Kane County Property Tax

In the realm of property ownership, understanding the intricacies of tax assessments is crucial. This article delves into the specifics of Kane County property taxes, exploring the assessment process, tax rates, exemptions, and more. With an in-depth analysis, we aim to provide a comprehensive guide to help property owners navigate this essential aspect of homeownership.

Understanding Kane County Property Taxes

Property taxes are a significant financial obligation for homeowners, and Kane County, with its vibrant communities and diverse real estate market, presents a unique tax landscape. The assessment process, tax rates, and available exemptions all contribute to the overall property tax burden for residents.

The Assessment Process

Kane County employs a systematic approach to property assessment, ensuring fairness and accuracy in tax calculations. The process begins with the Kane County Assessor’s Office conducting regular inspections and evaluations of properties within the county. These assessments take into account various factors, including:

- Property Type: Residential, commercial, industrial, or agricultural properties are assessed differently, reflecting their unique characteristics and market values.

- Market Value: The assessor determines the fair market value of each property based on recent sales data, property features, and local market trends.

- Property Condition: The condition of a property, including any improvements or damage, can impact its assessed value.

- Location: The location of a property within the county, including factors like school districts and zoning, can influence its assessed value.

Once the assessments are complete, property owners receive a Notice of Assessment, detailing the assessed value of their property. This notice serves as a crucial document for understanding the basis of their property taxes.

Tax Rates and Calculations

The property tax rate in Kane County is determined by a combination of factors, including:

- County Tax Rate: Set by the Kane County Board, this rate applies to all properties within the county.

- Local Tax Rates: Individual municipalities within Kane County may levy additional taxes, leading to variations in tax rates across the county.

- School District Taxes: A significant portion of property taxes goes towards funding local school districts, and these rates can vary significantly between districts.

- Special Assessments: Certain areas may be subject to special assessments for specific projects or improvements, impacting property tax bills.

To calculate the property tax bill, the assessed value of the property is multiplied by the applicable tax rates. This calculation results in the total tax liability for the property owner.

Exemptions and Reductions

Kane County offers a range of exemptions and reductions to ease the tax burden for eligible property owners. These include:

- Homestead Exemption: A reduction in assessed value for primary residences, providing a financial benefit to homeowners. The exemption amount varies based on income and other factors.

- Senior Citizen Exemption: Kane County offers exemptions for senior citizens who meet certain criteria, reducing their property tax liability.

- Veteran’s Exemption: Eligible veterans can receive a reduction in their property taxes, recognizing their service to the country.

- Agricultural Exemption: Properties used for agricultural purposes may be eligible for a reduced assessment, supporting the local farming industry.

It’s important for property owners to understand the eligibility criteria and application process for these exemptions to maximize their tax savings.

Appealing Property Assessments

If a property owner believes their assessment is inaccurate, they have the right to appeal. The Kane County Board of Review provides a formal process for property owners to challenge their assessments. The appeal process involves:

- Filing an appeal within a specified timeframe, usually after receiving the Notice of Assessment.

- Submitting supporting documentation to substantiate the appeal, such as recent sales data or property condition reports.

- Attending a hearing before the Board of Review, where the property owner can present their case.

- Receiving a decision from the Board, which can result in a change to the assessed value or no change.

Appealing an assessment requires careful preparation and an understanding of the process to increase the chances of a successful outcome.

Tax Payment Options and Deadlines

Property owners in Kane County have several options for paying their property taxes, including:

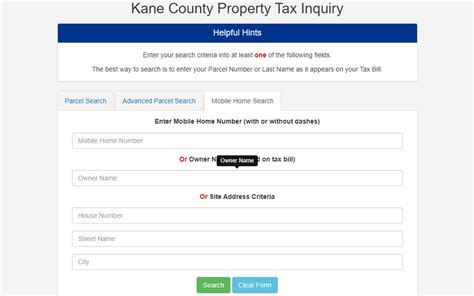

- Online Payment: A convenient and secure method, allowing property owners to pay their taxes through the Kane County Treasurer’s Office website.

- Mail-in Payment: Property owners can send their tax payments via mail, ensuring they meet the deadline to avoid penalties.

- In-Person Payment: For those who prefer a personal touch, payments can be made in person at the Kane County Treasurer’s Office during specified hours.

It’s crucial to note that property taxes are due by a specific deadline, typically in two installments. Late payments may incur penalties and interest, so staying informed about payment deadlines is essential.

Understanding the Tax Bill

A property tax bill provides valuable insights into the breakdown of taxes and their allocation. It includes information such as:

- Assessed Value: The assessed value of the property as determined by the Kane County Assessor.

- Tax Rates: A detailed breakdown of the tax rates applied to the property, including county, municipal, and school district rates.

- Exemptions: A summary of any exemptions applied to the property, reducing the overall tax liability.

- Payment Due Dates: Important deadlines for paying the property taxes to avoid penalties.

Familiarizing oneself with the tax bill can help property owners understand the components of their tax liability and identify any potential discrepancies.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure within Kane County. These taxes contribute to:

- Education: A significant portion of property taxes goes towards funding local schools, ensuring a quality education for children in the community.

- Public Safety: Taxes support the operations of police and fire departments, maintaining a safe environment for residents.

- Road Maintenance: Property taxes help maintain and improve local roads, ensuring safe and efficient transportation.

- Community Programs: Taxes fund various community programs, such as libraries, parks, and recreational facilities, enhancing the quality of life for residents.

Understanding the impact of property taxes on the community can foster a sense of responsibility and appreciation for the services and amenities provided.

Staying Informed and Engaged

Property ownership comes with a range of responsibilities, and staying informed about property taxes is crucial. Kane County provides resources to help property owners understand the assessment process, tax rates, and available exemptions. These resources include:

- The Kane County Assessor’s Office website, which offers detailed information on assessments, exemptions, and the appeal process.

- The Kane County Treasurer’s Office website, providing payment options, deadlines, and answers to frequently asked questions.

- Local community meetings and workshops, where property owners can engage with officials and fellow residents to discuss tax-related matters.

By staying engaged and informed, property owners can make informed decisions, advocate for their interests, and contribute positively to their community.

Conclusion

Navigating Kane County property taxes requires an understanding of the assessment process, tax rates, exemptions, and payment options. By exploring these aspects in detail, property owners can make informed decisions, ensure accurate assessments, and take advantage of available exemptions. Moreover, understanding the impact of property taxes on the community fosters a sense of responsibility and appreciation for the services and amenities provided.

How often are properties reassessed in Kane County?

+Properties in Kane County are typically reassessed every 4 years, although certain factors, such as significant improvements or damage, may trigger an earlier reassessment.

What happens if I miss the deadline to pay my property taxes?

+Missing the deadline to pay property taxes can result in penalties and interest. It’s important to stay informed about payment deadlines and explore payment options to avoid additional costs.

Can I appeal my property assessment if I believe it’s inaccurate?

+Yes, property owners have the right to appeal their assessments if they believe they are inaccurate. The appeal process involves submitting an application and attending a hearing before the Kane County Board of Review.