Nc State Sales Tax

The sales tax landscape in North Carolina, and specifically in relation to North Carolina State University (NC State), is an important topic for both residents and businesses alike. Understanding the intricacies of sales tax regulations can significantly impact financial planning and business operations. This article aims to provide a comprehensive guide to sales tax in North Carolina, with a particular focus on how it applies to NC State and its surrounding areas.

Sales Tax Fundamentals in North Carolina

North Carolina imposes a state sales tax on most tangible personal property and certain services. The state sales tax rate is currently 4.75%, one of the lower rates among U.S. states. However, it’s important to note that local governments can also levy additional sales taxes, creating a more complex tax environment.

Local Sales Tax Rates

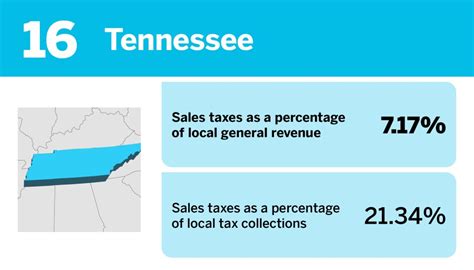

Local governments in North Carolina have the authority to impose their own sales taxes, which are added on top of the state rate. These local sales taxes can vary significantly from one jurisdiction to another, creating a patchwork of tax rates across the state. For instance, Wake County, where NC State is located, has an additional 2.25% local sales tax, bringing the total sales tax rate to 7% within the county.

Here's a table illustrating the sales tax rates for some key locations in North Carolina:

| Location | State Tax Rate | Local Tax Rate | Total Tax Rate |

|---|---|---|---|

| Raleigh (Wake County) | 4.75% | 2.25% | 7% |

| Durham (Durham County) | 4.75% | 2.50% | 7.25% |

| Charlotte (Mecklenburg County) | 4.75% | 2.25% | 7% |

| Asheville (Buncombe County) | 4.75% | 2% | 6.75% |

Sales Tax Exemptions

While most tangible personal property and services are subject to sales tax in North Carolina, there are certain exemptions. These include sales of certain food items, prescription drugs, and certain types of manufacturing equipment. Additionally, some non-profit organizations and government entities are exempt from sales tax.

NC State’s Role in Sales Tax

As a major institution in North Carolina, NC State plays a significant role in the local economy. Its impact extends beyond its direct operations, influencing the tax landscape for businesses and residents in the region.

NC State’s Economic Impact

NC State is a driving force in the Triangle region, which includes Wake, Durham, and Orange counties. The university contributes significantly to the local economy through its research, education, and business activities. Its presence attracts businesses and talent, fostering economic growth and development.

According to a 2022 Economic Impact Study, NC State's annual economic impact on North Carolina is estimated to be over $8.5 billion. This impact is felt across various sectors, including education, healthcare, technology, and retail.

Sales Tax and NC State’s Operations

As a large institution, NC State is subject to the state and local sales taxes. This means that the university, its departments, and affiliated businesses must navigate the complex sales tax landscape when making purchases or selling goods and services.

For instance, when NC State procures equipment or supplies, it must consider the applicable sales tax rates. Similarly, when the university's bookstores or dining services sell goods or meals, they must collect and remit the appropriate sales taxes.

Sales Tax Compliance and Challenges

Compliance with sales tax regulations can be challenging, especially in a state like North Carolina with varying local tax rates. Businesses and institutions like NC State must ensure they are aware of the latest tax rates and regulations to avoid penalties and ensure fair taxation.

Sales Tax Software and Solutions

To simplify sales tax compliance, many businesses and institutions utilize sales tax software. These tools can help automate tax calculations, ensure accurate tax collection, and provide real-time updates on tax rate changes. For NC State, such software could be invaluable in managing its sales tax obligations efficiently.

Some popular sales tax software solutions include Avalara, Vertex, and TaxJar. These platforms offer features like automated tax calculation, tax rate database updates, and tax return filing assistance.

Sales Tax Audits and Enforcement

The North Carolina Department of Revenue regularly conducts sales tax audits to ensure compliance. These audits can be complex and time-consuming, especially for large institutions like NC State. It’s essential for businesses and institutions to maintain accurate records and be prepared for potential audits.

The Future of Sales Tax in North Carolina

The sales tax landscape in North Carolina is likely to evolve in the coming years. As the state’s economy grows and changes, so too will the tax regulations. Understanding these potential changes is crucial for businesses and institutions like NC State to stay ahead of the curve.

Potential Sales Tax Reforms

There have been ongoing discussions about sales tax reforms in North Carolina. Some proposed changes include simplifying the tax structure, reducing the state sales tax rate, and expanding the list of tax-exempt items. While these reforms could bring benefits, they also present challenges for businesses and institutions that must adapt to new regulations.

Technology and Sales Tax

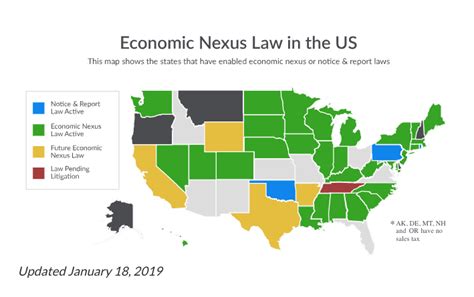

The rise of e-commerce and digital platforms has had a significant impact on sales tax collection. North Carolina, like many other states, is adapting its tax regulations to account for these changes. This includes implementing laws to tax online sales and ensuring compliance with out-of-state sellers.

Conclusion

Understanding and navigating the sales tax landscape in North Carolina is crucial for both businesses and institutions like NC State. By staying informed about the latest regulations, utilizing modern tools, and maintaining accurate records, organizations can ensure compliance and make informed financial decisions.

FAQ

What is the current state sales tax rate in North Carolina?

+

The current state sales tax rate in North Carolina is 4.75%.

Are there any sales tax exemptions in North Carolina?

+

Yes, North Carolina offers sales tax exemptions for certain items like food, prescription drugs, and manufacturing equipment. Non-profit organizations and government entities are also exempt.

How do local sales taxes work in North Carolina?

+

Local governments in North Carolina have the authority to impose their own sales taxes, which are added on top of the state rate. These local taxes can vary significantly, creating a complex tax environment.

What is the economic impact of NC State on North Carolina?

+

NC State’s annual economic impact on North Carolina is estimated to be over $8.5 billion. This impact is felt across various sectors, including education, healthcare, technology, and retail.

How can businesses and institutions stay compliant with sales tax regulations in North Carolina?

+

Businesses and institutions can stay compliant by utilizing sales tax software, staying informed about the latest regulations, and maintaining accurate records. Regular audits and consultations with tax professionals can also help ensure compliance.