Washington State Property Tax Rate

Welcome to this comprehensive guide on Washington State's property tax rates. Property taxes are an essential aspect of homeownership, and understanding how they work and the rates applied in your state is crucial. In Washington, property taxes play a significant role in funding various public services, including schools, roads, and emergency services. This article aims to provide you with an in-depth analysis of Washington's property tax system, including the rates, assessment process, and exemptions, to help you better navigate your financial responsibilities as a homeowner.

Understanding Washington's Property Tax Rates

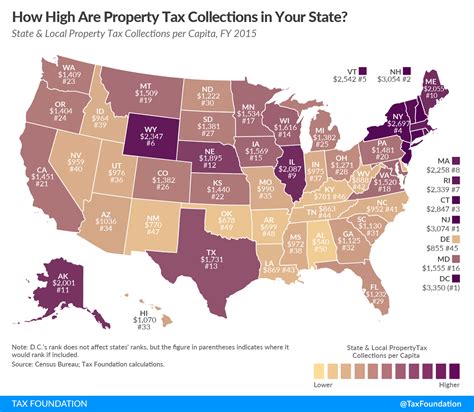

Washington State employs a system of ad valorem taxation for property taxes. This means that the amount of tax owed by a property owner is directly proportional to the assessed value of their property. The tax rate is applied as a percentage of the assessed value, and this rate varies across different jurisdictions within the state.

The property tax rates in Washington are determined by local governments, including counties, cities, and special purpose districts. These jurisdictions have the authority to set their own tax rates, which can result in varying rates across different areas of the state. This local control over tax rates ensures that communities have the financial resources necessary to provide local services tailored to their specific needs.

To calculate the property tax liability for a specific property, the assessed value of the property is multiplied by the tax rate applicable to that jurisdiction. The assessed value is typically determined by the county assessor's office and is based on a property's market value. This value is then adjusted for any exemptions or special assessments that may apply.

| Jurisdiction | Average Property Tax Rate |

|---|---|

| King County | 1.07% |

| Pierce County | 1.13% |

| Snohomish County | 1.04% |

| Spokane County | 1.28% |

| Benton County | 1.42% |

It's important to note that these average rates are just a general indication and may not reflect the exact tax rate for a specific property. The actual tax rate can vary based on the property's location, the type of property (residential, commercial, or agricultural), and any additional levies or special assessments imposed by local governments.

Factors Influencing Property Tax Rates

Several factors contribute to the variation in property tax rates across Washington. These factors include the cost of providing local services, the demand for public facilities, and the overall economic climate of the area. For instance, regions with higher populations and greater infrastructure needs may have higher tax rates to support the maintenance and development of public amenities.

Additionally, the state's property tax system allows for the implementation of special levies and assessments. These additional charges are often used to fund specific projects or services, such as school bond initiatives, transportation improvements, or public safety enhancements. These special levies can significantly impact the overall property tax rate for a particular jurisdiction.

Assessment and Valuation Process

The valuation of properties in Washington is a crucial step in determining the property tax liability. Each county in the state has an assessor's office responsible for evaluating properties within their jurisdiction. These assessors determine the market value of properties using various methods, including sales comparison, cost approach, and income capitalization.

The assessment process aims to ensure fairness and accuracy in property valuation. Assessors consider factors such as the property's location, size, improvements, and comparable sales data to determine a fair market value. This value is then used as the basis for calculating the property's assessed value, which is typically a percentage of the market value.

It's important for property owners to understand the assessment process and their rights regarding property valuation. If a property owner believes their assessed value is inaccurate, they have the right to appeal the assessment. This process involves submitting an appeal to the county assessor's office and providing evidence to support their claim. The assessor's office will then review the appeal and make a determination.

Property Tax Exemptions and Relief Programs

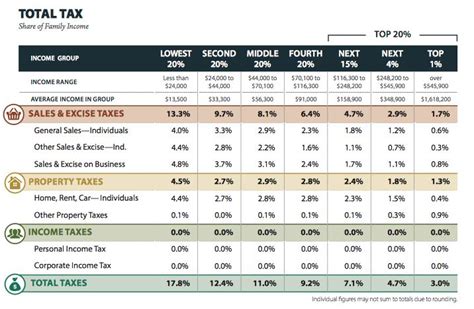

Washington State offers several property tax exemptions and relief programs to ease the financial burden on certain groups of property owners. These exemptions and programs are designed to provide support to seniors, veterans, individuals with disabilities, and low-income homeowners.

