Will County Property Taxes

Property taxes are an essential aspect of local governance and play a significant role in funding various public services and infrastructure within Will County, Illinois. Understanding the intricacies of these taxes, including their calculation, distribution, and impact on residents, is crucial for both property owners and those considering investment in the area.

Understanding Will County Property Taxes

In Will County, property taxes are a primary source of revenue for local governments, including municipalities, townships, school districts, and special taxing districts. These taxes are levied on both residential and commercial properties, with the funds being used to support a wide range of services and facilities, such as schools, libraries, fire and police departments, roads, and other community amenities.

The property tax system in Will County operates under a unique and complex framework, reflecting the diverse needs and priorities of the region's various jurisdictions. Each taxing district sets its own tax rate, resulting in a wide variation of tax burdens across the county.

For instance, consider the fictional case of Oakfield Township, a suburban township in Will County. In Oakfield, property taxes contribute significantly to the funding of the local school district, Oakfield Public Schools, which boasts a reputation for academic excellence. Consequently, property owners in Oakfield often bear a higher tax burden to support the district's educational programs and facilities.

On the other hand, in more rural areas of Will County, such as the Spring Creek Township, property taxes might be directed towards funding essential services like road maintenance, emergency response, and agricultural support programs, reflecting the unique needs of the township's residents and businesses.

How Property Taxes are Calculated in Will County

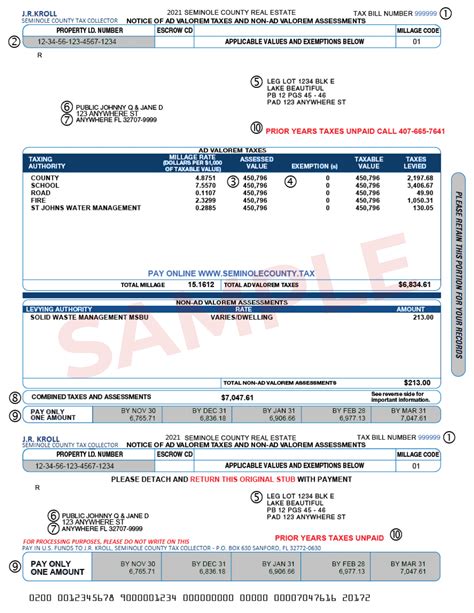

The calculation of property taxes in Will County involves several key factors, including the assessed value of the property, the tax rate, and any applicable exemptions or deductions.

The assessed value of a property is determined by the Will County Assessor's Office, which conducts regular assessments to ensure fairness and accuracy. This value is then multiplied by the tax rate, which is set annually by the various taxing districts. The resulting figure is the property's tax liability.

To illustrate, let's consider a residential property in Joliet, the county seat of Will County. Suppose the property has an assessed value of $250,000 and is located in a taxing district with a tax rate of 2.5%. The property's tax liability would be calculated as follows: $250,000 x 0.025 = $6,250. This means the property owner would owe $6,250 in property taxes for that year.

| Taxing District | Tax Rate (%) | Assessed Value ($) | Estimated Tax Liability ($) |

|---|---|---|---|

| Will County | 1.75 | 250,000 | 4,375 |

| Joliet Township | 1.1 | 250,000 | 2,750 |

| Joliet SD 204 | 1.4 | 250,000 | 3,500 |

| Total | 4.25 | 10,625 |

In this example, the property owner would owe a total of $10,625 in property taxes, which would be distributed among the various taxing districts based on their individual tax rates.

The Impact of Property Taxes on the Community

Property taxes in Will County have a profound impact on the community, shaping the economic landscape and the overall quality of life. They are a significant driver of economic growth, as they fund essential public services that attract businesses and residents alike.

For instance, well-funded schools, as supported by property taxes, can enhance a community's reputation, making it more attractive to families and young professionals. Similarly, investments in infrastructure and public safety can improve the overall livability of an area, boosting property values and encouraging economic development.

However, the burden of property taxes can also be a significant concern for residents, especially those on fixed incomes or with limited financial means. It's essential for local governments to strike a balance between adequate funding for essential services and an equitable tax burden for property owners.

Efforts to manage property taxes effectively can include regular assessments to ensure fairness, the implementation of tax relief programs for vulnerable populations, and strategic investments in economic development initiatives to enhance the county's overall tax base.

Navigating the Will County Property Tax Landscape

Understanding the complexities of property taxes in Will County is essential for both current and prospective residents. While the system can be intricate, with various taxing districts and rates, it is designed to fund the diverse array of services and infrastructure that make Will County a desirable place to live and work.

By staying informed about the property tax landscape, residents can make more informed decisions about their financial obligations and advocate for policies that benefit the community as a whole. This includes staying engaged with local government, attending public meetings, and participating in the democratic process that shapes the distribution of property tax revenue.

In conclusion, property taxes in Will County are a vital component of the local economy and governance, offering both opportunities and challenges. By navigating this complex system with knowledge and engagement, residents can contribute to a thriving, well-funded community that supports the needs and aspirations of all its members.

What are the key factors that determine property tax rates in Will County?

+

Property tax rates in Will County are influenced by a variety of factors, including the budget needs of the various taxing districts, the assessed value of properties, and the overall economic conditions in the county. Each taxing district sets its own tax rate, which can lead to significant variations across the county.

How can residents stay informed about property tax changes and their impact?

+

Residents can stay informed by regularly checking the websites and newsletters of their local taxing districts, such as their municipality, township, and school district. These sources often provide updates on tax rates, budget plans, and public hearings where residents can voice their opinions.

Are there any tax relief programs available for Will County residents?

+

Yes, Will County offers several tax relief programs to assist eligible residents. These include the Senior Citizen Real Estate Tax Deferral Program, the Homestead Exemption Program, and the Property Tax Assessment Appeal process. Each program has its own eligibility criteria and application process.

How can property owners dispute their assessed value or tax liability in Will County?

+

Property owners who believe their assessed value or tax liability is incorrect can file an appeal with the Will County Assessor’s Office. This process typically involves submitting evidence to support the appeal, such as recent sales data of similar properties, and attending a hearing to present their case.

What is the timeline for property tax payments in Will County?

+

Property taxes in Will County are typically due in two installments. The first installment is due by March 1st, and the second by July 1st. However, the specific due dates and payment options can vary slightly depending on the taxing district, so it’s advisable to check with the local tax collector’s office for precise details.