Bridgeport Car Taxes

When it comes to vehicle ownership, understanding the various taxes and fees associated with registering and maintaining a car is crucial. In Bridgeport, Connecticut, car taxes are an important aspect of vehicle ownership that residents should be aware of. These taxes contribute to the city's revenue and help fund essential services. Let's delve into the world of Bridgeport car taxes, exploring what they entail, how they are calculated, and their impact on vehicle owners.

Understanding Bridgeport Car Taxes

Bridgeport, the largest city in Connecticut, imposes specific taxes on vehicles registered within its boundaries. These taxes are designed to generate revenue for the city and are an essential part of the municipal budget. Understanding these taxes is crucial for vehicle owners, as they directly affect the overall cost of car ownership.

The primary car tax in Bridgeport is the Property Tax on Vehicles. This tax is levied annually and is based on the assessed value of the vehicle. It is an essential source of revenue for the city, contributing to the maintenance and improvement of infrastructure, public safety, and other vital services.

In addition to the property tax, Bridgeport also imposes a Registration Fee for vehicles. This fee is typically paid during the registration process and helps cover administrative costs associated with maintaining vehicle records and issuing licenses.

Tax Calculation and Assessment

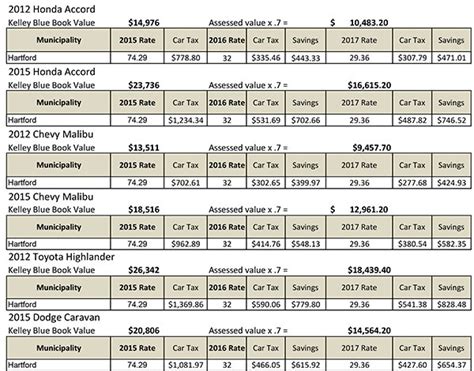

The calculation of car taxes in Bridgeport involves a few key factors. The primary determinant is the vehicle’s assessed value, which is determined by the city’s tax assessor’s office. This value is typically based on the vehicle’s make, model, year, and condition. The assessed value serves as the foundation for calculating the property tax on vehicles.

The property tax rate in Bridgeport is expressed as a mill rate, which represents the tax per thousand dollars of assessed value. This rate is set annually by the city and can vary depending on the budget requirements and economic conditions. For instance, in the fiscal year 2023, the mill rate for property taxes in Bridgeport was set at 38.55 mills.

To calculate the property tax on a vehicle, the assessed value is multiplied by the mill rate and then divided by 1,000. This formula provides the tax amount due for the vehicle. For example, if a vehicle has an assessed value of $15,000 and the mill rate is 38.55 mills, the property tax would be calculated as follows:

| Assessed Value | Mill Rate | Property Tax |

|---|---|---|

| $15,000 | 38.55 mills | $578.25 |

In this example, the property tax on the vehicle would be $578.25 for the year. It's important to note that this calculation is a simplified version, and actual tax calculations may involve additional factors and adjustments.

Impact on Vehicle Owners

The car taxes in Bridgeport have a direct impact on vehicle owners. These taxes add to the overall cost of owning a car, which can be a significant expense for residents. The property tax, in particular, can vary significantly based on the value and age of the vehicle. Older vehicles with lower assessed values may have lower taxes, while newer and more expensive vehicles can incur higher tax liabilities.

Vehicle owners in Bridgeport should be mindful of these taxes when budgeting for their car expenses. Additionally, it's essential to stay informed about any changes in tax rates or assessment methodologies, as these can affect the overall tax burden. Regularly reviewing tax assessments and understanding the tax calculation process can help vehicle owners anticipate and plan for their annual car tax obligations.

Registration Process and Fees

In addition to the property tax, vehicle owners in Bridgeport must navigate the registration process, which involves paying specific fees. The registration fee is an essential component of vehicle registration and helps cover the costs associated with maintaining accurate vehicle records and issuing licenses.

