Tax Free Weekend Missouri

Get ready to mark your calendars and take advantage of the upcoming Tax-Free Weekend in Missouri! This annual event is a fantastic opportunity for residents to save money on various purchases and is eagerly anticipated by both consumers and businesses alike. In this comprehensive guide, we will delve into the details of Missouri's Tax-Free Weekend, exploring its history, the eligible items, and providing valuable insights to help you make the most of this shopping extravaganza.

A Brief History of Missouri’s Tax-Free Weekend

The concept of a tax-free weekend originated as a way to stimulate the economy and provide a much-needed boost to consumers and retailers. Missouri joined several other states in implementing this initiative, offering a designated period when certain items are exempt from state sales tax.

The tradition of Tax-Free Weekend in Missouri can be traced back to 2004, when the state legislature passed a bill introducing this annual event. Since then, it has become a highly anticipated fixture in the Missouri retail calendar, drawing shoppers from all across the state.

Initially, the tax-free period was limited to a single weekend in August, but over the years, it has expanded to include additional categories of items and a longer duration. This expansion reflects the growing popularity of the event and its positive impact on the local economy.

Understanding the Tax-Free Weekend Eligibility

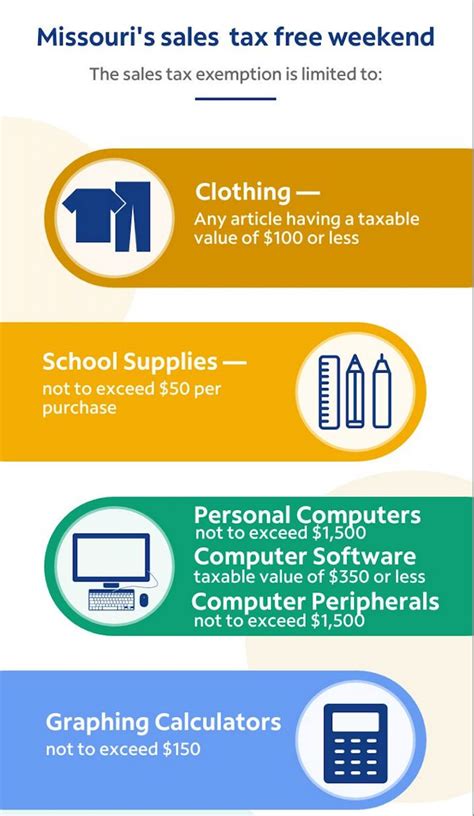

During Missouri’s Tax-Free Weekend, a wide range of items are eligible for exemption from state sales tax. This includes essential purchases for back-to-school season, as well as other necessary items for households and businesses.

Clothing and Footwear

One of the most popular categories during Tax-Free Weekend is clothing and footwear. Missouri residents can take advantage of tax-free purchases on a vast array of apparel and accessories, including:

- Shirts: From casual t-shirts to dress shirts, all styles are covered.

- Pants: Jeans, trousers, and leggings are all eligible.

- Outerwear: Jackets, coats, and even rain gear are included.

- Dresses: Whether for special occasions or everyday wear, dresses are tax-free.

- Accessories: Belts, hats, scarves, and gloves are also part of the tax-free offerings.

The tax exemption applies to clothing and footwear items priced at $100 or less per item. This means you can stock up on multiple items, as long as each individual piece falls within the price limit.

School Supplies and Computers

In addition to clothing, Tax-Free Weekend in Missouri extends to essential school supplies and computers. This category covers a wide range of items crucial for students and educators alike.

- Backpacks: Whether for elementary school students or college students, backpacks are tax-free.

- Notebooks: From spiral-bound to composition notebooks, all notebook styles are included.

- Pens and Pencils: Writing instruments of all kinds are exempt from sales tax.

- Calculators: Scientific calculators and basic models are eligible for tax exemption.

- Computers: Desktop computers, laptops, and even tablets are included in this category.

