Chisago County Property Tax

Welcome to this comprehensive guide on understanding and navigating the intricacies of property taxes in Chisago County, Minnesota. This article aims to provide an in-depth analysis of the property tax system, offering valuable insights for both residents and investors alike. By delving into the various factors that influence property tax assessments, payment processes, and strategies for managing tax obligations, we aim to empower you with the knowledge to make informed decisions regarding your real estate holdings.

Understanding the Chisago County Property Tax Landscape

Chisago County, nestled in the picturesque landscape of east-central Minnesota, boasts a vibrant real estate market with a diverse range of properties. From quaint lakeside cottages to sprawling agricultural estates, the county’s tax system plays a crucial role in managing the financial obligations associated with property ownership.

The property tax system in Chisago County is designed to generate revenue for the county's operations, including funding essential services such as schools, public safety, infrastructure development, and more. Property taxes are a significant source of income for local governments, and understanding this system is essential for homeowners and investors to effectively manage their financial obligations.

Property Tax Assessment Process

The journey towards determining property taxes begins with a comprehensive assessment process. In Chisago County, the Assessor’s Office is responsible for evaluating each property within the county to determine its taxable value. This process involves analyzing various factors, including:

- Property Type: Residential, commercial, agricultural, and vacant lands are assessed differently, considering their unique characteristics and market trends.

- Market Value: The assessor evaluates the property’s fair market value, considering recent sales data and property-specific attributes.

- Improvement: Any upgrades, renovations, or additions to the property can impact its taxable value.

- Taxable Value: This is the final assessed value upon which property taxes are calculated. It is a combination of the property’s market value and any applicable exemptions or adjustments.

The assessment process is intricate and follows a strict timeline. Property owners receive a Notice of Assessment, which provides detailed information about their property's assessed value. This notice serves as a critical tool for property owners to understand their tax obligations and identify any potential discrepancies.

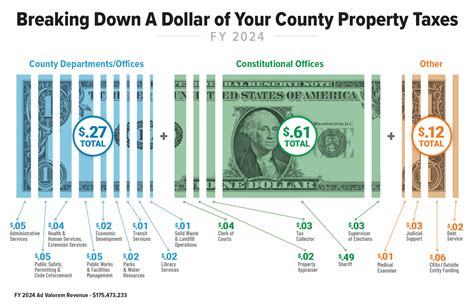

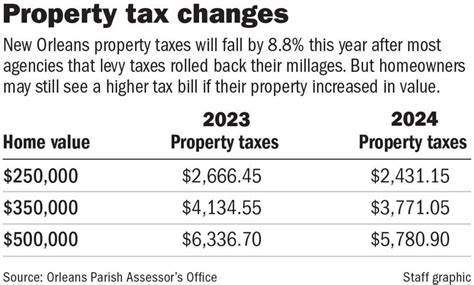

Property Tax Calculation

Once the taxable value of a property is established, the actual property tax amount is calculated. This process involves multiplying the taxable value by the applicable tax rate, which is determined by the county, school districts, and other local taxing authorities. The tax rate varies depending on the property’s location and the services it receives.

The tax rate is expressed as a percentage, and it can change annually based on budgetary needs and approved tax levies. Property owners can access the current tax rates through the county's official website or by contacting the tax assessor's office.

| Taxing Authority | Tax Rate (2023) |

|---|---|

| Chisago County | 0.78% |

| Local School District | 1.32% |

| Special Assessments (e.g., Water & Sewer) | Varies |

It's important to note that special assessments, such as those for water and sewer services, may be included in the property tax bill, and their rates can vary depending on the specific improvements and services provided to the property.

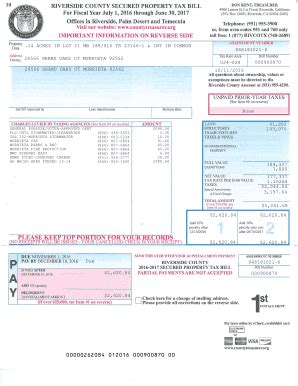

Payment Options and Deadlines

Chisago County offers various payment options to accommodate different preferences and financial situations. Property owners can choose from the following methods:

- Online Payment: A convenient and secure option available through the county’s official website. Property owners can make payments using their credit or debit cards.

- Mail-in Payment: Traditional method where property owners can send their payment by mail, ensuring the check reaches the designated tax office before the deadline.

- In-Person Payment: For those who prefer face-to-face interactions, payments can be made at the designated tax offices during specified business hours.

