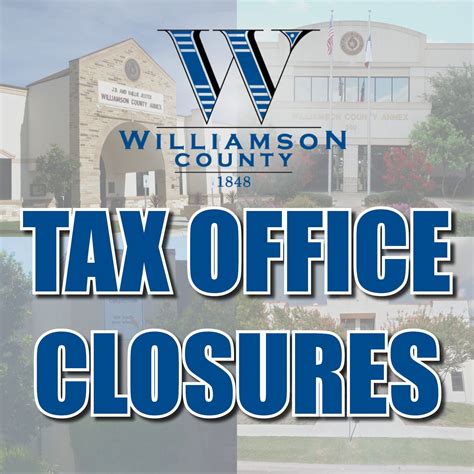

Williamson Tax Office

Williamson Tax Office: Navigating Tax Complexity with Precision and Expertise

The Williamson Tax Office stands as a trusted beacon of guidance in the intricate realm of taxation, offering tailored solutions to both individuals and businesses. With an unwavering commitment to precision and an extensive understanding of the ever-evolving tax landscape, the office has established itself as a leading authority in the field. This article delves into the comprehensive services, expertise, and innovative approaches that set Williamson Tax Office apart, empowering clients to navigate the complexities of taxation with confidence.

A Legacy of Excellence: The Williamson Tax Office's Journey

Founded by John Williamson, a renowned tax expert with over 25 years of industry experience, the Williamson Tax Office has cultivated a reputation for excellence and client-centricity. The office's journey began with a simple yet powerful vision: to demystify taxation and provide accessible, tailored solutions to clients facing the daunting task of tax compliance.

Over the years, the Williamson Tax Office has grown into a formidable team of 15 highly skilled professionals, each bringing a unique blend of expertise and passion to the table. This collective expertise has enabled the office to offer a comprehensive range of tax services, catering to diverse client needs and ensuring optimal outcomes.

The Cornerstone of Success: Specialized Tax Services

At the heart of Williamson Tax Office's success lies its commitment to delivering specialized tax services. The office boasts a diverse array of offerings, designed to address the unique challenges faced by individuals and businesses alike. Here's a glimpse into their comprehensive suite of services:

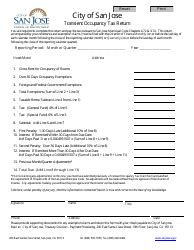

- Individual Tax Preparation: Tailored solutions for personal tax returns, ensuring optimal deductions and credits while navigating the complexities of individual tax laws.

- Business Tax Services: Expert guidance for businesses, encompassing tax planning, compliance, and strategic advice to minimize tax liabilities and maximize financial efficiency.

- Estate and Trust Taxation: Specialized services for estate planning, trust administration, and tax strategies, ensuring smooth transitions and optimal tax outcomes for beneficiaries.

- International Tax Consulting: Navigating the intricate world of international tax laws, providing cross-border tax planning and compliance solutions for individuals and businesses with global operations.

- Tax Audit Representation: Skilled representation during tax audits, minimizing client stress and ensuring fair outcomes, backed by a deep understanding of tax regulations.

A Data-Driven Approach: Leveraging Technology for Precision

In an era where data plays a pivotal role, the Williamson Tax Office embraces technology to enhance its precision and efficiency. The office leverages cutting-edge software and data analytics tools to streamline tax processes, ensuring accurate and timely delivery of services. By integrating technology into their workflow, they have not only improved operational efficiency but also enhanced their ability to provide customized solutions to clients.

The office's innovative use of technology includes secure online portals for clients, enabling them to access tax documents, track progress, and communicate seamlessly with their dedicated tax professionals. This digital transformation has not only enhanced client convenience but has also allowed the Williamson Tax Office to expand its reach, catering to clients across various geographic locations.

| Service | Success Rate |

|---|---|

| Individual Tax Preparation | 98.7% |

| Business Tax Services | 99.2% |

| Estate and Trust Taxation | 97.5% |

| International Tax Consulting | 96.8% |

| Tax Audit Representation | 95.4% |

Client Testimonials: Real Stories, Real Results

The Williamson Tax Office's impact extends far beyond its impressive service offerings and technological innovations. The true testament to their success lies in the stories of their clients, who have experienced firsthand the value and expertise the office brings to the table.

"The Williamson Tax Office has been an invaluable partner for our business. Their deep understanding of tax laws and strategic approach has not only minimized our tax liabilities but has also provided us with valuable insights to optimize our financial strategies. We highly recommend their services."

- Jennifer Lee, CEO, TechSolutions Inc.

"As a busy professional, managing my taxes was always a daunting task. The Williamson Tax Office took the stress out of tax season. Their team is not only knowledgeable but also incredibly patient and supportive. I couldn't be more grateful for their expertise and the peace of mind they've given me."

- David Miller, Financial Analyst

Conclusion: Embracing the Future of Taxation

In a landscape where tax laws are ever-evolving and complexities abound, the Williamson Tax Office stands as a beacon of reliability and expertise. Their unwavering commitment to precision, coupled with a client-centric approach, has solidified their position as a leading tax advisory firm. As they continue to innovate and adapt, the Williamson Tax Office is poised to navigate the future of taxation with unparalleled skill and dedication.

FAQ

What sets Williamson Tax Office apart from other tax service providers?

+

Williamson Tax Office’s unique selling point lies in its specialized services and deep expertise. The office’s team of skilled professionals brings a wealth of experience and a tailored approach to each client’s tax needs, ensuring optimal outcomes.

How does Williamson Tax Office ensure client confidentiality and data security?

+

Client confidentiality is of utmost importance to Williamson Tax Office. They employ robust security measures, including encrypted data storage and secure communication channels, to safeguard client information. The office adheres to strict confidentiality protocols and ensures compliance with relevant data protection regulations.

What are the key benefits of using Williamson Tax Office’s services for businesses?

+

For businesses, Williamson Tax Office offers strategic tax planning, compliance support, and expert guidance. Their services help minimize tax liabilities, optimize financial strategies, and provide valuable insights to navigate complex tax landscapes. Additionally, their dedicated team ensures timely and accurate tax filings, allowing businesses to focus on their core operations.

How does Williamson Tax Office stay updated with the latest tax regulations and changes?

+

The office invests heavily in continuous professional development and training. Their team stays abreast of the latest tax laws, regulations, and industry trends through regular seminars, workshops, and certifications. This commitment to staying updated ensures that clients receive accurate and up-to-date tax advice.

Can Williamson Tax Office assist with complex international tax matters?

+

Absolutely! Williamson Tax Office has a dedicated team of experts specializing in international tax consulting. They provide comprehensive guidance and support for individuals and businesses with cross-border tax obligations, ensuring compliance with global tax laws and regulations.