Sales Tax In Wichita Ks

Sales tax in Wichita, Kansas, is an essential aspect of understanding the city's financial landscape and how it impacts businesses and consumers alike. Wichita, the largest city in the state, has a unique sales tax structure that contributes to its overall economic framework. This article aims to provide an in-depth analysis of the sales tax system in Wichita, exploring its rates, regulations, and the broader implications for the local economy.

Understanding the Sales Tax Structure in Wichita

The sales tax system in Wichita is a combination of state and local taxes, with rates varying depending on the type of goods or services being purchased. This intricate tax structure is designed to fund essential government services and infrastructure projects while also supporting local initiatives.

State Sales Tax

The state of Kansas imposes a sales tax rate of 6.5%, which is applicable to most retail transactions. This base rate is a crucial component of the state’s revenue stream, contributing significantly to its overall budget.

| Category | Sales Tax Rate |

|---|---|

| General Merchandise | 6.5% |

| Food and Drugs | 6.5% |

| Prescription Drugs | 6.5% |

The state sales tax is applied to a wide range of goods, from clothing and electronics to groceries and pharmaceuticals. However, certain items, such as non-prepared food and prescription drugs, are considered essential and are therefore taxed at a lower rate, benefiting consumers and encouraging spending on these necessary items.

Local Sales Tax

In addition to the state sales tax, Wichita, like many other cities in Kansas, imposes a local sales tax to fund specific community projects and initiatives. This local tax rate varies depending on the jurisdiction and can significantly impact the overall sales tax burden for businesses and consumers.

| Jurisdiction | Local Sales Tax Rate |

|---|---|

| Wichita | 2.25% |

| Sedgwick County | 1.75% |

| Special Assessment Districts | Varies (up to 1.5%) |

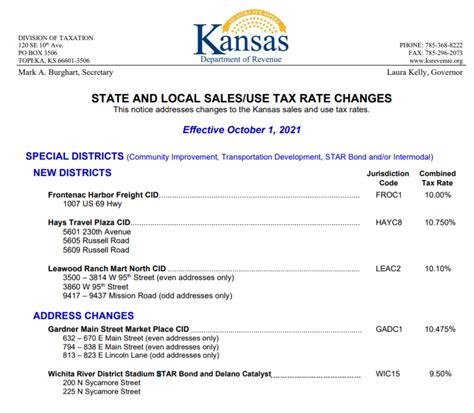

The city of Wichita imposes a local sales tax of 2.25%, which is dedicated to funding various city projects and maintenance. Sedgwick County, in which Wichita is located, adds an additional 1.75% to the sales tax, supporting county-wide initiatives. Moreover, specific areas within the city may have Special Assessment Districts, which can levy an extra tax of up to 1.5%, depending on the development and improvement needs of that particular district.

Combined Sales Tax Rates

When purchasing goods or services in Wichita, the total sales tax rate is the sum of the state and local taxes. This combined rate can significantly impact the final cost of an item, especially for higher-priced goods.

| Location | Total Sales Tax Rate |

|---|---|

| Wichita City | 8.75% |

| Sedgwick County | 8.25% |

| Special Assessment Districts | Varies (up to 8.25%) |

As illustrated in the table above, the total sales tax rate in Wichita can range from 8.75% to 10.25% depending on the specific location within the city. This variability is crucial for businesses to consider when pricing their goods and services, as it can impact their competitiveness in the market.

Sales Tax Exemptions and Special Considerations

While the sales tax system in Wichita generally applies to most retail transactions, there are specific exemptions and special considerations that businesses and consumers should be aware of.

Exemptions for Certain Goods and Services

Kansas, including Wichita, exempts certain goods and services from sales tax. These exemptions are designed to promote specific economic activities or support essential services.

- Non-Prepared Food: Food that is not intended for immediate consumption, such as groceries and certain beverages, is exempt from sales tax. This encourages residents to stock up on essential food items without a tax burden.

