Indiana Property Tax Lookup

Welcome to the comprehensive guide on the Indiana Property Tax Lookup system, a vital resource for homeowners, investors, and anyone interested in understanding the property tax landscape in the Hoosier State. This expert-level journal article will delve into the intricacies of Indiana's property tax assessment and collection process, offering an in-depth analysis and practical insights.

Understanding Indiana’s Property Tax System

Indiana’s property tax system is a complex yet essential component of the state’s fiscal framework. Property taxes are a significant revenue source for local governments, including counties, cities, townships, and school corporations. These taxes fund various essential services and infrastructure projects, making them a crucial aspect of the state’s economy.

The property tax system in Indiana is governed by a set of regulations and guidelines outlined in the Indiana Property Tax Code, which ensures uniformity and fairness across the state. The process involves assessing the value of properties, determining the applicable tax rates, and collecting taxes from property owners. This comprehensive guide will break down each step, offering a clear understanding of how the system operates.

Property Assessment Process

Property assessment is the foundation of Indiana’s property tax system. The process begins with the assessment date, which is typically set as January 1st of each year. As of 2023, the assessment date is January 1, 2024. On this date, the property’s value is determined, and this value serves as the basis for calculating the property taxes.

The Indiana Department of Local Government Finance (DLGF) oversees the assessment process. They provide guidelines and standards to ensure consistent valuation across the state. Assessors, who are appointed or elected officials, are responsible for evaluating properties within their jurisdictions. They consider various factors, including:

- Real Estate Market Trends: Assessors analyze recent sales data and market conditions to determine the property's fair market value.

- Property Characteristics: Factors such as size, location, age, and improvements are taken into account.

- Previous Assessments: Historical assessment data helps in identifying trends and ensuring consistency.

- Local Ordinances and Regulations: Assessors adhere to local guidelines, which may include specific valuation methods or exemptions.

Once the assessment is complete, property owners receive a Notice of Assessment, detailing the property's assessed value. This notice is typically mailed within a specific timeframe, allowing owners to review and, if necessary, appeal the assessment.

| Assessment Year | Notice Mailing Dates |

|---|---|

| 2024 | March 15th - April 15th |

| 2025 | March 15th - April 15th |

| ... | ... |

Determining Tax Rates

Once the property’s assessed value is established, the next step is to determine the applicable tax rates. Indiana’s property tax system operates on a two-tiered rate structure, consisting of:

- Statewide Tax Rate: A uniform rate set by the Indiana General Assembly, which applies to all properties in the state.

- Local Tax Rates: Each local government unit, such as a county, city, or school corporation, sets its own tax rate. These rates vary based on the revenue needs of the local entity.

The combination of the statewide and local tax rates results in the gross tax rate, which is then applied to the property's assessed value to calculate the total tax liability.

To ensure transparency and accountability, Indiana mandates the publication of tax rate ordinances by local governments. These ordinances detail the proposed tax rates and are typically adopted through public hearings, allowing for community input.

Property Tax Collection

Property tax collection is the final step in the process. In Indiana, property taxes are typically due in two installments, with specific due dates set by the local government. Failure to pay taxes on time can result in penalties and interest charges.

The Treasurer's Office in each county is responsible for collecting property taxes. They send out tax bills, which detail the property's assessed value, the applicable tax rates, and the total tax liability. Property owners have the option to pay online, by mail, or in person at the Treasurer's Office.

It's important for property owners to keep track of their tax bills and payment deadlines. Late payments can lead to additional fees and, in extreme cases, legal actions or tax liens.

Exploring Indiana’s Property Tax Lookup Tools

Indiana provides several online resources to help property owners and stakeholders access vital property tax information. These tools offer transparency and ease of access, ensuring that taxpayers have the information they need to manage their property tax obligations effectively.

Indiana Property Tax Lookup

The Indiana Property Tax Lookup is a comprehensive online platform designed to provide detailed property tax information. This tool, accessible via the Indiana MyTax website, offers a user-friendly interface and a wealth of data.

Key features of the Indiana Property Tax Lookup include:

- Property Search: Users can search for properties by address, parcel number, or owner's name. This feature is particularly useful for real estate professionals, investors, and neighbors looking to compare property values.

