Nyc Dept Of Finance Property Taxes

In New York City, property taxes are a crucial component of the city's revenue stream, funding essential services and infrastructure projects. The New York City Department of Finance (DOF) plays a pivotal role in managing and collecting these taxes, ensuring that property owners fulfill their obligations and that the city receives the necessary funds to operate effectively. This article aims to delve into the intricacies of property taxes in NYC, exploring the processes, rates, and implications for both residential and commercial property owners.

Understanding NYC Property Taxes

Property taxes in New York City are determined by the assessed value of a property, which is established by the DOF’s Office of the Tax Commission. This assessment takes into account factors such as the property’s location, size, and recent sales data. The assessed value is then multiplied by the tax rate to calculate the annual property tax liability.

The tax rate, known as the tax levy, is set annually by the New York City Council and is applied uniformly across all properties within a specific tax class. As of [current year], the tax rates for residential and commercial properties in NYC are as follows:

| Tax Class | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Class 1 (Residential) | $[rate] |

| Class 2-4 (Commercial) | $[rate] |

It's important to note that these tax rates can vary from year to year, and the DOF provides an online property tax rate table for the current and previous years, allowing property owners to calculate their estimated tax liability.

Assessed Value Determination

The assessed value of a property is a critical factor in determining property taxes. The DOF conducts periodic revaluations to ensure that assessed values remain accurate and reflect the current real estate market. During a revaluation, the department inspects properties, gathers data on recent sales, and adjusts assessed values accordingly.

Property owners have the right to appeal their assessed value if they believe it is incorrect or unfair. The DOF provides a grievance process that allows property owners to challenge their assessment. It's crucial for property owners to be aware of their rights and the procedures for challenging an assessment to ensure fairness in the tax system.

Tax Bill and Payment Options

The DOF issues property tax bills, also known as tax notices, twice a year. These bills outline the property’s assessed value, tax rate, and the amount due for the current billing period. Property owners have the option to pay their taxes in two installments, with the due dates typically falling in January and July.

The DOF offers various payment methods to accommodate different preferences and needs. Property owners can pay their taxes online through the DOF website, by phone, or in person at designated payment centers. Additionally, the department accepts payments by mail, ensuring flexibility and convenience for taxpayers.

For property owners facing financial difficulties, the DOF provides information on tax payment options, including installment plans and hardship programs. These options aim to assist property owners in maintaining compliance with their tax obligations while managing financial challenges.

The Role of the NYC Department of Finance

The DOF is the administrative arm responsible for managing and collecting property taxes in New York City. The department’s responsibilities extend beyond tax collection, as it also maintains records, enforces regulations, and provides valuable resources and services to property owners.

Tax Assessment and Collection

The Office of the Tax Commission within the DOF is tasked with assessing property values and determining tax liabilities. This office ensures that assessments are accurate and fair, taking into account factors such as property characteristics, location, and market trends. The Tax Commission also handles grievances and appeals, providing a mechanism for property owners to challenge assessments.

The DOF's Bureau of Tax Collection is responsible for collecting property taxes. This bureau ensures that tax payments are processed efficiently and that property owners receive timely notices and reminders. The bureau also works with taxpayers to resolve any issues or concerns related to their tax obligations.

Property Records and Information

The DOF maintains comprehensive records on all properties within New York City. These records include details such as ownership information, assessment data, and tax payment history. Property owners can access their records through the NYC Property Information System (MAP), which provides valuable information about their properties.

The DOF also offers a Property Tax Lookup Tool, allowing property owners and interested parties to search for tax information on specific properties. This tool provides access to assessment details, tax rates, and payment history, facilitating transparency and ease of access to critical property data.

Resources and Support for Property Owners

The DOF understands the complexities of property ownership and taxation, and as such, provides a range of resources and support to assist property owners. The department’s website offers an extensive property tax guide, covering topics such as tax rates, assessments, payments, and appeals. This guide serves as a comprehensive resource for property owners, helping them navigate the tax system effectively.

Additionally, the DOF conducts outreach and education initiatives, hosting workshops and seminars to inform property owners about their rights, responsibilities, and available resources. These initiatives aim to foster a better understanding of the property tax system and encourage compliance.

Challenges and Future Implications

While the DOF’s property tax system in NYC is well-established, it faces certain challenges and considerations that impact property owners and the city’s finances.