- Prescription Drugs: All prescription drugs, whether purchased at a pharmacy or a grocery store, are exempt from sales tax. This exemption aims to reduce the financial burden on individuals requiring essential medications.

- Manufacturing and Resale: Sales of goods for further manufacturing or resale are often exempt from sales tax. This exemption supports the industrial sector by reducing the tax burden on businesses engaged in these activities.

Special Considerations for Tourism and Entertainment

Wichita, being a vibrant city with a thriving tourism industry, has implemented special considerations for tourism-related sales tax. These measures aim to attract visitors and support the local economy.

- Hotel and Lodging Tax: In addition to sales tax, a hotel and lodging tax is imposed on accommodations. This tax rate is typically higher than the standard sales tax rate, with proceeds dedicated to promoting tourism and maintaining local attractions.

- Admission and Amusement Tax: A tax is applied to certain entertainment activities, such as concerts, sporting events, and amusement parks. This tax supports the cultural and recreational offerings of the city, enhancing its appeal to visitors.

Sales Tax Compliance and Filing

Ensuring compliance with the sales tax regulations is crucial for businesses operating in Wichita. Failure to comply can result in significant penalties and legal consequences.

Registration and Licensing

Businesses that sell taxable goods or services in Wichita must register with the Kansas Department of Revenue and obtain a seller’s permit. This permit authorizes the business to collect and remit sales tax on behalf of the state and local jurisdictions.

The registration process involves providing detailed information about the business, its location, and the types of goods or services it offers. Once registered, the business is issued a unique identification number, which must be displayed on all sales tax forms and documentation.

Sales Tax Calculation and Remittance

Businesses are responsible for calculating the sales tax on each taxable transaction and remitting the collected tax to the appropriate tax authorities. The sales tax is typically calculated based on the total sales amount, including any applicable discounts or promotions.

The frequency of sales tax remittance varies depending on the business's sales volume and the requirements set by the tax authorities. Most businesses are required to remit sales tax on a monthly or quarterly basis. Failure to remit the collected sales tax on time can result in penalties and interest charges.

Record Keeping and Audits

Maintaining accurate and detailed sales tax records is essential for compliance and audit purposes. Businesses must keep records of all sales transactions, including the date, amount, and the type of goods or services sold. These records must be retained for a minimum of three years, as per the requirements of the Kansas Department of Revenue.

Tax authorities may conduct audits to ensure compliance with sales tax regulations. During an audit, businesses must provide all relevant sales tax records, including invoices, receipts, and financial statements. Failure to produce accurate and complete records can result in penalties and additional scrutiny.

The Impact of Sales Tax on the Wichita Economy

The sales tax system in Wichita plays a crucial role in shaping the city’s economic landscape. It not only provides a significant source of revenue for the state and local governments but also influences consumer behavior and business operations.

Revenue Generation and Budget Allocation

Sales tax is a primary source of revenue for the city of Wichita and Sedgwick County. The collected sales tax funds are allocated to various government services, including public safety, education, infrastructure development, and social welfare programs. This revenue stream is particularly important for funding essential services and maintaining a high quality of life for residents.

The allocation of sales tax revenue is a complex process, with different jurisdictions having varying priorities and needs. The city and county governments work together to ensure that the revenue is distributed fairly and efficiently, considering the unique requirements of each district.

Consumer Behavior and Spending Patterns

The sales tax rate can significantly impact consumer spending patterns. Higher sales tax rates can discourage discretionary spending, especially on luxury items, as consumers may opt to purchase these items in lower-tax jurisdictions or online.

On the other hand, lower sales tax rates can encourage consumer spending, particularly on essential goods and services. This can lead to increased economic activity and support for local businesses. Wichita's sales tax structure, with its varying rates and exemptions, aims to strike a balance between generating revenue and promoting consumer spending.

Business Operations and Competitiveness

For businesses operating in Wichita, the sales tax system is a critical consideration in their overall operations and pricing strategies. The total sales tax rate, which includes both state and local taxes, can impact a business’s profitability and competitiveness.

