Understanding the Financial Impact of Colorado Estate Tax on Your Wealth

In the intricate maze of wealth management and estate planning, few topics invoke as much scrutiny and nuance as the estate tax landscape—particularly within Colorado, where state-specific legislation intertwines with federal policies to shape the financial destiny of high-net-worth individuals. The question that beckons: how does Colorado's unique estate tax regime influence the transfer of wealth, and what strategic considerations should residents heed to optimize their legacy preservation while minimizing tax exposure? This inquiry unravels layers of legal, fiscal, and strategic dimensions, warranting a thorough investigative exploration that deciphers complex statutes, economic implications, and expert insights, ultimately guiding individuals in making informed, future-proof decisions about wealth transfer.

Deciphering Colorado’s Estate Tax: A State-Level Perspective

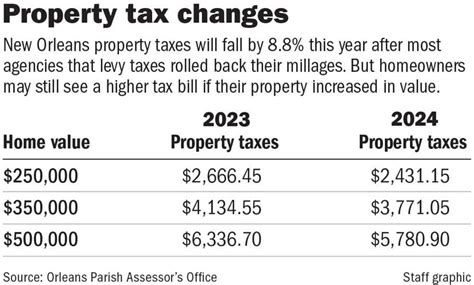

While many are familiar with the federal estate tax system—imposing a tax on estate values exceeding approximately $12.92 million in 2023—state-level estate taxes create an additional layer of complexity, particularly in jurisdictions like Colorado. Unlike the federal framework, which taxes estates at the point of transfer before inheritance, Colorado’s laws historically have been less aggressive. Yet, understanding the precise scope of Colorado’s estate tax structure is crucial for effective planning.

As of the latest legislative updates, Colorado does not levy a traditional estate tax. Instead, it employs mechanisms such as the inheritance tax, which, under recent law, has been phased out or rendered irrelevant through legislative amendments. However, recent proposals and legislative discussions hint at potential changes or alternative methods of wealth transfer taxation that could emerge in the future, prompting vigilance among estate planners and wealthy residents.

Moreover, Colorado residents are subject to federal estate tax thresholds, but state-specific nuances—like the absence of a standalone Colorado estate or inheritance tax—mean that many of the anticipated state-level liabilities have been effectively nullified or minimized. That said, understanding the distinction and staying updated on legislative shifts remains vital for ensuring compliance and strategic advantage.

Historical Context and Legislative Developments

Historically, Colorado had an inheritance tax that taxed transfers based on the relationship between the decedent and the beneficiary, with rates reaching up to 4.55%. The Taxpayer Relief Act of 1997 phased out many state inheritance taxes, and Colorado subsequently aligned its policies accordingly. Despite this, ongoing debates about wealth and estate taxation—amplified by national discussions around wealth inequality—have led to renewed interest in state-level taxes, and Colorado’s legislative bodies continue to evaluate potential revenue measures that could impact estate transfer strategies.

Recent legislative efforts have focused less on direct estate taxes and more on tightening regulations related to estate valuation, gift taxes, and intergenerational wealth transfer transparency. These nuances underscore the importance of tailored legal advice, particularly for high-net-worth individuals with complex estate portfolios.

| Relevant Category | Substantive Data |

|---|---|

| Federal estate tax exemption (2023) | $12.92 million per individual, indexed annually for inflation |

| Colorado inheritance tax | Phased out; currently no applicable state inheritance tax |

| Estimated impact on estates exceeding exemption | Federal liabilities apply; potential for new state taxes if legislation changes |

Financial Implications of Colorado’s Framework on Wealth Transfer

The absence of a state estate or inheritance tax in Colorado, at least for now, presents a strategic advantage for affluent individuals. Yet, the overall financial impact cannot be viewed solely through the lens of tax liabilities; it encompasses considerations like asset valuation, liquidity needs, and intergenerational transfer strategies.

For estates exceeding federal exemption levels, the burden primarily materializes at the federal tier, where estate tax rates can reach up to 40%. Wealthy Colorado residents, therefore, often focus on federal planning instruments—such as irrevocable trusts, gifting strategies, and valuation discounts—to mitigate liabilities effectively. The absence of additional state taxes simplifies some aspects but does not eliminate the need for meticulous planning.

