Sales Tax In Oxnard Ca

Welcome to our comprehensive guide on the sales tax landscape in Oxnard, California. As an expert in the field, I will delve into the intricacies of sales tax in this vibrant city, offering a detailed analysis and practical insights. Oxnard, a bustling coastal city, presents a unique environment for businesses and consumers alike, and understanding its sales tax structure is crucial for compliance and strategic decision-making.

Understanding Sales Tax in Oxnard, CA

Sales tax in Oxnard operates within the framework of both state and local regulations, creating a complex yet essential system for revenue generation and economic management. With a deep understanding of these regulations, businesses can navigate the tax landscape with confidence and accuracy.

Oxnard's sales tax system is composed of several key components, each playing a vital role in the overall tax structure. These components include the state sales tax rate, the city's local tax rate, and any additional district-specific tax rates that may apply. Additionally, certain jurisdictions may impose special tax rates for specific categories of goods or services, further adding to the complexity.

To illustrate, let's consider a hypothetical scenario. Imagine a business selling consumer electronics in Oxnard. The state sales tax rate applies as a baseline, but the business must also account for the city's local tax rate, which varies depending on the specific location within Oxnard. Furthermore, if the business operates in a designated district with a special tax rate, this additional rate must be factored into the overall sales tax calculation.

Key Components of Oxnard's Sales Tax

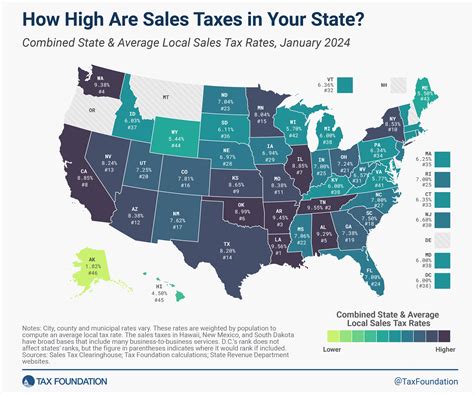

- State Sales Tax Rate: California imposes a statewide sales and use tax rate of 7.25%. This rate is applied uniformly across the state and forms the foundation of the sales tax system.

- Oxnard's Local Tax Rate: The city of Oxnard levies an additional local sales tax rate of 1.25%. This rate is specifically designated for the city and is added to the state rate to determine the total sales tax applicable within Oxnard's boundaries.

- District-Specific Tax Rates: Certain areas within Oxnard may fall under designated tax districts, such as special assessment districts or redevelopment areas. These districts may have their own unique tax rates, often used to fund specific projects or initiatives. Businesses operating within these districts must be aware of and comply with these additional tax obligations.

| Sales Tax Jurisdiction | Tax Rate |

|---|---|

| State of California | 7.25% |

| City of Oxnard | 1.25% |

| Example Tax District (Special Assessment District) | 1.00% |

Calculating Sales Tax in Oxnard

Calculating sales tax in Oxnard involves a straightforward yet precise process. By understanding the applicable tax rates and applying them correctly, businesses can ensure compliance and maintain accurate financial records.

To calculate the total sales tax for a transaction in Oxnard, the following steps should be followed:

- Determine the State Sales Tax: Start by multiplying the transaction amount by the state sales tax rate of 7.25%. This calculation provides the state sales tax portion.

- Apply the City's Local Tax: Next, add the city's local tax rate of 1.25% to the transaction amount. This calculation gives the local sales tax portion specific to Oxnard.

- Consider District-Specific Rates: If the transaction occurs within a designated tax district, add the applicable district-specific tax rate to the transaction amount. This additional rate may vary depending on the specific district and the nature of the transaction.

- Sum Up the Tax Components: Finally, add up all the calculated tax components to determine the total sales tax applicable to the transaction. This total sales tax should be collected from the customer and remitted to the appropriate tax authorities.

For example, if a customer purchases goods worth $100 in Oxnard, the sales tax calculation would be as follows:

- State Sales Tax: $100 x 7.25% = $7.25

- City's Local Tax: $100 x 1.25% = $1.25

- Total Sales Tax: $7.25 + $1.25 = $8.50

Therefore, the customer would pay a total of $108.50 for the goods, including the sales tax.

Sales Tax Exemptions and Special Considerations

While sales tax is generally applicable to most transactions, there are certain exemptions and special considerations to be aware of in Oxnard. These exemptions and considerations can vary depending on the nature of the business, the type of goods or services being sold, and the specific circumstances of the transaction.

- Resale Exemption: Businesses engaged in the resale of goods may be eligible for a sales tax exemption. This exemption applies when the goods are purchased for resale purposes and not for the business's own use. To claim this exemption, businesses must obtain a resale certificate and provide it to their suppliers.

