Trump Child Support Tax Law

The topic of Trump Child Support Tax Law has garnered significant attention, especially given the intricate nature of the legal and financial aspects surrounding the former president and his financial dealings. While the details of this matter are complex and often shrouded in a degree of uncertainty, this article aims to delve into the known facts, legal frameworks, and potential implications to provide a comprehensive understanding of this intriguing issue.

Understanding the Trump Child Support Landscape

The discussion on Trump’s child support obligations is a multifaceted one, intertwining with his personal life, business dealings, and the intricate web of American tax laws. It is essential to approach this topic with a comprehensive understanding of the relevant legal and financial frameworks.

Legal Obligations and the Tax System

Child support payments are legally mandated financial contributions made by one parent to another to support the upbringing of their children. These payments are governed by state laws and can be influenced by various factors such as the income of the parents, the number of children involved, and the specific needs of the child. In the case of Donald Trump, the situation becomes more complex due to his substantial wealth, diverse business ventures, and the unique tax considerations that come with them.

The Internal Revenue Service (IRS) plays a crucial role in this scenario, as it is responsible for enforcing tax laws and regulations. The IRS has the authority to audit tax returns, assess penalties for non-compliance, and even initiate legal actions against individuals or entities who fail to meet their tax obligations. This includes child support payments, which are considered taxable income for the receiving parent and are deductible for the paying parent.

Trump’s Financial Profile and Child Support

Donald Trump’s financial profile is notoriously complex, with a vast array of assets, businesses, and investments. His net worth has been a subject of debate, with estimates ranging from hundreds of millions to several billion dollars. This complexity extends to his tax obligations, including those related to child support.

Trump has been married three times and has five children from these marriages. While the specifics of his child support obligations are not publicly available, it is reasonable to assume that these payments would be substantial, given his financial status. The exact amounts, however, are not within the public domain, making it challenging to provide precise figures or details.

Legal Battles and Controversies

The topic of Trump’s child support has been further muddled by legal battles and controversies. In recent years, there have been reports and allegations regarding potential non-payment or underpayment of child support. These allegations have been made by Trump’s former wives and have led to public scrutiny and media attention.

The legal system often provides a shield of privacy, making it difficult to obtain concrete details about ongoing or resolved legal matters. As a result, the specifics of any legal disputes or settlements related to Trump's child support obligations remain largely unknown to the public.

The Intersection of Child Support and Tax Laws

The relationship between child support and tax laws is a critical aspect of this discussion. Understanding how these two areas intersect provides valuable insights into the potential implications and challenges faced by individuals with substantial financial obligations.

Tax Treatment of Child Support Payments

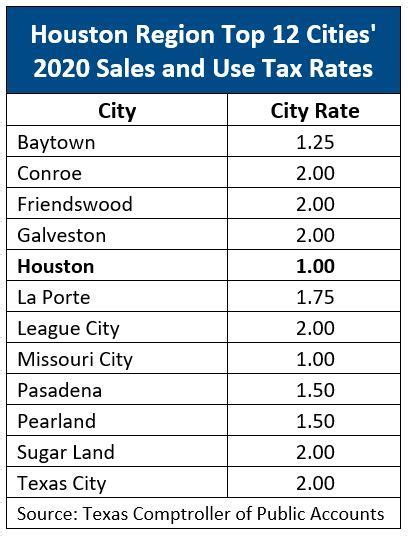

In the United States, child support payments are treated differently from other forms of income for tax purposes. The receiving parent must include child support payments in their taxable income, just like any other form of income. This means that the recipient is subject to federal and state income taxes on these payments.

On the other hand, the paying parent can deduct child support payments from their taxable income. This deduction reduces the payer's overall tax liability, providing a financial benefit. However, this deduction is not available for voluntary payments made beyond the legally mandated amount. It is solely applicable to the court-ordered child support obligations.

Challenges and Potential Pitfalls

The intersection of child support and tax laws presents several challenges and potential pitfalls for individuals involved. One of the primary concerns is the accurate reporting and documentation of child support payments. Both the paying and receiving parents must ensure that these payments are properly recorded and reported to the IRS.