Furthermore, estate planning now hinges heavily on non-tax factors, including asset protection, business succession, and philanthropic goals. As estate assets diversify into real estate, business interests, and intangible assets, comprehensive valuation becomes complex, demanding expert appraisals and advanced legal arrangements.

Impacts of Legislative Trends and Future-Proofing Wealth

Recent policy proposals—although not yet enacted—have rekindled discussions about instituting progressive estate or inheritance taxes in Colorado, potentially with thresholds lower than federal levels. If such legislation passes, wealth transfer strategies would need immediate recalibration. Anticipating these changes involves stress-testing current estate plans against possible legislative scenarios, emphasizing flexibility and resilience.

One promising approach involves establishing trust structures in states with favorable tax treatments, combined with gifting strategies designed to leverage the federal exemption effectively. Wealthy individuals should also explore the use of life insurance policies as liquidity buffers, ensuring smooth asset transfer without forced liquidation.

| Potential Future Legislation | Expected Implications |

|---|---|

| Lower estate or inheritance tax thresholds | Increased tax liabilities for estates previously below federal exemption limits |

| Progressive tax rates on wealth transfers | Necessity for ongoing estate restructuring and asset diversification |

| Enhanced transparency and valuation rules | More rigorous documentation and valuation practices necessary |

Practical Strategies for Wealth Preservation in Colorado

Despite the current absence of a state estate tax, wealthy Colorado residents can adopt a myriad of practical planning tactics to optimize wealth transfer and minimize tax burdens. These include:

- Advanced Gifting Strategies: Leveraging federal gift exclusions (e.g., $17,000 per recipient in 2023) to transfer wealth incrementally, reducing taxable estate size.

- Establishing Trusts: Utilizing irrevocable trusts for asset protection, estate liquidity, and control, especially in jurisdictions with favorable trust laws.

- Business Succession Planning: Structuring ownership and exit strategies for family businesses to minimize transfer taxes and ensure continuity.

- Life Insurance Policies: Funding estate liquidity needs, paying potential estate taxes, and providing heirs with tax-free inheritance.

- Asset Valuation and Diversification: Conducting professional appraisals to optimize valuation discounts and diversify holdings to mitigate concentration risks.

Consulting with Estate Planning Professionals

Implementing these strategies effectively demands collaboration with estate attorneys, financial planners, and tax advisors specialized in Colorado law. Their expertise facilitates customized planning aligned with evolving laws, personal goals, and estate complexity—fostering resilience against legislative changes and market fluctuations.

| Key Strategies | Outcome |

|---|---|

| Incremental Gifting | Reduces estate size, leverages federal exclusions |

| Trust Structures | Provides control, protection, and potential tax advantages |

| Insurance Policies | Ensures liquidity, minimizes forced asset sale |

| Asset Diversification | Mitigates concentration risk and enhances valuation flexibility |

Key Points

- Colorado’s current legislative stance offers a favorable environment for estate transfer without state estate tax liabilities.

- High-net-worth individuals must proactively deploy sophisticated planning tools to hedge against future legislation and optimize wealth transfer.

- Strategic asset placement, valuation, and legal structuring are central to minimizing fiscal burdens and safeguarding family legacy.

- Ongoing legal and legislative vigilance is essential to adapt plans in response to emerging policies.

- Collaborating with experienced professionals ensures comprehensive planning tailored to unique family circumstances and goals.

Does Colorado currently impose an estate or inheritance tax?

+No, Colorado does not currently impose a standalone estate or inheritance tax. The state phased out its inheritance tax law in the late 20th century, positioning itself as one of the more tax-favorable states for estate transfer planning.

How does federal estate tax affect Colorado residents?

+Federal estate tax applies to estates exceeding the exemption threshold—$12.92 million in 2023—regardless of state residence. For Colorado residents with estates below this limit, federal liabilities are minimal or nonexistent, but planning should still consider possible legislative changes.

What planning strategies are advisable to minimize tax impact?

+Implementing gifting strategies, establishing trusts, utilizing life insurance, and diversifying assets are proven methods. Working with qualified estate professionals ensures strategies are tailored, compliant, and adaptable to future laws.

Could future legislation pose a threat to current planning?

+Yes, legislative proposals may revisit estate and inheritance taxes, potentially lowering thresholds or increasing rates. Maintaining flexible, update-ready estate plans is critical for resilience against such changes.