Sales Tax For Vehicles In Arkansas

When purchasing a vehicle in Arkansas, it is essential to understand the state's sales tax laws to ensure a smooth and compliant transaction. The sales tax on vehicles can significantly impact the overall cost, so being well-informed is crucial for both buyers and sellers. This article aims to provide a comprehensive guide to the sales tax regulations for vehicles in Arkansas, covering various scenarios and offering valuable insights for anyone involved in the automotive sales process.

Understanding Arkansas Sales Tax for Vehicles

Arkansas, like many other states, imposes a sales tax on the purchase of vehicles. This tax contributes to the state’s revenue and is used to fund various public services and infrastructure. Understanding the intricacies of this tax is vital to avoid any legal issues and financial surprises during the vehicle acquisition process.

The Arkansas Sales Tax Rate

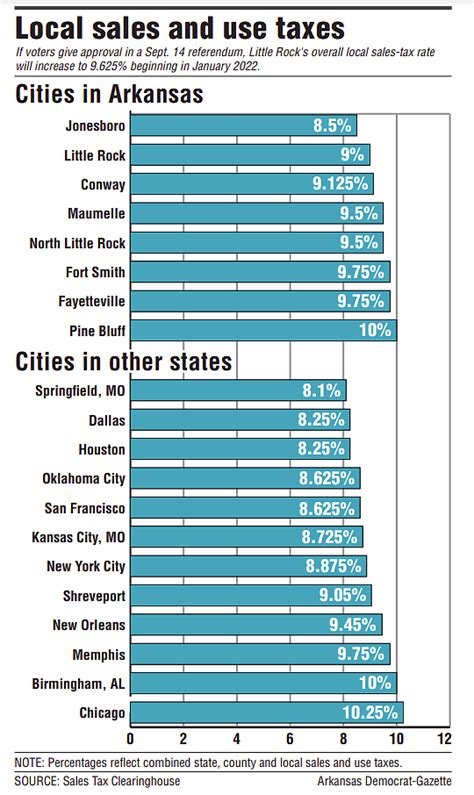

The general sales tax rate in Arkansas is 6.5%, which applies to most tangible personal property, including vehicles. However, it is important to note that the tax rate can vary depending on the county or city where the vehicle is purchased. Some counties or municipalities have additional local sales taxes, which can increase the total tax rate.

| County | Sales Tax Rate |

|---|---|

| Benton County | 7.0% |

| Pulaski County | 8.0% |

| Washington County | 7.25% |

| Faulkner County | 6.75% |

| More counties... | Varies |

It is advisable to check the specific sales tax rate for the county where the vehicle purchase will take place. The Arkansas Department of Finance and Administration provides a comprehensive list of local sales tax rates for easy reference.

Calculating Sales Tax on Vehicles

The sales tax on a vehicle is calculated based on the purchase price. Here’s a simple formula to estimate the sales tax:

Sales Tax = Purchase Price x Sales Tax Rate

For example, if you purchase a vehicle for $20,000 in a county with a 7% sales tax rate, the sales tax would be:

Sales Tax = $20,000 x 0.07 = $1,400

So, the total cost of the vehicle would be $20,000 plus the $1,400 sales tax, resulting in a final price of $21,400.

Exemptions and Special Considerations

While the general sales tax rate applies to most vehicle purchases, there are certain exemptions and special considerations in Arkansas. These include:

- Trade-Ins: When trading in a vehicle, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that the tax is applied only on the net amount.

- Military Personnel: Active-duty military personnel stationed in Arkansas may be eligible for a sales tax exemption on the purchase of a vehicle. They must provide proper documentation to qualify.

- Vehicle Type: Certain types of vehicles, such as electric or hybrid cars, may be eligible for tax credits or reduced sales tax rates. These incentives aim to promote environmentally friendly transportation options.

- Dealer Sales Tax License: Automotive dealerships often have a sales tax license, which allows them to collect and remit sales tax on behalf of the buyer. This simplifies the process and ensures compliance.

It is crucial to consult with a tax professional or the Arkansas Department of Finance and Administration to understand the specific exemptions and requirements applicable to your situation.

