Sales Tax Rate In Washington

Sales tax is a common form of taxation in the United States, with each state having its own set of rules and rates. Washington, a state in the Pacific Northwest region, has a unique sales tax system that plays a significant role in its economy and has an impact on both residents and businesses. Understanding the sales tax rate in Washington is crucial for anyone doing business or making purchases within the state.

Washington’s Sales Tax System

Washington’s sales tax system is a combination of state and local taxes, making it slightly more complex than a flat-rate tax. The state imposes a 6.5% sales tax on most retail transactions, which serves as the base rate. However, this is not the only tax applied to purchases in Washington.

In addition to the state sales tax, local jurisdictions, including counties, cities, and special purpose districts, are authorized to levy their own add-on taxes to the state rate. These additional taxes can vary significantly depending on the location of the purchase. For instance, the city of Seattle imposes an additional 2.25% sales tax, bringing the total sales tax rate in Seattle to 8.75%.

This local variation in sales tax rates is not uncommon in the United States, but it adds an extra layer of complexity for businesses operating across different regions of Washington. They must ensure they are aware of and compliant with the specific tax rates applicable to their customers' locations.

Understanding the Impact of Washington’s Sales Tax

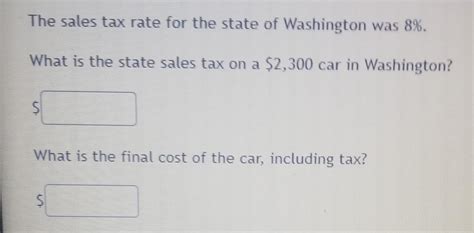

The sales tax rate in Washington has a direct impact on the cost of goods and services for both residents and visitors. For residents, it adds a significant cost to their daily purchases, potentially affecting their disposable income and spending habits.

Businesses, especially those in the retail and e-commerce sectors, need to be particularly mindful of Washington's sales tax rates. They must ensure they are collecting and remitting the correct amount of tax to the appropriate authorities. Failure to do so can result in penalties and legal issues.

The Role of Sales Tax in Washington’s Economy

Sales tax is a vital source of revenue for the state of Washington. It funds various public services and infrastructure projects, contributing to the overall economic health of the state. The tax revenue collected helps maintain and improve roads, schools, and other public facilities, ensuring a high quality of life for Washington residents.

Additionally, sales tax can act as a tool to promote certain economic activities. For instance, Washington has implemented tax incentives for certain industries, encouraging businesses to locate within the state. These incentives can take the form of reduced sales tax rates or exemptions for specific products or services.

Comparing Washington’s Sales Tax with Other States

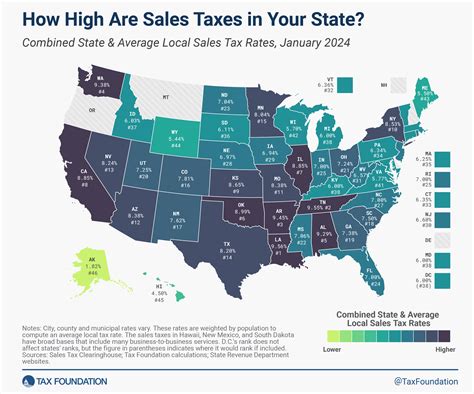

Washington’s sales tax rate of 6.5% is relatively moderate compared to other states. Some states, like California and New York, have sales tax rates exceeding 8%, while others, like Alaska and Delaware, have no sales tax at all.

However, it's important to note that the overall tax burden in Washington can be higher due to the combination of state and local taxes. The additional local taxes can significantly increase the total sales tax rate, making Washington a relatively high-tax state for certain regions.

| State | State Sales Tax Rate | Total Average Sales Tax Rate (including local taxes) |

|---|---|---|

| Washington | 6.5% | Varies (typically between 7% and 9%) |

| California | 7.25% | Varies (typically between 8% and 10%) |

| New York | 4% | Varies (typically between 7% and 9%) |

| Alaska | 0% | Varies (some cities impose local sales taxes) |

| Delaware | 0% | 0% |

The table above provides a snapshot of sales tax rates in various states. While Washington's state sales tax rate is moderate, the total sales tax burden can vary significantly depending on the location within the state.

The Future of Sales Tax in Washington

As with any tax system, Washington’s sales tax rates are subject to change. The state and local governments periodically review and adjust tax rates to meet revenue needs and policy objectives. These changes can impact the overall cost of living and doing business in Washington.

In recent years, there have been discussions and proposals to reform Washington's tax system, including suggestions to modify or eliminate the sales tax. However, any significant changes would require legislative action and public support. For now, businesses and individuals should stay informed about the current sales tax rates and their potential future changes.

Frequently Asked Questions

What is the state sales tax rate in Washington?

+

The state sales tax rate in Washington is 6.5%.

Are there any products or services exempt from sales tax in Washington?

+

Yes, certain products and services are exempt from sales tax in Washington. These include prescription drugs, medical services, and some groceries. Additionally, certain industries may be eligible for tax incentives, reducing their effective sales tax rate.

How often are sales tax rates updated in Washington?

+

Sales tax rates in Washington are typically updated annually, with changes taking effect on the first day of April. However, local jurisdictions may adjust their rates more frequently, subject to local legislation and approval processes.

Can businesses collect sales tax on behalf of multiple jurisdictions in Washington?

+

Yes, businesses operating in multiple jurisdictions within Washington are responsible for collecting and remitting sales tax to each applicable jurisdiction. This can be a complex process, especially for businesses with a large number of locations or online sales.

Are there any sales tax holidays in Washington?

+

No, Washington does not currently have any sales tax holidays. However, the state may offer periodic tax incentives or rebates to promote certain economic activities or assist specific industries.