Property Taxes Arkansas

Property taxes in Arkansas are a significant revenue source for local governments, funding essential services like schools, fire departments, and infrastructure maintenance. The state's property tax system is relatively straightforward, with rates varying across counties and municipalities. Understanding how property taxes work in Arkansas is crucial for homeowners, investors, and anyone interested in real estate within the state.

The Basics of Property Taxes in Arkansas

Arkansas's property tax system is based on the ad valorem principle, which means taxes are assessed based on the property's value. The assessed value of a property is determined by the county assessor's office, taking into account factors such as location, size, improvements, and market conditions.

Once the assessed value is determined, it is multiplied by the applicable tax rate to calculate the property tax liability. These tax rates, also known as millage rates, are set by local taxing authorities, including counties, cities, school districts, and special-purpose districts. The millage rate represents the number of dollars owed per $1,000 of assessed value.

Assessed Value Calculation

The assessed value of a property in Arkansas is typically 20% of the fair market value. For instance, if a property has a fair market value of $200,000, its assessed value for tax purposes would be $40,000 (20% of $200,000). However, certain types of properties, such as agricultural lands, may have different assessment ratios.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 20% |

| Commercial | 20% |

| Industrial | 20% |

| Agricultural | Varies (typically 10-20%) |

The assessed value is then adjusted for any applicable exemptions or deductions, such as the homestead credit or senior citizen exemption.

Tax Rates and Millage

Arkansas's tax rates, or millage rates, are expressed in mills, with one mill representing one-tenth of a cent. The millage rate is determined by each taxing authority and can vary widely across the state. For example, a property located in a rural area with a low millage rate may have a lower tax burden compared to a similar property in an urban area with a higher millage rate.

The combined millage rate for a specific property is the sum of the rates set by all the taxing authorities that have jurisdiction over that property. This includes county, city, school district, and any special-purpose district rates.

Property Tax Rates and Variations

Property tax rates in Arkansas can vary significantly from one location to another due to the diverse tax structures implemented by local governments. Understanding these variations is crucial for individuals considering property ownership or investment in different parts of the state.

County-Level Variations

Each of Arkansas's 75 counties sets its own property tax rates, resulting in a wide range of rates across the state. For instance, the county of Benton, which includes the city of Bentonville, had a combined millage rate of 44.27 mills in 2022, while Randolph County had a rate of 69.20 mills for the same year.

These variations can be influenced by factors such as the cost of running local services, the level of funding needed for schools, and the presence of special districts within a county.

City and Municipal Variations

Cities and municipalities in Arkansas also have the authority to set their own property tax rates. This can lead to further variations in tax burdens, even within the same county. For example, the city of Little Rock had a combined millage rate of 52.97 mills in 2022, while the nearby city of North Little Rock had a rate of 51.35 mills for the same period.

Municipal tax rates can be influenced by factors such as the need for additional funding for local services, infrastructure projects, or economic development initiatives.

School District Variations

School districts in Arkansas play a significant role in property tax rates. These districts have their own millage rates, which can significantly impact the overall tax burden for property owners within the district. For instance, the Bentonville School District, located in Benton County, had a millage rate of 42.30 mills in 2022, while the Little Rock School District had a rate of 58.39 mills for the same year.

School district tax rates are often determined by the financial needs of the district, including funding for teachers, facilities, and educational programs.

Special District Variations

Special districts in Arkansas, such as fire protection districts or water and sewer districts, can also levy property taxes. These districts are established to provide specific services and are funded through property taxes. The millage rates for special districts can vary widely and are often included in the overall millage rate for a property.

| Special District | Millage Rate (2022) |

|---|---|

| Central Fire Protection District | 3.86 mills |

| North Little Rock Water Reclamation District | 4.00 mills |

| Maumelle Water & Sewer District | 2.00 mills |

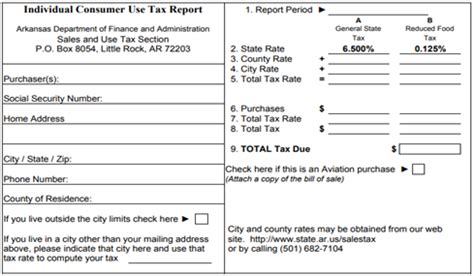

Understanding Property Tax Bills

Property tax bills in Arkansas provide a detailed breakdown of the taxes owed, allowing property owners to understand how their tax liability is calculated. These bills typically include information on the assessed value of the property, the applicable millage rates, and any exemptions or deductions applied.

