Llc Tax Filing Deadline

When it comes to running a business, understanding the intricacies of tax obligations is crucial for success and compliance. For Limited Liability Companies (LLCs), tax filing deadlines are an essential aspect to keep in mind. In this comprehensive guide, we will delve into the world of LLC tax filing deadlines, providing you with a detailed breakdown of the key dates, requirements, and strategies to ensure your business remains in good standing with the tax authorities.

Unraveling the Complexity of LLC Tax Deadlines

The tax landscape for LLCs can be complex, as these entities offer a unique blend of pass-through taxation and the limited liability protection of a corporation. As an LLC owner, it's imperative to stay on top of the various tax obligations, which can include income taxes, payroll taxes, sales taxes, and more.

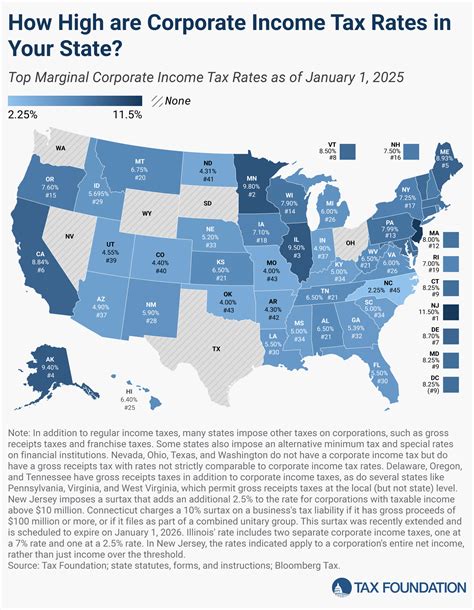

One of the primary challenges for LLCs is the variation in tax deadlines across different states and jurisdictions. While some aspects of tax filing remain consistent nationwide, such as federal income tax deadlines, other obligations can vary significantly based on your business location and specific industry.

Federal Income Tax Deadlines for LLCs

For federal income tax purposes, LLCs are treated as pass-through entities. This means that the LLC itself does not pay income taxes; instead, the profits or losses are "passed through" to the owners, who report them on their individual tax returns.

The deadline for LLC owners to file their individual tax returns, including the reporting of LLC income, is typically April 15th of the following year. However, it's crucial to note that this deadline can be extended by filing Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return". This extension grants an additional six months, pushing the deadline to October 15th.

It's important to remember that while this extension provides more time to file, it does not extend the deadline for paying any taxes owed. Interest and penalties may accrue on unpaid taxes from the original due date.

State and Local Tax Deadlines

When it comes to state and local tax obligations, the landscape becomes more diverse. Each state has its own set of rules and regulations, which can include income taxes, sales taxes, franchise taxes, and various other levies. Here's a breakdown of some key state-specific tax deadlines:

| State | Income Tax Deadline | Sales Tax Deadline |

|---|---|---|

| California | April 15th (Individual) / April 15th (Business) | Monthly or Quarterly, due on the 25th of the following month |

| Texas | April 15th (Individual) / May 15th (Business) | Monthly, due on the 20th of the following month |

| New York | April 15th (Individual) / April 15th (Business) | Monthly or Quarterly, due on the 23rd of the following month |

| Florida | April 15th (Individual) / April 15th (Business) | Monthly, due on the 20th of the following month |

| Illinois | April 15th (Individual) / April 15th (Business) | Monthly, due on the 25th of the following month |

It's crucial to note that these are general guidelines, and specific deadlines may vary based on the type of tax, business entity, and other factors. For instance, some states offer extended deadlines for LLCs that operate as S-Corps or partnerships.

Payroll Tax Deadlines

If your LLC has employees, you must also comply with payroll tax obligations. These taxes include federal income tax withholding, Social Security and Medicare taxes (FICA), and Federal Unemployment Tax (FUTA). The deadlines for payroll tax filings are as follows:

- Monthly Deposits: If your LLC's payroll tax liability exceeds a certain threshold, you must deposit taxes monthly. The deposit deadlines fall on the 15th of the following month for the previous month's payroll. For example, taxes withheld in January would be due on February 15th.

