Oregon Tax Rate

When it comes to taxes, understanding the rates and their implications is crucial for both individuals and businesses. Oregon, known for its stunning natural beauty and vibrant economy, has a unique tax system that sets it apart from many other states in the US. Let's delve into the specifics of the Oregon tax rate and explore how it impacts residents and businesses within the state.

Unraveling the Oregon Tax Landscape

Oregon’s tax structure is a blend of progressive personal income tax rates, a corporate income tax, and a range of other taxes that contribute to the state’s revenue. Understanding these rates is essential for making informed financial decisions and planning.

Personal Income Tax: A Progressive Approach

Oregon takes a progressive approach to personal income taxation, which means that as your income increases, so does your tax rate. This system aims to ensure fairness and provide a balanced revenue stream for the state. The personal income tax rates in Oregon are as follows:

- For single filers with taxable income up to 4,000, the rate is 5.0%.</li> <li>Income between 4,001 and 7,500 is taxed at 5.5%.</li> <li>The rate jumps to 7.6% for income ranging from 7,501 to 125,000.</li> <li>Income exceeding 125,000 is taxed at 9.9%.

These rates are applicable for the 2023 tax year and may be subject to adjustments in the future. It’s worth noting that Oregon allows for various deductions and credits, which can reduce the overall tax liability for individuals.

Corporate Income Tax: Attracting Businesses

To encourage economic growth and attract businesses, Oregon has a corporate income tax rate that is relatively competitive compared to other states. The rate stands at 6.6% for the 2023 tax year. This flat rate applies to all corporations doing business in the state, regardless of their size or revenue.

Oregon also offers various incentives and tax credits for businesses, especially those focused on innovation and job creation. These incentives aim to foster a business-friendly environment and contribute to the state’s economic development.

Other Taxes: A Comprehensive Overview

In addition to personal and corporate income taxes, Oregon has a range of other taxes that contribute to its overall tax landscape. These include:

- Sales and Use Tax: Oregon has a statewide sales and use tax rate of 0%, making it one of the few states without a general sales tax. However, certain local jurisdictions may impose their own sales taxes.

- Property Tax: Property taxes in Oregon are assessed at the local level, with rates varying across counties and municipalities. The state’s average effective property tax rate is approximately 1.10%.

- Estate and Inheritance Tax: Oregon has an estate tax but no inheritance tax. The estate tax rate varies based on the value of the estate, with rates ranging from 10.8% to 16% for estates valued at $1 million or more.

- Excise Taxes: Oregon imposes excise taxes on various goods and services, including fuel, tobacco, and insurance premiums. These taxes are typically passed on to consumers and can impact the cost of living.

| Tax Type | Rate |

|---|---|

| Personal Income Tax | 5.0% - 9.9% |

| Corporate Income Tax | 6.6% |

| Sales and Use Tax | 0% (Statewide) |

| Property Tax | Varies (Average: 1.10%) |

| Estate Tax | 10.8% - 16% |

The Impact on Residents and Businesses

The Oregon tax rate has a significant influence on the lives of residents and the operations of businesses within the state. Let’s explore how it shapes the financial landscape:

Personal Finance: Navigating Tax Obligations

For individuals residing in Oregon, understanding the personal income tax rates is crucial for effective financial planning. The progressive nature of the tax system means that higher-income earners contribute a larger share of their income to state revenues. However, the availability of deductions and credits can help reduce the overall tax burden.

Oregon’s absence of a general sales tax is a significant advantage for residents. While it may not impact day-to-day purchases, it does provide a competitive edge when making larger purchases, as consumers are not subjected to additional sales taxes. This factor can influence buying decisions and contribute to a higher standard of living.

Business Operations: A Competitive Environment

Businesses operating in Oregon benefit from the state’s competitive corporate income tax rate. The flat 6.6% rate provides a stable and predictable tax environment, allowing companies to plan their financial strategies with confidence. This rate is particularly attractive for small and medium-sized businesses, as it simplifies tax compliance.

Furthermore, Oregon’s tax incentives for businesses focused on innovation and job creation are a significant draw. These incentives not only encourage economic growth but also foster a business-friendly atmosphere. As a result, the state has become a hub for startups and established companies alike, contributing to a thriving business ecosystem.

Economic Development: A Balanced Approach

Oregon’s tax system is designed to promote economic development while maintaining fairness. The progressive income tax rates ensure that higher-income individuals contribute proportionally more, providing a robust revenue stream for the state. This revenue is then invested back into the community through various public services and infrastructure projects.

The absence of a general sales tax also has a positive impact on the economy. It encourages consumer spending, as individuals are not burdened with additional taxes at the point of sale. This, in turn, stimulates economic activity and supports local businesses.

Future Implications and Considerations

As with any tax system, Oregon’s rates and structure are subject to potential changes and adjustments. Here are some key considerations for the future:

Potential Rate Adjustments

Tax rates are dynamic and can be influenced by various factors, including economic conditions and legislative decisions. While Oregon’s current rates provide stability, it’s essential to stay informed about any proposed changes. Monitoring local news and following legislative updates can help individuals and businesses stay prepared for potential tax adjustments.

Economic Impact and Growth

Oregon’s tax structure has played a significant role in attracting businesses and fostering economic growth. As the state continues to develop and evolve, it’s crucial to assess the long-term impact of its tax policies. A balanced approach that encourages economic development while maintaining fairness will be essential for sustaining Oregon’s vibrant economy.

Tax Policy and Social Programs

The revenue generated through Oregon’s tax system funds various social programs and initiatives. These programs, ranging from healthcare to education, have a direct impact on the well-being of residents. Understanding the correlation between tax rates and the availability of social services is crucial for both taxpayers and policymakers.

How does Oregon's lack of a sales tax impact its economy?

+Oregon's absence of a general sales tax encourages consumer spending and makes the state more competitive for businesses. This absence of a sales tax can lead to increased economic activity and attract companies looking to reduce their tax burden.

Are there any tax incentives for renewable energy projects in Oregon?

+Yes, Oregon offers various tax incentives for renewable energy projects. These incentives aim to promote sustainability and include tax credits and exemptions for businesses involved in renewable energy production and research.

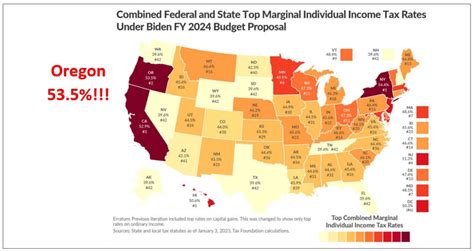

How does Oregon's progressive income tax rate compare to other states?

+Oregon's progressive income tax rate is relatively competitive compared to other states. While some states have higher top marginal rates, Oregon's structure ensures a fair contribution from higher-income earners while offering benefits through deductions and credits.

Understanding the Oregon tax rate is crucial for individuals and businesses alike. By unraveling the state’s tax landscape, we’ve gained insights into its impact on personal finances, business operations, and economic development. As Oregon continues to thrive, its tax system will play a pivotal role in shaping its future.