Registration Fee Structure

The registration fee in Bridgeport is determined by the Department of Motor Vehicles (DMV) and can vary depending on the vehicle type and its characteristics. Generally, the fee structure is as follows:

- Standard Passenger Vehicles: A flat fee is charged for registering a standard passenger vehicle, which typically includes cars, SUVs, and pickup trucks.

- Commercial Vehicles: Vehicles used for commercial purposes, such as trucks and vans, may have higher registration fees based on their weight and intended use.

- Specialty Vehicles: Vehicles like motorcycles, trailers, and recreational vehicles often have unique registration fee structures tailored to their specific characteristics.

It's important to note that the registration fee is typically paid during the initial registration process and subsequent renewals. The fee contributes to the overall cost of vehicle ownership and helps support the administrative functions of the DMV.

Registration Process Steps

To register a vehicle in Bridgeport, vehicle owners must follow a series of steps. Here’s a simplified overview of the registration process:

- Vehicle Inspection: In some cases, vehicles may require an inspection to ensure they meet safety standards. This step is often required for older vehicles or vehicles with significant modifications.

- Title Transfer or Application: If purchasing a new vehicle, the buyer must obtain a title transfer from the seller. For new residents, an application for a Connecticut title may be necessary.

- Emissions Testing: Depending on the vehicle's age and location, an emissions test may be required to ensure the vehicle meets environmental standards.

- Registration Fee Payment: Vehicle owners must pay the applicable registration fee, which can be done online, by mail, or in person at designated DMV offices.

- Registration and License Plate Issuance: Once the fee is paid and all necessary documentation is provided, the DMV will issue a registration certificate and license plates for the vehicle.

The registration process ensures that vehicles are properly documented, licensed, and in compliance with state and local regulations. It also allows the city to track vehicle ownership and maintain accurate records for tax purposes.

Tax Relief and Exemptions

While car taxes are an essential part of vehicle ownership, Bridgeport offers certain tax relief and exemptions to eligible individuals and vehicles. These measures aim to alleviate the tax burden for specific groups and promote certain initiatives.

Tax Exemptions

Bridgeport provides tax exemptions for certain types of vehicles and individuals. Here are some common tax exemptions:

- Disabled Individuals: Vehicles owned by individuals with disabilities may be eligible for tax exemptions or reduced tax rates. This exemption encourages accessibility and supports individuals with special needs.

- Military Personnel: Active-duty military personnel and their families may be exempt from certain taxes or receive reduced tax rates as a way to honor and support their service.

- Senior Citizens: Older residents may qualify for tax exemptions or reduced rates based on their age and income. This measure helps alleviate the financial burden on senior citizens.

It's important for eligible individuals to research and understand the specific criteria and documentation required to claim these tax exemptions. Staying informed about tax relief programs can help vehicle owners maximize their savings and navigate the tax landscape effectively.

Tax Relief Programs

In addition to tax exemptions, Bridgeport may offer tax relief programs to support specific initiatives or promote economic development. These programs can provide temporary or permanent tax reductions for certain vehicles or individuals.

For instance, Bridgeport may implement a Tax Abatement Program for new businesses or startups to encourage economic growth. This program could offer reduced property taxes for vehicles owned by these businesses during a designated period. Similarly, the city might introduce a Green Vehicle Incentive to promote environmentally friendly vehicles, providing tax breaks for electric or hybrid cars.

Tax relief programs are often designed to stimulate specific sectors or promote sustainable practices. Vehicle owners should stay updated on any such initiatives to take advantage of potential tax savings and contribute to the city's broader goals.

Impact on the City’s Budget and Services

Car taxes in Bridgeport play a crucial role in shaping the city’s budget and funding essential services. The revenue generated from these taxes contributes significantly to the city’s financial health and stability.

Budget Allocation

The revenue from car taxes is allocated to various city departments and initiatives. Here’s a breakdown of how the tax revenue may be distributed:

- Infrastructure Maintenance: A significant portion of the tax revenue goes towards maintaining and improving the city's infrastructure, including roads, bridges, and public transportation systems.

- Public Safety: Car taxes support the city's police and fire departments, ensuring adequate staffing and equipment to maintain public safety.