- Automatic Payment Plans: Some financial institutions offer automatic payment plans, allowing property owners to set up automatic deductions from their accounts to cover tax payments.

The payment deadlines are critical to avoid late fees and penalties. Property taxes in Chisago County are typically due in two installments, with the first half due by May 15th and the second half due by October 15th. It's essential to stay informed about these deadlines to ensure timely payment.

Managing Property Tax Obligations

Navigating the property tax landscape requires a strategic approach to ensure compliance and financial well-being. Here are some key strategies and considerations for effectively managing your property tax obligations:

Understanding Tax Exemptions and Credits

Chisago County offers various tax exemptions and credits to eligible property owners. These programs aim to provide financial relief and encourage specific behaviors. Some common exemptions and credits include:

- Homestead Credit: This credit provides a reduction in property taxes for homeowners who use their property as their primary residence.

- Senior Citizen Exemption: Property owners aged 65 or older may qualify for an exemption on a portion of their property taxes.

- Agricultural Land Exemption: Properties designated for agricultural use may be eligible for reduced tax assessments.

- Veteran’s Exemption: Military veterans and their surviving spouses may receive tax exemptions based on their service.

It's crucial to research and understand the eligibility criteria for these exemptions and credits. Consult with the county's tax assessor's office or seek professional advice to determine which programs you may qualify for.

Appealing Property Assessments

If you believe your property’s assessed value is inaccurate or higher than comparable properties in the area, you have the right to appeal. The assessment appeal process allows property owners to challenge the assessor’s determination and seek a more accurate valuation.

To initiate an appeal, property owners must gather evidence, such as recent sales data of similar properties, appraisals, or expert opinions. It's advisable to consult with a tax professional or attorney specializing in property tax appeals to navigate this process effectively.

Strategic Property Management

Managing your property strategically can have a significant impact on your tax obligations. Here are some considerations:

- Maintenance and Upkeep: Regular maintenance and timely repairs can help preserve the value of your property and potentially avoid unnecessary assessments for improvements.

- Energy Efficiency: Investing in energy-efficient upgrades not only reduces utility costs but may also qualify for tax incentives or credits.

- Rental Properties: If you own rental properties, proper record-keeping and understanding the tax implications of rental income are essential. Consult with a tax advisor to ensure compliance.

- Capital Improvements: When planning significant improvements or renovations, consider the potential impact on your property taxes. Work with professionals to ensure compliance and maximize tax benefits.

Stay Informed and Seek Professional Guidance

The property tax landscape can be complex, and staying informed is crucial. Subscribe to local news sources, attend community meetings, and engage with the county’s tax assessor’s office to stay updated on any changes or initiatives that may impact your tax obligations.

Additionally, consider seeking professional guidance from tax advisors, accountants, or attorneys specializing in property tax matters. They can provide personalized advice based on your specific circumstances and help you navigate the complexities of the tax system.

Conclusion: A Strategic Approach to Property Taxes

Understanding and effectively managing property taxes is an essential aspect of responsible property ownership. By familiarizing yourself with the assessment process, tax calculation methods, and available exemptions, you can make informed decisions and strategically plan your financial obligations.

Chisago County's property tax system, while intricate, is designed to provide a stable revenue stream for essential local services. By staying informed, seeking professional guidance when needed, and adopting a proactive approach to property management, you can navigate the tax landscape with confidence and ensure your real estate investments thrive.

How often are property tax assessments conducted in Chisago County?

+Property tax assessments in Chisago County are typically conducted annually. The Assessor’s Office works on a rotating schedule, assessing approximately one-sixth of the county’s properties each year. This ensures that all properties are reassessed every six years.

Can I pay my property taxes in installments?

+Yes, Chisago County offers the option to pay property taxes in two installments. The first half is due by May 15th, and the second half is due by October 15th. This provides flexibility for property owners to manage their finances effectively.

Are there any penalties for late property tax payments?

+Yes, late property tax payments may incur penalties and interest. It’s important to stay informed about the payment deadlines and make timely payments to avoid additional charges. The county typically charges a penalty of 1% per month on late payments.

Can I dispute my property tax assessment if I believe it is inaccurate?

+Absolutely! Property owners have the right to appeal their tax assessments if they believe the valuation is incorrect or inconsistent with comparable properties. The appeal process involves gathering evidence and presenting your case to the Board of Assessment Appeals. It’s advisable to seek professional guidance for a successful appeal.