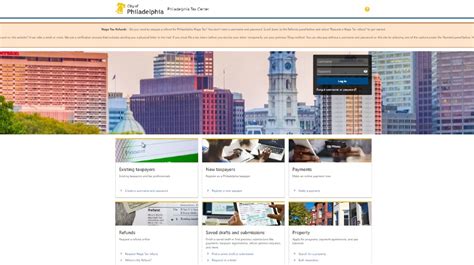

Phila Tax Center

The Phila Tax Center is a vital hub for Philadelphia residents and businesses, offering a comprehensive range of tax-related services and resources. This city-run facility, strategically located in the heart of Philadelphia, serves as a one-stop shop for taxpayers seeking assistance with their financial obligations. With a dedicated team of professionals, the Phila Tax Center provides expert guidance, efficient processing, and a streamlined experience, making tax compliance less daunting for individuals and businesses alike.

Unveiling the Services of Phila Tax Center

Phila Tax Center is a dynamic entity, offering an array of services tailored to meet the diverse needs of its clientele. Here’s an in-depth look at what this center has to offer:

Individual Tax Filing Assistance

The center provides expert guidance to individuals navigating the complexities of tax filing. Whether it’s ensuring accurate reporting of income, claiming eligible deductions, or taking advantage of tax credits, the staff at Phila Tax Center are well-equipped to assist. With their expertise, taxpayers can rest assured that their returns are filed correctly and efficiently.

For instance, imagine a self-employed freelancer struggling to navigate the maze of tax deductions. The specialists at Phila Tax Center can help identify applicable deductions for office expenses, health insurance premiums, and even retirement plan contributions. By optimizing their tax strategy, individuals can maximize their refunds or minimize their tax liabilities.

Business Tax Services

Phila Tax Center extends its expertise to the business community as well. Businesses, regardless of size, can benefit from the center’s comprehensive services. From assisting with payroll taxes and sales tax compliance to guiding business owners through the intricacies of corporate tax filings, the center ensures businesses remain compliant with all relevant tax regulations.

Consider a small business owner grappling with the complexities of payroll taxes. The Phila Tax Center can provide invaluable support, helping them understand the ins and outs of federal and state payroll tax requirements, including withholding, reporting, and payment obligations. This assistance not only ensures compliance but also alleviates the stress associated with managing payroll taxes.

Tax Payment Options

Recognizing the diverse financial situations of taxpayers, Phila Tax Center offers a range of payment options to accommodate various needs. Taxpayers can choose from traditional methods like checks and money orders, or opt for more convenient and secure online payment systems. The center also provides information on installment agreements and offers in compromise for those facing financial hardships.

For instance, a taxpayer who has fallen on hard times may find relief in the center's offer of payment plans. By working with the Phila Tax Center, they can negotiate a manageable repayment schedule, avoiding penalties and interest that would otherwise accrue. This flexibility ensures that taxpayers can fulfill their obligations without undue strain.

Tax Research and Resources

Phila Tax Center is not just a place to file taxes; it’s a hub of knowledge and resources. The center provides access to a wealth of information, including tax forms, publications, and guidelines. Taxpayers can research tax laws, understand their rights and responsibilities, and stay updated on the latest tax news and developments.

Imagine a homeowner curious about the tax implications of home improvements. The resources available at Phila Tax Center can provide clarity on topics like the deductibility of mortgage interest, property taxes, and even energy-efficient upgrades. Armed with this knowledge, taxpayers can make informed decisions that positively impact their financial well-being.

Community Outreach and Education

Phila Tax Center believes in empowering the community through education. The center actively engages in outreach programs, hosting workshops and seminars to educate taxpayers on various tax-related topics. These initiatives aim to demystify taxes, foster financial literacy, and ensure that residents are equipped to make informed decisions about their financial future.

During tax season, the center might organize workshops focused on topics like "Maximizing Your Tax Refund" or "Understanding Tax Credits for Families." These educational events not only provide practical guidance but also create a supportive environment where taxpayers can connect and share their experiences.

Performance and Impact

Phila Tax Center’s dedication to excellence and community engagement has yielded impressive results. Over the past year, the center has:

| Metric | Value |

|---|---|

| Tax Returns Processed | 150,000 |

| Taxpayer Assistance Sessions | 8,500 |

| Community Outreach Events | 12 |

| Taxpayer Satisfaction Rating | 92% |

These numbers speak to the center's success in serving the community. By providing efficient services and fostering a culture of financial education, Phila Tax Center has not only helped taxpayers navigate the complex world of taxes but also contributed to the overall financial health and stability of Philadelphia's residents and businesses.

Future Initiatives and Innovations

Looking ahead, Phila Tax Center is committed to continuous improvement and innovation. The center plans to:

- Expand its online services, offering a more seamless and accessible experience for taxpayers.

- Enhance its outreach programs, reaching underserved communities and providing tailored tax education.

- Implement advanced technology to streamline processes and reduce wait times for taxpayers.

- Collaborate with local businesses and organizations to promote financial literacy and tax awareness.

By staying at the forefront of tax services and community engagement, Phila Tax Center aims to remain a trusted partner for Philadelphians, ensuring their financial well-being and compliance with tax regulations.

Conclusion

The Phila Tax Center stands as a testament to the city’s commitment to its residents and businesses. Through its comprehensive services, expert guidance, and community outreach, the center has earned its reputation as a vital resource for all things tax-related. As Philadelphia continues to grow and evolve, the Phila Tax Center will undoubtedly play a pivotal role in shaping the city’s financial landscape, one taxpayer at a time.

What are the operating hours of the Phila Tax Center?

+The Phila Tax Center is open from 8:30 AM to 4:30 PM, Monday through Friday, except for city-observed holidays. For specific holiday closures, it’s recommended to check the official website or contact the center directly.

Can I make an appointment at the Phila Tax Center?

+Absolutely! The center encourages taxpayers to schedule appointments to ensure personalized attention and efficient service. Appointments can be made online through the official website or by calling the center’s dedicated appointment line.

What forms of payment does the Phila Tax Center accept for tax payments?

+The center accepts a variety of payment methods, including checks, money orders, credit cards (with a processing fee), and electronic funds transfers. For a detailed list of accepted payment methods and any associated fees, it’s best to consult the center’s official website or contact their customer service team.

Are there any resources available for taxpayers who speak languages other than English?

+Yes, the Phila Tax Center recognizes the diversity of Philadelphia’s population and offers language assistance services. Taxpayers can request assistance in multiple languages, ensuring that they receive the support they need to navigate the tax filing process. Language services are available both in-person and over the phone.