- Assessment Details: The lookup tool provides access to current and historical assessment data. Property owners can review their assessment history, ensuring they have accurate information for tax planning and potential appeals.

- Tax Bill Information: Property owners can view their tax bills, including the breakdown of taxes owed to various local government entities. This transparency helps taxpayers understand how their tax dollars are allocated.

- Payment Options: The platform often provides links or instructions for online tax payment, making it convenient for taxpayers to settle their obligations promptly.

The Indiana Property Tax Lookup is a valuable resource for taxpayers, offering a quick and efficient way to access critical property tax information.

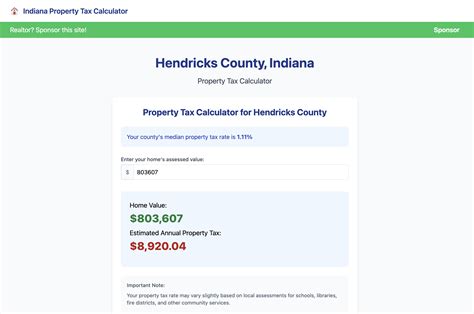

County Property Tax Lookup Tools

In addition to the state-level lookup tool, many counties in Indiana offer their own property tax lookup platforms. These county-specific tools provide detailed information tailored to the local tax system.

For instance, the Marion County Property Tax Lookup, accessible via the Marion County Treasurer's Office, offers a range of features, including:

- Property Search by Address: A user-friendly search function allows taxpayers to quickly find their property's tax information.

- Tax Bill History: Taxpayers can access a detailed history of their tax bills, including previous years' data.

- Tax Rate Information: The platform provides an overview of the current and historical tax rates applicable in Marion County.

- Payment Options: Taxpayers can make payments online, ensuring a convenient and secure transaction process.

Each county may have unique features and interfaces for their property tax lookup tools, so it's essential to explore the specific resources available in your area.

Understanding Property Tax Exemptions and Deductions

Indiana offers a range of property tax exemptions and deductions to eligible taxpayers. These provisions aim to reduce the tax burden for certain categories of property owners, providing financial relief and promoting social welfare.

Common Property Tax Exemptions

Some of the common property tax exemptions in Indiana include:

- Homestead Deduction: Homeowners may be eligible for a deduction on their primary residence, reducing the assessed value of their property for tax purposes. This deduction can provide significant savings for homeowners.

- Senior Citizen Deduction: Senior citizens aged 65 or older may qualify for a deduction on their primary residence, reducing their property tax liability. This exemption aims to support older adults in maintaining their homes.

- Veterans' Deduction: Indiana offers various deductions and exemptions for veterans, including a deduction on their primary residence. These provisions honor the service of veterans and provide financial relief.

- Disabled Veteran Exemption: Disabled veterans may be eligible for a full or partial exemption from property taxes. This exemption is a recognition of their service and the sacrifices they have made.

It's crucial for property owners to understand the specific eligibility criteria and application processes for these exemptions. The Indiana Department of Revenue provides detailed information and guidance on their website.

Other Deductions and Credits

In addition to the above exemptions, Indiana offers various other deductions and credits to eligible taxpayers. These include:

- Mortgage Interest Deduction: Homeowners can deduct the interest paid on their mortgage loans, providing a tax benefit for homeowners with mortgages.

- Property Tax Credit: Certain taxpayers, particularly those with low incomes, may qualify for a property tax credit. This credit can offset a portion of their property tax liability.

- Rent Credit: Renters who meet specific income criteria may be eligible for a rent credit, which can be applied against their property tax liability.

Understanding these deductions and credits can help taxpayers maximize their savings and manage their property tax obligations effectively.

Property Tax Appeals and Disputes

In certain situations, property owners may wish to appeal their property’s assessed value or challenge their tax liability. Indiana provides a structured process for taxpayers to address concerns and resolve disputes.

Appealing Property Assessments

Property owners who believe their property’s assessed value is inaccurate have the right to appeal. The appeal process typically involves the following steps:

- Informal Review: Property owners can request an informal review with the assessor's office to discuss concerns and potentially resolve the issue.

- Formal Appeal: If the informal review does not result in a satisfactory resolution, taxpayers can file a formal appeal with the County Property Tax Assessment Board of Appeals (PTABOA). This board hears appeals and makes decisions regarding assessment adjustments.