Sample Property Tax Bill

Consider the following example of a property tax bill for a residential property in Arkansas:

| Property Address | Assessed Value | Tax Rate (Mills) | Tax Amount |

|---|---|---|---|

| 123 Main Street, Little Rock, AR | $200,000 | 50.00 | $10,000 |

In this example, the property has an assessed value of $200,000, and the applicable tax rate is 50 mills. The tax amount owed for this property is $10,000, calculated by multiplying the assessed value by the tax rate ($200,000 x 0.050 = $10,000).

Exemptions and Deductions

Arkansas offers various exemptions and deductions to reduce the tax burden on certain properties and individuals. These include the homestead credit, which provides a tax reduction for owner-occupied residences, and the senior citizen exemption, which reduces the assessed value of properties owned by individuals aged 65 or older.

Other deductions, such as the military exemption for veterans or the agricultural exemption for farmers, can also significantly impact the property tax liability.

Appealing Property Tax Assessments

Property owners in Arkansas have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or if they disagree with the tax rate applied. The appeals process typically involves submitting an application to the county assessor's office and providing evidence to support the requested change.

Reasons for Appeal

Common reasons for appealing a property tax assessment in Arkansas include:

- Overvaluation of the property compared to similar properties in the area.

- Errors in the assessment, such as incorrect square footage or missing improvements.

- Changes in the property's condition or use that affect its value.

- Disagreement with the tax rate set by local authorities.

The Appeals Process

The appeals process in Arkansas typically involves the following steps:

- Review the assessment notice: Carefully examine the assessment notice sent by the county assessor's office to identify any discrepancies or errors.

- Gather evidence: Collect relevant documents, such as recent appraisals, sales data of similar properties, or photos showing the property's condition.

- Submit an appeal: Prepare and file an appeal with the county assessor's office, providing detailed reasons for the appeal and supporting evidence.

- Hearing or mediation: Depending on the county's procedures, your appeal may be heard by a board of review or go through a mediation process.

- Decision and further appeals: The county assessor's office will issue a decision on your appeal. If you are dissatisfied with the decision, you may have the option to appeal to higher authorities, such as the county board of equalization or the Arkansas Board of Review.

Impact of Property Taxes on Real Estate Transactions

Property taxes in Arkansas play a significant role in real estate transactions, influencing both buyers and sellers. Understanding the tax implications can help individuals make informed decisions when buying or selling property in the state.

Buyer Considerations

For buyers, property taxes are an essential factor to consider when evaluating the affordability and long-term costs of a property. A higher tax burden can impact a buyer's ability to secure financing or may require a larger down payment. Additionally, buyers should be aware of any special assessments or upcoming tax increases that could affect their future tax liability.

Seller Considerations

Sellers, on the other hand, should be mindful of how property taxes can impact the marketability of their property. Properties with lower tax burdens may be more attractive to buyers, potentially resulting in a quicker sale and a higher sale price. Sellers should also be prepared to address any concerns buyers may have regarding property taxes during the negotiation process.

Tax Consequences for Buyers and Sellers

When a property is sold, there are several tax consequences to consider. Buyers may be eligible for certain tax credits or deductions, such as the mortgage interest deduction or the property tax deduction. Sellers, however, may face capital gains taxes on the sale, depending on their profit and holding period.

It's important for both buyers and sellers to consult with tax professionals or real estate agents who are knowledgeable about property taxes in Arkansas to ensure they understand the potential tax implications of their transactions.

FAQs

How often are property tax assessments conducted in Arkansas?

+

Property tax assessments in Arkansas are conducted annually by the county assessor’s office. However, the actual date of assessment may vary slightly from county to county.

Can I pay my property taxes online in Arkansas?

+

Yes, many counties in Arkansas offer online payment options for property taxes. Visit your county assessor’s website or contact their office for specific instructions on how to pay your taxes online.

What happens if I don’t pay my property taxes in Arkansas?

+

Failure to pay property taxes in Arkansas can result in penalties, interest, and potentially the loss of your property through a tax sale. It’s important to stay current on your tax payments to avoid these consequences.

Are there any tax relief programs for seniors or veterans in Arkansas?

+

Yes, Arkansas offers several tax relief programs for seniors and veterans. These include the Senior Citizen Tax Deferral Program and the Disabled Veterans Property Tax Exemption. Contact your county assessor’s office or the Arkansas Department of Finance and Administration for more information.

Can I estimate my property taxes before buying a home in Arkansas?

+

Yes, you can estimate your property taxes by multiplying the assessed value of the property by the applicable tax rate. Keep in mind that this is an estimate, and the actual tax liability may vary based on any exemptions or deductions you may be eligible for.