Where Is My Dc State Tax Refund

The DC State Tax Refund process is an important aspect for residents of the District of Columbia who are awaiting their tax returns. Understanding the status and timeline of these refunds is crucial for financial planning and budgeting. In this comprehensive guide, we will delve into the intricacies of the DC tax refund system, providing you with expert insights and a step-by-step breakdown of the process. From the initial filing to the moment your refund lands in your account, we've got you covered.

The DC Tax Refund Journey: A Comprehensive Overview

Filing your taxes and awaiting your refund can be a nerve-wracking experience. However, with the right information and a bit of preparation, the process can be streamlined and less stressful. Let's embark on a journey to uncover the steps and considerations involved in claiming your DC state tax refund.

Step 1: Filing Your DC Tax Return

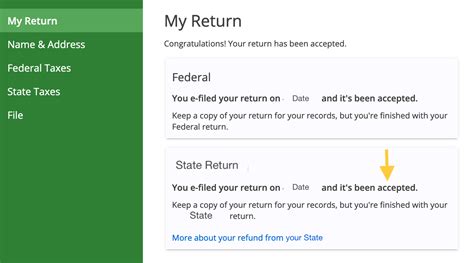

The first step towards receiving your refund is, of course, filing your DC tax return accurately and on time. The District of Columbia offers several filing options, including online filing through the DC eFile system, which is a secure and convenient method. You can also choose to file your return by mail, although online filing often provides a faster processing time.

When preparing your tax return, it's essential to gather all the necessary documents, such as W-2 forms, 1099s, and any other relevant tax documents. The DC Office of Tax and Revenue provides comprehensive guidelines and resources to ensure you have all the information you need. Make sure to double-check your calculations and review your return before submission to avoid any potential errors.

Once you've filed your return, the waiting game begins. The DC Office of Tax and Revenue aims to process refunds within a reasonable timeframe, but several factors can influence the speed of the process.

Step 2: Understanding the DC Refund Timeline

The timeline for receiving your DC state tax refund can vary depending on several factors, including the method of filing, the complexity of your return, and the overall volume of tax returns being processed. Generally, the DC government strives to issue refunds within 45 days of receiving a complete and accurate return.

However, it's important to note that this timeline is an estimate, and there may be instances where refunds are processed faster or slower. The DC Office of Tax and Revenue keeps taxpayers informed through regular updates on their website, providing the latest information on refund processing times and any potential delays.

During peak tax season, the volume of returns can significantly impact the speed of processing. The DC government encourages taxpayers to file early to avoid potential delays caused by high demand. By filing early, you can also take advantage of any available tax credits or deductions, maximizing your refund amount.

| Filing Method | Estimated Processing Time |

|---|---|

| Online (DC eFile) | Approximately 4-6 weeks |

| 6-8 weeks or more |

Step 3: Tracking Your DC State Tax Refund

In today's digital age, staying informed about the status of your refund is easier than ever. The DC Office of Tax and Revenue offers an online tool called the Where's My Refund tracker, which allows taxpayers to check the status of their refund anytime, anywhere.

To use this tracker, you'll need to provide some basic information, including your Social Security Number, your filing status (single, married filing jointly, etc.), and the exact amount of your expected refund. This information ensures that the tracker provides accurate and personalized results.

The Where's My Refund tracker updates its information regularly, providing real-time insights into the progress of your refund. It can indicate whether your return has been received, is being processed, or if there are any issues that require further attention. This tool is an invaluable resource for staying informed and managing your expectations during the refund process.

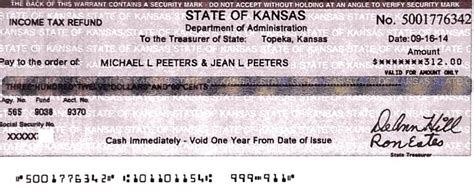

Step 4: Receiving Your DC State Tax Refund

Once your refund has been processed and approved, it's time to receive the fruits of your tax-filing labor. The DC government offers several methods for refund disbursement, allowing taxpayers to choose the option that best suits their needs.

The most common method is direct deposit, which is a secure and efficient way to receive your refund. By providing your bank account information during the filing process, the DC Office of Tax and Revenue can deposit your refund directly into your account, often within a few days of processing.