- State Board of Tax Commissioners: If the PTABOA's decision is unfavorable, taxpayers can appeal to the Indiana State Board of Tax Commissioners, which is the final administrative review body.

- Court Appeal: If all administrative avenues are exhausted, taxpayers may file a court appeal. This is a legal process and should be undertaken with the guidance of legal counsel.

It's essential for taxpayers to understand the timelines and requirements for each step of the appeal process. The Indiana Department of Local Government Finance provides detailed guidelines and resources to assist taxpayers in navigating this process.

Disputing Tax Bills

Property owners may also dispute their tax bills if they believe there are errors or discrepancies. Common reasons for disputing a tax bill include:

- Incorrect Assessment: If the property's assessed value is inaccurate, taxpayers can dispute the bill and request a correction.

- Overpayment: Taxpayers who believe they have overpaid their taxes can request a refund.

- Exemption Issues: If a taxpayer is eligible for an exemption but it was not applied, they can dispute the bill and request the exemption be considered.

To resolve these disputes, taxpayers can contact their local Treasurer's Office or the Department of Local Government Finance for guidance. It's important to act promptly, as there are specific timelines and requirements for disputing tax bills.

Future Outlook and Considerations

As Indiana’s property tax system continues to evolve, there are several considerations and potential changes on the horizon.

Legislative Changes

The Indiana General Assembly periodically reviews and updates the Property Tax Code. Recent legislative changes include:

- Expanding eligibility criteria for certain exemptions, such as the Senior Citizen Deduction and the Disabled Veteran Exemption, to provide broader relief to taxpayers.

- Introducing new provisions to address emerging issues, such as the impact of COVID-19 on property values and tax collections.

- Streamlining the appeal process to ensure fairness and efficiency for taxpayers.

It's essential for taxpayers and stakeholders to stay informed about legislative updates, as they can have a significant impact on property tax obligations.

Technological Advancements

Indiana is continually improving its online tools and resources to enhance the property tax lookup and payment process. Some potential future developments include:

- Enhanced Property Search: Advanced search functionalities, such as mapping tools and integrated data layers, could provide more precise property information.

- Mobile Accessibility: Developing mobile-friendly versions of the property tax lookup tools would make information more accessible to taxpayers on the go.

- Data Visualization: Visual representations of property tax data, such as interactive maps and charts, could improve user experience and understanding.

These technological advancements aim to improve transparency, efficiency, and user experience for taxpayers and stakeholders.

Community Engagement

As property taxes fund essential local services, community engagement plays a vital role in shaping the tax system. Taxpayers and stakeholders can actively participate in the process by:

- Attending public hearings on tax rate ordinances to provide input and feedback.

- Engaging with local government officials to discuss concerns and suggestions.

- Staying informed about local tax issues and initiatives through community forums and newsletters.

By actively participating in the property tax system, taxpayers can ensure that their voices are heard and that the system remains fair and responsive to community needs.

Conclusion

The Indiana Property Tax Lookup system is a vital resource for taxpayers, providing transparency and accessibility to critical property tax information. By understanding the assessment process, tax rates, and available exemptions, taxpayers can effectively manage their property tax obligations. Additionally, online lookup tools and resources enhance the user experience, making it easier for taxpayers to access and understand their property tax data.

As Indiana continues to refine its property tax system, taxpayers can expect a fair and efficient process, supported by technological advancements and community engagement. Staying informed about legislative changes, utilizing online tools, and actively participating in the tax process will empower taxpayers to make informed decisions and contribute to the vitality of their communities.

How often are properties reassessed in Indiana?

+Properties in Indiana are typically reassessed every three years. However, certain counties or under specific circumstances, reassessments may occur more frequently. It’s important for property owners to stay informed about the assessment schedule in their area.

What happens if I don’t receive my tax bill?

+If you do not receive your tax bill, it’s important to contact your local Treasurer’s Office promptly. They can provide you with a duplicate bill and assist you in making the necessary payment. Remember, late payments may result in penalties and interest charges.

How can I apply for a property tax exemption or deduction?

+The application process for property tax exemptions and deductions varies based on the specific exemption. The Indiana Department of Revenue provides detailed guidelines and forms for each type of exemption. It’s essential to review the eligibility criteria and submit the required documentation to ensure a successful application.