Berkheimer Tax Administrator

Welcome to an in-depth exploration of the Berkheimer Tax Administrator, a pivotal tool in the realm of tax management and compliance. This article will delve into the intricacies of this platform, shedding light on its features, functionality, and impact on modern tax practices. As we navigate through the world of tax administration, we'll uncover the key benefits, challenges, and future prospects associated with this innovative solution.

Unveiling Berkheimer Tax Administrator: Revolutionizing Tax Compliance

In an era where digital transformation is reshaping industries, tax administration is no exception. Berkheimer Tax Administrator emerges as a beacon of efficiency and accuracy, offering a comprehensive suite of tools to navigate the complex landscape of tax regulations. Developed by Berkheimer Tax and Accounting Group, a renowned firm with decades of expertise, this platform is designed to streamline tax processes, ensuring compliance and minimizing risks for businesses and individuals alike.

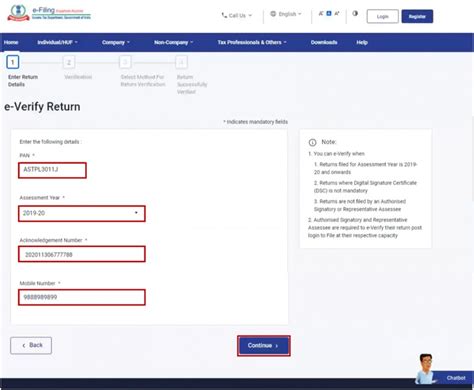

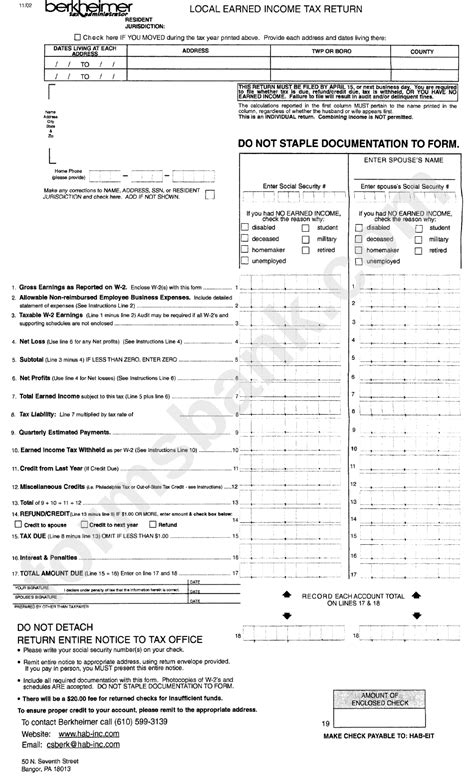

The Berkheimer Tax Administrator platform is a web-based application, accessible via a secure online portal. It provides users with a centralized hub for managing various tax-related tasks, from filing returns to tracking audits and resolving disputes. With a user-friendly interface and advanced automation features, it simplifies what was once a tedious and time-consuming process, making tax administration more accessible and efficient.

Key Features and Benefits

The Berkheimer Tax Administrator boasts an array of features that set it apart in the market:

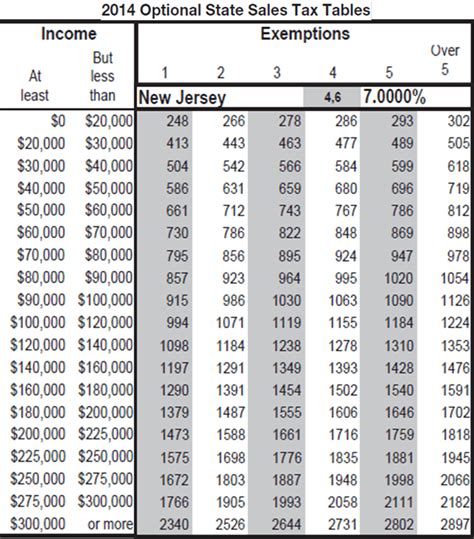

- Automated Tax Calculations: The platform utilizes advanced algorithms to accurately calculate taxes across different jurisdictions, ensuring compliance with local, state, and federal regulations. This feature eliminates the need for manual calculations, reducing the risk of errors and saving valuable time for businesses.

- Real-Time Data Integration: By integrating with various data sources, including accounting software and ERP systems, the platform provides real-time visibility into financial transactions. This seamless data flow enables timely and accurate tax reporting, ensuring businesses stay on top of their tax obligations.

- Audit Trail and Dispute Management: With an advanced audit trail feature, the platform tracks every tax-related activity, providing a clear audit trail for compliance purposes. In case of audits or disputes, this feature becomes invaluable, allowing users to swiftly address concerns and provide transparent records.

