How Much Is Sales Tax In Washington

In the state of Washington, sales tax is a significant component of the revenue generated for the state government and local municipalities. Understanding the intricacies of sales tax in Washington is essential for both consumers and businesses alike, as it directly impacts their financial obligations and operations.

Sales Tax Rates in Washington

Washington State has a unique sales tax system, as it is one of the few states in the US that does not levy a general sales tax on retail transactions. Instead, the state imposes a gross receipts tax on businesses, which is then passed on to the consumers in the form of higher prices. This tax is known as the Business & Occupation (B&O) tax and it varies depending on the type of business and its revenue.

The B&O tax is a privilege tax that businesses must pay for the right to operate in Washington. It is calculated based on the gross income of the business and can range from 0.471% to 1.9% for most industries. For example, manufacturers are taxed at a rate of 0.471%, while retailers face a higher rate of 1.9%.

| Industry | B&O Tax Rate |

|---|---|

| Manufacturing | 0.471% |

| Retail Sales | 1.9% |

| Service Businesses | 1.5% |

| Wholesale Sales | 0.8% |

It's important to note that the B&O tax is just one component of the overall tax burden for businesses in Washington. In addition to this tax, businesses may also be subject to other taxes, such as public utility taxes, retail sales taxes (in certain jurisdictions), and various local taxes.

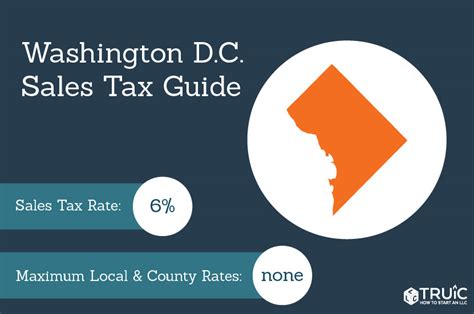

Local Sales Taxes in Washington

While Washington State does not have a general sales tax, many local jurisdictions within the state do levy their own sales taxes. These local sales taxes are added on top of the B&O tax and vary greatly depending on the location. For instance, the city of Seattle imposes an additional sales tax of 0.1% to fund transportation projects.

These local sales taxes are often referred to as city or county option taxes, and they can be used to fund a variety of projects and services, including public transportation, healthcare, education, and more. The rates and uses of these taxes can be quite diverse, making it essential for businesses and consumers to stay informed about the specific taxes in their area.

| Jurisdiction | Sales Tax Rate |

|---|---|

| King County | 0.0% - 3.9% |

| Pierce County | 0.0% - 3.1% |

| Snohomish County | 0.0% - 3.9% |

| Spokane County | 0.0% - 2.5% |

The range of sales tax rates within a county can be quite wide due to the inclusion of special purpose districts, such as public facility districts, transportation benefit districts, and conservation future districts, each of which may have their own sales tax rates.

Sales Tax Exemptions and Special Cases

Washington’s sales tax system also includes a variety of exemptions and special cases that can impact the overall tax burden for both businesses and consumers. Certain goods and services are exempt from sales tax, such as most food products, prescription drugs, and medical devices. Additionally, charitable organizations may be exempt from certain taxes if they meet specific criteria.

Another unique aspect of Washington's sales tax system is the resale certificate. Businesses that purchase goods for resale can provide a resale certificate to their suppliers, exempting them from paying sales tax on those purchases. This allows businesses to avoid double taxation, as they will collect sales tax from the final consumer when the goods are sold.

Impact on Businesses and Consumers

The absence of a general sales tax in Washington can lead to some complexities for businesses and consumers. For businesses, the B&O tax adds an additional layer of complexity to their tax obligations, requiring them to understand and calculate the tax based on their specific industry and revenue. For consumers, the lack of a general sales tax can make it more difficult to understand the true cost of goods, as the B&O tax is often included in the price without being explicitly stated.

Additionally, the diversity of local sales taxes can create further complexities. Businesses operating in multiple jurisdictions within the state may need to navigate different tax rates and rules, while consumers may face varying tax rates depending on where they make their purchases. This can impact pricing strategies for businesses and purchasing decisions for consumers.

Future Outlook and Policy Considerations

The unique sales tax system in Washington has been a subject of ongoing debate and policy discussions. Some argue that the current system, with its reliance on the B&O tax and local sales taxes, is overly complex and places an unfair burden on certain industries. There have been proposals to introduce a general sales tax, similar to those in other states, to simplify the tax system and provide a more stable revenue stream for the state.

However, the introduction of a general sales tax is not without its challenges. It could potentially shift the tax burden to lower-income individuals, who may be more sensitive to changes in sales tax rates. Additionally, the current system, with its emphasis on local option taxes, provides a level of flexibility for local governments to fund specific projects and services that may not be achievable with a state-wide sales tax.

As such, any changes to Washington's sales tax system would require careful consideration of the potential impacts on businesses, consumers, and local governments. The state's unique tax structure is a reflection of its commitment to local control and flexibility, and any modifications would need to balance these principles with the need for a fair and stable tax system.

How does Washington’s sales tax system compare to other states?

+Washington’s sales tax system is unique among US states. Most states have a general sales tax that is applied to most retail transactions, whereas Washington relies on a gross receipts tax (B&O tax) that is paid by businesses and often passed on to consumers. This makes Washington’s tax system more complex compared to most other states.

What is the difference between the B&O tax and sales tax?

+The B&O tax is a gross receipts tax paid by businesses based on their revenue. It is a privilege tax, meaning it is a fee for the right to operate in Washington. Sales tax, on the other hand, is a tax on the sale of goods and services and is typically paid by consumers. In Washington, the B&O tax is often passed on to consumers through higher prices, serving a similar function to a sales tax.

Are there any sales tax holidays in Washington?

+No, Washington does not have sales tax holidays like some other states. Sales tax holidays are specific periods when certain items are exempt from sales tax, typically for a few days. These holidays are designed to stimulate the economy and provide temporary tax relief to consumers.