Chino Ca Sales Tax

Welcome to a comprehensive exploration of the Chino, California sales tax, a vital aspect of local economic operations. Chino, nestled in the heart of San Bernardino County, boasts a thriving commercial landscape, and understanding its sales tax intricacies is crucial for businesses and consumers alike. This guide aims to provide an in-depth analysis, offering insights into rates, exemptions, and the broader impact on the local economy.

Unraveling the Chino Sales Tax: A Comprehensive Guide

The sales tax landscape in Chino is a multifaceted system, comprising both state and local components. At its core, sales tax is a consumption tax levied on the sale of goods and services, serving as a crucial revenue source for local and state governments. In this context, Chino's sales tax structure takes on particular significance, influencing the daily operations of businesses and the purchasing decisions of consumers.

Sales Tax Rates: A Breakdown

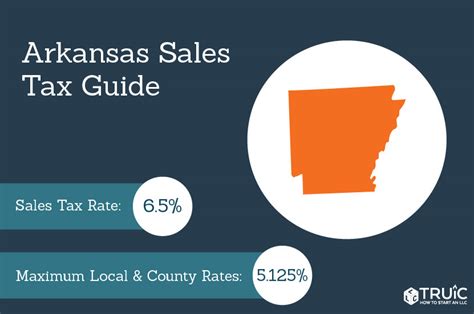

Chino's sales tax rate is a composite of several tax jurisdictions, each contributing a specific percentage to the overall rate. The California state sales tax rate currently stands at 7.25%, a uniform rate across the state. However, local municipalities, including Chino, have the authority to levy additional taxes, known as local option taxes, to cater to their unique financial needs.

In the case of Chino, the city imposes a local sales tax of 1.25%, bringing the total sales tax rate within the city limits to 8.50%. This rate is applicable to most tangible personal property and certain digitally provided products and services. The rate is subject to change, so it's advisable to refer to the California State Board of Equalization for the most current information.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Chino City | 1.25% |

| Total Chino Sales Tax | 8.50% |

Exemptions and Special Considerations

While the sales tax rate is a standard across most transactions, there are certain exemptions and special cases to be aware of. California, and consequently Chino, offers exemptions for specific goods and services. These exemptions are designed to promote certain economic activities or provide relief to specific industries or consumers.

For instance, many essential food items are exempt from sales tax, providing a cost relief to consumers. Additionally, certain medical devices and prescription drugs are also exempt, benefiting the healthcare sector and patients. It's important to note that these exemptions can vary based on state and local regulations, so a thorough understanding of the specific laws is crucial.

Impact on Local Economy

The sales tax revenue generated in Chino plays a pivotal role in the city's economic health and development. It funds essential services such as public safety, infrastructure development, and social services. By contributing to these vital areas, sales tax helps create a conducive environment for businesses and residents, fostering economic growth and stability.

Furthermore, the sales tax also influences consumer behavior. With a higher sales tax rate, consumers might be more inclined to shop online or in neighboring cities with lower tax rates. This dynamic underscores the importance of a well-balanced sales tax structure, ensuring it doesn't hinder local businesses or consumer spending.

Sales Tax Compliance and Filing

Compliance with sales tax regulations is a critical aspect for businesses operating in Chino. Businesses are responsible for collecting, reporting, and remitting sales tax to the appropriate tax authorities. The California State Board of Equalization provides detailed guidelines and resources to help businesses navigate the complex world of sales tax compliance.

Sales tax filing involves periodic submissions of sales tax returns, detailing the tax collected during a specified period. The frequency of filing can vary based on the business's sales volume and tax liability. Late filings or non-compliance can result in penalties and interest charges, making timely and accurate filings essential.

Sales Tax in Practice: A Case Study

Consider a hypothetical scenario: A tech startup, TechInnovate Inc., opens a retail store in Chino, selling cutting-edge electronic devices. When a customer purchases a laptop for $1,500, the business is responsible for collecting an additional $123.75 (8.50% of $1,500) in sales tax. This amount is then remitted to the state and local tax authorities, contributing to the city's revenue stream.

In this scenario, TechInnovate Inc. must ensure it complies with sales tax regulations, accurately calculating and remitting the tax. Failure to do so could result in legal consequences and damage the business's reputation.

Future Implications and Potential Changes

The sales tax landscape is dynamic, subject to potential changes and amendments. These changes can be driven by various factors, including economic shifts, legislative decisions, or changes in consumer behavior. For instance, the rise of e-commerce has prompted discussions around sales tax fairness and collection, potentially leading to new regulations.

Furthermore, economic downturns or fiscal constraints might prompt local authorities to consider sales tax rate adjustments. While these changes are speculative, staying informed about potential shifts is crucial for businesses and consumers alike. Regularly monitoring sales tax news and updates ensures one remains prepared for any upcoming changes.

Conclusion: Navigating Chino's Sales Tax Landscape

In conclusion, the sales tax system in Chino, California, is a complex yet crucial component of the local economy. From understanding the rate structure to navigating exemptions and compliance, a comprehensive grasp of sales tax is essential for businesses and consumers. By staying informed and compliant, one can contribute to the vibrant economic ecosystem of Chino while also reaping the benefits of a well-regulated sales tax system.

What is the current sales tax rate in Chino, CA?

+The current sales tax rate in Chino, California is 8.50%, comprising the state rate of 7.25% and a local rate of 1.25%.

Are there any sales tax exemptions in Chino?

+Yes, Chino, like many other areas in California, offers sales tax exemptions for certain goods and services. These exemptions include essential food items, medical devices, and prescription drugs.

How often do businesses need to file sales tax returns in Chino?

+The frequency of sales tax return filings depends on the business’s sales volume and tax liability. Generally, businesses file quarterly or monthly, but this can vary. It’s best to consult the California State Board of Equalization for specific guidelines.

What happens if a business fails to comply with sales tax regulations in Chino?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and legal consequences. It’s crucial for businesses to stay informed and compliant to avoid such issues.