Washington State Auto Sales Tax

When it comes to purchasing a vehicle in Washington State, one of the key considerations for residents is the auto sales tax. Washington, like many other states, imposes a sales tax on the purchase of motor vehicles. This tax contributes to the state's revenue and helps fund various public services and infrastructure. In this comprehensive guide, we will delve into the intricacies of the Washington State auto sales tax, exploring its rates, exemptions, and the impact it has on both buyers and the automotive industry.

Understanding the Washington State Auto Sales Tax

The auto sales tax in Washington is an essential component of the state’s tax system, designed to generate revenue for essential public services. This tax applies to the sale or lease of motor vehicles, including cars, trucks, motorcycles, and certain recreational vehicles. It is a critical source of funding for the state’s transportation infrastructure, education, and other vital programs.

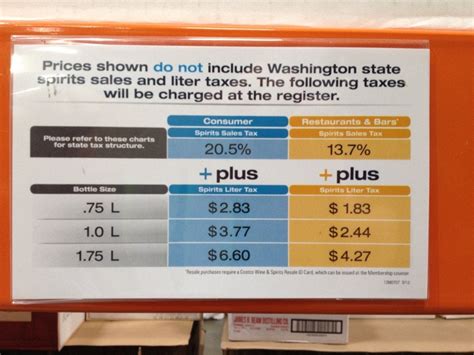

Washington State follows a straightforward approach to its auto sales tax, with a flat rate applied to all vehicle purchases. As of my last update in January 2023, the sales tax rate for vehicles in Washington is 6.5%. This rate is consistent across the state and is applied to the total purchase price of the vehicle, including any additional fees or options.

The 6.5% sales tax rate in Washington is relatively moderate compared to some other states, which can have sales tax rates exceeding 10% for vehicle purchases. This makes Washington an attractive destination for car buyers seeking to minimize their tax burden.

Exemptions and Special Considerations

While the sales tax in Washington is generally applicable to all vehicle purchases, there are certain exemptions and special considerations that buyers should be aware of. These exemptions can significantly reduce the overall tax liability for specific types of vehicles or buyers.

One notable exemption is for the purchase of alternative fuel vehicles. Washington State offers a sales tax exemption for vehicles powered by electricity, hydrogen, or other alternative fuels. This exemption encourages the adoption of environmentally friendly transportation options and promotes the state's commitment to sustainability.

| Vehicle Type | Sales Tax Exemption |

|---|---|

| Electric Vehicles | Up to $30,000 in vehicle value |

| Hydrogen Fuel Cell Vehicles | Up to $30,000 in vehicle value |

| Other Alternative Fuel Vehicles | Up to $10,000 in vehicle value |

Additionally, certain types of vehicles, such as recreational vehicles (RVs) and trailers, have specific tax considerations. These vehicles are subject to a different tax calculation based on their gross vehicle weight rating (GVWR). The sales tax rate for RVs and trailers is calculated as a percentage of the GVWR, with the rate varying depending on the vehicle's weight.

Calculating the Auto Sales Tax in Washington

Calculating the auto sales tax in Washington is a straightforward process, as it involves a simple multiplication of the vehicle’s purchase price by the applicable tax rate. Let’s walk through an example to illustrate how this works.

Imagine you are purchasing a new car in Washington State, and the vehicle has a total purchase price of $35,000. To calculate the sales tax, you would multiply the purchase price by the sales tax rate of 6.5%:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $35,000 x 0.065

Sales Tax = $2,275

In this example, the sales tax on the vehicle would amount to $2,275. This amount would be added to the purchase price, resulting in a total cost of $37,275 for the vehicle.

Taxable vs. Non-Taxable Components

It’s important to note that the sales tax in Washington is calculated based on the purchase price of the vehicle, excluding certain non-taxable components. These non-taxable items typically include sales tax, trade-in value, and certain fees, such as registration and license fees.

For instance, if the purchase price of a vehicle includes a trade-in allowance of $5,000, this amount would not be subject to the sales tax calculation. The sales tax would only be applied to the net purchase price, which is the difference between the total purchase price and the trade-in value.