For those who prefer a more traditional method, a paper check is also an option. The DC government will mail your refund check to the address provided on your tax return. While this method may take slightly longer, it provides a tangible representation of your hard-earned refund.

Regardless of the method you choose, it's essential to keep an eye on your mail or bank account to ensure you receive your refund promptly. If you have not received your refund within the estimated timeframe, it's advisable to contact the DC Office of Tax and Revenue to inquire about the status and potential reasons for the delay.

Common Issues and Solutions: Navigating DC State Tax Refunds

While the DC tax refund process is generally straightforward, there may be instances where issues arise. Understanding common problems and their solutions can help you navigate these situations smoothly.

Issue 1: Delayed Refunds

One of the most common concerns taxpayers face is a delayed refund. While the DC government strives for timely processing, several factors can cause refunds to be delayed, including errors on the tax return, missing information, or even system glitches.

If you find that your refund is taking longer than expected, the first step is to check the status using the Where's My Refund tracker. This tool will provide valuable insights into the progress of your refund and may reveal any issues that need to be addressed.

If the tracker indicates that your refund is being held due to an error or missing information, it's crucial to take immediate action. Contact the DC Office of Tax and Revenue and provide any additional information or documentation required to resolve the issue. By being proactive, you can help expedite the process and get your refund back on track.

Issue 2: Missing or Incorrect Information

Accurate and complete information is vital when filing your tax return. Even a small mistake or missing detail can lead to delays or even denial of your refund. Common errors include incorrect Social Security Numbers, misspelled names, or miscalculations.

To avoid these issues, take the time to review your tax return thoroughly before submission. Double-check all the information, especially your personal details and the calculations. Consider using tax preparation software or seeking the assistance of a tax professional to ensure accuracy.

If you realize that you've made an error after filing, don't panic. Contact the DC Office of Tax and Revenue promptly and explain the situation. They will guide you on the best course of action, which may involve filing an amended return or providing additional documentation.

Issue 3: Refund Fraud and Security Concerns

In today's digital world, tax refund fraud and security concerns are unfortunately common. Cybercriminals may attempt to intercept your refund or gain access to your personal information, leading to potential identity theft.

To protect yourself, it's crucial to be vigilant and take proactive measures. Always use secure connections when filing your taxes online and avoid public Wi-Fi networks. Keep your personal information, including Social Security Numbers and bank account details, secure and confidential.

The DC Office of Tax and Revenue takes security seriously and has implemented robust measures to safeguard taxpayer information. They continuously monitor for potential threats and work closely with law enforcement to combat fraud. However, it's essential for taxpayers to remain aware and report any suspicious activities or potential fraud attempts.

Maximizing Your DC State Tax Refund: Expert Tips

While the primary goal is to receive your refund promptly, there are strategies you can employ to maximize the amount you receive. Here are some expert tips to help you make the most of your DC state tax refund.

Tip 1: Take Advantage of Tax Credits and Deductions

The District of Columbia offers various tax credits and deductions that can significantly reduce your tax liability and increase your refund. These include the Earned Income Tax Credit (EITC), Child Tax Credit, and deductions for education expenses, medical costs, and more.

Research and understand the tax credits and deductions you may be eligible for. Consult with a tax professional or use reliable online resources to ensure you're maximizing your benefits. By taking advantage of these opportunities, you can potentially increase your refund and put more money back into your pocket.

Tip 2: Explore Tax-Saving Strategies

Beyond credits and deductions, there are other strategies you can employ to save on your taxes and increase your refund. For example, contributing to tax-advantaged retirement accounts, such as a 401(k) or IRA, can provide significant tax benefits. These accounts allow you to reduce your taxable income and potentially qualify for additional tax credits.

Additionally, consider exploring tax-efficient investment strategies. Certain investments, such as municipal bonds or real estate, can provide tax advantages. By diversifying your investment portfolio with tax-efficient options, you can minimize your tax liability and maximize your refund.

It's important to note that tax-saving strategies should be tailored to your individual financial situation. Consult with a financial advisor or tax professional to determine the most suitable strategies for your specific needs.

Tip 3: Plan for the Future with Your Refund

Receiving a tax refund can be a significant financial boost, but it's important to use it wisely. Instead of viewing it as a windfall, consider it an opportunity to improve your financial well-being and plan for the future.