Registration and Title Transfer

After purchasing a vehicle in Arkansas, the next step is to register it and obtain a title. The sales tax payment is typically a part of this process. Here’s a breakdown of the registration and title transfer procedure:

Registration Process

To register a vehicle in Arkansas, you will need the following documents:

- Proof of insurance

- Title or bill of sale

- Emission certificate (if applicable)

- Proof of identity and residency

- Payment for registration fees and sales tax

The registration fees and sales tax can be paid at the Arkansas Office of Motor Vehicle, either in person or online. The sales tax paid during registration is applied to the total amount owed, including any additional fees.

Title Transfer

When purchasing a used vehicle from a private seller, you will need to obtain a title transfer. The seller must sign the title over to you, and you must complete the necessary forms provided by the Arkansas Office of Motor Vehicle. The sales tax is typically included in the registration process, so it is not a separate payment.

Online Registration and Sales Tax Payment

Arkansas offers an online registration and titling system, known as the e-Services, which allows for convenient and efficient vehicle registration and sales tax payment. This service is available for both new and used vehicle purchases.

Sales Tax for Out-of-State Vehicle Purchases

If you purchase a vehicle from outside Arkansas, you will still need to pay sales tax when registering it in the state. The sales tax is based on the purchase price or the vehicle’s fair market value, whichever is higher. Here’s a breakdown of the process:

Vehicle Purchased from a Dealer

If you buy a vehicle from an out-of-state dealer, the dealer will typically provide you with a bill of sale or other documentation. You will need to bring this documentation to the Arkansas Office of Motor Vehicle to register the vehicle and pay the sales tax.

Vehicle Purchased from a Private Party

When purchasing a vehicle from a private party in another state, you will need to obtain a bill of sale or other proof of purchase. This document should include the purchase price, vehicle details, and the seller’s signature. Upon registering the vehicle in Arkansas, you will pay the sales tax based on the purchase price or fair market value.

Fair Market Value Determination

In cases where the purchase price is not available or is significantly lower than the vehicle’s actual value, the Arkansas Office of Motor Vehicle may determine the fair market value. This is typically done using resources like Kelly Blue Book or other reputable valuation tools. The sales tax is then calculated based on this fair market value.

Sales Tax Refunds and Adjustments

In certain situations, you may be eligible for a sales tax refund or adjustment. Here are some common scenarios:

Trade-In Adjustment

If you trade in a vehicle when purchasing a new one, you may be eligible for a sales tax adjustment. The sales tax paid on the trade-in vehicle can be applied to the sales tax owed on the new vehicle, reducing the overall tax liability.

Military Deployment

Active-duty military personnel who are deployed out of state may be eligible for a sales tax refund on their vehicle purchase. This refund is granted to compensate for the additional tax burden incurred during deployment. The refund process involves submitting the necessary documentation to the Arkansas Department of Finance and Administration.

Vehicle Returned or Sold

If you purchase a vehicle and later return or sell it within a certain timeframe, you may be eligible for a sales tax refund. This scenario typically applies to vehicles purchased from dealerships under specific circumstances. The refund process involves providing proof of the vehicle’s return or sale and submitting the necessary forms.

Frequently Asked Questions

Can I deduct sales tax on my vehicle purchase from my taxes?

+In most cases, sales tax on vehicle purchases is not deductible for federal income tax purposes. However, certain states may offer deductions or credits for specific circumstances. It is advisable to consult with a tax professional or refer to the state’s tax guidelines.

What if I don’t pay the sales tax when registering my vehicle?

+Failing to pay the sales tax when registering a vehicle can result in penalties and interest charges. It is important to pay the sales tax in full to avoid legal consequences and ensure compliance with Arkansas tax laws.

Are there any sales tax holidays for vehicle purchases in Arkansas?

+Arkansas does not currently have specific sales tax holidays for vehicle purchases. However, the state may offer sales tax holidays for other categories of items during certain periods. It is recommended to check the Arkansas Department of Finance and Administration’s website for any updates or announcements.