Property Tax In Dallas Tx

Property taxes in Dallas, Texas, are a vital component of the city's revenue system, contributing significantly to the funding of essential public services and infrastructure. The process of property taxation in Dallas involves a unique set of regulations and practices that impact both residents and businesses alike. Understanding these taxes is crucial for property owners, as it influences their financial obligations and planning.

Understanding Property Taxes in Dallas, TX

In the heart of Texas, Dallas County plays a pivotal role in administering property taxes, with a robust system designed to assess and collect these taxes efficiently. This system is governed by a combination of state laws and local regulations, creating a comprehensive framework for property valuation and taxation.

Property owners in Dallas are subject to an annual assessment process, where the Dallas Central Appraisal District (DCAD) determines the taxable value of their properties. This value is influenced by various factors, including the property's location, size, and recent sales data of comparable properties. The assessed value forms the basis for calculating the property tax liability.

The Role of Appraisal Districts

Appraisal districts like DCAD are critical to the property tax system, as they are responsible for ensuring that property values are fair and accurate. These districts employ professional appraisers who utilize a variety of methods, including cost, income, and market approaches, to determine property values. This process aims to create a balanced and equitable taxation system.

The appraisal process typically involves the following steps:

- Data Collection: Appraisers gather information about the property, including its physical characteristics, improvements, and any recent sales data.

- Market Analysis: They analyze the local real estate market to determine the property's value based on similar sales in the area.

- Valuation: Using the collected data and market analysis, appraisers assign a value to the property, which is then used for tax calculations.

Tax Rates and Calculations

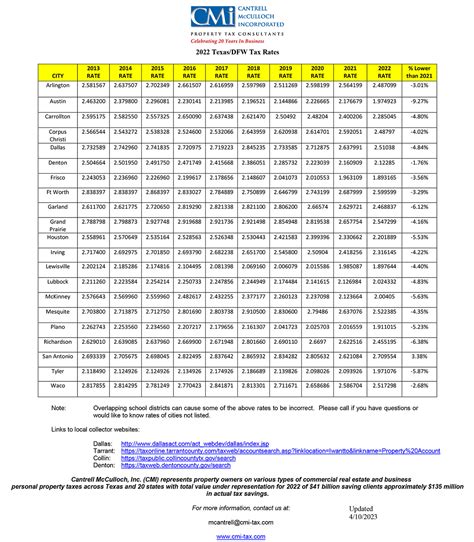

Once the property's value is determined, the tax rate is applied to calculate the final tax amount. In Dallas, the tax rate is established by various taxing entities, such as the city, county, school districts, and special districts. These entities set their own tax rates based on their budgetary needs and the services they provide.

The tax rate is typically expressed as a percentage per $100 of assessed property value. For instance, if a property is valued at $200,000 and the tax rate is 2%, the annual property tax would be calculated as follows:

| Property Value | Tax Rate | Tax Amount |

|---|---|---|

| $200,000 | 2% | $4,000 |

It's important to note that tax rates can vary significantly between different areas within Dallas County, due to the presence of multiple taxing entities and their unique needs.

Payment Options and Due Dates

Property tax payments in Dallas are typically due twice a year, with specific deadlines set by the taxing entities. Failure to pay by the due date can result in penalties and interest, and in some cases, properties may be subject to tax liens or foreclosure.

To make payments more manageable, the Dallas County Tax Office offers various payment options, including online payments, payment plans, and the ability to pay by check, money order, or credit card. Property owners are encouraged to stay informed about their payment due dates and take advantage of the available payment options to ensure timely payments.

Property Tax Rates and Trends in Dallas

Dallas, like many other cities in Texas, operates under a system of taxation that is largely driven by the state’s unique tax policies. Texas is known for its absence of a personal income tax, which places a greater emphasis on property taxes to fund public services.

Average Tax Rates in Dallas

According to recent data, the average effective property tax rate in Dallas is approximately 2.25%, which is slightly higher than the national average. This rate can vary depending on the specific location within the city and the services provided by the taxing entities.

| Average Tax Rate | Location |

|---|---|

| 2.1% | Downtown Dallas |

| 2.3% | Suburban Areas |

| 2.5% | High-Value Properties |

It's worth noting that these rates are subject to change annually, influenced by factors such as the property's value appreciation, local economic conditions, and the budgetary needs of the taxing entities.