Failure to accurately report child support payments can lead to serious legal and financial consequences. The IRS has the authority to impose penalties for underreporting or non-reporting of income, including child support. These penalties can be substantial and may include fines, interest charges, and even criminal prosecution in severe cases.

Audit Risks and Compliance

Given the complex nature of child support payments and their tax implications, individuals with substantial child support obligations are at a higher risk of IRS audits. The IRS may scrutinize the tax returns of these individuals to ensure compliance with tax laws and regulations. This increased scrutiny can be a significant burden, requiring thorough documentation and accurate record-keeping.

To mitigate the risks associated with audits, it is crucial for individuals to maintain detailed records of their child support payments. This includes keeping receipts, bank statements, and any other relevant documentation that can substantiate the payments made. Additionally, seeking professional tax advice can help individuals navigate the complex tax landscape and ensure compliance with the law.

Future Implications and Potential Reforms

The Trump Child Support Tax Law discussion raises important questions about the current legal and tax frameworks surrounding child support. As the landscape evolves, there may be opportunities for reform and improvement to address some of the challenges and complexities highlighted above.

Potential Reforms and Policy Changes

One potential area for reform is the tax treatment of child support payments. Currently, the paying parent receives a tax deduction, while the receiving parent must include the payments in their taxable income. This arrangement can create a disparity in the tax burden between the two parties.

Some experts and advocates have proposed alternative models, such as treating child support payments as non-taxable income for the receiving parent. This approach would alleviate the tax burden on the recipient and potentially encourage more equitable distribution of financial responsibilities. However, such reforms would require careful consideration and analysis to ensure they do not create unintended consequences or exacerbate existing issues.

Addressing Complexity and Transparency

The complexity of the current system, particularly for individuals with substantial financial obligations, highlights the need for increased transparency and simplicity. Simplifying the tax treatment of child support payments could reduce the administrative burden on both parents and improve overall compliance.

Additionally, promoting transparency in the legal process surrounding child support determinations could help address some of the controversies and challenges faced by individuals involved. Increased transparency can lead to better understanding, reduced litigation, and more equitable outcomes for all parties.

The Role of Technology and Innovation

In an era of technological advancements, there is an opportunity to leverage innovative solutions to improve the child support system. Digital platforms and tools can streamline the process, enhance record-keeping, and provide real-time updates on payment status and compliance.

For instance, developing secure online portals for child support payments and documentation could improve efficiency and reduce the administrative burden on parents and legal professionals. Additionally, integrating these platforms with tax software could simplify the reporting process and ensure accurate and timely compliance with tax laws.

Conclusion: A Complex Landscape

The Trump Child Support Tax Law topic underscores the intricate and often challenging nature of the legal and financial systems surrounding child support. While the specifics of Trump’s child support obligations remain largely unknown, the broader discussion highlights the need for reform, transparency, and innovation in this area.

As the legal and tax landscapes continue to evolve, it is essential to approach these issues with a comprehensive understanding of the complexities involved. By addressing the challenges and leveraging opportunities for improvement, we can strive for a more equitable and efficient child support system that serves the best interests of all parties involved.

How are child support payments determined in the United States?

+Child support payments are typically determined by state guidelines, which consider factors such as the income of both parents, the number of children involved, and the specific needs of the child. These guidelines ensure a fair and consistent approach to child support across different states.

Can child support payments be modified or adjusted over time?

+Yes, child support orders can be modified if there is a significant change in circumstances, such as a substantial increase or decrease in income, a change in custody arrangements, or other relevant factors. The process for modification varies by state, but generally involves a court hearing to review the proposed changes.

Are there any tax benefits for parents paying child support?

+Yes, parents who pay court-ordered child support can deduct these payments from their taxable income. This deduction reduces the payer’s overall tax liability and is a benefit provided by the tax system to alleviate some of the financial burden associated with child support obligations.