Fitw Tax Meaning

Welcome to an insightful exploration of the term "FITW Tax" and its implications. This concept, while seemingly straightforward, carries significant weight in certain industries and business contexts. Understanding the nuances of FITW Tax is crucial for professionals, especially those in the financial and tax advisory sectors, to ensure compliance and efficient operations.

Unraveling the FITW Tax Enigma

FITW Tax, an acronym for "First In, Tax Out," is a specific tax strategy often employed by businesses and individuals to manage their tax liabilities. This strategy involves carefully timing transactions and accounting entries to optimize tax payments. It is a common practice in countries where the tax system is structured around a "first-in, first-out" (FIFO) principle, ensuring that the oldest assets or transactions are disposed of first for tax purposes.

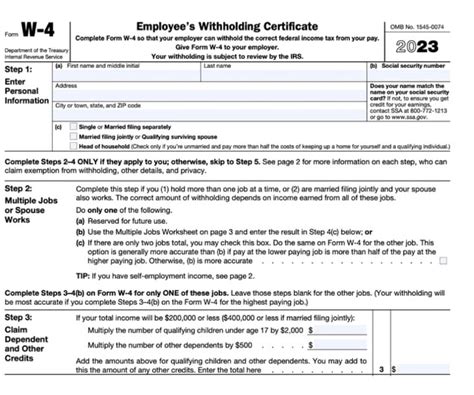

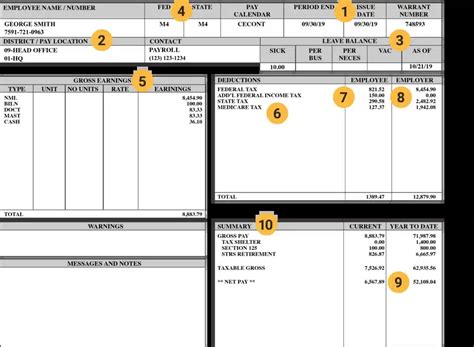

The application of FITW Tax can be complex, requiring a deep understanding of tax laws and regulations. It often involves strategic planning to ensure that the earliest acquired assets or transactions are utilized or sold first, thus impacting the tax liability. This strategy can be particularly beneficial for businesses with varying asset values or transaction dates, as it allows for a more tailored approach to tax management.

Real-World FITW Tax Scenarios

Imagine a company, "Global Tech Inc.," that operates in a jurisdiction with a FIFO tax system. The company has a diverse portfolio of assets, including equipment, inventory, and investments, each with different acquisition dates and values. By employing the FITW Tax strategy, Global Tech Inc. can strategically choose which assets to utilize or sell first, thereby controlling their tax obligations.

| Asset Type | Acquisition Date | Value |

|---|---|---|

| Equipment | 01/01/2020 | $50,000 |

| Inventory | 06/15/2021 | $35,000 |

| Investments | 11/10/2022 | $70,000 |

In this scenario, Global Tech Inc. might opt to utilize the oldest equipment first, as per the FITW Tax strategy, to reduce their tax liability. This strategic decision allows them to manage their tax obligations effectively while maintaining a competitive edge in the market.

Legal and Ethical Considerations

While FITW Tax is a legitimate tax strategy, it must be employed within the legal and ethical boundaries of tax laws. Misuse or misinterpretation of this strategy can lead to serious legal repercussions, including fines, penalties, or even criminal charges. Therefore, businesses and individuals must seek professional advice to ensure compliance and avoid potential pitfalls.

Additionally, the ethical implications of FITW Tax cannot be overlooked. While it is a legal strategy, businesses must consider the potential impact on stakeholders, including customers, employees, and investors. A well-executed FITW Tax strategy should not compromise the company's integrity or reputation.

Navigating FITW Tax Challenges

Implementing FITW Tax strategies can be complex, especially for businesses with diverse portfolios and frequent transactions. It requires a robust accounting system, accurate record-keeping, and a proactive approach to tax planning. Businesses should invest in robust accounting software and trained professionals to ensure that FITW Tax strategies are implemented effectively and ethically.

Moreover, the tax landscape is dynamic, with frequent changes in regulations and laws. Staying updated with these changes is crucial to ensure that FITW Tax strategies remain compliant and beneficial. Regular reviews of tax strategies and consulting with tax professionals can help businesses navigate these challenges effectively.

How does FITW Tax differ from other tax strategies?

+

FITW Tax is unique in its focus on timing transactions and accounting entries based on the FIFO principle. Other tax strategies might involve different principles, such as LIFO (Last-In, First-Out) or averaging methods, which have distinct implications for tax liabilities.

Is FITW Tax applicable to all businesses and individuals?

+

FITW Tax is most relevant in jurisdictions with a FIFO tax system. Its applicability depends on the specific tax laws and regulations of a region. Not all businesses or individuals will benefit from this strategy, as it is highly context-specific.

What are the potential risks of mismanaging FITW Tax strategies?

+

Mismanaging FITW Tax strategies can lead to significant tax discrepancies, which may result in hefty fines, penalties, or even legal action. It can also impact a business’s financial stability and reputation, especially if it leads to inaccurate financial reporting.