Understanding Ohio Car Sales Tax: How It Affects Your Purchase

Securing a vehicle in Ohio isn’t merely a transaction of selecting a make, model, and destination; it embodies a complex interplay of state regulations, tax obligations, and economic considerations that can significantly influence the total cost of ownership. For buyers, understanding the nuances of Ohio’s car sales tax—how it is calculated, when it applies, and its broader implications—is essential to navigating the purchasing process with confidence and strategic insight. This article aims to dissect Ohio’s car sales tax system with precision, grounded in recent legislative updates, industry standards, and practical applications, transforming what might seem opaque into an accessible blueprint for informed vehicle acquisition.

Basics of Ohio Car Sales Tax: The Foundation of Vehicle Purchase Costs

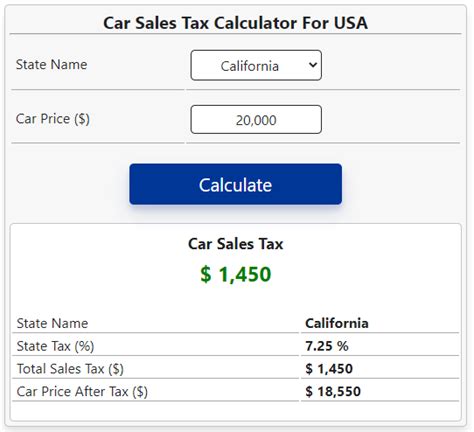

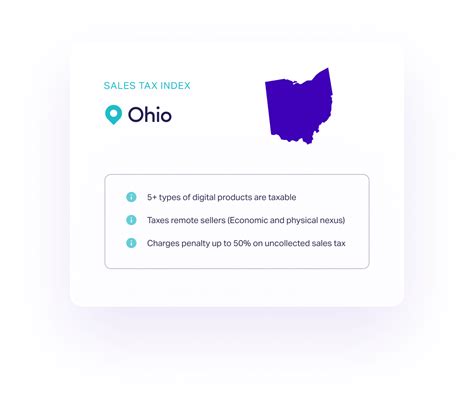

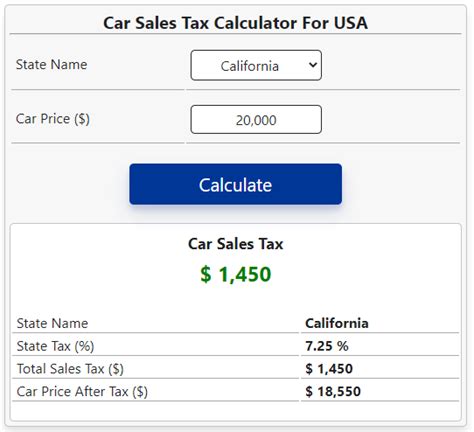

At its core, Ohio imposes a sales tax on the purchase of most motor vehicles, a revenue stream that contributes significantly to state and local budgets. Understanding this tax begins with grasping its foundational structure—how it is calculated, the rate applied, and the thresholds or exemptions that might alter the financial landscape for individual buyers. Ohio’s state sales tax rate on vehicle purchases currently stands at 5.75%, but local jurisdictions often add additional levies, creating a combined rate that can vary from 6.5% to over 8%.

For example, purchasing a new car priced at $30,000 in a jurisdiction with a 7.5% total sales tax rate would result in a tax liability of $2,250. Importantly, Ohio’s tax calculation isn’t simply a flat percentage, but rather depends on the local tax rate, the specifics of the transaction (new vs. used), and whether certain exemptions or credits apply. The tax is never a guesswork but a precise figure determined by state and local tax authorities, secured through documentation at the point of sale and reflected in your final sales receipt.

Tax Calculation and Payment Timing for Ohio Car Buyers

When considering the timing of tax payments, Ohio buyers must recognize that the sale tax is typically due at the point of purchase—whether at a dealership or through a private sale. In dealership transactions, the tax is usually included in the closing paperwork, with the dealer responsible for remitting it to the respective tax authorities. Conversely, private sales require the purchaser to pay the tax directly to the county auditor’s office within 30 days of the transaction, using the applicable form and paying the assessed amount based on current rates.

Key Points

- Ohio’s combined car sales tax varies depending on jurisdiction, often ranging from 6.5% to above 8%.

- Tax calculation is based on the purchase price, with specific exemptions for certain vehicles or circumstances.

- Timely payment is crucial, especially for private sales, to avoid penalties or interest charges.

- Dealerships typically handle the tax remittance, simplifying the process for consumers.

- Tax credits and discounts can sometimes reduce the effective taxable amount, worth investigating before finalizing the purchase.

Impacts of Ohio Car Sales Tax on Different Purchase Scenarios

The influence of Ohio’s car sales tax is multifaceted, affecting different buyer profiles—from residents to non-residents, from new vehicle purchasers to used car buyers. Each scenario bears distinct nuances, bearing implications for overall financial planning and strategic decision-making.

