Trump Child Support Law Taxes

In the complex landscape of American politics and legislation, the Trump administration's policies have often sparked intense debates and discussions. One such policy that has gained attention is the Trump Child Support Law, particularly the implications it has on taxes and the lives of those it affects.

The Trump Child Support Law: An Overview

The Trump Child Support Law, officially known as the Child Support Amendments of 2018, was a significant legislative initiative introduced during the Trump presidency. It aimed to address several key issues within the child support system, striving to enhance enforcement, streamline processes, and improve the overall effectiveness of child support payments.

The law targeted several critical areas within the child support framework, including:

- Enforcement Measures: The legislation proposed stricter enforcement mechanisms to ensure that non-custodial parents meet their child support obligations. This included the potential for increased penalties for non-payment and enhanced methods for locating and tracking down delinquent parents.

- Simplified Procedures: One of the primary goals was to simplify the often complex and cumbersome child support processes. This involved standardizing procedures across states, improving communication between state agencies, and providing clearer guidelines for parents navigating the system.

- Support for Custodial Parents: The law aimed to provide additional support and resources to custodial parents, ensuring they received the necessary financial assistance to raise their children. This included potential improvements to payment distribution systems and enhanced access to legal services.

- Addressing Child Support Arrears: A significant focus was on addressing the issue of unpaid child support, or arrears. The law proposed strategies to tackle this problem, including improved collection methods and potential incentives for parents to clear their debts.

However, amidst these well-intentioned goals, the law's potential impact on taxes and the broader financial landscape sparked debates and concerns among experts and the public alike.

Tax Implications: Unraveling the Complexity

The intersection of the Trump Child Support Law and taxes presents a nuanced and intricate web of considerations. Here’s a detailed exploration of these implications:

Child Support Payments and Taxability

Under the Trump Child Support Law, the tax treatment of child support payments underwent a significant transformation. Historically, child support payments were not considered taxable income for the recipient, nor were they tax-deductible for the payer. This was a widely accepted principle, ensuring that child support served its primary purpose of providing financial support for the child’s upbringing without being influenced by tax considerations.

However, the Trump administration proposed a radical shift in this paradigm. The new law suggested that child support payments should be treated as taxable income for the recipient and tax-deductible for the payer. This change aimed to align child support with other forms of income and expenses, treating it more like alimony or other financial settlements.

This proposed change sparked intense debates among tax experts and legal professionals. Critics argued that taxing child support payments could have unintended consequences, potentially discouraging parents from making timely payments and reducing the overall amount available for the child's welfare. Proponents, on the other hand, suggested that this alignment with other forms of income could provide a more equitable tax treatment and reduce potential tax evasion.

The taxability of child support payments remains a highly contested issue, with no clear consensus among experts. The potential implications for families and the broader economy are significant, making it a crucial aspect of the Trump Child Support Law's legacy.

Impact on Tax Collection and Compliance

The proposed changes to the tax treatment of child support payments had broader implications for tax collection and compliance. If implemented, these changes could have a significant impact on the Internal Revenue Service (IRS) and state tax agencies.

First, treating child support payments as taxable income would increase the number of individuals and families subject to tax liability. This would potentially lead to a surge in tax filings, especially among custodial parents who may not have previously filed taxes due to their low income or reliance on child support payments.

Second, the tax deductibility of child support payments for the payer could create a new category of deductions for taxpayers. This would require the IRS and state agencies to establish clear guidelines and procedures for claiming these deductions, ensuring accuracy and preventing potential abuse.

Furthermore, the implementation of these changes would require enhanced coordination between child support enforcement agencies and tax authorities. This could lead to the development of new systems and protocols to ensure accurate reporting and collection of taxes related to child support payments. The potential for increased complexity and administrative burdens on both taxpayers and government agencies is a significant consideration.

Despite these challenges, proponents argue that the alignment of child support with other taxable income and deductions could lead to a more streamlined and efficient tax system. It could also potentially reduce tax evasion and improve overall compliance, especially among those who may have previously avoided paying taxes on their child support payments.