- Manufacturing Exemption: Manufacturers may also be eligible for sales tax exemptions on certain purchases. This exemption applies to raw materials, components, and equipment used directly in the manufacturing process. To claim this exemption, manufacturers must meet specific criteria and obtain the necessary documentation.

- Agricultural Sales: Sales of agricultural products, such as crops, livestock, and certain agricultural machinery, may be exempt from sales tax. However, the specific exemptions and qualifications can vary, so it's essential for agricultural businesses to consult the relevant regulations and guidelines.

- Special Tax Districts: As mentioned earlier, certain areas within Oxnard may fall under special tax districts. These districts may have unique tax rates and requirements. Businesses operating within these districts should be aware of any specific tax obligations and ensure compliance with the applicable regulations.

Compliance and Reporting in Oxnard

Compliance with sales tax regulations is crucial for businesses operating in Oxnard. Accurate reporting and timely remittance of sales tax are essential to avoid penalties and maintain a positive relationship with tax authorities.

Businesses should follow these key steps to ensure compliance:

- Register for Sales Tax: Before commencing sales operations in Oxnard, businesses must register with the California Department of Tax and Fee Administration (CDTFA). This registration process ensures that businesses are authorized to collect and remit sales tax.

- Collect Sales Tax: Businesses must collect sales tax from customers at the point of sale. The collected tax should be calculated based on the applicable rates and added to the transaction amount.

- Maintain Records: It is essential to maintain accurate and detailed records of all sales transactions, including the sales amount, applicable tax rates, and the calculated sales tax. These records serve as proof of compliance and facilitate accurate reporting.

- File Sales Tax Returns: Businesses are required to file sales tax returns periodically, typically on a quarterly or monthly basis. These returns must be submitted to the CDTFA, along with the remittance of the collected sales tax. The due dates and filing requirements can vary, so businesses should refer to the CDTFA's guidelines.

- Stay Informed: Sales tax regulations can change, so businesses should stay updated on any amendments or new requirements. This includes monitoring changes in tax rates, exemption rules, and any special considerations that may impact their operations.

Penalties and Audits

Non-compliance with sales tax regulations can result in penalties and audits by the CDTFA. These penalties can include fines, interest charges, and even criminal charges in severe cases of tax evasion.

To avoid penalties, businesses should:

- Ensure accurate and timely filing of sales tax returns.

- Remit the collected sales tax to the CDTFA within the specified time frames.

- Keep detailed records to substantiate sales transactions and tax calculations.

- Respond promptly to any inquiries or requests for information from the CDTFA.

In the event of an audit, businesses should cooperate fully with the CDTFA auditors and provide the necessary documentation to support their sales tax calculations and compliance.

Conclusion: Navigating Oxnard's Sales Tax Landscape

Understanding and navigating the sales tax landscape in Oxnard is crucial for businesses to thrive and maintain compliance. By comprehending the applicable tax rates, exemptions, and reporting requirements, businesses can operate with confidence and avoid potential pitfalls.

This guide has provided a comprehensive overview of sales tax in Oxnard, offering practical insights and expert analysis. By following the steps outlined and staying informed about any changes in regulations, businesses can ensure a smooth and successful journey through Oxnard's sales tax environment.

Frequently Asked Questions

What is the current state sales tax rate in California?

+

The current state sales tax rate in California is 7.25% as of my last update. This rate is subject to change, so it’s important to stay updated with the latest information from official sources.

Are there any local tax rates in Oxnard that businesses should be aware of?

+

Yes, the city of Oxnard imposes an additional local sales tax rate of 1.25%. This rate is applicable within the city limits and should be considered when calculating the total sales tax.

Are there any special tax districts in Oxnard with unique tax rates?

+

Yes, Oxnard has designated tax districts, such as special assessment districts or redevelopment areas, with their own specific tax rates. Businesses operating within these districts should be aware of and comply with the applicable district-specific tax rates.

How often do businesses need to file sales tax returns in Oxnard?

+

The frequency of filing sales tax returns can vary depending on the business’s sales volume and the requirements set by the California Department of Tax and Fee Administration (CDTFA). Typically, businesses file returns on a quarterly basis, but some may be required to file monthly or annually. It’s important to refer to the CDTFA guidelines for specific filing requirements.

What are the consequences of non-compliance with sales tax regulations in Oxnard?

+

Non-compliance with sales tax regulations can result in penalties, interest charges, and even criminal charges in severe cases. Businesses should ensure accurate reporting, timely remittance of sales tax, and maintain proper records to avoid these consequences.