- Education: A portion of the tax revenue is allocated to local schools, helping fund educational programs, facilities, and teacher salaries.

- Health and Social Services: Tax revenue supports healthcare initiatives, social programs, and community development projects.

- Administrative Costs: The tax revenue also covers administrative expenses, such as maintaining government offices and providing essential services to residents.

The allocation of tax revenue is a complex process that involves careful planning and consideration of the city's needs and priorities. Bridgeport's government works diligently to ensure that tax revenue is utilized effectively and efficiently to benefit its residents.

Impact on City Services

The revenue generated from car taxes directly impacts the quality and availability of city services. Here’s how it influences various aspects of city life:

- Roads and Transportation: Car taxes contribute to the maintenance and improvement of roads, ensuring smooth travel and reducing traffic congestion. Well-maintained roads also enhance safety for all road users.

- Public Safety Response: The tax revenue helps fund police and fire departments, enabling quick response times and effective emergency services. This enhances the overall safety and security of the community.

- Educational Opportunities: Tax revenue supports local schools, allowing for the provision of quality education, resources, and extracurricular activities. This investment in education can positively impact the future of Bridgeport's youth.

- Community Development: The funds generated from car taxes can be directed towards community development projects, such as parks, recreational facilities, and cultural initiatives. These amenities enhance the quality of life for residents and attract new businesses and residents.

By understanding the impact of car taxes on the city's budget and services, vehicle owners can appreciate the broader role their tax contributions play in shaping the community they call home.

Future Implications and Potential Changes

As Bridgeport continues to evolve and adapt to changing economic and social landscapes, the city’s car tax policies may also undergo revisions and adjustments. Understanding potential future implications and changes can help vehicle owners stay prepared and informed.

Economic Factors

The city’s economic health and budget requirements can influence future tax policies. If Bridgeport experiences economic growth or faces financial challenges, it may impact the tax rates and assessment methodologies. For instance, during periods of economic prosperity, the city might consider tax incentives to attract businesses and residents, while economic downturns could lead to increased taxes to stabilize the budget.

Environmental Initiatives

Bridgeport’s commitment to environmental sustainability may shape future car tax policies. The city could introduce tax incentives or reductions for electric or hybrid vehicles to encourage the adoption of cleaner transportation options. Additionally, emissions standards and regulations could impact the tax structure for vehicles that do not meet certain environmental criteria.

Technology and Digitalization

Advancements in technology and digitalization can streamline the tax assessment and collection process. Bridgeport may explore digital platforms and online services to make tax payments more convenient and efficient. Additionally, the use of technology could lead to more accurate and fair tax assessments, ensuring that vehicle owners are treated equitably.

Community Feedback and Engagement

Bridgeport values community input and engagement, and this can influence future tax policies. The city may conduct surveys, hold public forums, or seek feedback from residents to understand their concerns and preferences regarding car taxes. This feedback can shape future initiatives and ensure that tax policies align with the needs and aspirations of the community.

Vehicle owners in Bridgeport should stay engaged and informed about potential changes to car tax policies. By actively participating in community discussions and staying updated on local news and initiatives, they can contribute to the development of fair and effective tax policies that benefit all residents.

How often are car taxes assessed in Bridgeport?

+

Car taxes in Bridgeport are typically assessed annually. Vehicle owners receive tax assessments based on the assessed value of their vehicles, and they are responsible for paying these taxes on a yearly basis.

Can I appeal my car tax assessment in Bridgeport?

+

Yes, vehicle owners have the right to appeal their car tax assessments if they believe the assessed value or tax calculation is inaccurate. The process involves submitting an appeal to the city’s tax assessor’s office and providing supporting documentation to justify the appeal.

Are there any tax incentives for buying a new car in Bridgeport?

+

Bridgeport may offer tax incentives or rebates for purchasing certain types of vehicles, such as electric or hybrid cars. These incentives are designed to promote environmentally friendly transportation options and encourage sustainable practices. It’s advisable to check with the city’s tax department or local dealerships for the latest information on available incentives.