Sales Tax In Washington

Sales tax in Washington State is an essential component of the state's revenue system, contributing significantly to the funding of public services and infrastructure. Unlike many other states in the US, Washington has a unique approach to sales taxation, which has both advantages and complexities. This article aims to provide an in-depth exploration of Washington's sales tax system, its rates, exemptions, and the impact it has on businesses and consumers alike.

Understanding Washington’s Sales Tax System

Washington State imposes a sales and use tax on the sale of tangible personal property, certain digitally-provided products and services, and some services within the state. The state sales tax is a percentage of the selling price of the item or service and is collected by the seller at the time of sale. This tax is then remitted to the Washington State Department of Revenue (DOR) by the business or individual selling the taxable item.

One of the notable characteristics of Washington's sales tax system is its uniformity. Unlike some other states with varying local sales tax rates, Washington has a single state-wide sales tax rate, ensuring consistency across the state. However, this does not mean that sales tax rates are uniform for all items; certain products and services are subject to different tax rates or even exemptions.

Sales Tax Rates in Washington

The standard sales tax rate in Washington is currently set at 6.5%, which is applicable to most retail sales of tangible personal property and some services. This rate is composed of a 6.5% state sales tax and a 0% local sales tax, as Washington does not have a separate local sales tax. However, it’s important to note that this rate can vary based on the type of item being sold and the location of the sale.

| Category | Tax Rate |

|---|---|

| General Merchandise | 6.5% |

| Food and Drugs | 0% |

| Prescription Drugs | 0% |

| Certain Services (e.g., Construction) | 6.5% |

| Digital Products and Services | 6.5% or higher, depending on location |

For example, while food and drugs are generally exempt from sales tax, certain prepared foods and beverages may be subject to the tax. Similarly, digital products and services, such as software downloads and streaming services, are taxed at varying rates depending on the location of the consumer.

Exemptions and Special Considerations

Washington State offers a range of sales tax exemptions, which can significantly impact the tax burden on businesses and consumers. Some of the key exemptions include:

- Food and Drugs: Most unprepared food items, over-the-counter drugs, and dietary supplements are exempt from sales tax.

- Prescription Drugs: All prescription drugs are exempt from sales tax, including those sold through pharmacies and medical supply stores.

- Clothing and Shoes: Washington does not impose sales tax on clothing and footwear items priced under $100.

- Educational Materials: Sales of books, magazines, newspapers, and certain educational supplies are exempt from sales tax.

- Manufacturing and Resale: Sales tax is not applied to items intended for manufacturing or resale, as these are considered business-to-business transactions.

It's important for businesses and consumers to understand these exemptions, as they can lead to significant savings. For instance, the clothing exemption can be a substantial benefit for families with children, as it covers a wide range of clothing items, including school uniforms and athletic wear.

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax in Washington involves several steps and considerations. For businesses, this process begins with understanding their sales tax registration requirements and obtaining the necessary licenses and permits.

Sales Tax Registration and Permits

Businesses operating in Washington State must obtain a Business License and a Sales Tax Permit from the DOR. The Business License is a general permit required for all businesses, while the Sales Tax Permit is specific to businesses engaging in taxable sales or providing taxable services. These permits ensure that businesses are registered with the state and authorized to collect and remit sales tax.

The DOR provides an online registration system, making it convenient for businesses to apply for these permits. Once registered, businesses receive a unique permit number, which they must display on all sales tax documents and reports.

Sales Tax Collection and Calculation

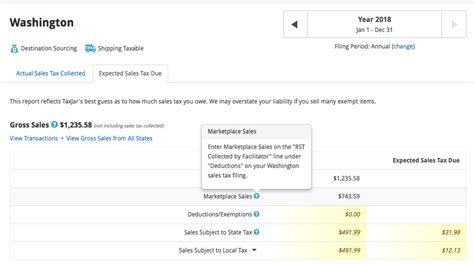

When a business makes a taxable sale, it is responsible for collecting the appropriate sales tax from the customer. This involves calculating the tax based on the sales price and the applicable tax rate. For example, if a business sells a taxable item for 100, and the sales tax rate is 6.5%, the business would collect 6.50 in sales tax, for a total sale of $106.50.

It's crucial for businesses to accurately calculate and collect sales tax to avoid penalties and maintain a positive relationship with the DOR. Miscalculations or undercharging can lead to audits and fines.

Sales Tax Remittance

After collecting sales tax from customers, businesses are required to remit this tax to the DOR on a regular basis. The frequency of remittance depends on the business’s sales volume and tax liability. Generally, businesses with higher sales volumes and tax liabilities are required to remit sales tax more frequently.

The DOR provides online tools and resources to assist businesses with sales tax remittance, including electronic filing and payment options. This ensures that businesses can meet their tax obligations efficiently and securely.

Compliance and Enforcement

Ensuring compliance with sales tax laws is a critical aspect of doing business in Washington State. The DOR plays a significant role in enforcing these laws, conducting audits, and ensuring that businesses and individuals are meeting their tax obligations.

Sales Tax Audits

The DOR has the authority to conduct sales tax audits to verify that businesses are accurately collecting and remitting sales tax. These audits can be triggered by various factors, including random selection, changes in business operations, or suspected non-compliance. During an audit, the DOR will review a business’s sales records, tax returns, and other financial documents to ensure compliance.

