Nebraska State Tax Return Status

The Nebraska Department of Revenue is dedicated to ensuring a seamless and efficient tax return process for its residents. This article aims to provide an in-depth analysis of the Nebraska State Tax Return Status, covering everything from the initial filing process to the timely receipt of refunds. With a focus on the unique features of Nebraska's tax system, we'll guide you through the steps and requirements, ensuring you have all the information you need to navigate the process with ease.

Understanding the Nebraska State Tax Return Process

Nebraska’s tax system is designed to be straightforward and accessible for all residents. The state offers a range of resources and tools to assist taxpayers in completing their returns accurately and on time. Whether you’re a first-time filer or a seasoned taxpayer, understanding the key steps and requirements is essential.

Filing Deadlines

The Nebraska state tax return deadline typically aligns with the federal tax deadline, which is usually April 15th of each year. However, it’s crucial to note that this date can vary depending on the day of the week and certain circumstances. For instance, if the 15th falls on a weekend or a holiday, the deadline may be extended to the following business day.

It’s recommended to check the official Nebraska Department of Revenue website for the most up-to-date information on tax deadlines. Staying informed ensures you meet all the necessary filing requirements without incurring any penalties.

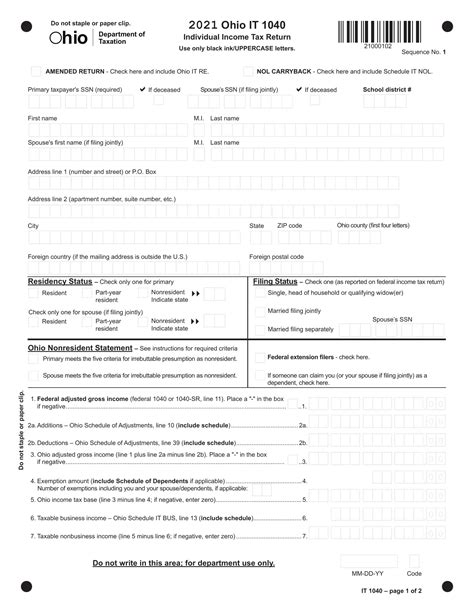

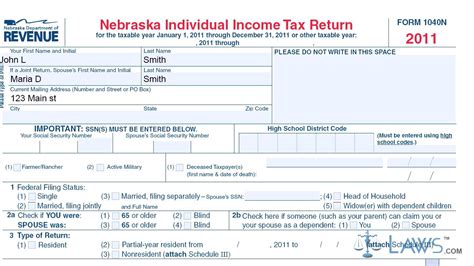

Tax Forms and Filing Methods

Nebraska offers a range of tax forms to cater to different taxpayer needs. The most common form is the NE Individual Income Tax Return (Form 1040NE), which is used by the majority of residents. This form covers various income sources, including wages, salaries, investments, and business income.

For those with more complex tax situations, such as self-employment or rental property income, the NE Schedule M-1 and Schedule SE may be required. These forms assist in calculating additional taxes and deductions specific to these income streams.

Nebraska also provides options for electronic filing (e-filing), which is the preferred method due to its efficiency and accuracy. Taxpayers can utilize the state’s official e-filing system or authorized tax software providers. Paper filing is still an option for those who prefer it, but it may take longer to process and receive a refund.

Required Documentation

To complete your Nebraska state tax return, you’ll need to gather certain documents and information. These typically include:

- Your social security number (SSN) or individual taxpayer identification number (ITIN)

- All W-2 forms from your employers

- 1099 forms for any additional income, such as interest or dividends

- Records of any other income sources, including self-employment or rental income

- Records of deductions and credits you plan to claim

It’s essential to keep all these documents organized and easily accessible to ensure a smooth filing process.

Tracking Your Nebraska State Tax Return

Once you’ve filed your Nebraska state tax return, you may want to track its status to stay informed about any updates or potential delays. The Nebraska Department of Revenue provides several methods for taxpayers to check the progress of their returns.

Online Tools

The most convenient way to track your Nebraska state tax return status is through the department’s online portal. By creating an account, you can access a range of services, including:

- Status Check: A real-time update on the processing stage of your return.

- Refund Tracker: An estimate of your refund amount and expected refund date.

- Payment Plans: The option to set up a payment plan if you owe taxes.

- Notice Center: A central hub for all official communications from the department.

The online portal is designed to be user-friendly, allowing taxpayers to navigate through the system with ease.

Telephone Hotline

If you prefer a more personal approach, the Nebraska Department of Revenue also offers a telephone hotline. By calling the designated number, you can speak to a customer service representative who can provide you with real-time updates on your return status.

However, it’s important to note that due to high call volumes during peak tax season, you may experience longer wait times. It’s recommended to utilize the online tools first, and only use the hotline if you require additional assistance.

Processing Times and Refunds

Nebraska aims to process state tax returns as quickly as possible, but the exact timeline can vary depending on several factors, including the filing method and the complexity of your return.

Generally, e-filed returns are processed faster than paper returns. If you filed your return electronically and included direct deposit information, you can expect your refund within 7-14 business days. Paper returns, on the other hand, may take up to 6-8 weeks to process.