New Vehicles Versus Used Vehicles: Differing Tax Treatments

When purchasing new vehicles, the tax is straightforward: it is calculated on the sale price as negotiated at the dealership. However, with used cars, the process can differ subtly. If the vehicle is bought through a private seller, the buyer must pay the applicable sales tax based on the purchase price or fair market value, whichever is higher. Dealer sales of used vehicles, however, are subject to the same tax calculation as new ones, often leading to higher immediate costs but providing streamlined compliance and documentation.

Another layer involves trade-ins—a common method to reduce taxable amount. Ohio law allows the trade-in value to offset the sales price, meaning that if a buyer trades in a vehicle valued at $10,000 on a purchase costing $20,000, the taxable amount becomes $10,000. Such strategies can considerably soften the tax burden, emphasizing the importance of negotiation and documentation in vehicle deals.

| Relevant Category | Substantive Data |

|---|---|

| Average combined state and local rate | Approximately 7% |

| Used vehicle trade-in credit | Up to trade-in value, reducing taxable base |

Legal and Administrative Aspects of Ohio’s Car Sales Tax

Beyond the dollar figures, the legal landscape governing Ohio’s vehicle sales tax involves strict compliance requirements, with multiple agencies overseeing collection, remittance, and auditing. The Ohio Department of Taxation presides over state-level collection, but local county auditors hold jurisdiction over property tax assessments related to vehicles, influencing annual ownership costs beyond initial purchase.

Legislative Evolution and Policy Changes

Historically, Ohio has periodically adjusted its sales tax policies to accommodate economic fluctuations and infrastructural needs. Recent legislative amendments have focused on streamlining the taxation process for online transactions and cross-jurisdictional purchases, acknowledging the evolving nature of vehicle acquisition—particularly amid surges in used car markets and digital marketplaces.

For example, legislation passed in 2022 enhanced enforcement mechanisms, ensuring private sellers and online platforms duly collect and remit applicable taxes, closing gaps that previously allowed for tax evasion. This regulatory shift underscores a broader trend: Ohio’s commitment to maintaining a fair, comprehensive tax system that adapts to modern transaction styles.

Key Points

- Ohio’s legislation continually updates compliance protocols for vehicle sales.

- Recent laws increased enforcement on private and online transactions.

- Stakeholders must stay informed of legislative changes to avoid penalties.

- Policy shifts often aim to harmonize tax collection across different sales channels.

- Understanding legislative context can aid in proactive tax planning.

Strategies to Minimize Ohio Car Sales Tax Liability

Smart planning and thorough knowledge enable buyers to optimize their financial position. While evading tax is illegal, legal strategies exist to mitigate its impact, often blending legislative loopholes, timing considerations, and transaction structuring.

Timing of Purchase and Delayed Payment Options

Purchasing a vehicle near the end of a fiscal quarter or tax year, especially if anticipating legislative adjustments, can sometimes reduce tax liabilities, particularly if new rates are expected to take effect. Additionally, in some circumstances, financing arrangements or lease agreements can influence the taxable amount, offering flexibility that can be leveraged strategically.

Utilizing Trade-in Credits and Tax Exemptions

If eligible, buyers should capitalize on trade-in credits to lower taxable value. Furthermore, certain vehicles—such as electric cars, hybrid models, or those used for qualifying purposes (like business or agriculture)—may qualify for partial exemptions or reduced rates, as designated by Ohio law.

| Relevant Category | Substantive Data |

|---|---|

| Trade-in value reduction | Full trade-in credit reduces taxable basis |

| Vehicle exemptions | Electrics exempt from certain local taxes in specific counties |

| Timing considerations | Buying at year's end may align with favorable policy shifts |

Concluding Reflections: The Broader Impact of Ohio’s Car Sales Tax

Understanding Ohio’s car sales tax system demands more than superficial familiarity—it requires a nuanced appreciation of legal frameworks, local variations, and strategic planning avenues. For consumers and industry stakeholders alike, this tax embodies not just a revenue source but a reflection of policy priorities balancing fiscal responsibility with economic stimulation.

In navigating this landscape, informed buyers can leverage their knowledge for financial advantage, ensuring compliance while avoiding unnecessary costs. Educated decision-making, consistent awareness of legislative updates, and an analytical approach to transaction structuring collectively foster not only savings but also peace of mind in one of life’s most substantial purchases.

How is Ohio’s car sales tax calculated for private versus dealer sales?

+Dealer sales typically include tax calculations integrated into the purchase price, with the dealer responsible for remittance. Private sales require the buyer to calculate and pay the tax directly to the county auditor based on the sale price or fair market value, within 30 days of purchase.

Are there exemptions for electric or hybrid vehicles in Ohio?

+Yes, certain electric vehicles qualify for partial exemptions or reduced rates depending on county policies. For example, some counties in Ohio incentivize electric vehicle adoption by exempting or discounting the sales tax for qualifying models.

What are the potential penalties for late or non-payment of Ohio vehicle sales tax?

+Failure to remit the applicable tax within stipulated periods can result in penalties, interest charges, and possible legal actions. It’s crucial for buyers to complete payments promptly to avoid these consequences, especially in private sales where oversight is stricter.