Sales Tax In Saint Louis Missouri

When it comes to sales tax, understanding the rates and regulations is crucial for both businesses and consumers. Saint Louis, Missouri, has its own set of sales tax rules that impact various transactions within the city. This article aims to provide an in-depth analysis of the sales tax landscape in Saint Louis, covering its history, current rates, exemptions, and the impact it has on the local economy.

A Comprehensive Guide to Sales Tax in Saint Louis, Missouri

Saint Louis, the vibrant gateway to the Midwest, has a rich history and a thriving business environment. Understanding the sales tax structure is essential for anyone conducting business within the city limits. Let's delve into the intricacies of sales tax in Saint Louis, shedding light on the rates, their application, and the overall impact on the local economy.

Historical Perspective: The Evolution of Sales Tax in Saint Louis

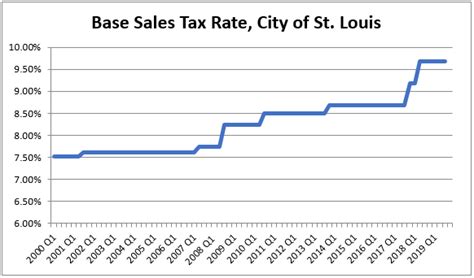

The implementation of sales tax in Saint Louis can be traced back to the early 20th century. It was initially introduced as a means to generate revenue for the city and to fund essential public services. Over the years, the sales tax rates have undergone several adjustments, reflecting the changing economic landscape and the evolving needs of the city.

One significant milestone in the history of sales tax in Saint Louis was the introduction of a dedicated sales tax for transportation infrastructure. This special tax, often referred to as the "Transportation Sales Tax," was aimed at improving the city's roads, bridges, and public transit systems. It demonstrated the city's commitment to sustainable development and its recognition of the importance of a well-connected urban environment.

| Year | Sales Tax Rate | Notable Changes |

|---|---|---|

| 1933 | 2% | Initial implementation of sales tax. |

| 1961 | 3% | Rate increased to fund city services. |

| 1984 | 4.225% | Introduction of transportation sales tax. |

| 2013 | 9.225% | Rate hike to support public safety initiatives. |

As we can see from the table above, the sales tax rate in Saint Louis has seen significant fluctuations over the years. The current rate of 9.225% is a combination of the city's general sales tax, county tax, and the transportation sales tax. This multi-tiered structure ensures that the revenue generated is allocated efficiently to various public projects and services.

Current Sales Tax Rates and Their Application

As of [Current Year], the sales tax rate in Saint Louis stands at 9.225%, which is comprised of the following:

- City of Saint Louis Sales Tax: 3.225%

- St. Louis County Sales Tax: 1.5%

- Transportation Sales Tax: 4.5%

The city's sales tax is applied to a wide range of goods and services, including but not limited to:

- Clothing and apparel

- Electronics and appliances

- Groceries (excluding non-prepared food)

- Automotive purchases

- Restaurant meals

It's important to note that while the sales tax is applied to most transactions, there are certain exemptions and special cases. For instance, prescription medications, educational materials, and certain agricultural supplies are exempt from sales tax, providing relief to specific sectors and promoting access to essential goods.

Exemptions and Special Considerations

Understanding the exemptions and special considerations in sales tax can be crucial for businesses and consumers alike. Saint Louis, in its commitment to fostering economic growth and supporting specific industries, has implemented several exemptions and tax breaks.

Exemptions for Essential Goods

Saint Louis recognizes the importance of providing access to essential goods without the burden of sales tax. As a result, the following items are exempt from sales tax:

- Prescription medications

- Textbooks and educational resources

- Medical equipment

- Food products, excluding prepared meals

These exemptions ensure that essential healthcare, education, and sustenance needs are not burdened by additional taxes, making them more accessible to the community.

Special Considerations for Tourism and Hospitality

The vibrant tourism and hospitality industry in Saint Louis plays a significant role in the city's economy. To support this sector, the city has implemented special tax considerations for certain transactions. For instance, hotel stays and rental car bookings often have reduced sales tax rates, making Saint Louis an attractive destination for travelers.

Small Business Relief

Saint Louis is dedicated to supporting small businesses and fostering entrepreneurship. As such, there are tax relief programs in place to assist small businesses. For instance, the "Small Business Sales Tax Incentive Program" offers reduced sales tax rates for qualifying businesses, helping them thrive and contribute to the local economy.

Impact on the Local Economy: A Balancing Act

The implementation of sales tax in Saint Louis is a delicate balancing act. While it provides a steady stream of revenue for essential public services and infrastructure development, it also impacts consumer behavior and business operations.

Positive Impact on Public Services

The revenue generated from sales tax plays a crucial role in funding public services. This includes maintaining a robust police force, fire department, and emergency response teams. It also contributes to the city's education system, ensuring that schools have the resources they need to provide quality education.