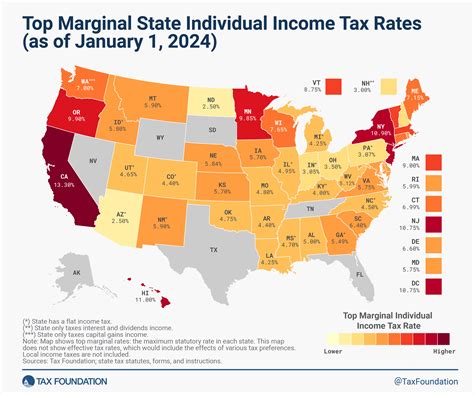

State-Level Variations and Challenges

The Trump Child Support Law, if implemented, would have introduced significant variations in tax treatment across states. Child support enforcement and tax collection are primarily state-level responsibilities, leading to a patchwork of regulations and practices.

States have different approaches to collecting and enforcing child support, and these variations would likely extend to the tax treatment of child support payments. Some states may choose to adopt the federal guidelines proposed in the Trump Child Support Law, while others may opt for alternative approaches or maintain the status quo.

This state-level variation could create complexities for taxpayers, especially those with cross-state obligations. It could lead to confusion and potential disputes over the tax treatment of child support payments, especially in cases where parents live in different states or have obligations in multiple jurisdictions.

Additionally, the implementation of the law could strain state resources, particularly in states with limited budgets and capacity. The need for enhanced coordination between child support agencies and tax authorities, as well as the potential for increased tax filings and enforcement actions, could pose significant challenges for state governments.

Real-World Impact and Case Studies

The potential impact of the Trump Child Support Law on taxes and families cannot be overstated. To illustrate this, let’s examine a few real-world scenarios and case studies:

Scenario 1: The Single Mother’s Dilemma

Imagine a single mother, Sarah, who relies heavily on child support payments to provide for her two children. Under the proposed tax changes, Sarah’s child support payments would now be considered taxable income. This could significantly reduce the disposable income she has available to support her family, potentially leading to financial strain and difficulty meeting her children’s needs.

Additionally, if Sarah's ex-partner, John, fails to make timely child support payments, the tax deductibility of these payments could provide him with a financial incentive to delay or avoid payments. This would further exacerbate Sarah's financial situation and potentially impact her ability to provide a stable home for her children.

Scenario 2: Complex Cross-State Cases

Consider a situation where a non-custodial parent, David, resides in State A and has child support obligations in State B. If State A adopts the Trump Child Support Law’s tax provisions, while State B does not, this could lead to confusion and potential disputes. David may face different tax consequences depending on how each state treats his child support payments, creating complexities in his financial planning and potential tax liabilities.

Furthermore, if David has multiple children with different mothers across different states, the variations in tax treatment could become even more intricate, requiring careful coordination and potentially leading to legal challenges.

Case Study: State Implementation Challenges

Let’s examine a hypothetical case study based on the experiences of a state tax agency. State X, facing budget constraints and a complex tax system, decides to implement the Trump Child Support Law’s tax provisions. This decision leads to several challenges:

- System Overhaul: The state's tax agency must invest significant resources in updating its systems and processes to accommodate the new tax treatment of child support payments. This includes training staff, developing new guidelines, and potentially integrating with child support enforcement systems.

- Increased Filings: With the new tax treatment, the state experiences a surge in tax filings, especially from custodial parents who were previously exempt from filing taxes. This places a strain on the agency's resources and may lead to delays in processing returns.

- Compliance Issues: The tax deductibility of child support payments creates a new category of deductions, leading to potential compliance challenges. The agency must develop robust procedures to verify the accuracy of these deductions and prevent potential abuse.

- Inter-Agency Coordination: The coordination between the state's tax agency and its child support enforcement agency becomes crucial. Both agencies must work together to ensure accurate reporting, collection, and distribution of taxes related to child support payments.

These real-world scenarios and case studies highlight the complex and far-reaching implications of the Trump Child Support Law on taxes and the lives of those it affects. The potential consequences, both positive and negative, underscore the importance of careful consideration and analysis before implementing such significant policy changes.

Future Implications and Expert Insights

As we reflect on the Trump Child Support Law and its potential impact on taxes, several key considerations and future implications emerge. Here’s a deeper dive into these aspects, guided by expert insights and analysis:

Equity and Fairness Considerations

One of the primary concerns surrounding the tax treatment of child support payments is the issue of equity and fairness. Proponents of the Trump Child Support Law argue that treating child support payments like other forms of income and expenses is a step towards a more equitable tax system.

