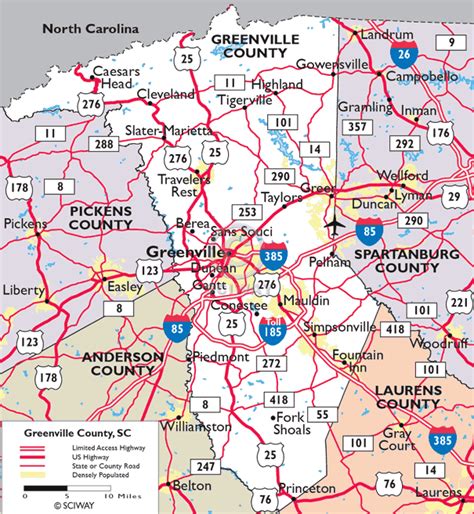

Greenville County Tax Collector

The Greenville County Tax Collector's Office plays a vital role in the administration and collection of taxes within Greenville County, South Carolina. This department ensures that residents and businesses meet their tax obligations, thereby contributing to the county's financial stability and the provision of essential public services. This article delves into the operations, services, and impact of the Greenville County Tax Collector's Office, offering an in-depth analysis for residents and businesses alike.

The Role and Responsibilities of the Greenville County Tax Collector

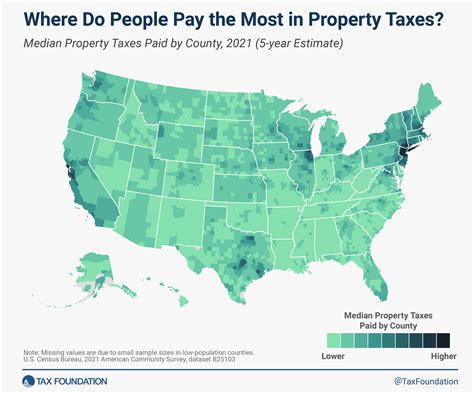

The primary function of the Greenville County Tax Collector is to efficiently manage and enforce tax collection processes. This involves overseeing property taxes, personal property taxes, vehicle taxes, and other applicable taxes within the county. The office is responsible for ensuring that taxpayers receive accurate tax bills, providing convenient payment options, and facilitating timely tax payments.

In addition to tax collection, the Tax Collector's Office also handles a range of related services. These include:

- Tax Assessment and Appeals: The office works closely with the Greenville County Assessor's Office to determine property values for tax purposes. Taxpayers can also file appeals with the Tax Collector's Office if they believe their property assessment is inaccurate.

- Vehicle Registration and Titling: Residents can register and title their vehicles through the Tax Collector's Office, which handles the necessary paperwork and processes associated with vehicle ownership.

- Taxpayer Assistance: The office provides assistance to taxpayers who have questions or need help with their tax obligations. This includes offering guidance on payment plans, tax exemptions, and other relevant matters.

- Online Services: Greenville County Tax Collector's Office has embraced technology, offering online services for taxpayers to access their account information, view tax bills, and make payments conveniently.

Tax Collection Process and Payment Options

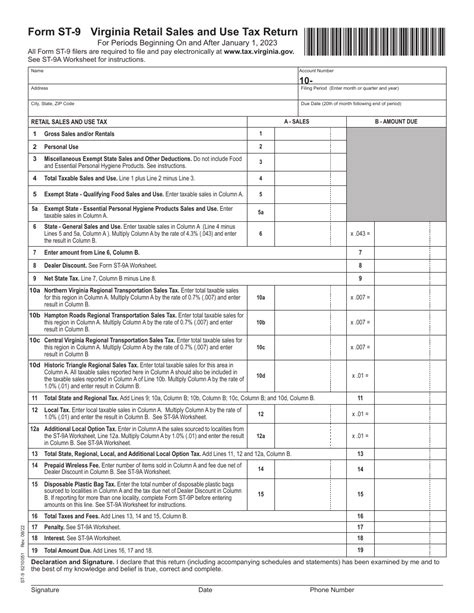

The tax collection process in Greenville County is designed to be efficient and taxpayer-friendly. Taxpayers receive their tax bills by mail, outlining the amount due and the due date. The Tax Collector’s Office offers a range of payment options to accommodate different preferences and circumstances:

- Online Payments: Taxpayers can make secure online payments through the Greenville County website using a credit card, debit card, or electronic check.

- In-Person Payments: Payments can be made in person at the Tax Collector's Office during regular business hours. Accepted forms of payment include cash, check, money order, and credit/debit cards.