- Quarterly Reports: Regardless of the size of your payroll tax liability, all LLCs with employees must file quarterly payroll tax reports. These reports are due on April 30th, July 31st, October 31st, and January 31st of the following year.

- Annual Returns: LLCs must also file annual payroll tax returns, typically Form 940 for FUTA and Form 941 for income tax withholding and FICA taxes. The deadline for these returns is January 31st of the following year.

Other Tax Obligations

In addition to the aforementioned taxes, LLCs may have other specific tax obligations depending on their industry, size, and location. These can include:

- Self-Employment Taxes: LLC owners who are also active in the business are considered self-employed and must pay self-employment taxes. The deadline for paying and filing these taxes aligns with the individual income tax deadline.

- Estimated Tax Payments: If your LLC has a significant income tax liability, you may be required to make estimated tax payments throughout the year. These payments are due on April 15th, June 15th, September 15th, and January 15th of the following year.

- Franchise Taxes: Certain states, such as California and Texas, impose franchise taxes on LLCs. These taxes are typically due annually, with specific deadlines set by the state.

Strategies for Effective Tax Management

Navigating the complex world of LLC tax filing deadlines can be challenging, but with the right strategies, you can ensure timely compliance and avoid penalties.

1. Stay Informed

Keep yourself updated on the latest tax laws and regulations. Subscribe to relevant newsletters, follow trusted tax resources, and consult with tax professionals to stay ahead of any changes that may impact your business.

2. Establish a Robust Accounting System

Implement a reliable accounting system that tracks all financial transactions accurately. This will not only help you stay organized but also simplify the tax filing process. Consider using accounting software specifically designed for small businesses or LLCs.

3. Set Reminders and Deadlines

Create a calendar specifically for tax-related deadlines. Mark the key dates mentioned above, and set reminders for each. This will help you stay on top of your obligations and ensure you don't miss any critical filing dates.

4. Consult Tax Professionals

While it's important to understand the basics of LLC tax filing, consulting with tax professionals can provide valuable insights and ensure you're taking advantage of all available deductions and credits. A tax advisor can also guide you through the complexities of state and local tax laws.

5. Stay Compliant with Record-Keeping

Maintain meticulous records of all financial transactions, receipts, and invoices. Proper record-keeping not only simplifies the tax filing process but also provides crucial documentation in case of an audit.

6. Plan for Quarterly Reviews

Schedule regular quarterly reviews of your financial records and tax obligations. This practice will help you stay on track, identify any potential issues early on, and make necessary adjustments to your tax strategy.

7. Explore Tax-Saving Opportunities

Stay informed about tax-saving opportunities that may be available to your LLC. This can include deductions for business expenses, credits for hiring or training employees, or special incentives offered by your state or industry.

Conclusion

Managing the tax obligations of an LLC requires diligence, organization, and a solid understanding of the relevant tax laws. By staying informed, utilizing effective accounting practices, and seeking professional guidance when needed, you can ensure that your LLC remains compliant and takes advantage of all available tax benefits.

Remember, while this guide provides a comprehensive overview, tax laws are subject to change, and specific circumstances may require additional considerations. Always consult with tax professionals for personalized advice tailored to your business.

What happens if I miss an LLC tax filing deadline?

+Missing a tax filing deadline can result in penalties and interest charges. It’s crucial to file as soon as possible to minimize these consequences. In some cases, you may also face late payment penalties if taxes are owed.

Can I change my LLC’s tax filing status or deadline?

+Yes, you can change your LLC’s tax filing status or deadline by filing specific forms with the IRS and your state tax agency. This process typically involves electing a different tax classification or changing your business structure.

Are there any tax benefits for LLCs?

+LLCs offer several tax benefits, including pass-through taxation, which means profits are taxed at the individual level, often at lower rates. Additionally, LLCs can deduct business expenses, which can significantly reduce their tax liability.

Can I file my LLC’s taxes online?

+Yes, many states and the IRS offer online filing options for LLC taxes. These platforms provide a convenient and secure way to file your tax returns and make payments.

How often should I consult a tax professional for my LLC?

+It’s recommended to consult a tax professional at least annually to review your tax obligations and strategies. However, if your business undergoes significant changes or faces complex tax issues, more frequent consultations may be beneficial.