However, critics argue that the proposed changes could disproportionately impact low-income families and single parents, many of whom rely heavily on child support payments to meet their basic needs. Taxing these payments could further reduce their disposable income, potentially leading to financial hardship and an increased reliance on social safety nets.

Experts suggest that a more nuanced approach may be necessary, taking into account the unique circumstances of each family and the potential impact of taxation on their financial stability. This could involve exploring alternative tax treatments, such as tax credits or deductions specifically targeted at child support payments, to ensure a more equitable outcome.

Administrative Burdens and Compliance Challenges

The implementation of the Trump Child Support Law’s tax provisions would likely introduce significant administrative burdens and compliance challenges for both taxpayers and government agencies.

Taxpayers, especially those who may not have previously filed taxes, would need guidance and support to navigate the new tax landscape. This could lead to increased demand for tax preparation services and potentially create challenges for low-income families who may not have the means to access these services.

Government agencies, particularly state tax authorities, would face the task of updating their systems and processes to accommodate the new tax treatment. This could require significant investments in technology, training, and staffing, placing a strain on already limited resources. The potential for increased tax filings and enforcement actions could further exacerbate these challenges.

Experts emphasize the importance of careful planning and coordination to mitigate these administrative burdens. This could involve exploring simplified tax filing options, providing targeted education and outreach to affected populations, and enhancing inter-agency collaboration to streamline processes and reduce duplication of efforts.

Potential Impact on Child Support Obligations

The taxability of child support payments could have unintended consequences on the overall level of child support obligations. Critics argue that making these payments taxable could create a disincentive for non-custodial parents to make timely payments, potentially leading to increased arrears and reduced financial support for children.

Additionally, the tax deductibility of child support payments for the payer could further complicate matters. This could provide a financial incentive for parents to negotiate lower child support obligations, as they would be able to offset some of the cost through tax deductions. This could potentially impact the financial stability of custodial parents and children, especially in cases where the non-custodial parent has significant tax liabilities.

Experts suggest that a comprehensive review of child support guidelines and enforcement mechanisms may be necessary to address these potential consequences. This could involve exploring alternative approaches, such as tax credits or incentives, to encourage timely payment and ensure that child support obligations remain a priority for non-custodial parents.

State-Level Implementation and Variations

The potential for state-level variations in the implementation of the Trump Child Support Law’s tax provisions is a significant consideration. States have varying approaches to child support enforcement and tax collection, leading to a complex landscape of regulations and practices.

Some states may choose to adopt the federal guidelines proposed in the law, while others may opt for alternative approaches or maintain the status quo. This variation could create confusion and potential disputes, especially for individuals with cross-state obligations.

Experts emphasize the need for clear and consistent guidelines at the federal level to provide a framework for state implementation. This could involve developing model legislation or best practices to guide states in their decision-making process. Additionally, enhanced coordination and collaboration between states could help address cross-state issues and ensure a more uniform approach to the tax treatment of child support payments.

Conclusion

The Trump Child Support Law, with its proposed changes to the tax treatment of child support payments, has sparked intense debates and discussions. The potential implications for taxes, families, and the broader economy are significant and far-reaching.

While the law aimed to address critical issues within the child support system, the tax implications it raises require careful consideration and analysis. The potential impact on equity, administrative burdens, child support obligations, and state-level variations underscores the complexity of this policy initiative.

As we navigate the ongoing debates and discussions surrounding the Trump Child Support Law, it is crucial to engage in thoughtful dialogue, consider expert insights, and explore alternative approaches to ensure a fair and effective child support system that serves the best interests of children and families.

What was the primary goal of the Trump Child Support Law?

+The primary goal of the Trump Child Support Law was to enhance the enforcement of child support obligations, streamline processes, and improve the overall effectiveness of the child support system.

How did the law propose to treat child support payments for tax purposes?

+The law proposed to treat child support payments as taxable income for the recipient and tax-deductible for the payer, aligning it with other forms of income and expenses.

What are the potential challenges of implementing these tax provisions at the state level?

+Implementing these tax provisions at the state level could lead to variations in tax treatment, increased administrative burdens, and potential compliance challenges. States would need to update their systems, processes, and coordination with child support enforcement agencies.