Impact of Tax Rates on Property Owners

The relatively high tax rates in Dallas can significantly impact property owners, especially those with valuable real estate holdings. For instance, a homeowner with a property valued at 500,000 could expect to pay approximately <strong>11,250 in annual property taxes, assuming a 2.25% tax rate.

| Property Value | Tax Rate | Annual Tax Amount |

|---|---|---|

| $500,000 | 2.25% | $11,250 |

These taxes contribute to the funding of essential services like education, public safety, and infrastructure development, which are vital for the city's growth and prosperity.

Trends and Future Outlook

Over the past decade, property values in Dallas have experienced a steady increase, driven by factors such as population growth, economic development, and urban revitalization initiatives. As a result, property tax revenues have also risen, providing a stable source of funding for local governments and school districts.

Looking forward, the city of Dallas is projected to continue its growth trajectory, attracting new residents and businesses. This growth is expected to further increase property values and, consequently, property tax revenues. However, the city's commitment to maintaining a competitive business environment and its unique tax policies will play a significant role in shaping the future tax landscape.

Comparative Analysis: Property Taxes in Dallas vs. Other Cities

When compared to other major cities across the United States, Dallas’s property tax rates fall within a similar range. However, the absence of a state income tax in Texas can make the overall tax burden relatively higher for property owners.

Dallas vs. New York City

In a comparison with New York City, which is known for its high cost of living and substantial tax burden, Dallas’s property tax rates appear more favorable. New York City’s effective property tax rate averages around 1.6%, which is significantly lower than Dallas’s average of 2.25%.

| City | Average Tax Rate |

|---|---|

| Dallas | 2.25% |

| New York City | 1.6% |

However, it's important to consider the overall tax structure. New York City has a robust income tax system, which contributes significantly to its revenue, whereas Dallas relies more heavily on property taxes.

Dallas vs. Houston

Comparing Dallas to its neighboring city, Houston, reveals a similar story. Houston’s average effective property tax rate is slightly lower than Dallas’s, at approximately 2.1%. This difference can be attributed to Houston’s larger geographic area and diverse tax base.

| City | Average Tax Rate |

|---|---|

| Dallas | 2.25% |

| Houston | 2.1% |

Despite the slight variation, both cities rely heavily on property taxes to fund their operations and public services.

Dallas’s Unique Position

Dallas’s position as a major economic hub in Texas, with a diverse business landscape and a thriving real estate market, makes it a key contributor to the state’s tax revenue. The city’s focus on economic development and business-friendly policies has attracted numerous companies and individuals, leading to a steady increase in property values and tax revenues.

In conclusion, understanding the property tax landscape in Dallas is essential for both residents and businesses. The city's tax system, governed by a combination of state and local regulations, provides a stable revenue stream for essential public services. While property taxes in Dallas are relatively higher compared to some other cities, they are a necessary component of the city's economic vitality and growth.

How often are property taxes assessed in Dallas, TX?

+Property taxes in Dallas are assessed annually. The Dallas Central Appraisal District (DCAD) conducts an appraisal process each year to determine the taxable value of properties. This ensures that tax assessments are up-to-date and reflect any changes in property values.

What factors influence the property tax rate in Dallas?

+The property tax rate in Dallas is determined by various taxing entities, such as the city, county, school districts, and special districts. These entities set their own tax rates based on their budgetary needs and the services they provide. Factors influencing the tax rate include the cost of providing services, infrastructure development, and economic conditions.

How can property owners protest their tax assessments in Dallas?

+If a property owner believes their tax assessment is incorrect or unfair, they have the right to protest. In Dallas, the process involves filing a protest with the Appraisal Review Board (ARB) within a specified timeframe. The ARB conducts hearings to review and decide on protests, aiming to ensure fair and accurate tax assessments.

What are the consequences of not paying property taxes in Dallas?

+Failure to pay property taxes in Dallas can result in serious consequences. The taxing authorities may impose penalties and interest on late payments. In severe cases, the property could be subject to a tax lien, which could lead to foreclosure if the taxes remain unpaid. It’s crucial for property owners to stay informed about their payment due dates and take advantage of available payment plans if needed.