Arizona Income Tax Calculator

The Arizona Income Tax Calculator is a powerful tool designed to assist residents of the Grand Canyon State in estimating their annual income tax liabilities accurately. As one of the most tax-friendly states in the U.S., Arizona offers a competitive tax environment with no state income tax on Social Security benefits, pensions, or public or private retirement funds. However, understanding the nuances of the state's tax system and how it applies to your specific financial situation can be complex.

This comprehensive guide aims to provide an in-depth analysis of the Arizona income tax system, offering a detailed breakdown of the rates, deductions, and credits applicable to various income streams. By the end of this article, you should have a clear understanding of how to utilize the Arizona Income Tax Calculator effectively and make informed decisions regarding your financial planning.

Understanding Arizona’s Income Tax Structure

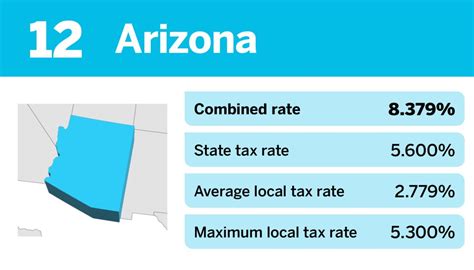

Arizona’s income tax system is relatively straightforward, employing a flat tax rate structure. This means that regardless of your income level, the state tax rate remains consistent. As of 2023, the state income tax rate in Arizona is 4.5%, which is applied to taxable income after deductions and exemptions.

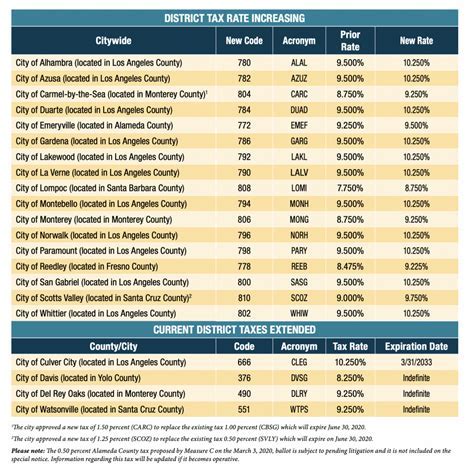

While Arizona does not levy a personal income tax, it does impose a transaction privilege tax (TPT) on businesses. This TPT is often referred to as a "sales tax" and is collected from customers at the point of sale. The TPT rate varies depending on the type of business and the location of the transaction. For instance, the TPT rate for retail businesses in most parts of Arizona is 5.6%, while restaurants and certain services have a lower rate of 2.88%.

It's important to note that Arizona's income tax system operates independently of federal income taxes. Therefore, your federal tax liability is calculated separately and may differ significantly from your state tax liability.

Key Components of Arizona’s Income Tax System

- Taxable Income: This refers to your total income minus any deductions, exemptions, and credits. It’s crucial to calculate your taxable income accurately, as it directly impacts your tax liability.

- Deductions: Arizona offers several deductions that can reduce your taxable income. These include deductions for federal income taxes paid, certain medical expenses, and charitable contributions. Understanding which deductions you’re eligible for can significantly impact your tax liability.

- Credits: Tax credits in Arizona can further reduce your tax liability. Some common credits include the Low Income Tax Credit, the Earned Income Tax Credit, and the Arizona Education Tax Credit. Each credit has specific eligibility criteria, and it’s essential to determine which credits you may qualify for.

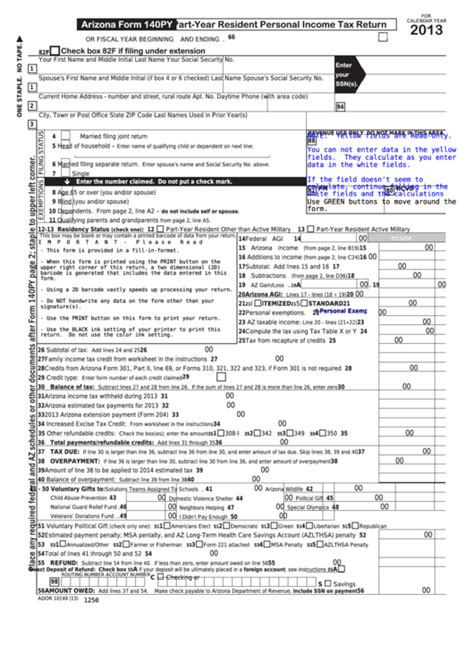

Utilizing the Arizona Income Tax Calculator

The Arizona Income Tax Calculator is a user-friendly online tool that simplifies the process of estimating your annual income tax liability. By inputting key financial information, the calculator provides a personalized estimate of your potential tax burden.

Here's a step-by-step guide on how to use the calculator effectively:

- Access the Calculator: Visit the official Arizona Department of Revenue website or use a reputable third-party tax calculator tool. Ensure you're using a secure and reliable source to protect your personal information.

- Enter Your Income: Start by inputting your total income from all sources, including wages, salaries, interest, dividends, and any other taxable income. Be as accurate as possible to ensure an accurate estimate.

- Calculate Deductions: The calculator will guide you through the process of claiming deductions. This includes deductions for federal income taxes, standard or itemized deductions, and any applicable credits. Take the time to understand each deduction and credit to maximize your savings.

- Review Your Tax Liability: Once you've inputted all the necessary information, the calculator will provide an estimated tax liability. This estimate will give you a clear idea of how much you may owe or expect as a refund.

