Nj Auto Sales Tax

When it comes to purchasing a vehicle, understanding the sales tax implications is crucial, especially in a state like New Jersey, which has its own set of rules and regulations. In this comprehensive guide, we will delve into the world of New Jersey auto sales tax, exploring the ins and outs, rates, exemptions, and everything else you need to know to navigate the process with confidence.

Understanding New Jersey Auto Sales Tax

New Jersey, often referred to as the Garden State, imposes a sales tax on the purchase of vehicles, which contributes to the state’s revenue and funding for various services and infrastructure projects. This tax is applicable to both new and used vehicles, making it an important consideration for car buyers.

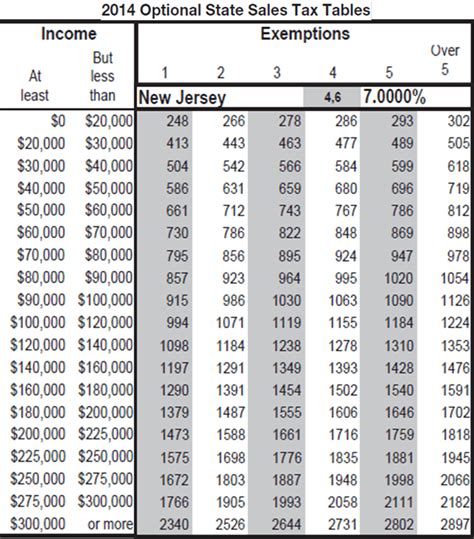

The NJ auto sales tax is a percentage-based tax calculated on the purchase price of the vehicle. The state of New Jersey utilizes a straightforward and uniform tax rate, ensuring consistency across all counties and dealerships. As of the latest available information, the current sales tax rate for vehicles in New Jersey stands at 7%.

Calculating Sales Tax

To illustrate the calculation process, let’s consider an example. Suppose you are purchasing a new car with a sticker price of $30,000. The sales tax amount would be determined by multiplying the purchase price by the tax rate:

| Sales Tax Calculation | Result |

|---|---|

| $30,000 x 0.07 | $2,100 |

In this scenario, the sales tax owed on the vehicle would be $2,100. This amount is in addition to the purchase price and any other applicable fees and charges.

Exemptions and Special Cases

While the NJ auto sales tax applies to most vehicle purchases, there are certain exemptions and special cases worth noting. Understanding these exceptions can help you determine if you qualify for any tax relief.

- Disabled Veterans: New Jersey offers a sales tax exemption for certain disabled veterans. To be eligible, veterans must have a disability rating of 100% due to service-connected disabilities and must meet specific criteria outlined by the state. This exemption can provide significant savings for those who qualify.

- Trade-Ins: When trading in your old vehicle as part of a new purchase, the sales tax is typically calculated based on the difference between the purchase price of the new vehicle and the trade-in value of the old one. This ensures that you are only taxed on the net amount, providing some relief on the overall tax liability.

- Leased Vehicles: If you are leasing a vehicle in New Jersey, the sales tax is calculated differently. Instead of applying to the entire purchase price, the tax is spread out over the lease term. This means you pay a portion of the sales tax with each monthly payment, making it a more manageable expense.

Filing and Payment Process

Now that we have a grasp of the sales tax rates and exemptions, let’s explore the process of filing and paying the NJ auto sales tax.

Step-by-Step Guide

- Obtain the Proper Forms: When purchasing a vehicle from a dealership, the necessary tax forms will typically be provided to you. These forms include the Sales and Use Tax Return for Motor Vehicles (Form ST-5) and the Registration Application (Form MV-6). If you are purchasing from a private seller, you may need to obtain these forms separately.

- Complete the Forms: Ensure that all required information is accurately filled out on the forms. This includes details about the vehicle, such as the make, model, and VIN, as well as your personal information and tax identification number.

- Calculate the Tax: Using the purchase price and the applicable tax rate, calculate the sales tax amount. Double-check your calculations to avoid any errors.

- Make the Payment: The sales tax is typically due at the time of purchase. You can pay the tax using various methods, including cash, check, or electronic payment. Ensure that you receive a receipt or confirmation of payment.

