Nys Sales Tax Filing

The New York State (NYS) sales tax is a consumption tax imposed on the sale of goods and certain services. Businesses operating in New York are responsible for collecting and remitting sales tax to the state, ensuring compliance with the tax regulations. The NYS sales tax filing process involves several steps, and understanding these steps is crucial for businesses to meet their tax obligations accurately and timely.

Understanding the NYS Sales Tax

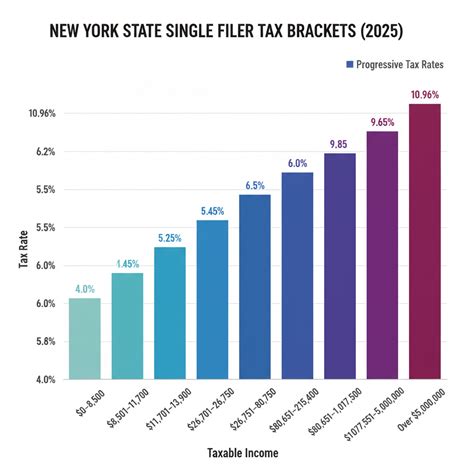

The NYS sales tax is a state-level tax, but it is important to note that sales tax rates can vary by county and even by locality within a county. The state sales tax rate is set at 4%, and this is applied uniformly across the state. However, counties and cities have the authority to impose additional sales taxes, leading to variations in the total sales tax rates across different regions in New York.

For example, consider the city of New York, which has a local sales tax rate of 4.5%, bringing the total sales tax rate to 8.5% when combined with the state sales tax. On the other hand, counties like Suffolk and Nassau have an additional county sales tax of 4%, resulting in a total sales tax rate of 8%.

| Location | State Sales Tax | Local Sales Tax | Total Sales Tax Rate |

|---|---|---|---|

| New York City | 4% | 4.5% | 8.5% |

| Suffolk County | 4% | 4% | 8% |

| Nassau County | 4% | 4% | 8% |

Businesses need to be aware of the specific sales tax rates applicable to their locations to accurately collect and remit sales tax. The NYS Department of Taxation and Finance provides resources and guidance to help businesses understand the sales tax regulations and rates specific to their regions.

Registration and Obtaining a Sales Tax Certificate

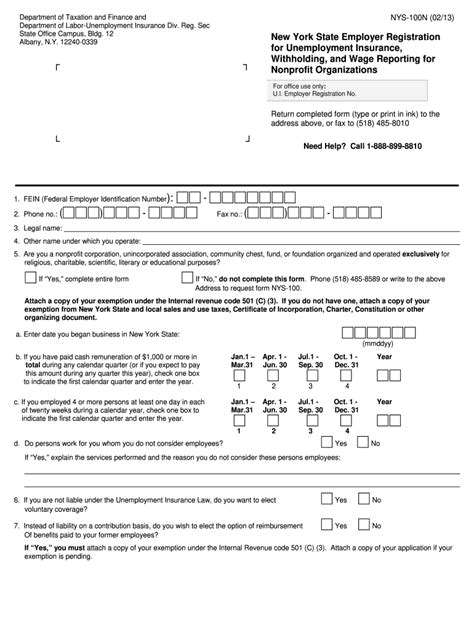

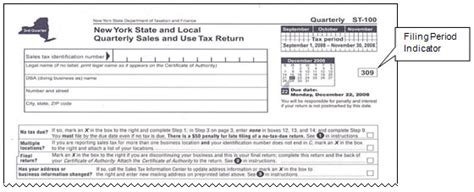

To collect and remit sales tax in New York, businesses must first register with the NYS Department of Taxation and Finance. This process involves completing the Form ST-120, Application for Certificate of Authority, which can be done online or by mail. The form requires businesses to provide detailed information about their operations, including the nature of their business, the products or services offered, and the locations where they conduct sales.

Once the application is processed, the Department will issue a Sales Tax Certificate of Authority, which serves as official recognition that the business is authorized to collect and remit sales tax in New York. This certificate includes a unique Account Number, which is crucial for all future tax filings and correspondence with the Department.

It is important for businesses to safeguard this certificate and keep it accessible for future reference. The Account Number is a critical identifier, and businesses may need to provide it when making payments, filing returns, or communicating with the Department regarding tax-related matters.

Sales Tax Filing Frequency and Due Dates

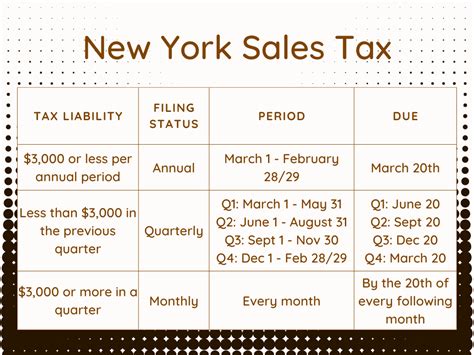

The frequency of sales tax filings in New York depends on the amount of sales tax collected by the business. Generally, businesses are required to file sales tax returns and make payments on a monthly, quarterly, or annual basis.