Property Value Fluctuations

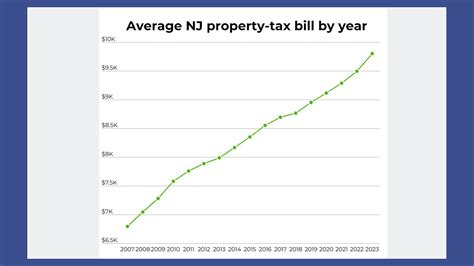

The real estate market in New York City is dynamic, with property values experiencing fluctuations over time. These fluctuations can lead to disparities in tax liabilities, as property taxes are based on assessed values. When property values increase rapidly, some property owners may face significant tax increases, while others may benefit from lower assessments.

To address this challenge, the DOF employs periodic revaluations to ensure that assessed values remain accurate and fair. However, the timing and frequency of these revaluations can impact property owners differently, depending on the timing of their property's assessment.

Compliance and Enforcement

Ensuring compliance with property tax obligations is a critical aspect of the DOF’s work. The department must strike a balance between encouraging compliance and enforcing regulations. Non-compliance with tax obligations can lead to penalties, interest charges, and even legal action.

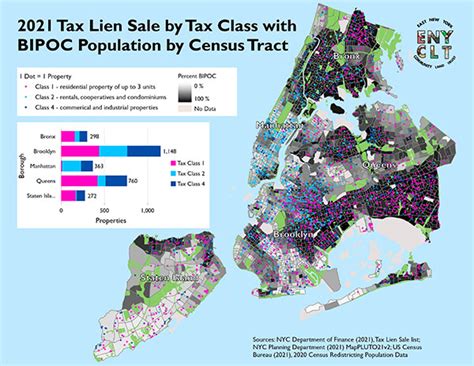

The DOF's enforcement efforts focus on educating property owners about their responsibilities and providing support to assist them in meeting their tax obligations. However, for those who intentionally evade taxes or fail to comply, the department has the authority to take legal action, including liens and property seizures.

Future Trends and Innovations

The DOF is committed to staying abreast of technological advancements and industry best practices to enhance its operations. The department is exploring ways to improve the property tax system, including the potential for online grievance filing, enhanced data analytics for more accurate assessments, and streamlined payment processes.

Furthermore, the DOF is actively involved in discussions and initiatives to address housing affordability and equity concerns in New York City. These efforts aim to ensure that the property tax system remains fair and accessible to all property owners, regardless of their financial circumstances.

Conclusion

Understanding and navigating the property tax system in New York City is essential for both residential and commercial property owners. The NYC Department of Finance plays a critical role in managing and collecting property taxes, ensuring that the city receives the necessary revenue to fund vital services and infrastructure. By staying informed about tax rates, assessments, and payment options, property owners can effectively manage their tax obligations and contribute to the city’s financial stability.

As the DOF continues to innovate and adapt, property owners can expect a more efficient and transparent tax system. With access to valuable resources and support, property owners can navigate the complexities of property taxes with confidence, knowing that their contributions are essential to the growth and development of New York City.

How often are property taxes assessed in NYC?

+Property taxes in NYC are assessed annually. The Department of Finance conducts periodic revaluations to ensure that assessed values remain accurate and reflect the current real estate market.

Can property owners appeal their assessed value in NYC?

+Yes, property owners have the right to appeal their assessed value if they believe it is incorrect or unfair. The Department of Finance provides a grievance process that allows property owners to challenge their assessment and seek a review.

What payment options are available for property taxes in NYC?

+The Department of Finance offers various payment options, including online payments, phone payments, in-person payments at designated centers, and mail payments. Property owners can also explore installment plans and hardship programs if they face financial difficulties.

How can property owners stay informed about tax rates and changes in NYC?

+Property owners can stay informed by regularly visiting the Department of Finance’s website, which provides updates on tax rates, assessments, and other relevant information. The DOF also offers email alerts and notifications to keep taxpayers informed about important changes and deadlines.

What resources does the NYC Department of Finance offer to support property owners?

+The NYC Department of Finance provides a range of resources, including a comprehensive property tax guide, online tools for accessing property records and tax information, and educational workshops and seminars. These resources aim to assist property owners in understanding their rights, responsibilities, and available support.