Similar to clothing and footwear, the tax exemption for school supplies and computers is applicable to items priced at $500 or less per item. This allows students, parents, and educators to purchase multiple items while still benefiting from the tax-free advantage.

Other Eligible Items

Missouri’s Tax-Free Weekend also includes a few additional categories that may vary from year to year. These items are subject to change based on state legislation and may include:

- Sports Equipment: Items such as baseball gloves, basketballs, and soccer cleats may be tax-free during specific years.

- Tools: Hand tools and power tools are sometimes included in the tax exemption, making it an excellent time for DIY enthusiasts to stock up.

- Bedding and Linens: Sheets, comforters, and pillowcases may be eligible for tax-free status during certain Tax-Free Weekends.

It's important to note that the eligibility and specific items covered can vary from year to year, so it's advisable to check the official guidelines released by the Missouri Department of Revenue prior to the event.

Maximizing Your Tax-Free Weekend Shopping Experience

To make the most of Missouri’s Tax-Free Weekend, it’s essential to plan and strategize your shopping trip. Here are some tips to help you navigate this exciting event:

Create a Shopping List

Before heading out, create a detailed shopping list based on your needs and the eligible categories. This will help you stay focused and ensure you don’t miss out on any essential items.

Compare Prices and Deals

Research and compare prices online and in-store to find the best deals. Many retailers offer special discounts and promotions during Tax-Free Weekend, so keep an eye out for these opportunities.

Check Store Hours and Policies

Familiarize yourself with the store hours and any specific policies implemented during Tax-Free Weekend. Some stores may extend their operating hours or have dedicated sales staff to accommodate the increased foot traffic.

Consider Online Shopping

If you prefer the convenience of online shopping, many retailers offer online tax-free sales during this period. Check their websites and take advantage of any online-exclusive deals.

Spread Out Your Purchases

To maximize your savings, consider spreading out your purchases over multiple stores. This way, you can take advantage of different promotions and ensure you stay within the price limits for tax exemption on each item.

The Impact of Tax-Free Weekend on the Local Economy

Missouri’s Tax-Free Weekend has a significant impact on the state’s economy, stimulating consumer spending and boosting local businesses. During this period, retailers often see a surge in sales, which can lead to increased revenue and job opportunities.

The event also encourages consumers to support local businesses, as they can save money on their purchases. This, in turn, strengthens the local economy and fosters a sense of community.

Furthermore, the tax-free weekend provides an opportunity for businesses to promote their products and services, attract new customers, and build brand loyalty. It's a win-win situation for both consumers and businesses, creating a positive economic cycle.

Conclusion

Missouri’s Tax-Free Weekend is an exciting event that offers residents a chance to save money on essential purchases. By understanding the eligible items and planning your shopping trip effectively, you can make the most of this annual opportunity.

So, mark your calendars, create your shopping lists, and get ready to enjoy a tax-free shopping experience in Missouri! Remember to stay informed about the latest guidelines and take advantage of the fantastic deals and promotions during this special weekend.

When is Missouri’s Tax-Free Weekend in 2023?

+

Missouri’s Tax-Free Weekend for 2023 is scheduled for August 4th to August 6th. Mark these dates on your calendar to ensure you don’t miss out on the savings!

Are there any restrictions on the number of items I can purchase during Tax-Free Weekend?

+

There are no restrictions on the quantity of items you can purchase. However, each item must fall within the specified price limit to be eligible for tax exemption. For clothing and footwear, the limit is 100 per item, and for school supplies and computers, it's 500 per item.

Can I combine Tax-Free Weekend savings with other discounts or promotions?

+

Absolutely! Many retailers offer additional discounts and promotions during Tax-Free Weekend, allowing you to maximize your savings. Be sure to check for any applicable coupons, sales, or special offers to get the best deals.

Are there any age restrictions for participating in Tax-Free Weekend?

+

No, Tax-Free Weekend is open to shoppers of all ages. Whether you’re a student, parent, or simply looking for a great deal, everyone can benefit from the tax exemption during this event.