One strategy is to pay off high-interest debt, such as credit cards or personal loans. By reducing your debt burden, you can free up more of your income for savings and investments. Alternatively, you could use your refund to build an emergency fund, ensuring you have a financial safety net for unexpected expenses.

If you have long-term financial goals, such as buying a home or saving for retirement, consider allocating a portion of your refund towards these goals. By making consistent contributions, you can make significant progress towards achieving your financial dreams.

The Future of DC State Tax Refunds: A Look Ahead

As technology advances and tax systems evolve, the DC government is continuously working to improve the tax refund process. Here's a glimpse into the future of DC state tax refunds and the potential changes and advancements taxpayers can expect.

Enhanced Online Services and Mobile Apps

The DC Office of Tax and Revenue is committed to providing convenient and user-friendly online services. In the future, we can expect even more robust online platforms and mobile apps that allow taxpayers to file their returns, track refunds, and manage their tax accounts with ease.

These enhanced digital tools will provide real-time updates, personalized refund estimates, and secure communication channels, making the tax refund process more accessible and efficient.

Data-Driven Insights and Tax Planning

By leveraging data analytics and machine learning, the DC government can provide taxpayers with valuable insights and predictions. These tools can help individuals understand their tax obligations better, identify potential deductions and credits, and plan their finances more effectively.

With access to data-driven insights, taxpayers can make informed decisions about their tax strategies, ensuring they maximize their refunds and minimize their tax liabilities.

Expanded Taxpayer Support and Education

The DC Office of Tax and Revenue recognizes the importance of taxpayer education and support. In the future, we can expect expanded resources and initiatives aimed at helping taxpayers navigate the complex world of taxes.

This may include comprehensive online guides, webinars, and workshops to educate taxpayers on various tax topics, from filing basics to advanced tax planning. By empowering taxpayers with knowledge, the DC government aims to reduce errors and improve the overall tax experience.

Conclusion: A Smooth and Informed Journey

Navigating the DC state tax refund process can be a seamless and rewarding experience with the right knowledge and tools. By understanding the steps involved, staying informed, and employing expert strategies, you can maximize your refund and achieve your financial goals.

From filing your return accurately to tracking your refund and receiving it promptly, this comprehensive guide has provided you with the insights and resources to make the most of your DC state tax refund. Remember to stay vigilant, take advantage of available credits and deductions, and plan for the future with your refund.

As the tax landscape continues to evolve, the DC government is dedicated to improving the taxpayer experience. With enhanced online services, data-driven insights, and expanded support, the future of DC state tax refunds looks bright and promising.

We hope this guide has been informative and helpful. For any further questions or concerns, don't hesitate to reach out to the DC Office of Tax and Revenue or consult with a tax professional. Happy tax refund season, and may your refund journey be smooth and rewarding!

How long does it typically take to receive a DC state tax refund?

+The estimated processing time for DC state tax refunds is approximately 4-6 weeks for online filings and 6-8 weeks or more for mail filings. However, this timeline can vary depending on various factors, including the complexity of the return and the volume of tax returns being processed.

What should I do if my DC state tax refund is delayed?

+If your DC state tax refund is taking longer than expected, you can check the status using the “Where’s My Refund” tracker provided by the DC Office of Tax and Revenue. This tool will provide you with real-time updates on the progress of your refund. If there are any issues or delays, contact the DC Office of Tax and Revenue for further assistance.

Can I receive my DC state tax refund through direct deposit?

+Yes, the DC government offers direct deposit as a refund disbursement method. By providing your bank account information during the filing process, you can receive your refund directly into your account, often within a few days of processing. Direct deposit is a secure and efficient way to receive your refund.

What if I made a mistake on my DC tax return after filing?

+If you discover an error on your DC tax return after filing, it’s important to take immediate action. Contact the DC Office of Tax and Revenue and explain the situation. They will guide you on the necessary steps, which may involve filing an amended return or providing additional documentation to correct the error.

How can I stay informed about DC state tax refund updates and news?

+The DC Office of Tax and Revenue provides regular updates and news on their website. By visiting their official website, you can stay informed about refund processing times, potential delays, and any important announcements related to tax refunds. Additionally, you can sign up for email alerts or follow their social media accounts for real-time updates.