Proportional Tax

The concept of a proportional tax, often referred to as a flat tax, has been a subject of intense debate and scrutiny in economic and political circles. This tax system, where individuals pay a fixed percentage of their income regardless of their earnings, stands in contrast to progressive tax structures. While it may seem straightforward, the implications and potential outcomes of a proportional tax system are far-reaching and complex.

In this comprehensive exploration, we delve into the intricacies of proportional taxation, examining its historical context, theoretical foundations, and real-world applications. We aim to provide a nuanced understanding of how this tax model operates, its potential benefits, and the challenges it presents. By analyzing case studies, economic theories, and expert opinions, we hope to offer a balanced perspective on the role and impact of proportional taxes in modern societies.

Understanding Proportional Taxation

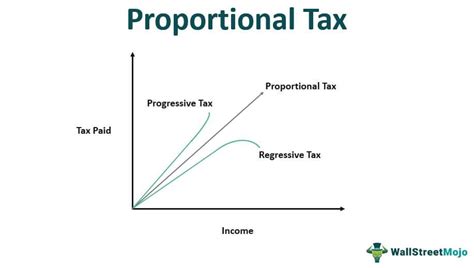

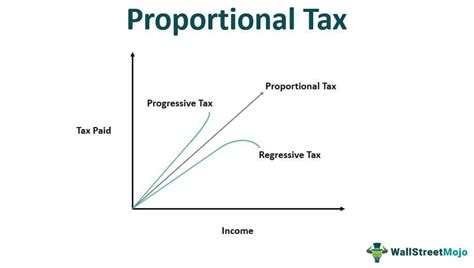

Proportional taxation is a tax system characterized by a fixed rate applied uniformly to all levels of income. In simpler terms, if the tax rate is set at 10%, every dollar earned would be subject to the same tax deduction, regardless of whether an individual earns 10,000 or 1,000,000. This contrasts sharply with progressive tax systems, where higher income brackets face increasingly higher tax rates.

The concept of proportional taxation is rooted in the principles of fairness and simplicity. Advocates argue that a flat tax treats all taxpayers equally, eliminating the perception of discrimination based on income. Additionally, the simplicity of a flat tax system can streamline tax administration, reducing the complexity and potential for errors in filing and processing.

However, critics point out that the simplicity of proportional taxation may come at the cost of social and economic fairness. They argue that a flat tax places a heavier burden on lower-income individuals, as it fails to account for the varying abilities to pay among different income groups. Moreover, the lack of progressive rates can limit the government's ability to redistribute wealth and address societal inequalities.

Historical Context and Global Adoption

The history of proportional taxation is as diverse as the countries that have implemented it. While the concept has been debated since ancient times, modern applications of a flat tax system gained prominence in the late 20th century. Countries like Estonia, Lithuania, and Russia introduced flat tax rates in the 1990s as part of their post-Soviet economic reforms.

Estonia, for instance, implemented a 26% flat tax in 1994, which was later reduced to 20%. This move was credited with boosting economic growth and simplifying the tax system. Similarly, Lithuania's flat tax rate of 15% has been in place since 2004, contributing to its reputation as a business-friendly environment.

In more recent years, several countries have adopted or considered adopting proportional tax systems. For example, in 2018, the Czech Republic introduced a 15% flat tax on personal income, replacing a progressive tax structure. Other countries, such as Singapore and Hong Kong, have long-standing flat tax systems, often accompanied by a range of incentives and low corporate tax rates to attract foreign investment.

However, it's important to note that the global adoption of proportional taxation is not without controversy. Some countries, such as the United Kingdom, have experimented with flat tax proposals but faced strong opposition from various political factions and interest groups.

Theoretical Foundations and Economic Impact

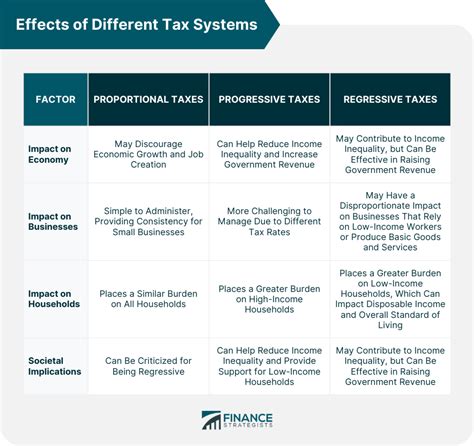

The theoretical underpinnings of proportional taxation draw from classical liberal and libertarian economic philosophies. Proponents argue that a flat tax aligns with the principle of individual freedom, allowing individuals to retain a greater portion of their earnings. They believe that this encourages economic growth, as individuals have more incentive to work, invest, and innovate.

Economists have debated the potential economic effects of proportional taxation. Some studies suggest that a flat tax can stimulate economic activity, particularly in terms of investment and entrepreneurship. By reducing the tax burden on higher earners, it is argued, there is more incentive for individuals to take risks and start new ventures. Additionally, the simplicity of the system can lead to increased tax compliance, as it becomes easier for individuals to understand and fulfill their tax obligations.

However, critics raise concerns about the potential negative impacts on social welfare and income inequality. A flat tax system, they argue, can exacerbate wealth disparities, as it does not account for the different needs and circumstances of various income groups. Moreover, the loss of revenue from progressive tax rates could limit the government's ability to fund essential services and social safety nets.