Similarly, sales tax paid on a vehicle in another state or country may not be taxable in Washington. However, it's essential to consult with a tax professional or refer to the Washington State Department of Revenue's guidelines to understand the specific rules and regulations regarding out-of-state purchases.

Impact on Buyers and the Automotive Industry

The auto sales tax in Washington State has a significant impact on both buyers and the automotive industry within the state.

Buyer Considerations

For buyers, the sales tax is an essential factor to consider when purchasing a vehicle. It adds to the overall cost of ownership and can influence their decision-making process. Buyers often factor in the sales tax when budgeting for a new vehicle, and it can impact their choice of vehicle and purchasing timeline.

Additionally, the sales tax can affect the negotiation process with dealerships. Buyers may strategically time their purchases to take advantage of tax incentives or promotions, such as tax-free weekends, to reduce their overall tax liability.

Automotive Industry Perspective

From the perspective of the automotive industry, the sales tax plays a crucial role in shaping the market dynamics and consumer behavior. Dealerships and manufacturers must consider the tax implications when setting prices and developing marketing strategies.

The sales tax can impact the competitiveness of dealerships, as buyers may compare prices across different states to find the most favorable tax rates. This can lead to increased competition among dealerships, especially those located near state borders, as they strive to offer attractive deals and incentives to retain customers.

Moreover, the auto sales tax contributes to the overall economic health of the state. The revenue generated from vehicle sales helps fund critical infrastructure projects, such as road maintenance and improvements, benefiting both the automotive industry and the general public.

Future Implications and Tax Trends

As with any tax system, the auto sales tax in Washington State is subject to potential changes and reforms. The state government periodically reviews tax policies to ensure they align with the evolving needs of the community and the economy.

One potential area of focus is the promotion of environmentally friendly vehicles. Washington State has already demonstrated its commitment to sustainability through the sales tax exemption for alternative fuel vehicles. In the future, we may see further incentives or tax breaks for electric vehicles and other green transportation options.

Additionally, as the automotive industry continues to evolve with the rise of electric and autonomous vehicles, the tax system may need to adapt to accommodate these new technologies. This could involve revisiting tax calculations, exemptions, and registration processes to ensure fairness and promote the adoption of innovative transportation solutions.

Staying informed about tax trends and legislative changes is essential for both buyers and industry professionals. Monitoring news and updates from the Washington State Department of Revenue and industry associations can provide valuable insights into any upcoming changes that may impact the auto sales tax landscape.

Conclusion

The Washington State auto sales tax is a vital component of the state’s tax system, providing revenue for essential public services and infrastructure. With a flat rate of 6.5%, Washington offers a moderate tax environment for vehicle purchases, making it an attractive option for car buyers. The tax system includes exemptions for alternative fuel vehicles and considers the weight of recreational vehicles in its calculations.

Understanding the auto sales tax and its implications is crucial for both buyers and the automotive industry. Buyers can make informed decisions by considering the tax burden, while dealerships and manufacturers can adapt their strategies to remain competitive. As the automotive industry continues to evolve, Washington's tax system may undergo further reforms to support sustainability and innovation.

Stay tuned for updates and news regarding the Washington State auto sales tax, as it remains an essential factor in the state's automotive landscape.

How often does Washington State review and update its auto sales tax rates?

+Washington State periodically reviews its tax policies, including the auto sales tax rate. However, major changes to the sales tax rate are relatively rare and typically occur only after careful consideration and public consultation. The state government aims to maintain a stable and predictable tax environment for businesses and residents.

Are there any additional fees or surcharges associated with vehicle purchases in Washington State?

+Yes, in addition to the auto sales tax, there may be other fees and surcharges associated with vehicle purchases in Washington State. These can include registration fees, title fees, and emissions testing fees. It’s important to consider these additional costs when budgeting for a new vehicle.

Can I deduct the auto sales tax from my Washington State income tax return?

+Unfortunately, the auto sales tax in Washington State is not deductible from your income tax return. However, it’s always advisable to consult with a tax professional or refer to the Washington State Department of Revenue’s guidelines for the most accurate and up-to-date information regarding tax deductions and credits.