- Monthly Filers: Businesses with sales tax liabilities exceeding $10,000 per quarter or $35,000 annually are required to file and pay sales tax on a monthly basis. The due date for monthly filings is the 20th of the following month.

- Quarterly Filers: Businesses with sales tax liabilities of $10,000 or less per quarter but more than $35,000 annually are required to file and pay sales tax on a quarterly basis. The due dates for quarterly filings are April 20th, July 20th, October 20th, and January 20th of the following year.

- Annual Filers: Businesses with sales tax liabilities of $35,000 or less annually are permitted to file and pay sales tax on an annual basis. The due date for annual filings is January 20th of the following year.

It is important for businesses to accurately determine their filing frequency based on their sales tax liabilities. The NYS Department of Taxation and Finance provides guidance and tools to help businesses calculate their sales tax liabilities and determine the appropriate filing frequency.

Sales Tax Return Filing Process

Filing a sales tax return in New York involves the following steps:

- Accessing the Online System: Businesses can access the NYS Department of Taxation and Finance's online filing system using their unique Account Number and a secure password. This system allows businesses to file sales tax returns, make payments, and view their tax account information.

- Completing the Sales Tax Return: The sales tax return, Form ST-150, is available online and can be completed digitally. The form requires businesses to provide detailed information about their sales, purchases, and the applicable sales tax rates for the reporting period.

- Calculating the Tax Liability: Businesses must calculate their sales tax liability for the reporting period based on their sales and the applicable tax rates. The online system provides tools to assist with this calculation, ensuring accuracy and compliance with the tax regulations.

- Making the Payment: Once the sales tax liability is calculated, businesses can make the payment through the online system using a credit card, electronic funds transfer, or by mailing a check or money order. The payment must be made by the due date to avoid penalties and interest.

It is important for businesses to review their sales tax returns carefully before submission to ensure the accuracy of the information provided. The NYS Department of Taxation and Finance provides resources and support to help businesses understand the filing process and address any questions or concerns they may have.

Sales Tax Payment Options and Due Dates

Businesses in New York have several options for making sales tax payments, including:

- Electronic Funds Transfer (EFT): Businesses can set up an EFT payment method, allowing them to make payments directly from their bank account. This option is convenient and ensures timely payment, as the funds are transferred automatically on the due date.

- Credit Card: Sales tax payments can be made using a credit card, which provides flexibility and allows businesses to earn rewards or take advantage of credit card benefits. However, there may be processing fees associated with credit card payments.

- Check or Money Order: Businesses can mail a check or money order made payable to the "New York State Department of Taxation and Finance" to the address provided on the sales tax return. It is important to ensure that the payment is received by the due date to avoid late payment penalties.

The due dates for sales tax payments align with the filing frequency determined by the business's sales tax liabilities. Monthly filers must make payments by the 20th of the following month, quarterly filers by the 20th of the respective months (April, July, October, and January), and annual filers by January 20th of the following year.

Businesses should carefully review the payment options available to them and choose the method that best suits their needs and preferences. It is important to ensure timely payment to avoid penalties and maintain compliance with the NYS sales tax regulations.

Sales Tax Exemptions and Discounts

New York State offers certain sales tax exemptions and discounts to eligible businesses and individuals. Understanding these exemptions and discounts can help businesses reduce their sales tax liabilities and manage their tax obligations more effectively.

Sales Tax Exemptions

Certain transactions are exempt from sales tax in New York. These exemptions vary depending on the nature of the transaction and the goods or services involved. Some common sales tax exemptions in New York include:

- Food and Beverages: Certain food items and non-alcoholic beverages are exempt from sales tax when sold for consumption off the premises. This exemption applies to grocery stores, convenience stores, and other retailers that sell food and beverages.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax in New York. This exemption includes both prescription medications and certain over-the-counter drugs that are prescribed by a licensed healthcare professional.

- Clothing and Footwear: Clothing and footwear items priced below a certain threshold are exempt from sales tax. In New York, clothing and footwear items costing $110 or less per item are exempt from sales tax.

- Books and Magazines: Sales of books and magazines are exempt from sales tax in New York. This exemption applies to both printed and digital formats, including e-books and online magazines.

It is important for businesses to stay updated on the latest sales tax exemptions and their applicability to their specific products or services. The NYS Department of Taxation and Finance provides detailed information and guidance on sales tax exemptions to help businesses understand their eligibility and compliance obligations.