If an audit reveals that a business has undercharged or failed to collect sales tax, the business may be liable for back taxes, interest, and penalties. Therefore, it's essential for businesses to maintain accurate records and ensure they are compliant with sales tax laws.

Enforcement and Penalties

The DOR has a range of enforcement tools at its disposal to ensure compliance with sales tax laws. These include issuing notices and demands for payment, imposing penalties and interest, and, in severe cases, pursuing legal action against non-compliant businesses or individuals.

Penalties for sales tax non-compliance can be significant, often based on the amount of tax owed and the severity of the violation. These penalties can include late payment penalties, failure to file penalties, and even criminal charges in cases of fraud or willful evasion.

Impact on Businesses and Consumers

Washington’s sales tax system has a significant impact on both businesses and consumers. For businesses, sales tax is a key consideration in pricing strategies, financial planning, and compliance requirements. It can affect a business’s competitive position and its ability to expand or invest.

For consumers, sales tax adds to the cost of goods and services, impacting their purchasing power and overall economic well-being. The variability in sales tax rates and exemptions can also create complexity and confusion, especially for those unfamiliar with Washington's tax system.

Business Considerations

From a business perspective, understanding and managing sales tax obligations is crucial for success. This involves not only collecting and remitting sales tax but also staying informed about changes in tax laws and regulations. Businesses must ensure they are registered, licensed, and compliant with all tax requirements to avoid penalties and maintain a positive reputation.

Additionally, businesses need to consider sales tax when setting prices for their goods and services. While higher prices can help offset the cost of sales tax, they may also make a business's products less competitive in the market. Finding the right balance is essential for maintaining profitability and market share.

Consumer Impact

For consumers, sales tax is an added cost that can significantly impact their purchasing decisions and overall financial health. While some consumers may be aware of the sales tax rate in their area and factor it into their budgeting, others may be surprised by the added cost at the point of sale.

The complexity of Washington's sales tax system, with its varying rates and exemptions, can also make it challenging for consumers to understand their tax obligations. This may lead to misunderstandings or even non-compliance, particularly for out-of-state consumers who are less familiar with Washington's tax laws.

Future of Sales Tax in Washington

As with any tax system, Washington’s sales tax is subject to ongoing review and potential changes. These changes can be driven by a variety of factors, including economic conditions, political priorities, and technological advancements.

Potential Changes and Reforms

There have been ongoing discussions and proposals for reforming Washington’s sales tax system. Some of the proposed changes include:

- Broadening the Tax Base: Proposals to expand the types of goods and services subject to sales tax, potentially including currently exempt items like food and drugs.

- Streamlining Tax Rates: Suggestions to simplify the tax system by reducing or eliminating local tax variations, leading to a more uniform tax rate across the state.

- Digital Tax Reform: With the rise of digital commerce, there have been calls to reform the sales tax system to better capture taxes on online sales, particularly for out-of-state retailers.

- Tax Relief and Incentives: Proposals to offer tax relief or incentives to certain businesses or industries, such as manufacturing or small businesses, to encourage economic growth and job creation.

While these proposals aim to address various economic and social issues, they can also spark debate and controversy. The potential impact on businesses and consumers must be carefully considered to ensure any reforms are fair and beneficial to all parties involved.

Economic and Social Considerations

The future of Washington’s sales tax system is closely tied to the state’s economic health and social priorities. As the state’s economy evolves, so too must its tax system to ensure it remains sustainable and equitable. This includes considering the impact of sales tax on different segments of society, particularly those who may be more vulnerable to economic fluctuations.

For example, sales tax exemptions for essential items like food and drugs can provide significant relief to low-income families, ensuring they have access to basic necessities. On the other hand, broadening the tax base to include these items could disproportionately affect these families, potentially leading to increased financial strain.

Conclusion

Washington State’s sales tax system is a complex yet essential component of the state’s revenue structure. It plays a vital role in funding public services and infrastructure, while also impacting businesses and consumers in significant ways. Understanding this system, its rates, exemptions, and compliance requirements is crucial for all parties involved.

As Washington continues to evolve and adapt to changing economic and social landscapes, its sales tax system will likely undergo further changes and reforms. These changes will aim to balance the need for revenue with the interests of businesses and consumers, ensuring a fair and sustainable tax system for the future.

What is the current sales tax rate in Washington State?

+The current state sales tax rate in Washington is 6.5% as of 2024. This rate is uniform across the state and does not include any local sales tax.

Are there any sales tax exemptions in Washington?

+Yes, Washington offers several sales tax exemptions. Some notable exemptions include food and drugs, prescription drugs, clothing and shoes under $100, educational materials, and items intended for manufacturing or resale.

How often do businesses need to remit sales tax in Washington?

+The frequency of sales tax remittance depends on the business’s sales volume and tax liability. Generally, businesses with higher sales volumes and tax liabilities are required to remit sales tax more frequently. The DOR provides guidance on remittance schedules based on a business’s specific circumstances.

What are the penalties for sales tax non-compliance in Washington?

+Penalties for sales tax non-compliance in Washington can be significant. They may include late payment penalties, failure to file penalties, and even criminal charges in cases of fraud or willful evasion. The DOR has a range of enforcement tools to ensure compliance.

Are there any proposed reforms to Washington’s sales tax system?

+Yes, there have been ongoing discussions and proposals for reforming Washington’s sales tax system. These include broadening the tax base, streamlining tax rates, reforming digital sales tax, and offering tax relief or incentives to certain businesses or industries.