How Does Wisconsin State Tax Impact Your Finances?

Wisconsin’s state tax policies wield a profound influence over the financial landscapes of its residents, ranging from individual taxpayers to small businesses and large corporations. For decades, policymakers and fiscal analysts have debated the efficacy and fairness of Wisconsin's tax structure, weighing its capacity to promote economic growth against its ability to generate sufficient revenue for public services. Understanding how Wisconsin state tax impacts personal finances requires an examination of tax rates, deductions, credits, and the broader fiscal ecosystem that shapes the economic environment within the Badger State.

Comprehensive Overview of Wisconsin State Tax System and Its Economic Impacts

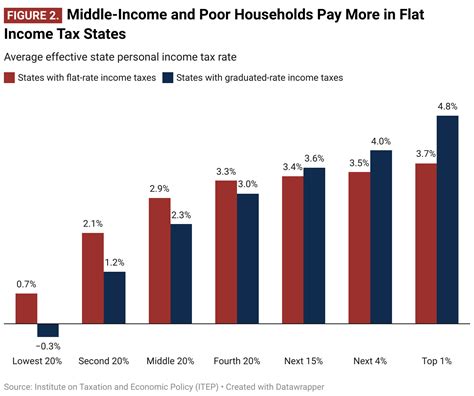

Wisconsin employs a multifaceted tax system comprising income taxes, sales and excise taxes, property taxes, and corporate taxes, each contributing differently to the state’s revenue and, consequently, affecting residents’ and businesses’ financial well-being. The state’s progressive income tax structure, combined with its sales tax rate of 5%, augmented by local levies, creates a complex web where taxpayer behavior, income levels, and consumption patterns intersect.

Tax Rates and Brackets: The Income Tax Experience in Wisconsin

Wisconsin’s individual income tax system is structured across several brackets, with rates ranging from 3.54% to 7.65% for the highest earners, as of the 2023 tax year. These rates are applied to taxable income after federal deductions and Wisconsin-specific adjustments. For middle-income taxpayers, effective tax rates tend to hover around 4-6%, depending on filing status and eligible deductions, impacting disposable income and consumption capacity.

In recent policy debates, proposals to adjust income brackets or modify tax rates have surfaced, aiming to balance revenue needs with income equality. These rates influence the marginal incentives for work and investment, especially considering Wisconsin’s notable use of tax credits and exemptions to mitigate the tax burden on low- and middle-income households.

| Relevant Category | Substantive Data |

|---|---|

| Top Income Tax Rate | 7.65% on taxable income over $266,680 (single filers, 2023) |

| Median Effective Tax Rate | Approximately 4.5% based on income distribution and deductions |

Sales and Property Taxes: Direct Effects on Household Finances

Wisconsin’s combined state and local sales tax rate is 5%, but this can escalate to 9% in certain jurisdictions due to local levies. This tax significantly impacts household budgets, particularly affecting lower-income households where a larger proportion of income tends to be spent on consumables. Additionally, property taxes, which are the primary source of local government revenue, vary widely across counties depending on real estate valuations and local policies.

High property taxes can substantially burden homeowners, especially in urban and suburban areas with valuable real estate. Conversely, lower property taxes in rural regions ease the burden but may limit local public service funding, indirectly influencing residents’ quality of life and local economic vitality.

| Relevant Category | Substantive Data |

|---|---|

| Average State Sales Tax | 5.0% (additional local taxes up to 4%) |

| Median Property Tax Rate | 1.68% of home value (statewide average, 2023) |

Corporate and Business Tax Environment and Its Influence on Economic Growth

Wisconsin’s corporate income tax rate stands at 7.9% as of 2023, with a taxable base that considers both income and capital investment. The state also levies franchise and manufacturing taxes designed to attract and retain business operations. Corporate tax policies directly affect business decision-making, employment levels, and capital investment, which in turn influence the overall health of the economy.

Tax incentives, credits, and exemptions are frequently employed to stimulate sectors like manufacturing, agriculture, and technology. However, debates persist regarding whether these incentives lead to genuine job creation or simply shift taxable bases without broader economic benefits.

| Relevant Category | Substantive Data |

|---|---|

| Corporate Income Tax Rate | 7.9% (2023) |

| Tax Incentive Utilization | Approximately $150 million annually in tax credits and exemptions (statewide) |

The Broader Fiscal and Socioeconomic Impacts of Wisconsin Taxation

Beyond the direct financial burdens or benefits, Wisconsin’s tax policies shape the socioeconomic fabric—including income inequality, access to quality public services, and overall quality of life. For instance, the revenue generated from taxes funds education, healthcare, transportation, and public safety, which are vital to economic stability and growth.

Policymakers grapple with the challenge of designing a tax system that promotes economic mobility while maintaining fiscal sustainability. The balance hinges upon progressive taxation, targeted tax credits, and public expenditure efficiency, which collectively influence individual wealth accumulation and overall prosperity.

Historical Context and Evolution of Wisconsin Tax Policies

Historically, Wisconsin has maintained relatively high state taxes compared to some neighboring states, justified by its commitment to an expansive social safety net and robust public infrastructure. Over time, tax reforms have oscillated between austerity and expansion, reflecting shifting political ideologies and economic priorities.

Recent reform efforts have aimed at simplifying the tax code, broadening the tax base, and reducing compliance burdens, but these initiatives often come with trade-offs, such as reduced revenue for essential public programs.

Key Points

- Tax rate structures: Progressive income taxes combined with sales and property taxes shape individual and corporate financial burdens.

- Fiscal balancing act: Adequate revenue generation versus economic competitiveness remains a central debate.

- Impact on household finances: Tax policies influence disposable income, consumption patterns, and long-term wealth accumulation.

- Regional disparities: Variations in local tax policies create uneven economic impacts across Wisconsin’s diverse communities.

- Policy considerations: Future reforms should carefully consider socioeconomic equity and sustainability to foster inclusive growth.

How does Wisconsin’s income tax affect low-income earners?

+Wisconsin’s progressive income tax system employs credits and exemptions to ease the burden on low-income families, but high marginal rates at the upper brackets can still reduce disposable income, potentially limiting consumption and saving opportunities for the most vulnerable.

What is the role of sales tax in regressive taxation?

+Sales tax disproportionately affects lower-income households as they allocate a larger share of their income to taxed goods and services, making it a regressive element within Wisconsin’s overall tax ecosystem.

Can property taxes influence economic mobility?

+Yes, high property taxes can burden homeowners and limit wealth accumulation, especially for marginalized communities, thus affecting economic mobility and perpetuating regional disparities within Wisconsin.