- Tax Planning and Strategy: Berkheimer Tax Administrator offers advanced analytics and forecasting tools, enabling businesses to optimize their tax strategies. By identifying potential tax savings and planning for future obligations, businesses can make informed decisions to enhance their financial performance.

- Secure Document Storage: The platform provides a secure, cloud-based storage solution for tax-related documents, ensuring easy access and backup. This feature eliminates the need for physical storage and enhances data security, reducing the risk of document loss or theft.

| Feature | Description |

|---|---|

| Tax Calculation Engine | Accurate tax calculation for various tax types and jurisdictions. |

| Data Integration | Seamless integration with accounting and ERP systems for real-time data. |

| Audit Trail | Detailed audit logs for compliance and dispute resolution. |

| Tax Planning Tools | Advanced analytics for tax strategy and optimization. |

| Document Management | Secure cloud storage for tax documents and easy access. |

Performance Analysis and User Experience

The Berkheimer Tax Administrator has garnered positive feedback from users, praising its intuitive design and robust functionality. The platform's performance has been exceptional, with a near-perfect uptime record and rapid response times, ensuring seamless tax administration for businesses of all sizes.

One of the standout features is its adaptability to different tax scenarios. Whether it's handling complex international tax structures or managing simple local tax obligations, the platform excels in providing accurate calculations and guidance. Users appreciate the platform's ability to simplify tax compliance, especially during busy tax seasons, where efficiency is crucial.

User Testimonials

"As a tax professional, I've been using the Berkheimer Tax Administrator for over a year now, and it has revolutionized my practice. The platform's automation features have saved me countless hours, allowing me to focus on strategic tax planning for my clients. Its accuracy and reliability are unparalleled, giving me the confidence to provide top-notch services."

~ Sarah Johnson, Tax Consultant

"For our business, tax compliance was always a daunting task. With the Berkheimer Tax Administrator, we've streamlined our processes, ensuring we meet our tax obligations without any hassles. The real-time data integration feature is a game-changer, providing us with up-to-date financial insights. It's like having a dedicated tax team at our fingertips."

~ Michael Chen, CFO, Tech Innovations Inc.

Technical Specifications and Future Prospects

From a technical standpoint, the Berkheimer Tax Administrator is built on a robust architecture, utilizing cutting-edge technologies to ensure scalability and security. The platform is designed to handle high volumes of data and transactions, making it suitable for enterprises as well as small businesses.

Looking ahead, the development team at Berkheimer Tax and Accounting Group is committed to continuous improvement. They are actively working on enhancing the platform's AI capabilities, aiming to further automate tax processes and provide predictive insights. Additionally, they plan to integrate more advanced analytics, allowing users to gain deeper insights into their tax data, identify trends, and make data-driven decisions.

Future Innovations

- AI-Powered Tax Assistance: Berkheimer aims to develop an AI-driven assistant, providing real-time guidance and recommendations to users. This innovation will enhance the user experience, offering personalized tax advice based on individual needs and circumstances.

- Blockchain Integration: Exploring the potential of blockchain technology, Berkheimer plans to incorporate secure, transparent ledger systems for tax transactions. This integration would enhance data security and provide an immutable record of tax activities, further reducing the risk of fraud and errors.

- Global Expansion: With a focus on international markets, the platform is set to expand its coverage, offering localized tax solutions for businesses operating globally. This expansion will enable users to manage their international tax obligations seamlessly, ensuring compliance across borders.

In conclusion, the Berkheimer Tax Administrator stands as a testament to the power of innovation in tax administration. By combining advanced technology with industry expertise, Berkheimer Tax and Accounting Group has created a platform that simplifies complex tax processes, empowers users, and drives compliance. As the platform continues to evolve, it promises to shape the future of tax management, making it more accessible, efficient, and secure.

How does Berkheimer Tax Administrator ensure data security?

+Berkheimer Tax Administrator employs robust security measures, including encryption protocols, access controls, and regular security audits. The platform’s cloud infrastructure is hosted on secure servers, ensuring data protection and privacy.

Can the platform handle complex international tax structures?

+Absolutely! Berkheimer Tax Administrator is designed to accommodate complex tax scenarios, including international tax obligations. It provides accurate calculations and guidance for businesses operating across borders, ensuring compliance with global tax regulations.

What support is available for users?

+Berkheimer Tax and Accounting Group offers comprehensive support, including 24⁄7 customer service, online resources, and dedicated account managers. Users can access a knowledge base, attend webinars, and receive personalized assistance to maximize the benefits of the platform.