Arizona Sales Tax Cars

When it comes to purchasing a car in the state of Arizona, understanding the sales tax implications is crucial. Arizona, like many other states, imposes a sales tax on vehicle purchases, and navigating this tax landscape can be essential for car buyers. This comprehensive guide will delve into the specifics of Arizona's sales tax on cars, providing you with all the information you need to make informed decisions during your car-buying journey.

Understanding Arizona’s Sales Tax Structure

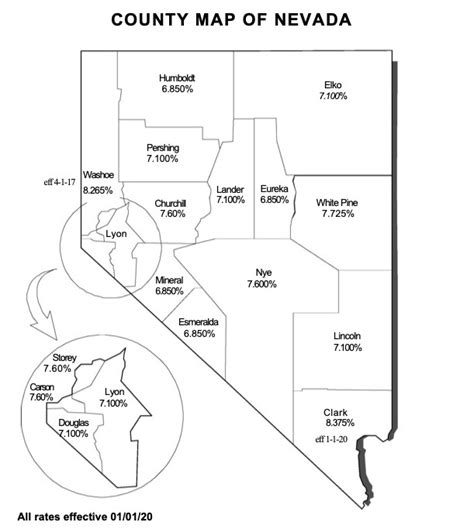

Arizona operates under a unique sales tax system that varies based on the location of the transaction and the type of vehicle being purchased. The state sales tax rate in Arizona is 5.6%, which serves as the foundation for the overall tax calculation. However, it’s important to note that this state tax is just one component of the total sales tax you’ll encounter.

In addition to the state sales tax, Arizona counties and municipalities have the authority to impose their own local sales taxes. These local taxes can significantly impact the overall tax burden on car buyers. The exact local sales tax rates can vary widely, with some areas having no additional tax and others imposing rates as high as 2% or more. This means that the total sales tax rate on a car purchase in Arizona can range from the state's base rate of 5.6% to upwards of 7.6% or more, depending on the location of the transaction.

Calculating Sales Tax on Car Purchases

Calculating the sales tax on a car purchase in Arizona involves a straightforward formula. You begin with the state sales tax rate, which is 5.6%, and then add the applicable local sales tax rate for the specific county or municipality where the transaction takes place. This combined rate is then applied to the purchase price of the vehicle to determine the total sales tax amount.

For example, if you're buying a car in a county with a local sales tax rate of 1.5%, the total sales tax rate would be 7.1% (5.6% state tax + 1.5% local tax). If the purchase price of the car is $30,000, the sales tax amount would be $2,130 ($30,000 x 0.071). It's important to note that this calculation assumes the car is new or used, as the sales tax treatment for new and used cars is generally the same in Arizona.

Exemptions and Special Cases

While the standard sales tax rate applies to most car purchases, there are certain exemptions and special cases to be aware of. For instance, if you’re a resident of a neighboring state and purchase a car in Arizona, you may be able to avoid paying Arizona sales tax. This is because Arizona, like many states, offers a “nonresident exemption” for out-of-state residents who purchase vehicles and intend to register them in their home state. However, this exemption has specific requirements and limitations, so it’s crucial to consult an expert or tax advisor to ensure you’re eligible.

The Impact of Trade-Ins and Leases

When trading in your old vehicle as part of a new car purchase, the sales tax calculation in Arizona becomes a bit more complex. The trade-in value is subtracted from the purchase price of the new car, and sales tax is then applied to the remaining amount. For example, if you’re buying a new car for 30,000 and your trade-in vehicle has a value of 10,000, the sales tax would be calculated on the 20,000 difference (30,000 - 10,000 = 20,000 x sales tax rate). This can significantly reduce the overall tax burden, making trade-ins an attractive option for many car buyers.

Leasing a car in Arizona also involves sales tax considerations. The sales tax on a leased vehicle is typically calculated based on the monthly payment, with the tax amount varying depending on the specific terms of the lease agreement. It's essential to carefully review the lease contract to understand how sales tax is factored into the monthly payments.

Comparative Analysis: Arizona vs. Other States

Arizona’s sales tax structure for car purchases is relatively straightforward compared to some other states. While the state tax rate of 5.6% is on the lower end of the spectrum, the potential addition of local sales taxes can bring the total rate in line with or even exceed that of many other states. For instance, some states have a higher base rate, such as California’s 7.25%, but may not have as many local tax variations.

Additionally, some states offer incentives or tax breaks for certain types of vehicles, such as electric or hybrid cars. Arizona does not currently have specific tax incentives for these eco-friendly vehicles, which can make it less attractive for buyers seeking such alternatives. However, it's important to note that tax policies can change, so staying updated on any potential incentives or changes in Arizona's tax structure is essential for informed decision-making.

