What Is A Tax Liability

Tax liability is a fundamental concept in the realm of personal and business finances, holding immense significance in the eyes of both individuals and enterprises. Understanding tax liability is crucial for making informed financial decisions and maintaining compliance with tax regulations. This article delves into the intricate world of tax liability, offering a comprehensive guide to help you navigate this essential aspect of financial management.

Unraveling the Concept of Tax Liability

Tax liability, in its essence, represents the total amount of tax that an individual or entity is legally obligated to pay to the government. It encompasses a wide range of taxes, including income tax, property tax, sales tax, and various other levies imposed by federal, state, and local authorities. The calculation of tax liability is a complex process, involving numerous factors such as income, deductions, credits, and tax rates.

The tax liability of an individual or business can vary significantly based on their unique circumstances. For instance, factors like employment status, investment income, and the presence of dependents can all influence the amount of tax owed. Additionally, tax liability can be affected by the choice of tax filing status, such as single, married filing jointly, or head of household.

Income Tax Liability

Income tax liability is one of the most common and significant types of tax obligations. It arises when an individual or business earns income from various sources, such as salaries, wages, dividends, or profits. The tax liability is determined by applying specific tax rates to the taxable income, which is the income remaining after deductions and exemptions.

The calculation of income tax liability involves a series of steps. First, the total income is calculated, including all taxable sources. Next, deductions are applied to reduce the taxable income. These deductions can include expenses related to business operations, charitable contributions, and certain personal expenses. The resulting taxable income is then subjected to tax rates specified by the tax authority.

For instance, consider an individual with an annual income of $80,000. After claiming deductions of $20,000 for business expenses and personal contributions, their taxable income becomes $60,000. Applying a progressive tax rate structure, they may owe a tax liability of $12,000, assuming a 20% tax rate on the first $10,000 of taxable income and a 30% rate on income above $10,000.

| Income Range | Tax Rate |

|---|---|

| $0 - $10,000 | 20% |

| $10,001 - $50,000 | 30% |

| Above $50,000 | 40% |

Other Types of Tax Liability

Beyond income tax, there are numerous other types of tax liabilities that individuals and businesses may encounter. Here are a few notable examples:

- Property Tax Liability: Property owners are often subject to property tax, which is levied on the value of their real estate holdings. The tax liability is typically calculated based on the assessed value of the property and the applicable tax rate.

- Sales Tax Liability: Sales tax is imposed on the sale of goods and services. Businesses are responsible for collecting and remitting sales tax to the appropriate tax authority. The tax liability is calculated as a percentage of the sale price, with rates varying by jurisdiction.

- Capital Gains Tax Liability: When individuals or businesses sell assets at a profit, they may incur capital gains tax liability. The tax is applied to the difference between the sale price and the original purchase price, known as the capital gain. The tax rate depends on factors like the holding period of the asset and the taxpayer's income bracket.

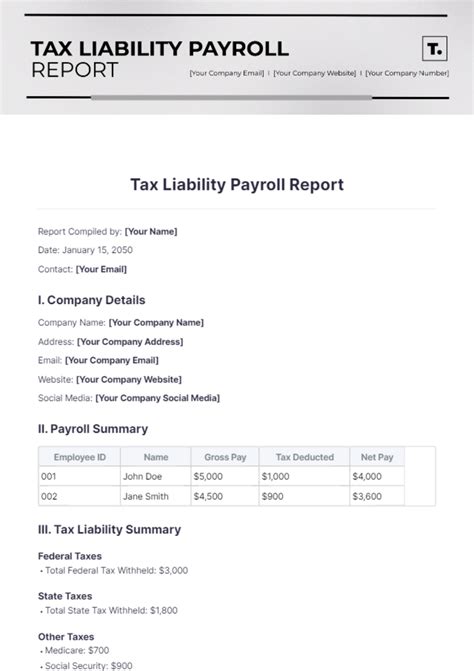

- Payroll Tax Liability: Employers have payroll tax obligations, including withholding income taxes from employees' wages and remitting them to the government. Additionally, employers are responsible for paying their share of Social Security and Medicare taxes, which contribute to funding social welfare programs.

