Great Britain Tax Calculator

The United Kingdom's tax system is a complex and intricate framework that plays a vital role in the nation's economy. The tax landscape is constantly evolving, and understanding its intricacies is crucial for individuals and businesses alike. From income tax to value-added tax (VAT), the UK tax system impacts every citizen and business operation. This article aims to delve into the specifics of the Great Britain Tax Calculator, offering an in-depth analysis and expert insights into this essential tool.

Understanding the Great Britain Tax Calculator

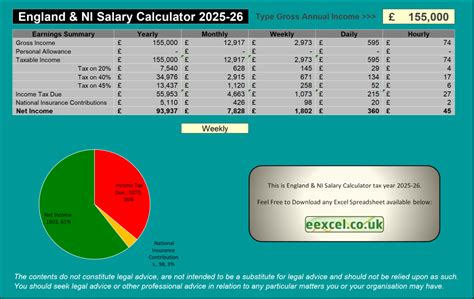

The Great Britain Tax Calculator is a sophisticated online tool designed to assist individuals and businesses in estimating their tax liabilities. It serves as a valuable resource for anyone seeking to comprehend and navigate the UK’s tax system effectively. This calculator, powered by advanced algorithms, provides accurate tax calculations based on various factors, including income, expenses, deductions, and specific tax regulations.

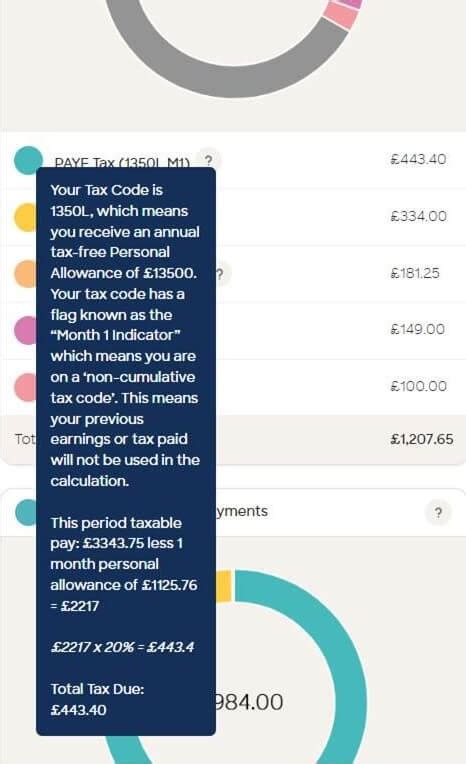

The calculator's user-friendly interface allows users to input their financial details, such as salary, investments, business income, and more. It then applies the relevant tax rates and allowances to provide a comprehensive breakdown of tax liabilities. This includes calculations for income tax, national insurance contributions, and other applicable taxes, ensuring a clear understanding of one's financial obligations.

Key Features and Benefits

- Real-time Tax Calculations: The calculator provides up-to-date tax calculations, ensuring users have the most accurate information based on the current tax year’s regulations.

- Customizable Inputs: Users can input specific financial details, allowing for personalized tax estimates tailored to their unique circumstances.

- Detailed Breakdown: The calculator offers a comprehensive breakdown of tax liabilities, providing insights into income tax, national insurance, and any applicable deductions or allowances.

- Scenario Analysis: Users can experiment with different financial scenarios to understand the impact of various factors on their tax obligations.

- Tax Planning Assistance: By offering accurate tax estimates, the calculator aids in effective tax planning, helping individuals and businesses optimize their financial strategies.

Target Audience and Usage

The Great Britain Tax Calculator is designed with a wide range of users in mind, catering to individuals from various financial backgrounds and businesses of all sizes. Here’s a breakdown of its target audience and usage:

| User Group | Usage |

|---|---|

| Individuals | The calculator is an invaluable tool for individuals seeking to understand their personal tax liabilities. It assists in estimating income tax, national insurance contributions, and any applicable taxes based on salary, investments, and other income sources. |

| Self-Employed Professionals | Self-employed individuals, such as freelancers, consultants, and sole traders, can use the calculator to estimate their business-related tax obligations. It helps determine income tax, VAT (if registered), and national insurance contributions. |

| Small Businesses | Small businesses, including startups and established enterprises, can leverage the calculator to estimate their corporate tax liabilities. It provides insights into corporation tax, VAT, and any applicable business taxes. |

| Accountants and Financial Advisors | Professionals in the accounting and financial advisory fields can utilize the calculator as a reference tool. It aids in providing accurate tax estimates to clients and ensures compliance with the latest tax regulations. |

| Students and Education | Students studying finance, accounting, or related fields can benefit from the calculator as a learning tool. It offers a practical understanding of tax calculations and the impact of various financial factors. |