- Mail-In Payments: Taxpayers can mail their payments to the Tax Collector's Office. It is essential to include the remittance slip from the tax bill to ensure proper credit.

- Payment Drop Boxes: For added convenience, the Tax Collector's Office provides payment drop boxes at various locations around Greenville County. These boxes are secure and accessible 24/7, allowing taxpayers to drop off their payments at their convenience.

To ensure timely tax payments, the Tax Collector's Office provides a Taxpayer Lookup Tool on its website. This tool allows taxpayers to search for their account information, view their tax bills, and make payments online. The office also sends out reminder notices for upcoming tax deadlines, helping taxpayers stay informed and avoid late fees.

| Tax Type | Due Date |

|---|---|

| Property Taxes | October 15 |

| Vehicle Taxes | June 30 |

| Personal Property Taxes | July 15 |

Tax Exemptions and Discounts

Greenville County offers several tax exemptions and discounts to eligible taxpayers. These include:

- Homestead Exemption: Greenville County residents who own and occupy their primary residence may be eligible for a property tax exemption. This exemption reduces the taxable value of the property, resulting in lower property taxes.

- Senior Citizen Discount: Senior citizens aged 65 and older may qualify for a discount on their property taxes. The discount is based on the taxpayer's income and property value.

- Veteran's Exemption: Veterans who meet certain criteria may be eligible for a property tax exemption. This exemption is available for both disabled and non-disabled veterans.

- Early Payment Discount: Taxpayers who pay their property taxes in full by a specified early payment deadline may receive a discount on their tax bill.

Performance and Impact

The Greenville County Tax Collector’s Office has a strong track record of effective tax collection and taxpayer services. According to the latest annual report, the office collected over $1.2 billion in taxes during the fiscal year, with a 99% collection rate for property taxes. This efficient tax collection process ensures that Greenville County has the financial resources necessary to fund critical public services and infrastructure projects.

The Tax Collector's Office has also received recognition for its innovative use of technology to enhance taxpayer services. In a recent survey, 92% of taxpayers expressed satisfaction with the online payment system, citing its convenience and ease of use. The office continues to explore new ways to improve its services, with a focus on streamlining processes and providing a positive taxpayer experience.

Community Engagement and Outreach

Beyond its core tax collection responsibilities, the Greenville County Tax Collector’s Office actively engages with the community. The office participates in local events and initiatives, providing information and assistance to taxpayers. This community engagement helps build trust and ensures that taxpayers understand their rights and obligations.

The Tax Collector's Office also collaborates with local schools and community organizations to educate young people about financial responsibility and tax awareness. By fostering financial literacy at a young age, the office aims to create a more informed and engaged taxpayer base in the future.

Future Initiatives and Challenges

Looking ahead, the Greenville County Tax Collector’s Office plans to continue modernizing its operations to meet the evolving needs of taxpayers. Key initiatives include:

- Enhanced Online Services: The office aims to further develop its online platform, offering additional services and features to make tax management more convenient and efficient.

- Mobile App Development: Greenville County Tax Collector's Office is exploring the development of a mobile app to provide taxpayers with on-the-go access to their account information and payment options.

- Data Security Upgrades: With the increasing importance of data security, the office is investing in advanced security measures to protect taxpayer information and ensure compliance with relevant regulations.

Despite these ambitious plans, the Tax Collector's Office also faces several challenges. These include keeping up with changing tax laws and regulations, adapting to evolving taxpayer expectations, and managing limited resources effectively. However, with a dedicated team and a focus on continuous improvement, the office is well-positioned to overcome these challenges and continue delivering exceptional taxpayer services.

Conclusion

The Greenville County Tax Collector’s Office plays a critical role in the financial health and stability of the county. Through efficient tax collection, innovative services, and community engagement, the office ensures that taxpayers can meet their obligations while also receiving the support and assistance they need. As Greenville County continues to grow and evolve, the Tax Collector’s Office will remain a vital partner in the community’s financial well-being.

What is the deadline for property tax payments in Greenville County?

+Property tax payments in Greenville County are due on October 15th each year.

Can I make tax payments online?

+Yes, the Greenville County Tax Collector’s Office offers online payment options through its website. Taxpayers can pay using a credit card, debit card, or electronic check.

Are there any tax exemptions or discounts available in Greenville County?

+Yes, Greenville County offers several tax exemptions and discounts, including the Homestead Exemption, Senior Citizen Discount, Veteran’s Exemption, and an Early Payment Discount.

How can I reach the Greenville County Tax Collector’s Office for assistance?

+You can contact the Greenville County Tax Collector’s Office by phone at (864) 467-7275 or visit their website for more information and online services.