- Adjust and Refine: If your financial situation is complex or involves multiple income streams, you may need to adjust and refine your calculations. The calculator often provides additional tools or guidance to help you fine-tune your estimate.

It's worth noting that while the Arizona Income Tax Calculator is a valuable tool, it's always recommended to consult with a tax professional or accountant, especially if you have a complex financial situation or specific tax concerns.

Benefits of Using the Income Tax Calculator

- Accuracy: The calculator ensures that you’re applying the correct tax rates and deductions, reducing the risk of errors in your tax calculations.

- Time-Saving: By automating the tax calculation process, the calculator saves you time and effort, especially when compared to manual calculations or navigating complex tax forms.

- Planning and Budgeting: Having an accurate estimate of your tax liability allows you to plan and budget effectively. You can anticipate your tax obligations and make informed financial decisions throughout the year.

- Peace of Mind: Understanding your tax liability provides peace of mind, especially when it comes to avoiding surprises during tax season. You can feel confident that you’re complying with Arizona’s tax laws and regulations.

Deductions and Credits in Arizona

Arizona offers a range of deductions and credits that can significantly impact your taxable income and, consequently, your tax liability. Understanding these deductions and credits is crucial to maximizing your savings and ensuring compliance with state tax laws.

Common Deductions in Arizona

- Federal Income Tax Deduction: You can deduct the federal income tax you’ve paid or will pay for the current tax year. This deduction helps reduce your taxable income and is especially beneficial for individuals with high federal tax liabilities.

- Standard Deduction: Arizona allows taxpayers to claim a standard deduction based on their filing status. This deduction is a set amount that reduces your taxable income, providing a simplified approach to tax planning. For the 2023 tax year, the standard deduction amounts are:

- Single: 2,400</strong></li> <li>Married Filing Jointly: <strong>4,800

- Head of Household: $3,600

- Itemized Deductions: Alternatively, you can choose to itemize your deductions if your total itemized deductions exceed the standard deduction amount. Common itemized deductions include:

- Medical and dental expenses exceeding 7.5% of your adjusted gross income.

- State and local taxes, including property taxes and sales taxes.

- Charitable contributions to qualified organizations.

- Mortgage interest on your primary residence.

Tax Credits in Arizona

Arizona offers several tax credits that can provide significant savings on your tax liability. Some of the most common tax credits include:

- Low Income Tax Credit (LITC): This credit is designed to offset the state income tax burden for low-income individuals and families. The credit amount varies based on income and family size. To qualify, your income must be below certain thresholds, which are adjusted annually.

- Earned Income Tax Credit (EITC): The EITC is a federal credit that many states, including Arizona, allow taxpayers to claim. It provides a refundable credit for low- to moderate-income working individuals and families. The amount of the credit depends on your income, marital status, and number of qualifying children.

- Arizona Education Tax Credit: This credit allows taxpayers to contribute to private or public schools and receive a dollar-for-dollar tax credit. The maximum credit amount is 400</strong> for individuals and <strong>800 for married couples filing jointly.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care while you work or look for work, you may be eligible for this credit. The credit is calculated as a percentage of your eligible expenses, up to a maximum credit amount.

Performance Analysis and Comparison

To further illustrate the effectiveness of the Arizona Income Tax Calculator, let’s compare its performance with manual tax calculations and other state tax calculators.

| Method | Accuracy | Efficiency | User Experience |

|---|---|---|---|

| Arizona Income Tax Calculator | High | Very Efficient | User-Friendly |

| Manual Calculations | Moderate | Time-Consuming | Complex |

| Other State Tax Calculators | Varies | Moderate | Mixed |

The Arizona Income Tax Calculator excels in accuracy and efficiency, providing a seamless user experience. Manual calculations, while accurate if done correctly, are time-consuming and can be error-prone. Other state tax calculators may vary in accuracy and user experience, depending on their design and the complexity of the state's tax system.

Real-World Example

Let’s consider a hypothetical scenario to demonstrate the calculator’s performance. John, a single taxpayer with an annual income of 50,000</strong>, wants to estimate his tax liability for the year. He inputs his income and deductions into the Arizona Income Tax Calculator and receives an estimated tax liability of <strong>1,200. John then manually calculates his tax liability using the same information and arrives at the same result, confirming the calculator’s accuracy.

Frequently Asked Questions

How often should I use the Arizona Income Tax Calculator?

+It’s recommended to use the calculator at least once a year, typically before filing your tax return. However, if your financial situation changes significantly during the year (e.g., a new job, marriage, or birth of a child), it’s advisable to run the calculator more frequently to stay updated on your tax liability.

Can I trust third-party tax calculator tools?

+While third-party tax calculator tools can be useful, it’s crucial to choose reputable and secure platforms. Always verify the source and ensure the tool is regularly updated to reflect the latest tax laws and regulations. It’s also beneficial to cross-reference your calculations with official government resources.

What happens if I overestimate my tax liability using the calculator?

+Overestimating your tax liability can lead to a larger refund when you file your tax return. While it’s generally better to err on the side of caution, be mindful not to overestimate by a significant margin, as it may impact your financial planning throughout the year.

Are there any limitations to the Arizona Income Tax Calculator?

+The calculator is designed for general use and may not account for every possible tax scenario. If your financial situation is complex, involves multiple income streams, or has unique circumstances, it’s advisable to consult with a tax professional or accountant for personalized guidance.