Vehicle Sales Tax Maryland

Vehicle sales tax is an essential aspect of vehicle ownership and purchase, impacting both buyers and sellers. In the state of Maryland, the sales tax system for vehicles is a critical component of the state's revenue stream, contributing significantly to the state's budget and economic activities. This article aims to provide a comprehensive understanding of vehicle sales tax in Maryland, including its rates, calculation methods, exemptions, and the impact it has on consumers and the automotive industry.

Understanding Vehicle Sales Tax in Maryland

Maryland, like many other states, imposes a sales tax on the purchase of vehicles, which is a vital source of revenue for the state government. This tax is applied to the sale of new and used vehicles, with the revenue generated used to fund various state programs and services. Understanding the vehicle sales tax system is crucial for both consumers and businesses operating in the automotive industry in Maryland.

Sales Tax Rates and Calculation

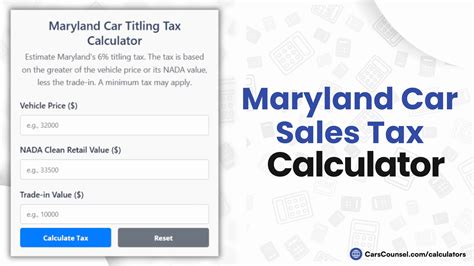

The sales tax rate for vehicles in Maryland is 6%, which is a standard rate applicable across the state. This rate is added to the purchase price of the vehicle, and the resulting amount is the total sales tax due. However, it’s important to note that the tax calculation is not as simple as multiplying the vehicle price by 6%. The sales tax is calculated based on the gross sales price, which includes not only the vehicle’s base price but also any additional fees, such as dealer preparation charges, delivery fees, and optional equipment costs.

For example, if a buyer purchases a new car with a base price of $30,000 and additional fees totaling $2,000, the gross sales price would be $32,000. The sales tax on this transaction would be calculated as follows:

| Gross Sales Price | Sales Tax Rate | Total Sales Tax |

|---|---|---|

| $32,000 | 6% | $1,920 |

So, in this case, the buyer would owe $1,920 in sales tax on the vehicle purchase.

Exemptions and Special Considerations

While the 6% sales tax rate is standard, there are certain exemptions and special considerations that can impact the sales tax calculation in Maryland. One notable exemption is for vehicles purchased by active-duty military personnel. Military members who are stationed in Maryland are exempt from paying sales tax on vehicle purchases, provided they present the necessary documentation, such as a valid military ID and a letter of verification from their commanding officer.

Additionally, Maryland offers a reduced sales tax rate of 3% for vehicles purchased by qualifying disabled individuals. To be eligible for this exemption, the individual must have a disability that meets specific criteria, and they must provide the necessary documentation, such as a disability certificate or a prescription from a licensed healthcare provider.

Another special consideration is the use of trade-ins. When a buyer trades in their old vehicle as part of a new vehicle purchase, the trade-in value is deducted from the gross sales price of the new vehicle. This can significantly impact the overall sales tax calculation, as the tax is applied to the reduced sales price after the trade-in value is taken into account.

Impact on Consumers and the Automotive Industry

The vehicle sales tax in Maryland has a significant impact on both consumers and businesses in the automotive industry. For consumers, the sales tax can be a substantial expense, especially when purchasing high-value vehicles. The tax can add thousands of dollars to the overall cost of the vehicle, impacting the buyer’s budget and financial planning.

From a consumer perspective, understanding the sales tax system is crucial when comparing vehicle prices and negotiating deals. Buyers should consider the sales tax when evaluating the total cost of ownership, as it can significantly affect the overall affordability of a vehicle. Additionally, being aware of exemptions and special considerations can help buyers save money and navigate the sales tax system more effectively.

For the automotive industry, the sales tax system in Maryland plays a vital role in shaping business operations and strategies. Dealers and automakers must factor in the sales tax when setting prices and structuring deals. The sales tax can influence the pricing of vehicles, particularly when dealers aim to offer competitive prices while maintaining profitability. Additionally, dealers must ensure compliance with tax regulations, accurately calculating and remitting sales tax to the state to avoid penalties.

The sales tax also impacts the industry's marketing and sales strategies. Dealers may choose to promote tax-free promotions or highlight the availability of tax exemptions to attract buyers. Additionally, the sales tax can influence the timing of vehicle purchases, with buyers potentially waiting for specific tax incentives or periods of reduced sales tax rates to make their purchases more cost-effective.

Future Implications and Potential Changes

As with any tax system, the vehicle sales tax in Maryland is subject to potential changes and reforms. While the current 6% rate has been stable for several years, there have been discussions and proposals for tax reform in the state, which could impact the sales tax on vehicles. These proposals often involve broader tax reform initiatives, aiming to address budget deficits or redistribute tax burdens more equitably.

One potential change that has been proposed is a shift from a flat sales tax rate to a graduated rate, where the tax rate increases with the vehicle's purchase price. Such a change could impact the affordability of high-end vehicles, potentially making them less accessible to certain buyers. On the other hand, it could also provide some relief for buyers of lower-cost vehicles, as the tax burden would be distributed more progressively.

Additionally, there have been discussions about expanding the scope of sales tax exemptions or introducing new incentives to promote specific types of vehicles, such as electric or hybrid cars. These incentives could take the form of reduced sales tax rates or rebates, encouraging consumers to adopt more environmentally friendly transportation options.

It's important to note that any changes to the vehicle sales tax system in Maryland would likely undergo extensive legislative processes and public consultations. The state government recognizes the significant impact of such changes on both consumers and the automotive industry, and any reforms would aim to strike a balance between generating revenue and promoting economic growth and consumer welfare.

Frequently Asked Questions

What is the sales tax rate for vehicles in Maryland?

+

The standard sales tax rate for vehicles in Maryland is 6%.

Are there any exemptions from vehicle sales tax in Maryland?

+

Yes, there are exemptions for active-duty military personnel and qualifying disabled individuals. Military members are exempt from paying sales tax, while disabled individuals benefit from a reduced rate of 3%.

How is the sales tax calculated on vehicle purchases in Maryland?

+

The sales tax is calculated based on the gross sales price, which includes the vehicle’s base price, dealer fees, delivery charges, and optional equipment costs. The tax rate of 6% is applied to this total amount.

Can I negotiate the sales tax on my vehicle purchase in Maryland?

+

The sales tax is a mandatory tax imposed by the state, and dealers do not have the authority to negotiate or waive it. However, you can negotiate the vehicle’s price, which can indirectly impact the overall sales tax amount.

Are there any upcoming changes to the vehicle sales tax system in Maryland?

+

While there have been discussions about potential tax reforms, no specific changes to the vehicle sales tax system have been implemented as of the latest information available. It’s advisable to stay updated on any legislative developments that may impact tax rates or exemptions.

In conclusion, understanding the vehicle sales tax system in Maryland is crucial for both consumers and businesses. The 6% sales tax rate, along with exemptions and special considerations, can significantly impact the overall cost of vehicle ownership. Consumers should be aware of these factors when making purchase decisions, while businesses must navigate the tax system to remain compliant and competitive. As the state continues to evaluate its tax policies, staying informed about potential changes is essential for all stakeholders in the automotive industry.