- Submit the Forms: Along with the completed forms and payment receipt, submit your application for vehicle registration to the appropriate authority. This is usually the New Jersey Motor Vehicle Commission (MVC) or a local MVC agency.

Timing and Deadlines

It’s crucial to be aware of the deadlines associated with filing and paying the NJ auto sales tax. Typically, you have 20 days from the date of purchase to register your vehicle and pay the sales tax. Failure to meet these deadlines can result in penalties and additional fees.

If you are purchasing a vehicle from out of state, the registration and tax payment process may vary. In such cases, it's advisable to consult with the NJ MVC or a tax professional to ensure compliance with the correct procedures.

Performance Analysis and Impact

The NJ auto sales tax plays a significant role in the state’s economy and has a direct impact on the automotive industry within New Jersey. Let’s explore some key performance indicators and the overall impact on the market.

Revenue Generation

The sales tax on vehicles is a substantial source of revenue for the state. According to recent data, the New Jersey Division of Taxation collected over $1.2 billion in auto sales tax revenue in a single fiscal year. This revenue contributes to funding essential services, such as education, healthcare, and infrastructure projects.

| Fiscal Year | Auto Sales Tax Revenue (in millions) |

|---|---|

| 2022 | $1,250 |

| 2021 | $1,180 |

| 2020 | $1,050 |

Market Impact

The NJ auto sales tax influences consumer behavior and market trends. While the tax adds to the overall cost of purchasing a vehicle, it also provides a level of stability and predictability for both buyers and sellers. Here are some key insights into the market impact:

- Price Sensitivity: The sales tax can impact consumers' purchasing decisions, especially when considering the overall price of the vehicle. Buyers may opt for vehicles with lower sticker prices to minimize the tax liability.

- Vehicle Choice: The tax can influence the types of vehicles consumers choose. Buyers may prefer more affordable options or explore leasing, which spreads out the tax burden over the lease term.

- Dealership Strategies: Dealerships often factor the sales tax into their pricing strategies. They may offer incentives or negotiate on the purchase price to make the overall cost more attractive to buyers.

Future Implications and Considerations

As we look ahead, it’s important to consider the potential future implications and evolving landscape of NJ auto sales tax.

Tax Rate Changes

The sales tax rate in New Jersey, currently set at 7%, is subject to change. While there have been no recent modifications, it’s crucial to stay informed about any potential adjustments. The state government may consider tax rate changes to align with economic goals or address budget concerns.

Electric Vehicle Incentives

With the growing popularity of electric vehicles (EVs), New Jersey has introduced incentives to promote their adoption. These incentives can include sales tax exemptions or reductions for qualifying EVs. Keeping an eye on these initiatives can provide significant savings for environmentally conscious buyers.

Online Sales and E-Commerce

The rise of online vehicle sales and e-commerce platforms presents a unique challenge for tax collection. New Jersey, like many other states, is exploring ways to ensure compliance and collect sales tax from online transactions. This evolving landscape may impact the purchasing process for online buyers.

FAQs

Can I negotiate the sales tax amount with the dealership?

+

No, the sales tax is a mandatory charge set by the state, and dealerships do not have the authority to negotiate or waive it. However, you can negotiate the purchase price of the vehicle, which will indirectly affect the sales tax amount.

Are there any penalties for late payment of the sales tax?

+

Yes, late payment of the sales tax can result in penalties and interest charges. It’s important to adhere to the deadline to avoid additional fees.

Can I claim a refund if I overpaid the sales tax?

+

If you believe you overpaid the sales tax, you can file a refund claim with the New Jersey Division of Taxation. However, it’s essential to have proper documentation and proof of overpayment.

Are there any online resources to calculate the sales tax for my vehicle purchase?

+

Yes, several online calculators and tools are available to estimate the sales tax based on your vehicle’s purchase price and the applicable tax rate. These can provide a quick estimate before making a purchase.

What happens if I fail to pay the sales tax within the specified deadline?

+

Failure to pay the sales tax within the deadline can result in penalties, interest charges, and even legal consequences. It’s crucial to prioritize timely payment to avoid these issues.