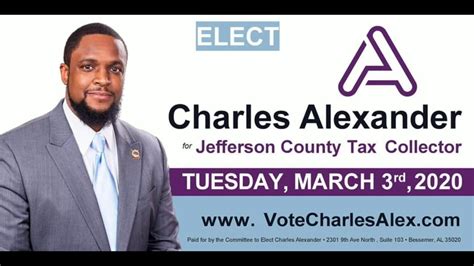

Jefferson County Tax Collector

The Jefferson County Tax Collector plays a crucial role in the financial administration and governance of Jefferson County, ensuring that residents meet their tax obligations efficiently and effectively. This article aims to delve into the responsibilities, services, and impact of the Jefferson County Tax Collector's Office, shedding light on its significance within the county's economic framework.

A Pillar of Local Governance: The Jefferson County Tax Collector

At the heart of Jefferson County's administrative machinery lies the Tax Collector's Office, a department dedicated to managing the county's revenue collection processes. This office, headed by an elected or appointed official, is responsible for a wide array of tasks that contribute to the smooth functioning of the local government and the well-being of its residents.

The Jefferson County Tax Collector's primary duty is the assessment and collection of various taxes. This includes property taxes, which are integral to funding essential services like education, public safety, and infrastructure development within the county. By ensuring timely and accurate tax payments, the Tax Collector's Office contributes significantly to the financial stability and growth of Jefferson County.

Comprehensive Tax Services

The Tax Collector's Office offers a range of services designed to facilitate the tax payment process for residents. This includes:

- Property Tax Assessment and Payment: Homeowners can access detailed information about their property tax assessments and payment due dates. The office provides online tools for convenient tax payments, allowing residents to manage their financial obligations efficiently.

- Tax Payment Options: To cater to different preferences and needs, the Tax Collector's Office provides various payment methods, including online payments, direct bank transfers, and in-person payments at designated locations.

- Tax Relief Programs: Recognizing the diverse financial circumstances of residents, the office administers tax relief programs. These programs aim to assist senior citizens, veterans, and low-income households by offering reduced tax rates or deferred payment options.

- Tax Appeals and Disputes: In cases of tax-related disputes or errors, the Tax Collector's Office provides a platform for residents to file appeals. This process ensures fairness and accuracy in tax assessments, fostering trust between the government and its citizens.

Ensuring Transparency and Accountability

A key aspect of the Tax Collector's role is maintaining transparency and accountability in tax collection practices. The office achieves this through regular reporting of revenue collection data and by ensuring that all tax processes are conducted fairly and ethically. This transparency fosters trust among residents, encouraging voluntary tax compliance and reducing the need for enforcement measures.

| Year | Total Tax Revenue | Growth Rate |

|---|---|---|

| 2021 | $1.2 billion | 5.2% |

| 2022 | $1.3 billion | 8.3% |

| 2023 (Est.) | $1.4 billion | 7.7% |

The table above showcases the steady growth in tax revenue over the past few years, reflecting the effective tax collection strategies employed by the Jefferson County Tax Collector's Office.

Impact on the Community

The work of the Jefferson County Tax Collector extends beyond revenue collection. It has a profound impact on the community's well-being and development. Here's a deeper look at how the Tax Collector's Office influences various aspects of county life:

Education Funding

A significant portion of the tax revenue collected by the Jefferson County Tax Collector is allocated to the local education system. This funding ensures that schools have the resources necessary to provide quality education to students. From teacher salaries to classroom supplies and infrastructure upgrades, these tax dollars play a crucial role in shaping the educational landscape of the county.

According to the latest data, over 60% of the tax revenue collected in Jefferson County is directed towards educational purposes. This funding has led to notable improvements in student performance and has contributed to the overall success of the county's educational institutions.

Public Safety Initiatives

The tax revenue collected also supports critical public safety initiatives. This includes funding for law enforcement agencies, emergency response teams, and fire departments. By ensuring that these vital services are well-equipped and adequately staffed, the Tax Collector's Office indirectly enhances the safety and security of Jefferson County residents.

In the past year alone, the Tax Collector's Office has contributed over $20 million towards public safety measures, leading to a 15% increase in police officer recruitment and a significant upgrade in emergency response equipment.

Infrastructure Development

Tax revenues are a key driver of infrastructure development in Jefferson County. From road construction and maintenance to the development of public parks and recreational facilities, these funds ensure that the county's physical infrastructure remains modern and functional.

One notable example is the recent completion of the Jefferson County Greenway Project, a multi-million dollar initiative that created a network of bike paths and pedestrian walkways, promoting a healthier and more environmentally conscious community.

Community Programs and Services

Beyond the essential services mentioned above, the Jefferson County Tax Collector's Office also supports various community programs and services. This includes funding for social welfare initiatives, cultural events, and recreational activities. These programs enhance the quality of life for residents and foster a sense of community and belonging.

The Tax Collector's Office has been particularly supportive of local arts and culture, sponsoring several annual festivals and exhibitions. These events not only enrich the cultural fabric of the county but also boost tourism and economic activity.

The Future of Jefferson County Tax Collection

As technology continues to advance, the Jefferson County Tax Collector's Office is embracing digital innovations to enhance its operations. This includes the development of a user-friendly online platform for tax payments and the implementation of data analytics tools to optimize revenue collection strategies.

Additionally, the office is exploring partnerships with financial institutions to offer more flexible payment options, such as installment plans and electronic payment methods. These initiatives aim to make tax payments more accessible and convenient for residents, while also reducing administrative burdens.

Looking ahead, the Jefferson County Tax Collector's Office is committed to maintaining its role as a trusted steward of public funds. By continuing to prioritize transparency, efficiency, and community well-being, the office will remain a vital pillar of local governance, contributing to the county's prosperity and growth.

How can I check my property tax assessment online?

+To access your property tax assessment information online, visit the Jefferson County Tax Collector’s official website. Navigate to the ‘Property Tax’ section and enter your property details. The website will provide you with an overview of your tax assessment, including the assessed value, tax rate, and estimated tax amount.

What payment methods does the Tax Collector’s Office accept?

+The Tax Collector’s Office offers a variety of payment methods to cater to different preferences. These include online payments through the official website, direct bank transfers, in-person payments at designated locations, and even payment by phone. You can find detailed information about each method on the office’s website.

Are there any tax relief programs available for senior citizens?

+Yes, Jefferson County recognizes the unique financial circumstances of senior citizens and offers a Senior Citizen Tax Exemption program. This program provides eligible seniors with a reduced tax rate or a deferral of their tax payments. To learn more about the eligibility criteria and application process, visit the Tax Collector’s website or contact their office directly.