Understanding Tax Liability: Key Considerations

Grasping the intricacies of tax liability is essential for effective financial planning and compliance. Here are some key considerations to keep in mind:

- Tax Laws and Regulations: Tax liability is governed by a complex web of laws and regulations. Staying updated on tax legislation and consulting with tax professionals can help individuals and businesses navigate the ever-changing tax landscape.

- Deductions and Credits: Deductions and tax credits can significantly reduce tax liability. It's crucial to explore all eligible deductions and credits applicable to your situation to minimize the tax burden.

- Tax Planning and Strategy: Developing a strategic tax plan can help optimize tax liability. This may involve timing income and expenses, choosing the right tax filing status, and taking advantage of tax-efficient investment strategies.

- Record Keeping: Maintaining accurate and organized financial records is essential for calculating tax liability accurately. Proper record keeping simplifies the tax preparation process and provides a clear audit trail.

- Tax Compliance and Deadlines: Failing to meet tax compliance requirements and deadlines can result in penalties and interest charges. Staying on top of tax obligations and filing deadlines is crucial to avoid unnecessary financial burdens.

The Impact of Tax Liability on Financial Decisions

Tax liability plays a pivotal role in shaping financial decisions, both at the personal and business levels. Here’s how tax liability influences various aspects of financial management:

Personal Finance

For individuals, tax liability impacts decisions related to income generation, savings, investments, and retirement planning. Maximizing tax-efficient strategies can help individuals retain more of their hard-earned money and achieve their financial goals.

For instance, contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can reduce taxable income and lower tax liability. Additionally, investing in tax-efficient assets or utilizing tax-loss harvesting strategies can further minimize tax obligations.

Business Finance

Businesses face a myriad of tax obligations, and understanding tax liability is crucial for making strategic financial decisions. Tax-efficient business operations can enhance profitability and cash flow.

Businesses may explore tax-efficient business structures, such as incorporating or forming limited liability companies (LLCs), to minimize tax liability. Additionally, businesses can leverage tax deductions for expenses like research and development, employee benefits, and equipment purchases.

Conclusion: Navigating Tax Liability

Tax liability is a critical component of personal and business finances, demanding careful consideration and strategic planning. By understanding the various types of tax liabilities, exploring tax-efficient strategies, and staying compliant with tax regulations, individuals and businesses can effectively manage their financial obligations.

Consulting with tax professionals and staying informed about tax laws can provide valuable guidance in navigating the complex world of tax liability. With a solid understanding of tax obligations, individuals and businesses can make informed financial decisions, optimize their tax positions, and achieve their financial aspirations.

How can I calculate my tax liability accurately?

+Calculating tax liability accurately involves a multi-step process. Start by determining your total income from all sources, including wages, self-employment income, investments, and any other taxable income. Next, apply eligible deductions, such as business expenses, charitable contributions, and personal exemptions. The resulting taxable income is then subjected to the applicable tax rates. It’s essential to consult tax guidelines and regulations to ensure accuracy. If you’re unsure, consider seeking professional tax advice.

What are some common tax deductions and credits that can reduce tax liability?

+There are numerous deductions and credits available to reduce tax liability. Some common deductions include business expenses, mortgage interest, state and local taxes, charitable contributions, and medical expenses. Tax credits, such as the Child Tax Credit, Earned Income Tax Credit, and various energy-efficient home improvements credits, can also provide substantial savings. It’s crucial to review your eligibility for these deductions and credits to maximize your tax savings.

How can I stay compliant with tax regulations and avoid penalties?

+Staying compliant with tax regulations is essential to avoid penalties and interest charges. Keep detailed records of your income, expenses, and deductions throughout the year. Ensure you understand the tax deadlines and file your tax returns on time. Consider using tax preparation software or engaging a tax professional to help you navigate the complexities of tax compliance. Additionally, staying informed about any changes in tax laws and regulations can help you stay on top of your tax obligations.