Ca Salary Tax Calculator

Welcome to our comprehensive guide on the California salary tax calculator, a vital tool for understanding your earnings and tax obligations in the Golden State. In this expert-driven article, we'll delve into the specifics of how this calculator works, its benefits, and the key considerations when using it. By the end, you'll have a clearer picture of your financial situation and the steps to take to optimize your earnings.

The California Salary Tax Calculator: An Essential Tool for Financial Planning

California, with its vibrant economy and diverse industries, attracts individuals from all walks of life. Whether you’re a seasoned professional or a recent graduate, understanding your tax liabilities is crucial for effective financial management. This is where the California salary tax calculator steps in, offering a user-friendly and accurate solution to navigate the complex world of state taxes.

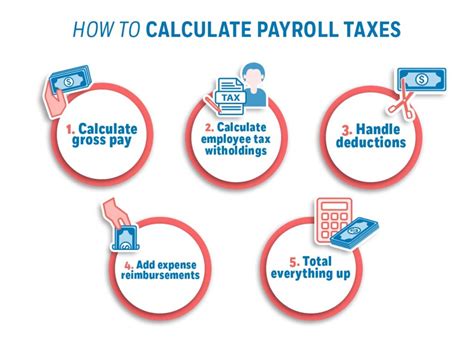

How the Calculator Works: A Step-by-Step Guide

The California salary tax calculator is designed to simplify the process of estimating your tax liability. Here’s a breakdown of its functionality:

- Input Your Salary: Begin by entering your annual salary or the amount you expect to earn in the current year. The calculator is flexible, accommodating various income levels, from entry-level salaries to high-earning professionals.

- Select Your Filing Status: Choose your filing status - whether you're filing as an individual, married filing jointly, married filing separately, or as a head of household. This step is crucial as it impacts the applicable tax rates and deductions.

- Factor in Exemptions and Deductions: Input any applicable exemptions, such as personal exemptions or those for dependents. Additionally, consider the various deductions allowed under California tax laws, including standard deductions or itemized deductions for specific expenses.

- Calculate State Tax: The calculator applies the relevant tax rates based on your income and filing status. California has a progressive tax system, with higher rates for higher incomes. The calculator ensures accuracy by considering these rates and any applicable tax brackets.

- Estimate Local Taxes: California's local tax rates can vary, so the calculator allows for the inclusion of local taxes specific to your county or city. This step ensures a comprehensive estimate of your total tax liability.

- Review and Adjust: After inputting all the necessary information, the calculator provides an estimated tax liability. You can then review and adjust any entries to see how changes in income, deductions, or exemptions impact your taxes.

By following these steps, you can gain a clear understanding of your tax obligations and make informed decisions about your financial planning.

Benefits of Using the California Salary Tax Calculator

The California salary tax calculator offers a range of advantages, making it an indispensable tool for taxpayers:

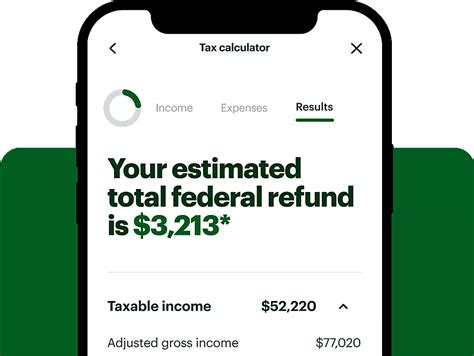

- Accuracy: The calculator is designed to provide precise estimates based on the latest tax laws and regulations. This ensures you have an accurate understanding of your tax liability, helping you avoid surprises when filing your taxes.

- Convenience: Accessible online, the calculator eliminates the need for complicated tax forms and lengthy calculations. You can quickly input your information and receive an instant estimate, saving you valuable time and effort.

- Financial Planning: By understanding your tax obligations, you can better plan your finances. The calculator allows you to experiment with different scenarios, helping you optimize your savings, investments, or retirement planning.

- Awareness of Tax Laws: Using the calculator keeps you informed about California's tax system and any changes in legislation. This knowledge empowers you to make strategic financial decisions and ensure compliance with state tax laws.

