Before Tax Vs Roth 401K

The decision between contributing to a pre-tax or Roth 401(k) plan is a crucial one, as it can have significant implications for your retirement savings and overall financial well-being. Both options offer unique advantages and considerations, and understanding the nuances of each can help you make an informed choice that aligns with your financial goals and tax situation.

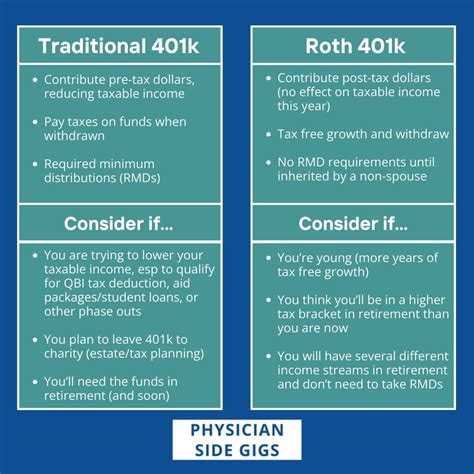

Understanding the Basics: Pre-Tax and Roth 401(k) Plans

A 401(k) plan is a popular retirement savings vehicle offered by many employers in the United States. It allows employees to contribute a portion of their pre-tax income to a retirement account, providing tax advantages and the potential for substantial long-term growth.

Pre-Tax 401(k) Contribution

With a pre-tax 401(k) contribution, the money you contribute is deducted from your gross income before federal and state taxes are calculated. This means that your taxable income is reduced, resulting in potentially lower tax liabilities in the current year. The contributions grow tax-deferred until withdrawal, at which point you’ll pay taxes based on your income tax bracket at the time of retirement.

Key Considerations:

- Lower taxable income in the current year.

- Potential tax savings, especially for those in higher tax brackets.

- Tax-deferred growth, allowing your investments to compound over time.

- Withdrawal during retirement may push you into a higher tax bracket.

Roth 401(k) Contribution

In contrast, a Roth 401(k) contribution is made with after-tax dollars. This means you contribute money that has already been taxed, but the growth and earnings on those contributions grow tax-free, and qualified withdrawals in retirement are also tax-free.

Key Advantages:

- Tax-free withdrawals in retirement, regardless of income level.

- Potential for higher tax savings if your income increases significantly over time.

- More flexibility in retirement planning, as you can access the contributions without penalty.

- Contributions may be subject to income limits and eligibility criteria.

| Comparison | Pre-Tax 401(k) | Roth 401(k) |

|---|---|---|

| Contribution Type | Pre-tax dollars | After-tax dollars |

| Tax Treatment | Tax-deferred growth, taxed upon withdrawal | Tax-free growth and withdrawals |

| Income Tax Bracket | Lower current income tax | No impact on current tax bracket |

| Withdrawal Flexibility | Penalties for early withdrawal | Penalties only on earnings, not contributions |

The Tax Advantage: Pre-Tax vs. Roth

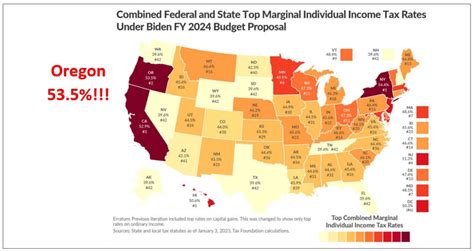

One of the primary considerations when choosing between a pre-tax and Roth 401(k) is the tax advantage each offers. The pre-tax option provides an immediate tax benefit by reducing your taxable income, which can be especially beneficial if you’re in a higher tax bracket.

Tax Savings with Pre-Tax Contributions

By contributing to a pre-tax 401(k), you effectively lower your taxable income for the current year. This can result in significant tax savings, especially if you have a high income or are in a higher tax bracket. However, it’s important to note that the tax savings are not permanent, as you’ll pay taxes on the withdrawals during retirement.

Long-Term Tax Benefits of Roth Contributions

While Roth contributions don’t provide an immediate tax benefit, they offer the potential for substantial long-term tax savings. By contributing after-tax dollars, you lock in your tax rate for the year of the contribution. This means that, regardless of your income level or tax bracket in retirement, you won’t owe taxes on the withdrawals from your Roth 401(k) account.

This feature can be particularly advantageous if you anticipate your income increasing significantly over time, as it allows you to benefit from tax-free growth and withdrawals in retirement.

Investment Growth and Withdrawal Flexibility

Another critical aspect to consider when choosing between a pre-tax and Roth 401(k) is the potential for investment growth and the flexibility of withdrawals.

Investment Growth Potential

Both pre-tax and Roth 401(k) plans offer the opportunity for substantial investment growth over time. However, the tax treatment of each option differs.

With a pre-tax 401(k), your contributions grow tax-deferred, meaning you don’t pay taxes on the investment gains until you make withdrawals during retirement. This can result in significant tax savings if your investments perform well.

On the other hand, a Roth 401(k) provides tax-free growth, as you’ve already paid taxes on the contributions. This means that any investment gains are also tax-free, providing a significant advantage for long-term retirement savings.

Withdrawal Flexibility

The flexibility of withdrawals is another crucial factor to consider. Pre-tax 401(k) contributions have certain restrictions and penalties for early withdrawals, especially if you’re under the age of 59½. You may face a 10% penalty and additional taxes on the withdrawal amount.

In contrast, Roth 401(k) contributions offer more flexibility. You can withdraw your contributions (but not earnings) at any time without penalty. This provides a level of financial flexibility that may be valuable in certain situations, such as an emergency or a significant life event.