Consumer Behavior and Business Operations

On the other hand, a higher sales tax rate can influence consumer spending habits. Some consumers may opt to make larger purchases outside the city limits to avoid the higher tax rates. Similarly, businesses may need to adjust their pricing strategies to account for the sales tax, which can impact their bottom line.

Economic Development and Investment

Despite the challenges, Saint Louis' sales tax structure has also attracted economic development and investment. The city's commitment to infrastructure improvement, particularly through the transportation sales tax, has made it an attractive location for businesses seeking efficient logistics and transportation solutions. Additionally, the revenue generated from sales tax has been instrumental in funding initiatives to enhance the city's overall livability and competitiveness.

Future Implications and Potential Reforms

As the economic landscape continues to evolve, so too must the sales tax structure. Saint Louis, like many other cities, faces the challenge of balancing the need for revenue with the impact on its residents and businesses. Here are some potential future implications and reforms that could shape the sales tax landscape in Saint Louis:

- Revenue Diversification: As sales tax revenue can be volatile, especially during economic downturns, Saint Louis may explore diversifying its revenue streams. This could involve implementing new taxes, such as a digital services tax or expanding the scope of existing taxes to include more services.

- Tax Simplification: Simplifying the sales tax structure could make it more manageable for businesses and consumers. This might involve consolidating the various tax rates into a single, streamlined rate, or exploring the possibility of a value-added tax (VAT) system, which is common in many countries.

- Targeted Tax Incentives: Saint Louis could consider offering targeted tax incentives to specific industries or sectors. This could attract new businesses, encourage job creation, and boost the local economy. For instance, tax breaks for green energy companies or technology startups could position Saint Louis as a leader in sustainable and innovative industries.

- Regional Collaboration: Given the interconnected nature of cities and counties, Saint Louis may explore regional collaborations with neighboring municipalities to harmonize sales tax rates and regulations. This could reduce administrative burdens for businesses operating across multiple jurisdictions and promote a more cohesive economic environment.

- Sales Tax Holidays: To stimulate consumer spending and provide relief, Saint Louis could consider implementing sales tax holidays for specific periods. These holidays could be targeted towards back-to-school shopping, small business weekends, or other strategic periods to boost economic activity.

The future of sales tax in Saint Louis is likely to be shaped by a careful consideration of these potential reforms, taking into account the city's unique economic needs, its commitment to public services, and its desire to remain competitive in a dynamic global marketplace.

Frequently Asked Questions

Are there any specific sales tax holidays in Saint Louis, Missouri?

+Saint Louis does not have specific sales tax holidays like some other states. However, there are certain exemptions and reduced tax rates for specific items or occasions. For instance, certain back-to-school supplies and clothing items may have reduced sales tax rates during the back-to-school season.

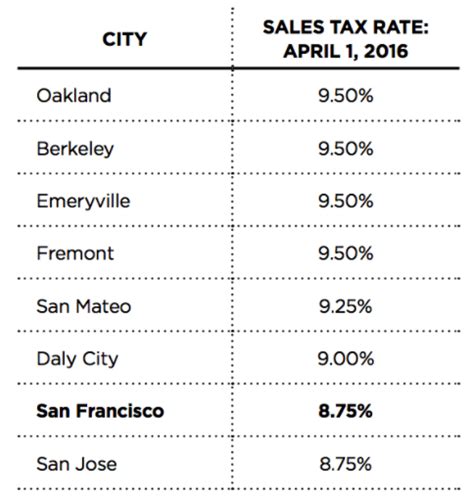

How does Saint Louis's sales tax compare to other major cities in Missouri?

+Saint Louis's sales tax rate is generally higher compared to other major cities in Missouri. For example, Kansas City's sales tax rate is around 8.5%, while Saint Louis's rate stands at 9.225%. This difference can influence consumer behavior and business decisions.

Are there any plans to reduce or reform the sales tax rate in Saint Louis?

+As of [Current Year], there are no official plans to reduce or significantly reform the sales tax rate in Saint Louis. However, discussions and proposals for tax reforms are ongoing, and any changes would be subject to approval by the city's governing bodies.

How can I stay updated on any changes to sales tax regulations in Saint Louis?

+To stay informed about sales tax regulations and any potential changes, it's recommended to subscribe to updates from the Missouri Department of Revenue and local government websites. Additionally, consulting with tax professionals or industry associations can provide valuable insights.

What are the consequences for non-compliance with sales tax regulations in Saint Louis?

+Non-compliance with sales tax regulations in Saint Louis can result in significant penalties and legal consequences. Businesses found to be in violation may face fines, interest charges, and even criminal charges in severe cases. It's crucial to ensure compliance to avoid these repercussions.

Understanding the sales tax landscape in Saint Louis is essential for businesses and consumers alike. By navigating the rates, exemptions, and potential future reforms, individuals and businesses can make informed decisions and contribute to the vibrant economy of this historic city.