It’s worth mentioning that Nebraska offers a Quick Refund option for those who need their refunds promptly. This service provides an estimated refund amount within 48 hours of filing, although the full refund may take longer to process.

Addressing Common Issues and Delays

Despite Nebraska’s efficient tax system, there may be instances where your return experiences delays or errors. Understanding these potential issues and knowing how to address them is crucial for a seamless experience.

Error Corrections

If the Nebraska Department of Revenue identifies errors or discrepancies in your return, they will reach out to you through the provided contact information. It’s essential to respond promptly to any such communications to resolve the issue and prevent further delays.

Common errors include incorrect social security numbers, math mistakes, or missing signatures. Reviewing your return carefully before filing can help minimize these issues.

Missing Information

In some cases, the department may require additional information to process your return. This could include missing forms, supporting documentation, or clarification on certain deductions or credits.

If you receive a notice requesting additional information, it’s crucial to respond promptly with the required details. Failure to do so may result in further delays or even penalties.

Identity Verification

To prevent fraud and ensure the security of taxpayer information, Nebraska may implement identity verification measures. This could involve sending a unique code to your registered email or mobile number, which you’ll need to input to access certain services or track your return.

It’s important to keep your contact information up-to-date with the department to ensure you receive these verification codes without any issues.

Future Implications and Tax Planning

Staying informed about Nebraska’s tax system and its potential changes is crucial for effective tax planning. By understanding the state’s tax landscape, you can make informed decisions to optimize your tax returns and potentially reduce your tax liability.

Tax Law Updates

Nebraska’s tax laws are subject to change, and it’s essential to stay updated on any new legislation or amendments. The Nebraska Department of Revenue provides regular updates and resources to help taxpayers navigate these changes.

Key areas to watch include income tax rates, deductions, and credits. Staying informed about these updates can help you maximize your tax benefits and plan your finances accordingly.

Tax Planning Strategies

Effective tax planning involves more than just filing your returns on time. It requires a strategic approach to optimize your tax situation and potentially reduce your overall tax burden.

Some strategies to consider include:

- Maximizing Deductions: Nebraska offers a range of deductions, such as the standard deduction or itemized deductions for certain expenses. Understanding which deductions you qualify for can significantly impact your tax liability.

- Credits and Incentives: The state also provides various tax credits for specific circumstances, such as the Low-Income Earned Income Tax Credit or the Property Tax Credit. Researching and claiming these credits can provide significant tax savings.

- Retirement Planning: Nebraska offers favorable tax treatment for retirement savings, such as contributions to IRAs or employer-sponsored retirement plans. Planning for your retirement while also optimizing your tax situation can be a win-win.

It’s always recommended to consult with a tax professional or financial advisor to develop a tailored tax planning strategy that aligns with your unique financial goals and circumstances.

The Role of Technology

In today’s digital age, technology plays a significant role in streamlining the tax process. Nebraska recognizes the benefits of technology and actively encourages taxpayers to utilize digital tools and resources.

Some of the ways technology can assist in your tax journey include:

- Online Filing: As mentioned earlier, e-filing is the preferred method for Nebraska taxpayers. It’s faster, more accurate, and reduces the risk of errors compared to paper filing.

- Tax Software: Authorized tax software providers offer user-friendly interfaces and step-by-step guidance to help taxpayers complete their returns accurately. These tools can also assist in identifying potential deductions and credits.

- Mobile Apps: Nebraska has developed mobile apps to provide taxpayers with convenient access to their account information, refund status, and other relevant tax resources. These apps can be a great way to stay informed on the go.

Embracing technology can not only simplify the tax process but also enhance your overall experience as a Nebraska taxpayer.

| Tax Form | Description |

|---|---|

| NE Individual Income Tax Return (Form 1040NE) | The primary tax form for most Nebraska residents |

| NE Schedule M-1 | Used for calculating additional taxes and deductions for certain income sources |

| Schedule SE | Required for self-employment income to calculate Social Security and Medicare taxes |

What happens if I miss the Nebraska state tax return deadline?

+If you miss the Nebraska state tax return deadline, you may be subject to late filing penalties and interest charges. It’s important to file as soon as possible to minimize these penalties. The Nebraska Department of Revenue website provides information on how to request an extension if needed.

Can I check my refund status online for Nebraska state taxes?

+Yes, you can check your Nebraska state tax refund status online through the Nebraska Department of Revenue website. Simply create an account and access the “Refund Tracker” tool to get an estimate of your refund amount and expected date.

What if I disagree with the outcome of my Nebraska state tax return?

+If you disagree with the outcome of your Nebraska state tax return, you have the right to appeal the decision. The Nebraska Department of Revenue provides an appeal process, which typically involves submitting additional documentation and explanations to support your case. It’s recommended to consult with a tax professional for guidance.

How can I stay updated on Nebraska’s tax laws and changes?

+To stay updated on Nebraska’s tax laws and changes, you can subscribe to the Nebraska Department of Revenue newsletter or follow their official social media accounts. They provide regular updates and announcements regarding tax legislation, deadlines, and other important information.