Sales Tax Discounts

New York State offers a sales tax discount program to certain businesses, providing them with a reduced sales tax rate. This program, known as the Sales Tax Discount for Small Businesses, is designed to support small businesses and reduce their tax burden.

To qualify for the sales tax discount program, businesses must meet specific criteria. These criteria include having annual sales tax liabilities of $50,000 or less and being registered as a sole proprietorship, partnership, or corporation with no more than 10 employees.

Eligible businesses can apply for the sales tax discount program by completing the Form ST-1150, Application for Sales Tax Discount for Small Businesses. The application requires businesses to provide information about their sales tax liabilities, number of employees, and other relevant details. Once approved, businesses can enjoy a reduced sales tax rate, helping them save on their tax obligations.

The sales tax discount program provides a significant benefit to small businesses in New York, allowing them to focus more on their operations and growth while managing their tax liabilities more affordably. It is important for small businesses to explore their eligibility for this program and take advantage of the potential savings it offers.

Sales Tax Record-Keeping and Audits

Maintaining accurate and organized sales tax records is crucial for businesses operating in New York. These records serve as evidence of compliance with the sales tax regulations and can be essential in the event of an audit.

Record-Keeping Requirements

The NYS Department of Taxation and Finance requires businesses to maintain specific sales tax records for a minimum of four years. These records should include the following:

- Sales invoices and receipts

- Purchase invoices and receipts

- Sales tax returns and payment records

- Records of exempt sales and purchases

- Any other documents related to sales tax transactions

Businesses should ensure that their sales tax records are easily accessible and well-organized. This makes it easier to retrieve information when filing sales tax returns or responding to inquiries from the Department. Additionally, accurate record-keeping helps businesses identify areas where they may be able to optimize their sales tax obligations and reduce their tax liabilities.

Sales Tax Audits

The NYS Department of Taxation and Finance conducts sales tax audits to ensure compliance with the tax regulations. Audits can be triggered by various factors, including random selection, high sales tax liabilities, or suspected non-compliance.

During an audit, the Department will review the business's sales tax records and transactions to verify the accuracy of the reported sales tax liabilities. The audit process may involve requests for additional documentation, interviews with business representatives, and on-site visits to review business operations.

It is important for businesses to cooperate fully with the audit process and provide the necessary documentation in a timely manner. Being proactive and prepared for potential audits can help businesses mitigate any potential issues and ensure a smooth audit experience. Additionally, businesses should take the opportunity to review their sales tax practices and procedures during an audit to identify areas for improvement and ensure ongoing compliance.

Future Implications and Ongoing Compliance

Staying compliant with the NYS sales tax regulations is an ongoing process for businesses. As the tax landscape evolves, businesses must stay updated on any changes to the sales tax rates, exemptions, and filing requirements. The NYS Department of Taxation and Finance provides resources and updates to help businesses stay informed and compliant.

Additionally, businesses should consider leveraging technology and sales tax automation tools to streamline their sales tax filing and compliance processes. These tools can help businesses calculate sales tax accurately, file returns efficiently, and manage their sales tax obligations more effectively.

By staying proactive and informed, businesses can ensure they meet their sales tax obligations accurately and timely, avoiding penalties and maintaining good standing with the NYS Department of Taxation and Finance. Ongoing compliance not only helps businesses avoid legal and financial repercussions but also contributes to a positive relationship with the state tax authorities.

What is the penalty for late sales tax filing or payment in New York State?

+Late sales tax filing or payment in New York State can result in penalties and interest. The penalty for late filing is typically 5% of the unpaid tax, with an additional 1% penalty for each month the return remains unpaid, up to a maximum of 25%. Late payment penalties are also imposed, typically starting at 5% of the unpaid tax and increasing over time. It is important to note that these penalties can be significant, so businesses should aim to file and pay their sales tax obligations on time to avoid additional costs.

Are there any online resources available to help businesses with their NYS sales tax obligations?

+Yes, the NYS Department of Taxation and Finance provides a range of online resources to assist businesses with their sales tax obligations. These resources include detailed guides, FAQs, and interactive tools to help businesses understand the sales tax regulations, calculate their tax liabilities, and navigate the filing process. Additionally, the Department’s website offers access to the online filing system, where businesses can register, file returns, and make payments.

How can businesses stay updated on changes to the NYS sales tax regulations?

+Businesses can stay updated on changes to the NYS sales tax regulations by regularly visiting the NYS Department of Taxation and Finance’s website, which provides the latest news, updates, and announcements related to sales tax. Additionally, businesses can subscribe to the Department’s email updates or follow their social media channels to receive timely notifications about any changes or important tax-related information.