- Comparison and Analysis: The calculator provides a basis for comparing your tax liability with previous years or with other states. This analysis can highlight areas for improvement or potential tax savings strategies.

Key Considerations and Tips for Using the Calculator

While the California salary tax calculator is a powerful tool, it’s essential to keep a few considerations in mind:

- Update Regularly: Tax laws can change annually, so ensure you're using the most recent version of the calculator. This guarantees that your estimates are based on the latest regulations and avoid any discrepancies.

- Understand Exemptions and Deductions: Take the time to research and understand the various exemptions and deductions allowed under California tax laws. This knowledge can significantly impact your tax liability and should be utilized to your advantage.

- Consider Other Income Sources: If you have additional income sources, such as investments, rental properties, or self-employment, ensure you account for these when using the calculator. These income streams may have different tax implications and should be factored into your calculations.

- Seek Professional Advice: While the calculator provides accurate estimates, complex tax situations may require professional guidance. Consider consulting a tax advisor or accountant for personalized advice, especially if your financial situation is unique or involves significant assets.

Future Implications and Tax Planning Strategies

Understanding your tax obligations through tools like the California salary tax calculator is just the first step. Here are some strategies to consider for effective tax planning:

- Maximize Deductions: Explore all eligible deductions to minimize your taxable income. This may include contributing to retirement accounts, taking advantage of tax-efficient investments, or claiming deductions for business expenses.

- Consider Tax-Efficient Investments: Certain investments, such as municipal bonds or real estate, offer tax advantages. These can reduce your tax liability and provide a more substantial return on your investment.

- Utilize Tax Credits: California offers various tax credits for specific situations, such as education credits or credits for energy-efficient home improvements. Research and claim any applicable credits to further reduce your tax burden.

- Review and Adjust Your Withholdings: Ensure your tax withholdings are appropriate for your financial situation. If you consistently receive a large tax refund, you may want to adjust your withholdings to increase your take-home pay throughout the year.

Table: California Tax Rates and Brackets (as of [current year])

| Income Bracket | Tax Rate |

|---|---|

| 0 - 9,950 | 1% |

| 9,951 - 18,350 | 2% |

| 18,351 - 30,850 | 4% |

| 30,851 - 53,750 | 6% |

| 53,751 - 275,750 | 8% |

| 275,751 - 551,500 | 9.3% |

| Over $551,500 | 10.3% |

Note: The above tax rates and brackets are subject to change and are provided as an example. Always refer to the latest official tax information for accurate rates.

Conclusion

The California salary tax calculator is an invaluable tool for individuals and businesses operating in the state. By providing accurate estimates and simplifying the tax calculation process, it empowers taxpayers to make informed financial decisions. Remember to stay informed about tax law changes and seek professional guidance when needed. With a clear understanding of your tax obligations, you can optimize your earnings and achieve your financial goals.

Frequently Asked Questions

How accurate are the estimates provided by the California salary tax calculator?

+The calculator provides highly accurate estimates based on the latest tax laws and regulations. However, it’s important to note that certain complex situations may require professional advice for a more precise calculation.

Can I use the calculator for businesses or self-employment income?

+Yes, the calculator is designed to accommodate various income sources, including business and self-employment income. It considers the unique tax implications of these income streams, providing an estimate tailored to your specific circumstances.

What happens if my financial situation is more complex than the calculator can handle?

+While the calculator is comprehensive, extremely complex financial situations may require professional tax advice. If you have multiple income streams, significant investments, or unique tax considerations, consulting a tax expert is recommended to ensure accurate calculations.

Are there any additional costs associated with using the California salary tax calculator?

+No, the California salary tax calculator is typically provided free of charge by reputable sources. However, if you choose to seek professional tax advice or utilize specialized tax preparation software, there may be associated fees.

How often should I update my tax estimates using the calculator?

+It’s a good practice to update your tax estimates using the calculator at least annually, especially when there are significant changes in your income, deductions, or tax laws. Regular updates ensure you stay informed and can make timely adjustments to your financial planning.