Did Trump End Income Tax

The notion that former President Donald Trump ended income tax is a misconception that warrants clarification. During his presidency, Trump and the Republican-led Congress did enact significant tax reforms, notably with the Tax Cuts and Jobs Act (TCJA), which became law in 2017.

The TCJA brought about the most substantial changes to the U.S. tax code in decades, with a focus on reducing taxes for individuals and businesses. However, it did not eliminate income tax altogether.

Understanding the Tax Cuts and Jobs Act (TCJA)

The Tax Cuts and Jobs Act represented a comprehensive overhaul of the U.S. tax system. Some of its key provisions included:

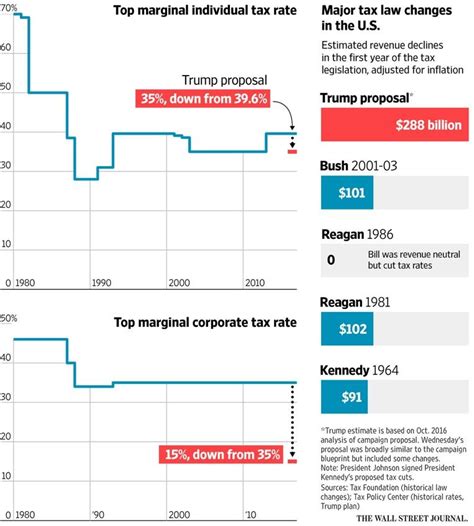

- Lower Individual Income Tax Rates: The TCJA introduced new tax brackets with lower rates for most taxpayers. For instance, the top marginal tax rate was reduced from 39.6% to 37%.

- Doubling of Standard Deductions: This change provided a significant tax break for many Americans, as it doubled the amount of income that could be excluded from taxation for those who choose not to itemize their deductions.

- Expansion of Child Tax Credit: The credit was increased from $1,000 to $2,000 per qualifying child, providing relief for families with children.

- Corporate Tax Rate Reduction: Perhaps the most controversial aspect of the TCJA was the reduction of the corporate tax rate from 35% to 21%, a move aimed at making American businesses more competitive globally.

- Repeal of Personal Exemption: To offset some of the revenue loss from lower tax rates, the TCJA repealed the personal exemption, which had allowed taxpayers to reduce their taxable income by a fixed amount for themselves and their dependents.

The Reality of Income Tax Under Trump

While the TCJA certainly provided substantial tax cuts for many Americans, it did not eliminate income tax. Income tax remains a cornerstone of the U.S. tax system, providing a significant portion of the federal government's revenue.

Here's a closer look at the income tax landscape during the Trump administration:

Individual Income Tax Rates

The TCJA introduced a new tax bracket structure with seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates applied to different income levels, with higher earners paying a higher percentage of their income in taxes.

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 - $9,875 (Single), $0 - $19,750 (Married Filing Jointly) |

| 12% | $9,876 - $40,125 (Single), $19,751 - $80,250 (Married Filing Jointly) |

| 22% | $40,126 - $85,525 (Single), $80,251 - $171,050 (Married Filing Jointly) |

| 24% | $85,526 - $163,300 (Single), $171,051 - $326,600 (Married Filing Jointly) |

| 32% | $163,301 - $207,350 (Single), $326,601 - $414,700 (Married Filing Jointly) |

| 35% | $207,351 - $518,400 (Single), $414,701 - $622,050 (Married Filing Jointly) |

| 37% | $518,401 and above (Single), $622,051 and above (Married Filing Jointly) |

Corporate Income Tax

The reduction of the corporate tax rate to 21% was a significant change, making the U.S. corporate tax system more competitive with other countries. This move was intended to encourage businesses to keep more of their profits and potentially reinvest them in their operations, leading to job creation and economic growth.

Expiration of TCJA Provisions

It's important to note that many of the provisions in the TCJA were set to expire after a certain period. For example, the individual income tax rate cuts were initially scheduled to expire after 2025. However, these provisions could be extended or made permanent through future legislative action.

The Impact and Criticisms of the TCJA

The Tax Cuts and Jobs Act had a significant impact on the U.S. economy and the lives of individual taxpayers. Here are some key points to consider:

- Economic Growth: Proponents of the TCJA argue that the tax cuts stimulated economic growth by putting more money in the pockets of taxpayers and reducing the tax burden on businesses. This, in turn, could lead to increased investment, job creation, and a boost in consumer spending.

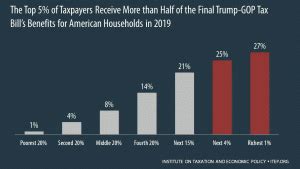

- Wealth Inequality: Critics of the TCJA often point out that the benefits of the tax cuts disproportionately favored high-income earners and corporations. The reduction in corporate tax rates, for instance, could lead to increased profits for businesses without necessarily translating into higher wages for workers.

- Budget Deficits: The substantial tax cuts under the TCJA resulted in a significant reduction in federal revenue. This contributed to an increase in the federal budget deficit, raising concerns about the long-term sustainability of the nation's finances.

- Simplification vs. Complexity: While the TCJA aimed to simplify the tax code, some argue that it introduced new complexities. The doubling of the standard deduction, for example, could make it more difficult for certain taxpayers to claim itemized deductions, particularly those with significant medical expenses or charitable contributions.

Conclusion

In summary, while the Trump administration's Tax Cuts and Jobs Act brought about significant tax reforms, it did not end income tax. Income tax remains a critical component of the U.S. tax system, providing a substantial portion of federal revenue. The TCJA's impact on the economy and individual taxpayers continues to be a topic of discussion and analysis, with differing perspectives on its effectiveness and long-term implications.

FAQ

Did the TCJA eliminate all taxes?

+No, the TCJA focused primarily on income taxes for individuals and businesses. Other types of taxes, such as payroll taxes and sales taxes, were not significantly altered.

How long did the TCJA’s tax cuts last?

+Many of the individual income tax cuts were scheduled to expire after 2025. However, they could be extended or made permanent through future legislation.

Did the TCJA impact state and local taxes?

+The TCJA did not directly change state and local taxes. However, some of its provisions, such as the limitation on state and local tax deductions, could indirectly impact state and local tax systems and revenue.