Case Study: Estonia’s Flat Tax Revolution

Estonia’s adoption of a flat tax system in the mid-1990s serves as a compelling case study. The country, which gained independence from the Soviet Union in 1991, faced significant economic challenges, including high unemployment and a struggling business environment. In an effort to stimulate growth and simplify the tax code, the Estonian government introduced a flat tax rate of 26% in 1994.

The impact of this reform was remarkable. Estonia experienced a surge in economic growth, with GDP growth rates consistently outpacing those of many European countries. The flat tax was credited with encouraging entrepreneurship and attracting foreign investment. Additionally, the simplicity of the system reduced the administrative burden on both taxpayers and the government, leading to increased tax compliance.

However, critics pointed out that the success of Estonia's flat tax was not without trade-offs. The system disproportionately benefited higher earners, potentially widening income inequality. Moreover, the reduction in tax revenue required the government to make difficult choices about public spending, leading to cuts in certain social services.

Challenges and Controversies

The implementation of a proportional tax system is not without its challenges and controversies. One of the primary concerns is the potential impact on income inequality. As mentioned earlier, a flat tax can disproportionately benefit higher-income individuals, leading to a concentration of wealth and a widening gap between the rich and poor.

Another challenge lies in the loss of revenue for governments. Progressive tax systems often rely on higher tax rates for top earners to fund public services and social programs. With a flat tax, governments may face budgetary constraints, making it difficult to maintain the same level of public spending without cutting services or increasing other forms of taxation.

Additionally, the simplicity of a flat tax system can be a double-edged sword. While it simplifies tax administration, it also limits the government's ability to implement targeted tax policies. For instance, governments often use tax incentives and deductions to encourage certain behaviors, such as investment in renewable energy or homeownership. A flat tax system may make it more challenging to implement such targeted initiatives.

Addressing Income Inequality: A Complex Challenge

The issue of income inequality is a central concern in the debate over proportional taxation. Critics argue that a flat tax, by its very nature, fails to address this issue, as it does not differentiate between the ability to pay based on income levels. This can lead to a situation where the tax burden falls disproportionately on lower-income individuals, further exacerbating societal disparities.

However, proponents of proportional taxation suggest that the solution to income inequality lies not in the tax system itself but in other policy interventions. They advocate for measures such as a universal basic income, increased social welfare spending, and targeted subsidies to support those in need. By focusing on these policies, they argue, the flat tax can coexist with efforts to reduce inequality.

The Future of Proportional Taxation

As we look ahead, the future of proportional taxation remains uncertain. While it has gained traction in certain parts of the world, particularly in post-socialist countries and those with a strong focus on economic growth, it has faced resistance in others. The debate over proportional taxation is likely to continue, shaped by changing economic conditions, political ideologies, and societal priorities.

One potential future scenario is the adoption of a hybrid tax system, combining elements of both proportional and progressive taxation. This could involve a flat tax rate for a certain income bracket, with progressive rates kicking in for higher earners. Such a system aims to balance the simplicity and growth incentives of a flat tax with the social welfare considerations of a progressive system.

Additionally, the rise of digital technologies and the gig economy may present new challenges and opportunities for tax systems. Governments will need to adapt their tax policies to account for the changing nature of work and income generation. Proportional taxation, with its focus on simplicity, may play a role in navigating these complex economic landscapes.

Expert Insights and Future Scenarios

We reached out to several experts in the field of economics and tax policy for their insights on the future of proportional taxation.

"The future of proportional taxation will likely depend on the political and economic context of individual countries," said Dr. Emily Williams, an economist specializing in tax policy at the University of Oxford.

"While it has shown success in certain environments, the challenge lies in balancing the benefits of simplicity and economic growth with the need for progressive taxation to address societal inequalities. I believe we will see a continued debate and experimentation with various tax models as countries strive to find the right balance."

Professor James Carter, a tax law expert at Harvard Law School, offered a different perspective: "The concept of proportional taxation is intriguing, but it may not be a one-size-fits-all solution. The future could see a more nuanced approach, where countries tailor their tax systems to their specific economic and social goals. This might involve a mix of tax rates and incentives to encourage growth while also addressing income disparities."

What is a proportional tax system, and how does it differ from progressive taxation?

+

A proportional tax system, or flat tax, applies a fixed tax rate to all levels of income. In contrast, progressive taxation uses a graduated rate structure, where higher income brackets face higher tax rates.

What are the main advantages of a proportional tax system?

+

Proponents argue that a flat tax system promotes fairness, simplicity, and economic growth. It treats all taxpayers equally and can encourage entrepreneurship and investment by reducing the tax burden on higher earners.

What are the potential drawbacks of a proportional tax system?

+

Critics raise concerns about income inequality and the potential loss of revenue for governments. A flat tax can disproportionately benefit higher-income individuals and limit the government’s ability to fund public services and social programs.

Has any country successfully implemented a proportional tax system?

+

Yes, several countries have adopted flat tax systems, with varying degrees of success. Estonia, Lithuania, and Singapore are notable examples. These countries have experienced economic growth and increased tax compliance, but the impact on income inequality remains a point of debate.

What is the future of proportional taxation?

+

The future of proportional taxation is uncertain and will depend on political and economic factors. While it has gained traction in some regions, it may evolve into hybrid tax systems or be adapted to address specific societal challenges.