Businesses must carefully consider the sales tax burden when setting their prices. A higher sales tax rate may necessitate adjusting prices upwards to maintain profitability. Conversely, a lower sales tax rate can provide an opportunity for businesses to offer competitive pricing, attracting more customers and increasing market share.

Economic Development and Growth

The sales tax system in Wichita also has implications for the city’s economic development and growth. The revenue generated from sales tax can be used to fund infrastructure projects, such as road improvements, public transportation, and utility upgrades, which are essential for attracting new businesses and supporting existing ones.

Additionally, the sales tax structure can influence the location decisions of businesses. A competitive sales tax rate, combined with other factors such as a skilled workforce and a favorable business environment, can make Wichita an attractive destination for new businesses, leading to job creation and economic growth.

Future Implications and Potential Changes

The sales tax system in Wichita, like any other tax structure, is subject to potential changes and reforms. These changes can be driven by various factors, including shifts in the economic landscape, political priorities, and public opinion.

Potential Rate Adjustments

The sales tax rates in Wichita, both at the state and local levels, can be adjusted to meet changing revenue needs or to promote specific economic goals. For instance, during economic downturns, governments may consider increasing sales tax rates temporarily to boost revenue and support essential services.

On the other hand, in times of economic prosperity, governments may choose to reduce sales tax rates to encourage consumer spending and support business growth. These rate adjustments are carefully considered, taking into account the potential impact on the local economy and the financial well-being of residents.

Streamlining the Tax System

Efforts to streamline the sales tax system in Wichita and Kansas as a whole are ongoing. These efforts aim to simplify the tax structure, reduce administrative burdens on businesses, and enhance compliance.

One potential approach is the implementation of a unified sales tax system, where the state and local jurisdictions work together to harmonize their tax rates and regulations. This could result in a more consistent and straightforward tax structure, making it easier for businesses to comply and for consumers to understand the tax they are paying.

Adapting to Technological Advances

The rise of e-commerce and online sales has presented new challenges for sales tax collection and compliance. Wichita, along with other cities and states, is exploring ways to adapt its sales tax system to accommodate these changes.

This may involve implementing new regulations for online sales, ensuring that businesses operating solely online are also collecting and remitting sales tax. Additionally, advancements in technology, such as automated tax calculation and filing systems, can enhance compliance and reduce the administrative burden on businesses.

Conclusion

The sales tax system in Wichita, Kansas, is a complex yet essential component of the city’s economic framework. It provides a significant source of revenue for the state and local governments, funds essential services, and influences consumer behavior and business operations.

Understanding the sales tax structure, including the varying rates and exemptions, is crucial for both businesses and consumers. It empowers businesses to make informed pricing decisions and ensures compliance with tax regulations. For consumers, this knowledge enables them to make conscious purchasing choices and understand the impact of their spending on the local economy.

As Wichita continues to evolve and adapt to changing economic conditions, the sales tax system will remain a key consideration for policymakers, businesses, and residents alike. The ongoing efforts to streamline and modernize the tax system reflect the city's commitment to fostering a competitive and sustainable economic environment.

What is the current state sales tax rate in Kansas?

+The current state sales tax rate in Kansas is 6.5% as of [current year]. This rate applies to most retail transactions across the state.

Are there any special tax districts in Wichita that businesses should be aware of?

+Yes, Wichita has Special Assessment Districts that can levy an additional sales tax of up to 1.5%. These districts are established to fund specific development and improvement projects within their boundaries.

How often do businesses in Wichita need to remit sales tax to the tax authorities?

+Businesses in Wichita typically remit sales tax on a monthly or quarterly basis, depending on their sales volume. The Kansas Department of Revenue sets the specific remittance frequency for each business.

What happens if a business fails to remit sales tax on time in Wichita?

+Failure to remit sales tax on time can result in penalties and interest charges. The Kansas Department of Revenue may also impose additional penalties for non-compliance, including potential revocation of the business’s seller’s permit.