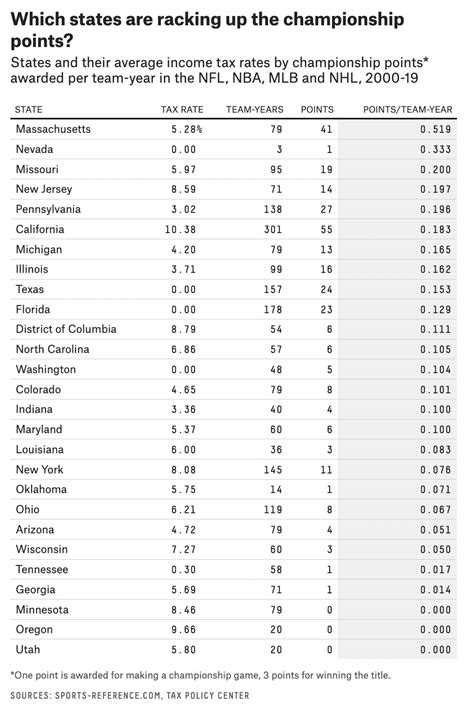

The implementation of the Jock Tax has sparked debates about fairness and equality within the sports industry. Critics argue that it creates an uneven playing field, as some states or countries may have more advantageous tax structures for athletes, potentially influencing team strategies and player decisions.

Impact on Team Strategies

Sports organizations must consider the financial implications of the Jock Tax when planning their schedules and travel arrangements. Teams may need to strategize to minimize their tax liabilities, which could impact their scheduling decisions, player acquisitions, and even their overall competitive strategies.

Addressing the Challenges

To mitigate the challenges posed by the Jock Tax, athletes and teams have adopted various strategies.

Legal and Tax Planning

Athletes and organizations often engage in meticulous legal and tax planning to optimize their financial situations. This may involve structuring their contracts and earnings to minimize tax liabilities, exploring residency options in states with favorable tax laws, and seeking professional advice to navigate complex tax regulations.

Collective Bargaining

Sports leagues and players' unions have engaged in collective bargaining processes to address the Jock Tax issue. Negotiations often focus on finding solutions that protect the financial interests of athletes while ensuring fairness across different teams and leagues.

Legislative Efforts

There have been legislative efforts to simplify or reform the Jock Tax system. Some states have introduced legislation to standardize tax rates or provide exemptions for certain types of earnings, aiming to reduce the administrative burden and promote fairness.

Future Outlook

The Jock Tax continues to evolve as sports leagues, athletes, and policymakers navigate its complexities. Here are some potential future implications and developments:

- Standardization: There may be a push for greater standardization of tax rates and regulations across states and countries to simplify compliance and reduce administrative costs.

- Digital Solutions: Technological advancements could lead to the development of digital platforms or tools to streamline the calculation and reporting of Jock Tax liabilities, making the process more efficient and accessible.

- International Agreements: As sports become increasingly global, there could be efforts to establish international tax agreements or treaties to address the taxation of athletes and teams who compete across borders.

- Player Empowerment: With increasing awareness and understanding of the Jock Tax, athletes may become more involved in advocating for fair and transparent tax systems, influencing policy decisions and negotiations.

Conclusion

The Jock Tax is a unique aspect of the sports industry that highlights the intersection of athletics and taxation. It presents challenges and opportunities for athletes, teams, and policymakers. As the sports landscape continues to evolve, so too will the strategies and regulations surrounding the Jock Tax, shaping the financial dynamics of the sports world.

How is the Jock Tax calculated for individual athletes?

+The calculation of the Jock Tax for individual athletes depends on the specific tax laws of the jurisdiction in which they earn income. It typically involves determining the portion of their earnings subject to taxation in that state or country and applying the relevant tax rate. Athletes often work with tax professionals to ensure accurate calculations.

Do all states in the US have a Jock Tax?

+No, not all states in the US impose a Jock Tax. While states like California and New York have long-standing Jock Tax laws, others, such as Texas, do not have state income tax. The presence and structure of the Jock Tax vary across states, making it essential for athletes to understand the tax regulations in each state they perform in.

Can athletes claim deductions or credits related to the Jock Tax?

+Yes, athletes may be eligible for certain deductions or credits related to the Jock Tax. These could include expenses incurred during travel or deductions for home-state taxes paid. However, the availability and applicability of such deductions vary based on the specific tax laws of each jurisdiction.