Senior Citizen Exemption

The Senior Citizen Exemption is available to homeowners who are at least 61 years old and meet specific income requirements. This exemption reduces the assessed value of the property, resulting in a lower property tax liability. The income limit for this exemption is adjusted annually and is based on the median household income in the state.

| Year | Income Limit |

|---|---|

| 2022 | $52,500 |

| 2023 | $54,000 |

To qualify for the Senior Citizen Exemption, homeowners must submit an application to their county assessor's office. The application process typically involves providing proof of age and income documentation. Once approved, the exemption is applied to the property's assessed value, and the property tax liability is adjusted accordingly.

Veteran's Exemption

Washington State recognizes the service and sacrifices made by veterans by offering a property tax exemption. This exemption reduces the assessed value of the property for qualifying veterans, resulting in a lower property tax bill. To be eligible, veterans must have served in the armed forces during a period of declared war or military conflict and have received an honorable discharge.

The amount of exemption varies depending on the veteran's service-connected disability status and the length of their service. Veterans with a service-connected disability of at least 10% are eligible for a partial exemption, while those with a higher disability rating or longer service duration may qualify for a full exemption.

Low-Income Homeowner Exemption

The Low-Income Homeowner Exemption is designed to assist low-income homeowners in maintaining their property tax obligations. This exemption reduces the assessed value of the property, providing relief to homeowners who meet specific income and asset limits. The income and asset limits are adjusted annually and are based on federal poverty guidelines.

| Year | Income Limit (Single Filers) | Asset Limit |

|---|---|---|

| 2022 | $39,750 | $20,000 |

| 2023 | $41,250 | $20,500 |

Homeowners interested in applying for the Low-Income Homeowner Exemption should contact their county assessor's office. The application process involves providing income and asset verification, and once approved, the exemption is applied to the property's assessed value, reducing the property tax liability.

Future Implications and Potential Changes

Washington's property tax system is subject to ongoing discussions and potential reforms. There are several proposals and initiatives aimed at addressing concerns regarding the fairness and transparency of the current system. Some of the key areas of focus include:

- Reassessing the valuation methods to ensure accuracy and fairness.

- Implementing measures to prevent rapid increases in property taxes during periods of high real estate market growth.

- Exploring options for providing additional tax relief to vulnerable populations.

- Streamlining the assessment and appeals process to make it more efficient and accessible to property owners.

As the state continues to evaluate its property tax system, it is crucial for homeowners to stay informed about any proposed changes and their potential impact. Being aware of these discussions can help property owners understand how future reforms may affect their financial obligations and allow them to participate in the decision-making process through public hearings and feedback opportunities.

Frequently Asked Questions

How often are property taxes assessed in Washington State?

+Property taxes in Washington State are assessed annually. The assessment process involves evaluating the market value of properties and determining their assessed value, which is then used to calculate the property tax liability. Homeowners receive their property tax bills, typically in February or March, and the taxes are due in April of each year.

Can property owners appeal their assessed value in Washington?

+Yes, property owners in Washington have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process involves submitting an application to the county assessor’s office, providing evidence to support their claim, and attending a hearing if necessary. The assessor’s office will review the appeal and make a determination, which can result in a change to the assessed value.

Are there any limits on property tax increases in Washington State?

+Washington State has implemented measures to limit rapid increases in property taxes. The state’s “60% rule” restricts the annual increase in property tax rates to a maximum of 1% plus the percentage increase in the consumer price index (CPI). This rule ensures that property taxes do not increase significantly during periods of high real estate market growth, providing stability for homeowners.

What happens if property taxes are not paid on time in Washington?

+If property taxes are not paid on time in Washington, penalties and interest may accrue. The specific penalties and interest rates can vary depending on the county and the timing of the payment. In some cases, failure to pay property taxes can result in a tax lien being placed on the property, which can impact the homeowner’s credit and ability to sell or refinance the property.

Are there any alternatives to paying property taxes in Washington State?

+While there are no direct alternatives to paying property taxes in Washington State, homeowners may be eligible for certain programs or exemptions that can reduce their property tax liability. These include the Senior Citizen Exemption, Veteran’s Exemption, and Low-Income Homeowner Exemption, which provide relief to qualifying individuals. Additionally, some counties offer payment plans or deferment options for eligible homeowners facing financial hardships.