Performance and Accuracy

The performance and accuracy of the Great Britain Tax Calculator are paramount to its effectiveness. The calculator’s underlying algorithms are meticulously designed and regularly updated to reflect the latest tax regulations. This ensures that users receive precise tax estimates based on the current tax year’s rules and allowances.

Real-World Performance Scenarios

To illustrate the calculator’s performance, let’s consider a few real-world scenarios:

- Salaried Employee: John, a salaried employee with a yearly income of £40,000, uses the calculator to estimate his income tax liability. The calculator provides a detailed breakdown, showing his income tax amount, national insurance contributions, and any applicable personal allowances. This helps John understand his tax obligations and plan his finances accordingly.

- Self-Employed Freelancer: Sarah, a self-employed freelancer, uses the calculator to estimate her business tax liabilities. She inputs her annual income from freelancing, which includes income from various clients. The calculator assists Sarah in determining her income tax, national insurance contributions, and any VAT obligations. This enables her to set aside the necessary funds for tax payments.

- Small Business Owner: Mike, the owner of a small e-commerce business, utilizes the calculator to estimate his corporate tax liability. He inputs his business income, expenses, and any applicable deductions. The calculator provides a clear overview of his corporation tax obligations, helping him budget and plan for future tax payments.

Accuracy and Data Verification

The calculator’s accuracy is a top priority. To ensure precision, the development team regularly conducts thorough testing and validation processes. This includes:

- Cross-referencing tax calculations with official HM Revenue and Customs (HMRC) guidelines and publications.

- Implementing automated testing frameworks to identify and rectify any calculation errors.

- Conducting user acceptance testing to gather feedback and address any user-reported issues.

- Collaborating with tax experts and accountants to validate the calculator's performance and ensure compliance with tax regulations.

Future Developments and Innovations

The developers of the Great Britain Tax Calculator are committed to continuous improvement and innovation. As the UK tax system evolves, the calculator aims to stay at the forefront of tax calculation technology.

Upcoming Features

Some of the exciting features in the pipeline include:

- Enhanced User Experience: The calculator will undergo a redesign to improve usability and accessibility, making it even more user-friendly for individuals and businesses.

- Tax Planning Tools: Integration of advanced tax planning tools will assist users in optimizing their financial strategies, providing insights into tax-efficient investments and savings.

- AI-Assisted Tax Calculations: Leveraging artificial intelligence, the calculator will offer more precise and personalized tax estimates, taking into account individual financial behaviors and preferences.

- Mobile Accessibility: A dedicated mobile app will be developed to ensure users can access the calculator on the go, making tax calculations convenient and accessible anytime, anywhere.

Long-Term Vision

The long-term vision for the Great Britain Tax Calculator is to establish it as the go-to resource for tax calculations in the UK. By continuously enhancing its features and accuracy, the calculator aims to become an integral part of the tax planning process for individuals and businesses.

With a focus on user-centric design and cutting-edge technology, the calculator will provide an intuitive and reliable platform for tax estimation, empowering users to make informed financial decisions.

How accurate are the tax calculations provided by the Great Britain Tax Calculator?

+The tax calculations provided by the Great Britain Tax Calculator are highly accurate. The calculator is regularly updated to reflect the latest tax regulations, ensuring that users receive precise estimates based on current guidelines. However, it’s important to note that the calculator provides estimates and may not account for all specific circumstances. For official tax assessments, it’s recommended to consult with a qualified tax professional.

Can I use the calculator for multiple tax years?

+Yes, the Great Britain Tax Calculator allows users to input financial details for different tax years. This feature is particularly useful for comparing tax liabilities across multiple years or for historical tax analysis. Simply select the appropriate tax year when using the calculator.

Are there any limitations to the calculator’s functionality?

+While the calculator is designed to cover a wide range of tax scenarios, it may not account for extremely complex or niche tax situations. For such cases, it’s advisable to consult with a tax specialist who can provide personalized advice based on your specific circumstances.