Real-World Example: Sales Tax on a Popular Vehicle

Let’s consider a real-world example to illustrate the impact of sales tax on a car purchase in Arizona. Suppose you’re in the market for a new Toyota Camry, which has a base price of around 26,000. If you were to purchase this vehicle in a county with a local sales tax rate of 1.5%, the total sales tax rate would be 7.1% (5.6% state tax + 1.5% local tax). Applying this rate to the 26,000 purchase price, the sales tax amount would be approximately 1,846 (26,000 x 0.071). This tax adds a significant cost to the overall purchase, highlighting the importance of understanding sales tax implications when buying a car.

| Sales Tax Component | Rate (%) |

|---|---|

| State Sales Tax | 5.6 |

| Local Sales Tax (Example) | 1.5 |

| Total Sales Tax Rate | 7.1 |

Expert Insights: Strategies for Managing Sales Tax

Navigating the sales tax landscape when purchasing a car in Arizona can be challenging, but there are strategies you can employ to manage this expense effectively.

Research Local Tax Rates

Before making a purchase, take the time to research the sales tax rates in the specific county or municipality where you plan to buy the car. This information is publicly available and can help you make informed decisions about where to shop. For instance, if you’re flexible with your location, you might consider buying in an area with a lower local tax rate to save on sales tax.

Negotiate the Purchase Price

Sales tax is calculated based on the purchase price of the vehicle, so negotiating a lower price can directly impact the amount of tax you owe. While haggling over prices might not be everyone’s forte, it’s a skill worth developing, especially when it comes to significant purchases like cars. Many dealerships are open to negotiation, and even a small reduction in the purchase price can result in substantial savings on sales tax.

Consider Trade-Ins Strategically

As mentioned earlier, trade-ins can significantly reduce the sales tax burden. When trading in your old vehicle, be sure to get an accurate estimate of its value. You can use online tools or consult with multiple dealerships to get a sense of the fair market value. Additionally, consider the timing of your trade-in. If you can time your purchase to coincide with promotions or tax incentives, you might be able to maximize the value of your trade-in and further reduce your sales tax liability.

Explore Financing Options

Financing a car purchase can impact the way sales tax is calculated and paid. Some financing options, such as leasing, might offer more flexibility in terms of upfront costs and monthly payments. It’s worth exploring these options and comparing them to traditional car loans to determine which approach aligns best with your financial goals and preferences.

Consult a Tax Professional

The sales tax landscape can be complex, especially when it comes to unique situations or special cases. If you have questions or concerns about your specific circumstances, it’s always a good idea to consult a tax professional. They can provide personalized advice and ensure you’re taking advantage of any applicable tax benefits or exemptions.

Future Implications: Tax Policy Changes

Tax policies are subject to change, and staying updated on any potential shifts in Arizona’s sales tax structure is crucial for car buyers. The state legislature can propose and pass new laws that impact sales tax rates or introduce new incentives. Additionally, local governments can adjust their tax rates, which can have a significant impact on the overall tax burden for car purchases.

Keeping an eye on legislative developments and following news related to tax policy changes can help you anticipate and plan for any upcoming shifts. This proactive approach can ensure you're prepared for any changes that may impact your car-buying experience and financial obligations.

Stay Informed: Arizona Tax Updates

To stay informed about Arizona’s tax policies, consider subscribing to newsletters or following reputable sources that cover tax-related news. Additionally, the Arizona Department of Revenue provides official updates and resources on its website, which can be a valuable source of information for understanding the latest tax regulations and any potential changes.

Conclusion: Navigating Arizona’s Sales Tax Landscape

Purchasing a car in Arizona involves navigating a complex sales tax landscape, but with the right knowledge and strategies, you can make informed decisions that minimize your tax liability. From understanding the state and local sales tax rates to exploring trade-ins and financing options, there are numerous ways to manage the sales tax aspect of your car purchase effectively.

By staying informed, researching local tax rates, and employing strategic approaches, you can ensure that sales tax doesn't become an unexpected burden during your car-buying journey. Remember, every state has its unique tax considerations, and Arizona is no exception. With the information provided in this guide, you're well-equipped to navigate Arizona's sales tax system and make confident decisions when purchasing a car.

Are there any specific tax incentives for electric or hybrid vehicles in Arizona?

+As of our last update, Arizona does not offer specific tax incentives for electric or hybrid vehicles. However, it’s worth checking for any potential changes or new incentives, as tax policies can evolve over time.

How do I know if I qualify for the nonresident exemption when buying a car in Arizona?

+The nonresident exemption is available to individuals who are not legal residents of Arizona and intend to register the vehicle in their home state. Consult with a tax professional or the Arizona Department of Revenue for specific requirements and guidelines.

Can I negotiate the sales tax rate when purchasing a car in Arizona?

+Sales tax rates are set by law and cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which directly impacts the sales tax amount you owe.

Are there any online tools to estimate sales tax for car purchases in Arizona?

+Yes, there are several online calculators and tools available that can help estimate the sales tax for car purchases in Arizona. These tools take into account the state and local tax rates based on your location.

How often do sales tax rates change in Arizona?

+Sales tax rates can change periodically, typically as a result of legislative actions. It’s important to stay updated on any changes, especially if you’re planning a significant purchase like a car.