Connecticut Tax Rate

Connecticut, a vibrant state in the northeastern region of the United States, boasts a rich history and a dynamic economy. When it comes to taxes, understanding the state's tax structure is crucial for both residents and businesses alike. This comprehensive guide aims to delve into the intricacies of the Connecticut Tax Rate, offering an in-depth analysis of its various components and their implications.

Unraveling the Connecticut Tax Landscape

Connecticut’s tax system is designed to fund a range of essential services and initiatives, contributing to the state’s overall prosperity. The tax structure encompasses several key elements, each playing a significant role in shaping the state’s fiscal landscape.

Income Tax: A Key Revenue Stream

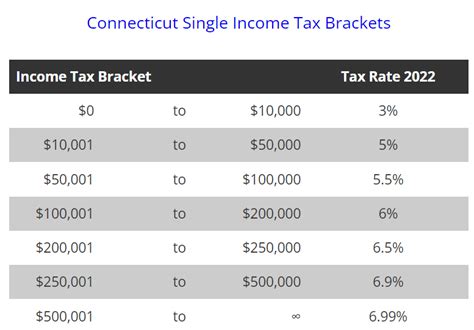

Income tax forms the backbone of Connecticut’s tax revenue. The state imposes a progressive income tax, meaning that higher income levels are taxed at increasingly higher rates. This system ensures that those with greater financial means contribute a larger share to the state’s coffers.

For instance, consider the case of John, a resident of Connecticut earning an annual income of 80,000. According to the state's tax brackets, John's income would be taxed at a rate of 3.07% for the first 10,000, 5.00% for the next 20,000, and so on, up to a maximum rate of 6.99% for income exceeding 500,000.

This progressive income tax structure not only provides a fair and equitable approach to taxation but also ensures that the state can meet its financial obligations, from funding education and healthcare to maintaining infrastructure.

Sales and Use Tax: Everyday Impact

Connecticut also levies a sales and use tax on various goods and services. This tax is a significant revenue source for the state and is applicable to most retail transactions. As of [current year], the general sales tax rate in Connecticut stands at 6.35%, making it one of the higher rates in the region.

However, it’s important to note that certain items are exempt from sales tax, including most food products and prescription medications. Additionally, Connecticut offers a temporary sales tax holiday each year, providing a boost to consumer spending and offering relief to taxpayers.

For businesses operating in Connecticut, understanding the intricacies of the sales and use tax is crucial. The state’s Department of Revenue Services provides detailed guidelines and resources to ensure compliance and ease of tax filing.

Property Tax: A Local Focus

Property tax is another vital component of Connecticut’s tax system. Unlike state-level taxes, property taxes are assessed and collected by local municipalities, providing a significant source of revenue for towns and cities.

The property tax rate in Connecticut can vary significantly from one town to another, depending on the local government’s budget and financial needs. As a result, homeowners and businesses may find themselves subject to different tax rates depending on their location within the state.

To illustrate, let’s consider the hypothetical town of Green Valley, where the property tax rate is set at 1.5% of a property’s assessed value. This means that a homeowner with a property assessed at 300,000 would owe <strong>4,500 in annual property taxes.

While property taxes can be a significant expense, they also play a crucial role in funding local services, such as schools, emergency response, and infrastructure maintenance.

Additional Taxes and Fees

Beyond the aforementioned taxes, Connecticut also imposes various other taxes and fees to support specific initiatives and programs.

- Estate Tax: Connecticut maintains an estate tax, which is imposed on the transfer of assets upon an individual’s death. The tax rate varies depending on the value of the estate.

- Excise Taxes: Certain goods and services, such as gasoline and tobacco products, are subject to excise taxes in Connecticut. These taxes are often used to fund specific programs or infrastructure projects.

- Corporate Taxes: Businesses operating in Connecticut are subject to corporate income taxes, with rates varying based on the nature and size of the business.

These additional taxes and fees contribute to the state’s overall tax revenue and support a range of critical services and initiatives.

Performance Analysis and Implications

Connecticut’s tax structure has a significant impact on the state’s economy and its residents’ financial well-being. By analyzing the performance of various tax components, we can gain insights into their effectiveness and potential areas for improvement.

Income Tax: A Balancing Act

The progressive income tax structure in Connecticut aims to strike a balance between generating revenue and maintaining fairness. While higher income earners contribute a larger share, it’s essential to consider the potential impact on economic growth and investment.

Studies suggest that high-income tax rates can sometimes discourage entrepreneurship and investment, leading to a potential slowdown in economic growth. However, the state’s progressive tax structure also ensures that essential services and social programs receive adequate funding.

As such, policymakers must carefully consider the trade-offs between revenue generation and economic incentives when making decisions about income tax rates.

Sales Tax: Encouraging Spending

Connecticut’s sales tax, while a significant revenue source, can also influence consumer behavior and economic activity. A high sales tax rate can discourage spending, particularly on discretionary items, leading to a potential decrease in retail sales and economic activity.

To mitigate this effect, the state’s temporary sales tax holidays have proven effective in boosting consumer spending and providing a welcome break for taxpayers. These initiatives demonstrate the state’s commitment to balancing revenue generation with taxpayer relief.

Property Tax: A Local Perspective

Property taxes play a critical role in funding local services and infrastructure. However, the variation in tax rates across different municipalities can lead to disparities in the quality of services and the overall tax burden on residents.

Local governments must carefully consider the impact of property tax rates on their residents’ financial well-being and economic vitality. Striking the right balance is essential to ensure that communities thrive and remain attractive places to live and do business.

Future Implications and Potential Reforms

As Connecticut’s tax landscape continues to evolve, several key considerations and potential reforms emerge.

- Simplification: Simplifying the tax code and reducing complexity can make it easier for taxpayers to understand and comply with their tax obligations. This could involve streamlining tax forms, reducing the number of tax brackets, and improving overall transparency.

- Revenue Stability: Ensuring a stable and predictable revenue stream is crucial for the state’s long-term fiscal health. Policymakers may consider exploring additional revenue sources or reforming existing taxes to provide a more consistent and reliable funding base.

- Equity and Fairness: Striving for a more equitable tax system is essential to ensure that the tax burden is distributed fairly among residents and businesses. This may involve reevaluating tax rates, exemptions, and deductions to promote a more progressive and inclusive tax structure.

By continually evaluating and refining its tax system, Connecticut can position itself for long-term economic growth and prosperity, while also ensuring that its residents and businesses thrive.

Conclusion

Connecticut’s tax rate is a complex and multifaceted topic, encompassing a range of taxes and fees that contribute to the state’s fiscal health. From income tax to sales tax and property tax, each component plays a crucial role in funding essential services and initiatives.

As we’ve explored, the state’s tax system has both advantages and potential areas for improvement. By understanding the intricacies of Connecticut’s tax landscape, residents and businesses can make informed decisions and contribute to the state’s continued prosperity.

Stay informed, and remember that a well-informed taxpayer is a responsible contributor to the community.

What is the current sales tax rate in Connecticut?

+As of [current year], the general sales tax rate in Connecticut is 6.35%. However, it’s important to note that certain items, such as food and prescription medications, are exempt from sales tax.

How does Connecticut’s income tax rate compare to other states?

+Connecticut’s income tax rates are generally higher compared to many other states in the region. The state’s progressive tax structure means that higher income levels are taxed at increasingly higher rates, making it a relatively high-tax state for those with higher incomes.

Are there any tax incentives or credits available in Connecticut?

+Yes, Connecticut offers various tax incentives and credits to promote economic development, support specific industries, and encourage investment. These incentives can include tax credits for research and development, job creation, and renewable energy projects, among others.