Income and Tax Bracket Considerations

Your current income and anticipated future income are critical factors when deciding between a pre-tax and Roth 401(k). These factors can influence the tax advantages and potential savings of each option.

Current Income and Tax Bracket

If you’re currently in a higher tax bracket, a pre-tax 401(k) can offer immediate tax savings by reducing your taxable income. This can be especially beneficial if you have a substantial income and are in the highest tax brackets.

However, it’s essential to consider the potential impact on your tax bracket during retirement. If you anticipate your income decreasing significantly in retirement, a pre-tax 401(k) may result in a higher tax liability when you withdraw funds.

Anticipated Future Income

On the other hand, if you expect your income to increase over time, a Roth 401(k) can be an excellent choice. By contributing after-tax dollars, you lock in your tax rate, ensuring that future withdrawals will be tax-free, regardless of your income level.

This strategy can be particularly advantageous if you anticipate significant career growth or changes that could impact your tax bracket.

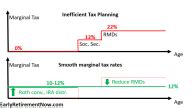

Maximizing Benefits: A Balanced Approach

In many cases, a balanced approach that utilizes both pre-tax and Roth 401(k) contributions can be an optimal strategy. This approach allows you to take advantage of the immediate tax savings of pre-tax contributions while also benefiting from the long-term tax-free growth and withdrawal flexibility of Roth contributions.

Diversifying Your Retirement Portfolio

By allocating a portion of your retirement savings to each type of 401(k), you diversify your tax exposure and potentially mitigate the risks associated with either option. This strategy can provide a more stable and predictable retirement income, especially if your tax situation is uncertain or likely to change over time.

Maximizing Employer Matching

Another advantage of a balanced approach is the ability to maximize employer matching contributions. Many employers offer matching contributions based on a percentage of your 401(k) contributions. By contributing to both pre-tax and Roth options, you can potentially increase the amount of employer matching funds you receive, further boosting your retirement savings.

Real-World Examples and Case Studies

Case Study: High-Income Earner

Consider John, a high-income earner in his 40s. John is currently in the highest tax bracket and anticipates his income remaining stable or slightly decreasing in retirement. In this scenario, a pre-tax 401(k) would be advantageous, as it allows him to take advantage of immediate tax savings and defer taxes on his investments.

Case Study: Career Starter

For someone like Sarah, a recent college graduate starting her career, a Roth 401(k) might be a better fit. With a lower income and potential for career growth and increased earnings over time, Sarah can benefit from the long-term tax-free growth and withdrawal flexibility of a Roth 401(k). This strategy ensures that her retirement savings remain tax-efficient, regardless of her future income.

Case Study: Balanced Approach

Tom, in his early 30s, has a stable income and anticipates some career growth over time. By adopting a balanced approach, Tom can contribute to both pre-tax and Roth 401(k) options. This strategy allows him to benefit from immediate tax savings while also locking in his tax rate for future withdrawals, providing a well-rounded and flexible retirement savings plan.

Future Implications and Retirement Planning

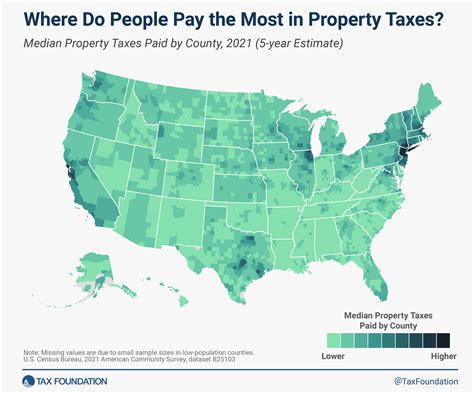

The choice between a pre-tax and Roth 401(k) can have long-lasting implications for your retirement planning and financial security. By carefully considering your current and future tax situation, investment goals, and withdrawal needs, you can make an informed decision that aligns with your financial priorities.

Long-Term Financial Planning

When planning for retirement, it’s essential to consider the potential impact of taxes on your savings and investments. A well-thought-out strategy that takes into account your tax situation, both now and in the future, can help you maximize your retirement savings and ensure a comfortable retirement.

The Impact of Tax Law Changes

It’s important to note that tax laws and regulations can change over time. While the current tax landscape favors certain strategies, future changes could impact the advantages of pre-tax and Roth 401(k) contributions. Staying informed about potential changes and consulting with financial professionals can help you adapt your retirement planning as needed.

The Role of Retirement Accounts in Financial Security

Retirement accounts, such as 401(k) plans, play a crucial role in building financial security for the future. By contributing consistently and strategically, you can accumulate substantial savings over time, providing a stable source of income during retirement. The choice between pre-tax and Roth contributions is a critical decision that can significantly impact the growth and tax efficiency of your retirement savings.

Can I have both a pre-tax and Roth 401(k) at the same time?

+Yes, many employers offer the option to contribute to both pre-tax and Roth 401(k) plans simultaneously. This allows you to diversify your retirement savings and take advantage of the benefits of both options.

Are there income limits for contributing to a Roth 401(k)?

+Yes, there are income limits for Roth 401(k) contributions. For single filers, the income limit for 2023 is 144,000, above which you may not be able to make Roth contributions. For married couples filing jointly, the limit is 214,000.

What happens if I withdraw from my pre-tax 401(k) before retirement age?

+Early withdrawals from a pre-tax 401(k) can result in a 10% penalty and additional taxes. However, there are certain exceptions, such as for qualified hardship withdrawals or if you meet specific criteria for a penalty-free withdrawal.